Investing in dividend stocks is a reliable way to build long term wealth. Dividends are payments that a company pays as a portion of its profits to compensate its shareholders for their investment, in other words itâs a share of profits among the equity holders.

Dividends form an important part in an investorâs decision making as they provide a steady stream of income to its investors and thus increase the overall stock investing profits, cushion the portfolio risk, and offer tax benefits. An increase in dividend signals that the company is in a sound fundamental position and it also might signal reduced capex needs in the near future.

Below are some of the key Australian Banks known for paying attractive dividends over the years.

Commonwealth Bank of Australia

Sydney-based Commonwealth Bank of Australia (ASX:CBA) provides banking and related services such as life insurance, institutional banking, international financing, stock broking and others for small and medium sized enterprises as well as individuals. With a market capitalisation of around AUD 141.96 billion with ~ 1.77 billion outstanding shares, CBA is trading at AUD 81.215, edging up 1.278% by AUD 1.025 with ~ 1.045 million shares traded (as on 18 June 2019, AEST: 12:16 PM).

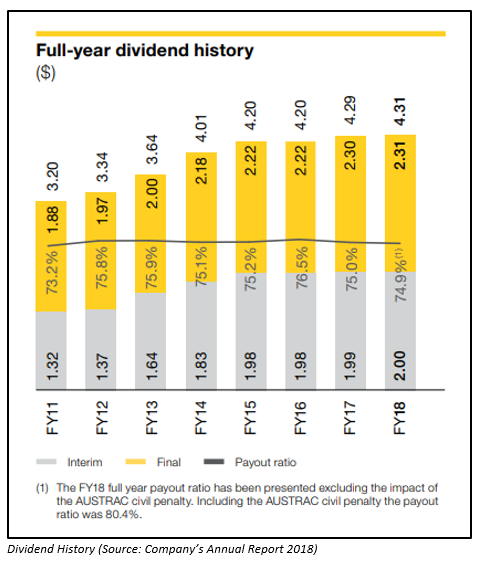

Besides, the stock has generated positive return yields including 15.78% in the last six months and 12.99% YTD. To date, Commonwealth Bank of Australiaâs annual dividend yield stands at 5.37%. CBA also paid out a fully franked dividend of AUD 1.01340 (Payment Date: 17 June 2019) for the quarter ended 15 June 2019.

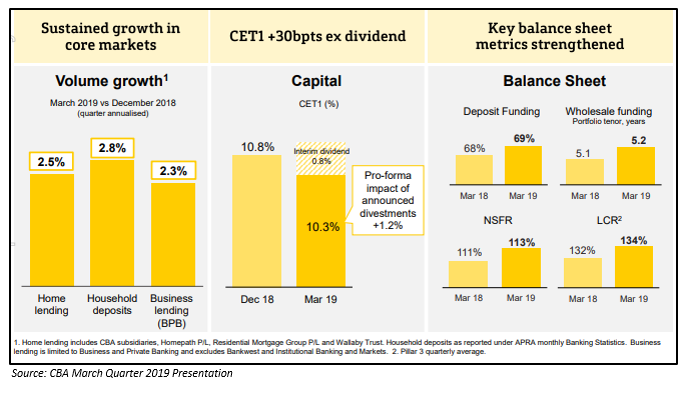

The company released its overview of the third quarter 2019 (Q3 2019), reporting sustained volume growth in core markets with home loan growth in line with system and continued growth in household deposits and business lending (BPB). Besides, the key metrics in the balance sheet strengthened with the Common Equity Tier 1 (capital) ratio of 10.3%, up 30 bpts, amidst a challenging environment (See figure below).

The unaudited statutory net profit was approximately $ 1.75 billion, with the cash net profit from continuing operations at $ 1.70 billion. There was 4% reduction in the operating income due to seasonal impacts and rebased fee income driven by the Better Customer Outcomes Program underway.

Meanwhile, the operating expenses increased 1% and the Loan Impairment expenses was around $ 314 million in the quarter.

