The recent few decades have been a roller-coaster phase in the investing world. There have been high and low tides, and the market has evolved along with the same. The one thing that has remained constant amid this dynamicity is the inclusion of new companies, their listing on stock exchanges and increase in the number of investors in the market.

In this article, we would understand the concept of an Initial Public Offering and take a sneak peek on few of the recent IPOâs that have been listed on the Australian Securities Exchange, and conclude by notifying the reader about few upcoming ASX IPOâs of the year:

What is an Initial Public Offering?

Often referred to as a stock market launch, an Initial Public Offering (IPO) is an event wherein a public company decides to get itself associated with an exchange market and commences its stock offering to the public/institutional investors. The process is also termed as floating or going public, since post official listing of a stock in the stock market, the private company is transformed into a public company.

An IPO is an indicator of the economyâs health. In a period of recession, IPOâs drop significantly, as the share market isnât lucrative during the phase. Once the IPOâs on the exchange increase, it depicts that the economy is back from the slack phase and booming.

Everyday names like Facebook, Amazon, Snapchat, Visa, General Motors have undergone this process. Currently, Chinese e-commerce mega-corp Alibaba Group Holding which trades on the NYSE and commenced its offering in 2014, is believed to be the largest IPO worldwide with a raising of approximately USD21.77 billion.

What is the process of an Initial Public Offering?

Before understanding the process of an IPO, let us quickly contemplate on the reason as to why an IPO takes place- amongst many, the prime ones would be - it is an opportunity for the companies to generate good money (capital raising) for expansion, useful during mergers and acquisitions, so that top talent can be attracted, to pay dividends and attain returns on stocks as fruits of labour, one awaits and cherishes.

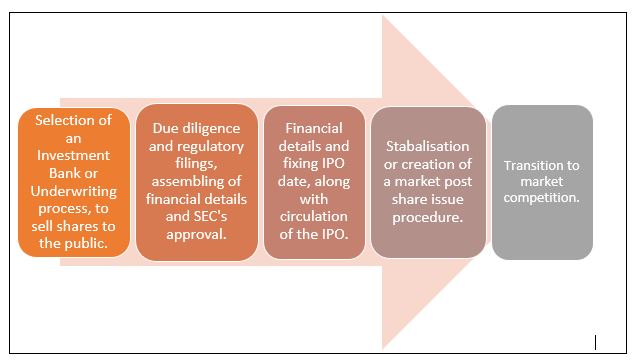

IPOâs take a lot of time, effort and regulations because they are live on an exchange. The process can be broken down into 5 steps as depicted below:

Initial Public Offering in Australia:

The IPO process in Australia comes with a range of opportunities. Companies choose to get listed on the Australian Securities Exchange, which is consistently ranked one amongst the most active top exchanges globally. The 150+ years old ASX has over 100 IPOâs on an annual basis and is regarded as the largest pool of investable funds in Asia. As of latter part of 2018, the exchange had over 2,200 listed companies over various sectors, with a market capitalisation of over $2 trillion, with 6.7 million share owners and 180 market participants.

