Australiaâs leading business bank, National Australia Bank Limited (ASX: NAB) has reported solid performance in the third quarter of FY19, despite operating in a challenging environment. For Q3 FY19, the bank reported an Unaudited statutory net profit of $1.70 billion and unaudited cash earnings of $1.65 billion.

If compared with 1H19 quarterly average, cash earnings were up 1% (excluding customer-related remediation). Due to the ongoing productivity savings from the transformation program, the expenses were flat during the period. NABâs revenue was up 1% during the period, reflecting growth in SME (Small and Medium Enterprise) lending and a slightly higher group margin.

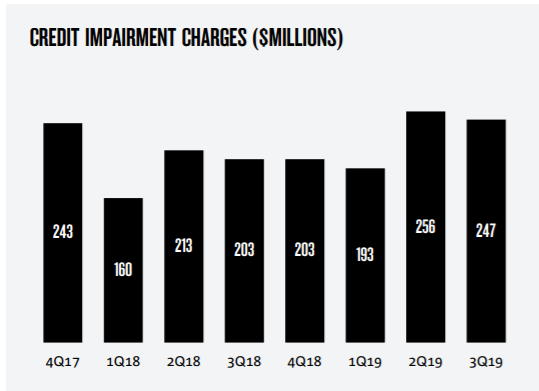

NAB has reported Credit impairment charges of $247 million in the third quarter, which is 10% higher if compared with the 1H19 quarterly average.

Credit Impairment Charges (Source: Company Reports)

As at 30 June 2019, NAB has a Group Common Equity Tier 1 (CET1) ratio of 10.4%, Leverage ratio (APRA basis) of 5.4%, Liquidity Coverage Ratio (LCR) quarterly average of 128% and Net Stable Funding Ratio (NSFR) of 113%.

While revealing the third quarter results, NABâs CEO Mr. Philip Chronican highlighted that the customer remediation programs and regulatory compliance investigations at the Bank are continuing and there is a potential for additional costs. He further informed about additional provisions which are expected to be recognised in the second half of 2019.

NABâs leadership was recently handed over to Mr. Ross McEwan, who is an experienced banker with an excellent track record. The appointment of Mr. Ross as the new CEO has significantly strengthened the management team of NAB.

NABâs CEO also highlighted that the bank is strongly progressing on its strategy of becoming a simpler and faster bank. Ever since the bank started its operations, it has witnessed a 27 percent decline in over- the-counter transactions and an 18 percent decline in call centre volumes.

Under the strategy of becoming a simpler and faster bank, NAB is focussed on delivering exceptional customer service, increased productivity and reduced operational and regulatory risks. Last year (FY18), the company made substation progress in becoming a simpler and faster bank. This includes:

- Reduction of number of products from approximately 600 to 495, and products capable of digital origination increased from 10% to 19%;

- Over-the-counter transactions in branches declined 15% following the completed rollout of 805 smart ATMs.

- Time required to open Everyday consumer accounts reduced from up to 48 hours to less than 7 minutes, and term deposit rollovers (both in branch and online) have been simplified to one click, reducing processing time by 70%;

- Organisational structure flattened to 7 layers between the CEO and customer for 94% of employees (66% at September 2017).

During the third quarter, NAB also progressed on its strategy of backing its customers and community. For its customers and community, the bank took the following initiatives:

- Launched an initiative from February to simplify and reduce fees, with 67 fees removed by the end of June;

- Announced a partnership with ClimateWorks Australia to enable farmers to adopt sustainable and profitable land management practices.

- Pledged $2 billion of funding over five years to help emerging technology companies build and grow their businesses;

- Priority Segments Net Promoter Score (NPS)4 improved from -17 in March to -14 in June with NAB ranked equal first of the major banks;

On the stock performance front, the share price of NAB increased by 13.41% during the past six months as on 13 August 2019. NABâs stock has a PE multiple of 13.480x and an annual dividend yield of 6.58%. At market close on 14 August 2019, NABâs stock was trading at a price of $27.650, down by 0.036% intraday, with a market capitalization of circa $79.74 billion. The stockâs 52 weeks high price stands at $29.000- and 52-weeks low price of $22.520 with an average volume of ~6,975,716.

Like NAB, various other leading banks of Australia are operating in a challenging environment. Westpac Banking Corporation (ASX: WBC), a leading Australian bank, reported a decline of 22% in its cash earnings for H1 FY19 as compared to pcp, majorly impacted by remediation & restructuring items. Like NAB, WBC is currently focussed on Remediating customer issues and along with that it is taking actions to implement Royal Commission recommendations.

Westpac Banking Corporation (ASX:WBC) has witnessed an uplift of 8.44% in its share price, over the last six months. WBCâs stock has a PE multiple of 13.750x and an annual dividend yield of 6.63%. At market close on 14 August 2019, WBCâs stock was trading at a price of $28.520, up by 0.635% intraday, with a market capitalisation of circa $98.9 billion. The stockâs 52 weeks high price stands at $30.440 and 52-weeks low price of $23.300 with an average volume of ~6,989,748.

Among the top four banks of Australia(in terms of market cap), one is Australia And New Zealand Banking Group Limited (ASX: ANZ) which reported a decline of 5% in its Statutory Profit After Tax of 1H FY19 as compared to pcp.

In the half year period, ANZ took several business initiatives which include:

- Introduction of single home loan origination system for all channels in Australia to improve the application and assessment process;

- Increasing the number of dedicated home loan assessors in Australia to assist with enhanced verification;

- Increasing home loans and retail deposits in New Zealand by 6% respectively year on year;

- Maintaining digital wallet leadership with more than 88 million transactions;

- Increasing dedicated remediation team by over 50% to improve the speed in which customers are refunded;

- Contacting more than 276,000 customers to help them get better value from their banking products.

ANZ has witnessed an uplift of 1.43% in its share price, over the last six months. ANZâs stock has a PE multiple of 12.330x and an annual dividend yield of 5.92%. At market close on 14th August 2019, ANZâs stock was trading at a price of $27.030, up by 0.074% intraday, with a market capitalisation of circa $76.56 billion. The stockâs 52 weeks high price stands at $30.390 and 52-weeks low price of $22.980 with an average volume of ~5,509,990.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.