Westpac Banking Corp

Westpac Banking Corp (ASX: WBC), headquartered in Sydney, provides general and savings financial services to customers including individuals, businesses, and corporations worldwide across Australia, New Zealand, Asia, and the Pacific region. With a market capitalisation of around AUD 96.46 billion and approximately 3.45 billion outstanding shares, WBC is trading at AUD 28.010, marginally up 0.107% by AUD 0.030 with ~ 1.42million shares traded (as on 18 June 2019, AEST: 12:32 PM).

Westpacâs Annual dividend yield is over 6.7% (as per ASX, as on 17 June 2019). Besides, the WBC stock has generated positive returns of 13.51% in the last six months and 14.30% YTD.

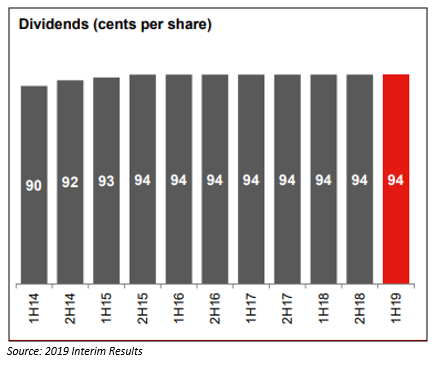

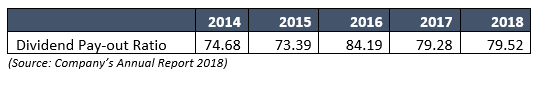

Recently on 5 June 2019, WBC announced an ordinary fully franked dividend of AUD 0.940 relating to the period of six months ended 31 March 2019 with a payment date of 24 June 2019. The dividend reinvestment plan (DRP) will operate with a 1.5% discount applied to the market price. The latest dividend reflects a payout ratio of 98%.

For the first half of 2019 ended 31 March 2019, Westpac announced a profit of $ 3,173 million and while the cash earnings amounted to $ 3,296 million, down 22%. The Groupâs performance in the first half was largely affected by significant remediation and restructuring expenses like provisions for estimated customer refunds (around $ 617 million after tax) and Westpacâs wealth strategy related expenses, totalling ~$ 136 million after tax.

National Australia Bank Ltd

Melbourne-based National Australia Bank Limited (ASX: NAB) was established in 1834 and provides financial and banking services to customers worldwide across the United States, the United Kingdom, Asia, Australia, and New Zealand. With a market capitalisation of around AUD 74.95 billion and 2.81 billion outstanding shares, NAB is trading at AUD 26.610, down 0.188% by AUD 0.050 with approximately 1.8 million shares traded (as on 18 June 2019, AEST: 12:45 PM). The stock has also generated positive return yields of 13.21% for the last six months and 12.82% YTD.

Besides, the company has an annual dividend yield of 6.83% (as per ASX, as on 17 June 2019).

Recently on 17 June 2019, National Australia Bank announced a dividend of AUD 0.8029 on the preferential share, NABPB - CNV PREF 3-BBSW+3.25% PERP NON-CUM RED T-12-20, relating to the quarter to 16 September 2019. On the same day, a dividend of AUD 0.93520 was announced on convertible notes, NABPF - CAP NOTE 3-BBSW+4.00% PERP NON-CUM RED T-06-26, also for the September quarter. Both dividends will be paid out on 17 September 2019.

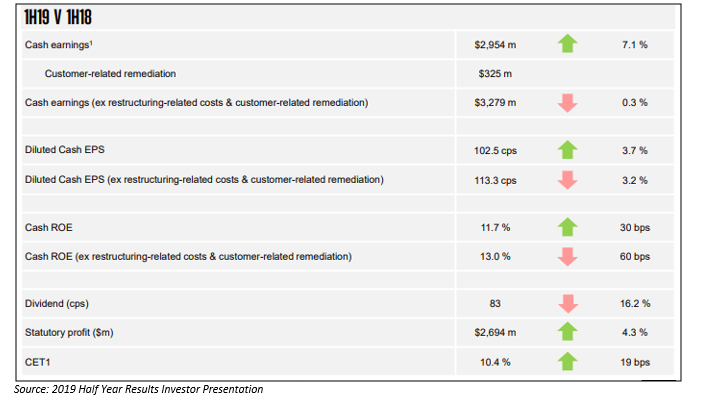

As per NABâs 2019 Half Year (1HFY19) Results Investor Presentation, the dividend reduced by 16.2% given more difficult operating environment and also to improve capital generation. The 1H19 dividend payout ratio was around 77% of cash earnings (70% excluding customer-related remediation). There was increased flexibility to accommodate earnings volatility, further regulatory changes and RWA growth.

