According to a report published by one of the Big Four Accounting firms - KPMG, Australia has witnessed a five-fold increase in the number of fintech start-up firms over the past 5 years period. Interestingly, the sub-sectors covered by the fintech firms has been diverse, the investment rising from $53 million in 2012 to more than $675 million in 2016. The payments and lending companies were the firsts and main ones to adopt the fintech concept, while wealth-tech, reg-tech, blockchain and insur-tech followed suit.

Fintech, as the word suggests, is an amalgamation of finance and technology. It can be best described as the technology that enables and supports banking and financial services. In a tech-savvy and financially evolving economy, Australia is a hot spot for this concept.

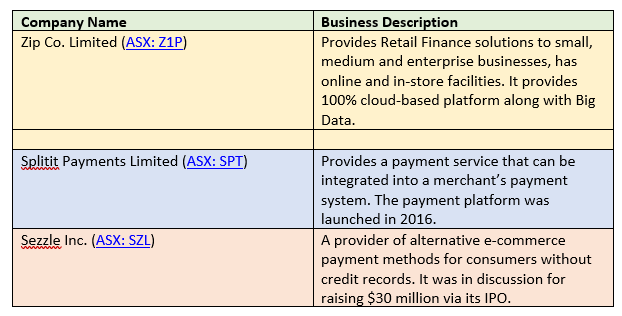

In this article, we would look at the growth and updates delivered by the three ASX-listed fintech companies, and understand their stock performances and returns generated:

Z1Pâs FY19 Results

On 22 August 2019, Zip Co Limited (ASX: Z1P) announced its full year results for the year ended 30 June 2019. Recording a successful year, the company notified about a whopping 138% jump in its revenue standing at $84.2 million, annualising at over $100 million. The transaction volume soared up by 108% to $1,128.5 million and receivables loan books were up by 115% to $682.6 million. The Reported cash EBTDA was at $9.2 million and Zip Co. raised $54.4 million worth net of costs, in an oversubscribed capital raise.

FY19 Highlights (Source: Z1Pâs Report)

A highlight of the period, was the launch of the Zip App, transforming the customer experience. Another highlight was the acquisition of global tech platform, PartPay, which was acquired for NZ$50.8 million, and provided entry into four new markets (NZ, UK, US & SA). The company increased its shareholding in US-based, QuadPay to 15%. Z1P reported over 1.3 million customers, up by 80% and more than 16,000 partners, up by 54% on its platform.

As at 30 June 2019, Z1P had $12.6 million in cash on its balance sheet and $631.5 million worth available funding facilities. Post an increase in the facility provided by NAB in the zipMoney Trust 2017-1, the total facility size reached $731.5 million in July 2019. $71.5 million was held in equity subordination, across Z1Pâs funding programs.

Z1Pâs Credit performance was good, with Net bad debts of 1.63% down from 2.61% in June 2018. Arrears were 1.89% compared to 1.87% at June 2018. Its Repayment profile stood at 13% -14%.

On the outlook front, for FY20 period, the company is aiming at tapping 2.5 million customers with an active Zip account and $2.2 billion in annualised transaction volume. It plans to integrate PartPay and enhance the market share in New Zealand and a launch in UK is also in the pipeline.

Moreover, Zip Co. would launch Zip Biz, an instalment product for small business, providing an interest-free digital wallet up to $25k. The product is expected to be in the market before the end of the year with a number of launch partners.

Pleased with the results, MD and CEO Mr Larry Diamond stated that the company is striving towards driving more customers, making transactions at more places and often.

Splitit Paymentsâ New Partners

Enriching its growth stance and paving towards survival in a competitive climate, Splitit Payments Limited (ASX: SPT) welcomed two new partners in the kitty, to aid its affairs. SPT is rapidly scaling up through partnerships with large global players that provide access to multiple merchants and higher value transactions, and do not incur a notable additional operational cost.

On 13 August 2019, the company announced its partnership with one of the world's leading providers of music software, Ableton AG, which helps artists to create, produce and perform music. The companyâs monthly instalment payment solution could be used by the virtual users of Ableton in North America, South America, a few EU countries and Australia.

As part of the deal, the company would earn merchant fees for each consumerâs transaction that passes through the Splitit Payments Platform, which is live online at Ableton.com US site. There were no minimum volumes (contractual) mentioned in the partnership.

Continuing the partnership bandwagon, SPT announced a new 5-year partnership agreement with Atlanta-based eCommerce as a Service solution provider, Ally Commerce, on 19 August 2019, who would offer the companyâs interest and fee free monthly instalment payment solution to its huge enterprise merchants, Ally Commerce eases businesses in an end-to-end way, wherein the brand producers enable online sales for the consumers. The partnership received its first merchant, Respironics Colorado, owned by Phillips.

Earlier in July 2019, the company had partnered up with GHL ePayments Sdn Bhd, a part of GHL Systems Berhad, one of the top merchant acquirers in the ASEAN region and the digital player Kogan.com Limited (ASX:KGN).

Sezzle Inc.âs IPO and Operational Update

Sezzle Inc. is one of the companies that investors and market enthusiasts are keenly looking at and awaiting its first statutory report as an ASX-listed company for the 6-month period to 30 June 2019, which would be released this reporting season, on 30 August 2019. Also, the first quarterly Appendix 4C would be released on 31 October 2019.

The new hot stock listed on the Australian Securities Exchange on 30 July 2019, Sezzle Inc. (ASX: SZL), commenced trading its CDIâs on a deferred settlement basis after completion of its oversubscribed A$43.6 million IPO, the target raising being $30 million.

The funds raised through the company going public would be used to support its growth strategy, tapping and capturing future growth opportunities, and expanding the retail merchant base and product offering. As an another player promoting the âbuy now, pay laterâ in Australia, the company aims to up its game, through its operations and continue growing while it provides free of interest instalment solutions to users.

The operational updates, as provided by the company on 30 June 2019, depicted that SZL had 5,048 Active Merchants using its platform, up by 1,727 from last quarter. Active Customers increased to 429,898, up by 160,078 from last quarter. Underlying Merchant Sales for the quarter ended 30 June 2019 were $41.9 million, up by $13.6 million from the last quarter. Merchant Fees were at $2.1 million, up by $0.7 million from the prior quarter.

SZLâs Operational Highlights (Source: SZLâs Report)

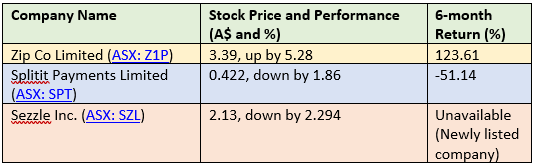

Let us look at the stock performances and 6-month return of the above-mentioned stocks, trading on ASX as on 23 August 2019 (AEST 3:12 PM):

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.