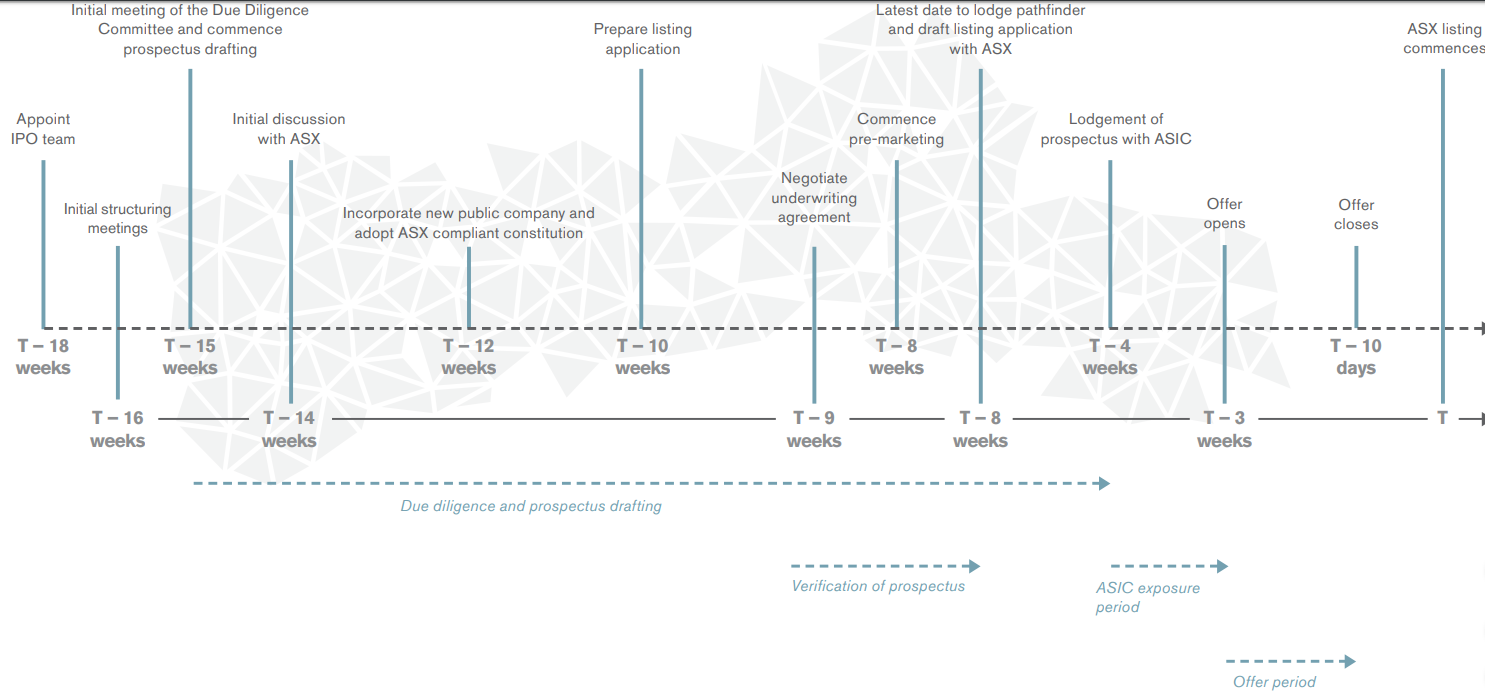

The exchange lays down general tests and certain specific requirements for listing a company. These include the profits test, assets test, quarterly reporting of its financials and escrow arrangements. A prospectus is prepared and rolled out in the market with all the details that investors need. The below image explains the time frame of an IPO on the ASX:

Indicative IPO timeline (Source: ASX)

Let us now look at the three most recent IPOâs that got listed on the ASX, their share performances and recent updates:

Quickfee Limited (ASX: QFE)

Company Profile: A company from the diversified financials group of industries, and a payment platform provider, Quickfee Limited sets up business firms with an online portal which aids them in conducting payment options for clients. The company acts as a silent middleman between the business entity and the payment portal. QFE was listed with the ASX on 11 July 2019 and has its registered office in Carlton South, Victoria.

Share Price Information: By the closure of the trading session, on 24 July 2019, QFEâs shares was at A$0.390, up by 9.859 per cent with approximately 140.55 million outstanding shares. The market capitalisation of the company is A$49.9 million, and in the last 5 days, it has delivered a negative return of 19.32 per cent.

Business Operations Update: On 12 July 2019, QFE released its Business Operations Update, stating its successful admission to the official list of the ASX. As on 30 June 2019, the company had signed up with 618 and 236 professional services firm in Australia and the US, respectively. The transaction value increased by 170 per cent in Australia and stood at A$28.3 million in FY19 as compared to FY18. This increased by 182 per cent in the US ($136.8 million). The lending activity was up by 17 per cent (A$42 million in FY19) and 108 per cent ($8.3 million) in Australia and the US, respectively. QFE welcomed two additional sales representatives in the US team to dive into the US market.