The overall financial performance for 1HFY19 was impacted by further customer-related remediation as can be understood from the figure below.

Bendigo and Adelaide Bank Ltd

Victoria-based Bendigo and Adelaide Bank Limited (ASX: BEN) provides its customers with a variety of banking and other financial services, including first mortgage housing finance, retail and business banking, commercial finance, funds management, treasury and foreign exchange services, superannuation and trustee services. In addition, Bendigo also offers internet banking. With a market capitalisation of around AUD 5.64 billion and ~ 491.9 million outstanding shares, the BEN stock is trading at AUD 11.545, up 0.654% by AUD 0.075 with ~ 0.42 million shares traded (as on 18 June 2019, AEST: 12:58 PM). The stock has generated positive return of 11.13% for the last six months and 9.44% for YTD.

The company has an annual dividend yield of 6.1% to date (as per ASX, as on 17 June 2018).

Recently on 14 June 2019, Bendigo announced an ordinary dividend of AUD 0.89910 on its preference shares BENPG - CNV PREF 3-BBSW+3.75% PERP NON-CUM RED T-06-24 (Record Date: 3 September 2019; Payment Date: 13 September 2019) relating to a period of quarter to 12 September 2019. In addition, it has also announced a dividend of AUD 1.64710 (Record Date: 20 November 2019; payment Date: 2 December 2019) relating to the period of six months to 1 December 2019.

On 30 May 2019, Bendigo and Adelaide Bank announced that Jacqueline Hey would be succeeding Robert Johanson as the next Chairperson. Mr Johanson would retire after the Bankâs Annual General Meeting to be held on 29 Octâ19.

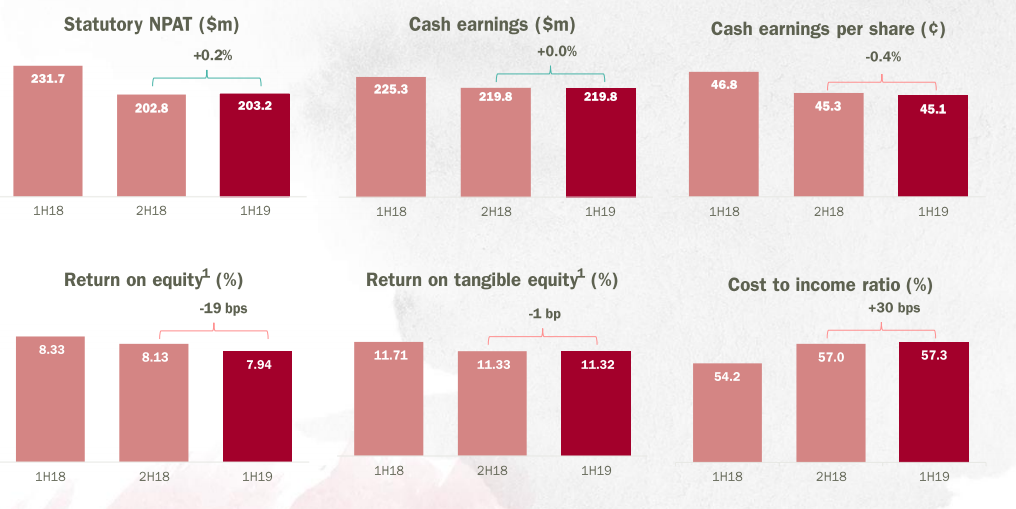

A snapshot of Bendigoâs interim results for the six months to 31 December 2019 is as follows:

Source: Companyâs Interim Result Presentation

Source: Companyâs Interim Result Presentation

Bank of Queensland Limited

Brisbane-based Bank of Queensland Limited (ASX: BOQ) is a full-service financial institution which operates retail branches, business banking centers, and equipment finance centers throughout Australia and New Zealand. The Bank also operates an automated teller machine (ATM) network throughout Australia. With a market capitalisation of around AUD 3.87 billion and approximately 405.78 million outstanding shares, the shares of BOQ are treading at AUD 9.495, down 0.367%, by AUD 0.035 with ~ 0.81 million shares traded in total (as on 18 June 2019, AEST: 12:58PM).

