One of Australiaâs leading bank, National Australia Bank Limited (ASX: NAB) is going for new leadership to transform its operations and culture. In an early release published on Friday, 19th July 2019, the Bank announced the appointment of highly experienced and skilled Mr Ross McEwan as its new CEO and MD.

NABâs stock was up by 2.192% during todayâs intraday trade.

Additionally, the Board believes that it has secured a well proven CEO who will be an ideal leader for NAB. From the period of 2013 to 2019, Mr McEwan served as Chief Executive of Royal Bank of Scotland Group, a large international banking and financial services company. In his extensive experience, Mr McEwan delivered important and practical improvements for the customers.

In the past one year, NAB faced a lot of challenges including scrutiny by the Royal Commission, the resignation of CEO, Andrew Thorburn and Chairman, Ken Henry and most importantly, losing the trust of its customers. Under the new leadership of Mr McEwan, NAB intends to transform its operations and culture around leading customer services, experience and products in anticipation of earning back the trust of its customers.

The appointment of Mr Ross McEwan means that Mr Philip Chronican currently serving as Interim CEO will transition to the post of Chairman in mid-November 2019, stepping into the shoes of Dr Ken Henry. Subsequently, NABâs Board will put other interim management arrangements suitable to the Australian Prudential Regulation Authority (APRA) in place if required. Mr Chronican has been an Interim CEO since March 2019, following the resignation of Andrew Thorburn after 4.5 years as CEO. Dr Henry expressed his intentions in February to resign from the Board once the permanent CEO position has been filled. He joined the Board as a Director in 2011 and became Chairman in 2015.

The appointment of Mr McEwan is subject to regulatory approvals, with a rolling contract, which can either be terminated by Mr McEwan or NAB by serving 26 weeksâ notice. A restraint period of six months will be applicable post termination.

The three key components of Mr McEwanâs remuneration package are:

- Fixed Remuneration

- Fixed remuneration of $2.5 million per annum (inclusive of superannuation and any salary sacrifice arrangements), reviewed annually in accordance with NABâs remuneration policy.

Annual Variable Reward

- Potential to earn between 0% and 150% of fixed remuneration;

- 50% of any variable reward earned will be paid in cash and 50% will be provided in the performance rights vesting evenly over four years. A dividend equivalent payment will be made only on vested rights.

Long Term Variable Reward

- An annual grant of up to 130% of fixed remuneration provided in performance rights, which are not dividend eligible;

- Vesting subject to performance testing at the end of a four-year performance period against customer measures (relative Net Promoter Score) and financial measures (relative Total Shareholder Return).

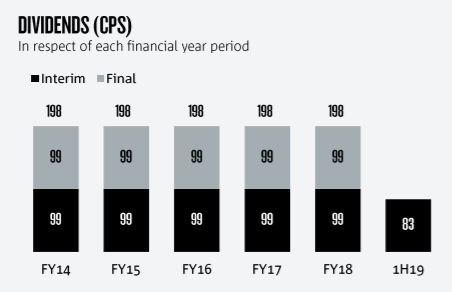

On the financial performance front, in the first half of FY19, NAB reported Statutory Net Profit of $2,694 million and cash earnings of $2,954 million. The net interest margin of NAB in the first half was down by 7 basis point while its expenses were up by 1.7%. For the half year period, NABâs Board decided to pay a dividend of 83 cents per share, fully franked, down 16% on pcp.

Dividend Summary (Source: Company Reports)

Background on Royal Commission: In December 2017, the Government of Australia formed a Royal Commission into âMisconduct in the Banking, Superannuation and Financial Services Industryâ, which is a significant step in establishing transparency in the financial services industry. The Royal Commission is a formal public inquiry that can only be instigated by the executive branch of the Australian Government and is directed by the terms of reference. During 2018, the Royal Commission has conducted public hearings on a wide range of matters that were related to the business and operations of the group, including consumer lending, business lending, provision of financial advice and the conduct of the financial regulators. In the Interim Report released on 28th September 2018, the Commissioner identified a series of questions, which rose from the Royal Commissionâs work. These questions were intended to provoke further debate around the reasons for prior conduct and what changes could be made to the financial services industry to prevent misconduct in the future. Later, the Royal Commission released its Final Report, providing recommendations to improve the financial services industry.

On the stock performance front, in the past six months, NABâs shares have provided a return of 8.16% as on 18th July 2019. At market close on 19th July 2019, NABâs stock was trading at a price of $27.510, with a market capitalisation of circa $77.61 billion. Its 52-week high price stands at $29.000, and 52-week low price stands at $22.520, with an average volume ~7,242,145. The stock is trading at a PE multiple of 13.120x and an annual dividend yield of 6.76%.

Now letâs take a look at a few other leading banksâ stock performance.

Westpac Banking Corporation (ASX:WBC)

A leading provider of financial services in Australia, Westpac Banking Corporation (ASX: WBC) has witnessed an increase of 5.47% in its share price over a period of last six months as on 18th July 2019. At market close on 19th July 2019, WBCâs stock was trading at a price of $27.880, with a market capitalisation of circa ~$96.25 billion. The stock has an annual dividend yield of 6.82% and a PE ratio of 13.380x. Its 52 weeks high and low price stands at $30.440 and $23.300, with an average volume of ~7,229,365.

Commonwealth Bank of Australia (ASX:CBA)

The stock of Commonwealth Bank of Australia (ASX: CBA) has provided a return of 11.13% in the last six months as on 18th July 2019. At market close on 19th July 2019, CBAâs stock was trading at a price of $82.090, with a market capitalisation of circa ~$144.06 billion. The stock has an annual dividend yield of 5.3% and a PE ratio of 15.860x. Its 52 weeks high and low price stands at $83.990 and $65.230, with an average volume of ~ 3,085,406.

Australia And New Zealand Banking Group Limited (ASX:ANZ)

The shares of Australia And New Zealand Banking Group Limited (ASX: ANZ) have provided a return of 4.03% in the last six months. At market close on 19th July 2019, ANZâs stock was trading at a price of $27.510, with a market capitalisation of circa ~$76.87 billion.

It is very important for any financial institution to have an experienced and skilled leadership team on-board in order to reach their respective goals and objectives. NAB took several months to appoint its new CEO, which demonstrates that how serious and careful NABâs Board was in choosing its CEO.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.