Besides, the stock has generated return of -1.04% and 0.21% for the last six months and YTD respectively. Bank of Queensland has an annual dividend yield of 7.56% (as per ASX as on 17 June 2019).

On 20 May 2019, the Bank paid out an ordinary fully franked dividend of AUD 0.34 relating to a period of six months ended 28 February 2019 (Record Date: 2 May 2018).

Recently on 6 June 2019, the Bank announced that Mr George Frazis has been appointed as the new Managing Director & CEO, effective 5 September 2019.

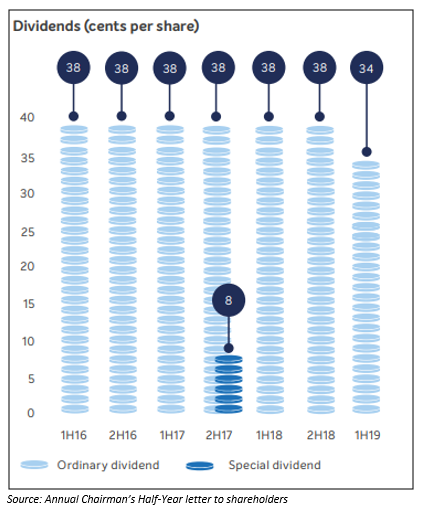

According to the half year report for the six months to 28 February 2019, Bank of Queenslandâs capital position remains strong at 9.26 %, but as a result of the challenging revenue and cost environment that BOQ and the industry faced, the Board declared a dividend of 34 cps, which was 4 cps lower compared to the prior period. the bankâs dividend figures for the past three years is as below:

Australia and New Zealand Banking Group Limited

Docklands, Australia-based Australia and New Zealand Banking Group Limited (ASX:ANZ) is also a well-known financial sector enterprise. With a market capitalisation of AUD 79.95 billion and ~ 2.83 billion outstanding shares, the ANZ stock is trading at a price of AUD 28.155, down 0.442% by AUD 0.125, with ~ 3.89 million shares traded (as on 18 June 2019, AEST: 1:13 PM). In addition, the stock has generated positive return of 15.85% for the last six months and 18.52% YTD.

The Groupâs annual dividend yield stands at around 5.66% (as per ASX, as on 17 June 2019).

Yesterday on 17 June 2019, following the resignation of David Hisco, the group has temporarily appointed Antonia Watson as the Chief Executive Officer of ANZ New Zealand. Previously in the same month, the Bank announced the close of the sale of its Australian life insurance unit, OnePath Life, to Zurich Financial Services Australia.

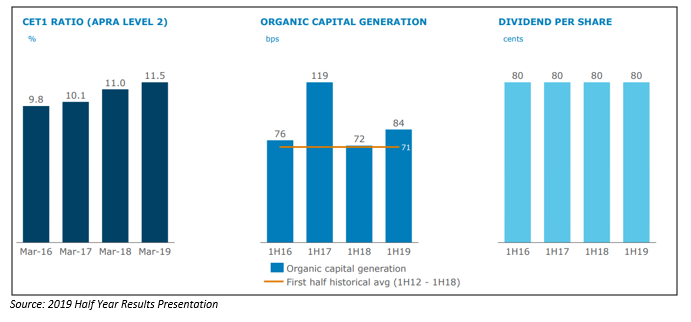

On 31 May 2019, the Group announced an ordinary fully franked dividend of AUD 0.80 concerning the six months to 31 March 2019, to be paid out on 1 July 2019.

A snapshot of the Bankâs Capital Management status for the half year ended 31 March 2019 is as follows:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.