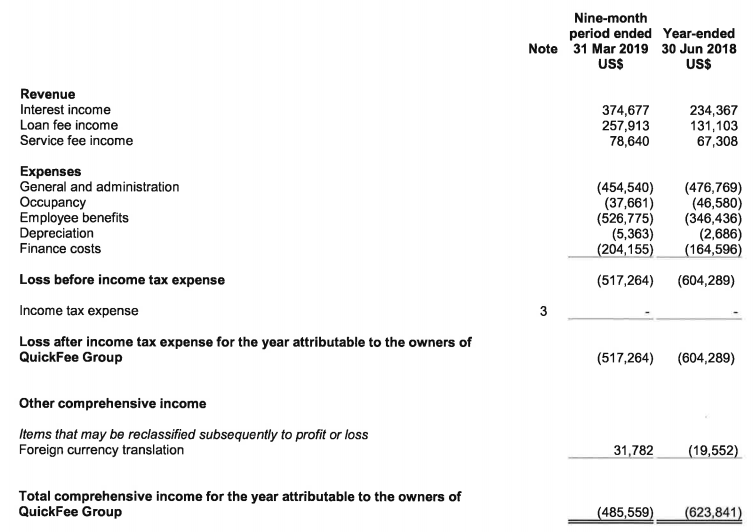

Financial Update: In its report for the nine-month period ending 31 March 2019, the Group reported a loss of USD517,264 post taxation.

QFEâs financial update (Source: QFEâs Report)

Invex Therapeutics Limited (ASX: IXC)

Company Profile: Perth based, biopharmaceutical player established in March 2019 and listed on 5 July 2019 on the ASX, Invex Therapeutics Limited focusses on developing effective treatments for neurological health issues that arise out of raised intracranial pressure. The company conducts extensive research and development to understand pressure regulation in the brain, and has keen interest in the repurposing of Exenatide, which is an approved drug.

Share Price Information: On 24 July 2019, IXCâs shares last traded on ASX at A$0.805, zooming up by 14.28 per cent with approximately 55 million outstanding shares. The market capitalisation of the company is A$40.43 million, and in the last 5 days, it has delivered a negative return of 25 per cent.

June 2019 Quarterly Report: On 24 July 2019, IXC provided June 2019 Quarterly Report to the market, stating that it was assigned the IP rights from the University of Birmingham and the Orphan Drug Designations for The US and Europe. The funds from the recent IPO would be utilised towards the expansion of its IP portfolio and conclude the repurposing of Exenatide. An in process clinical study in IIH (with top-line tata expected next year) and initiating of a second proof of concept clinical study in another indication would also be part of it.

By the close of the quarter, IXC had a cash position of $12.17 million.

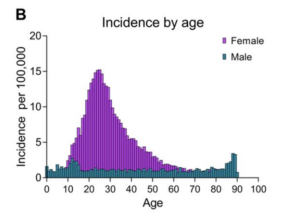

Investor Presentation: In the investor presentation, released on 5 July 2019, the company stated that almost 90 per cent of IIH patients were obese women of childbearing age, and currently there are no approved drug to cure it. The Phase II Study in IIH was ongoing with 10 patients enrolled and completed to date.

IIH patient age (Source: IXCâs Report)

VGI Partners Limited (ASX: VGI)

Company Profile: A fund manager formed in 2008 and listed on 21 June 2019 on the ASX, VGI Partners Limited is a global equity manager and manages the capital for individuals with high net worth, family offices and VGI Partners Global Investments Limited (ASX:VG1). The companyâs team is based in New York, Tokyo and Sydney and the company invests in a relatively small number of high-quality businesses.

Share Price Information: On 24 July 2019, VGIâs shares last traded at A$12.4, up by 3.247 per cent with approximately 67.07 million outstanding shares. The market capitalisation of the company is A$805.48 million, and in the last one month, it has delivered a return of 14.49 per cent.

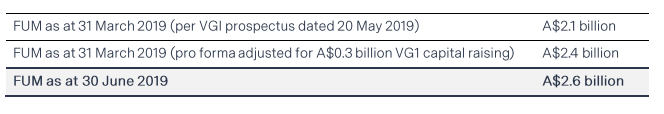

FUM, Performance Fees and Dividend Update: On 15 July 2019, VGI provided an update on its Funds under management, Performance fees and dividend for June 2019. The company recognises its performance fees on a crystallised basis (as and when they are due and payable). For the period ending June 30, VGI would crystallise almost A$32 million in performance fees. On the dividend end, VGI would target a dividend pay-out ratio in the range of 50 per cent to 75 per cent of the NPAT, from the second half of FY19.

VGIâs FUM (Source: VGIâs Report)

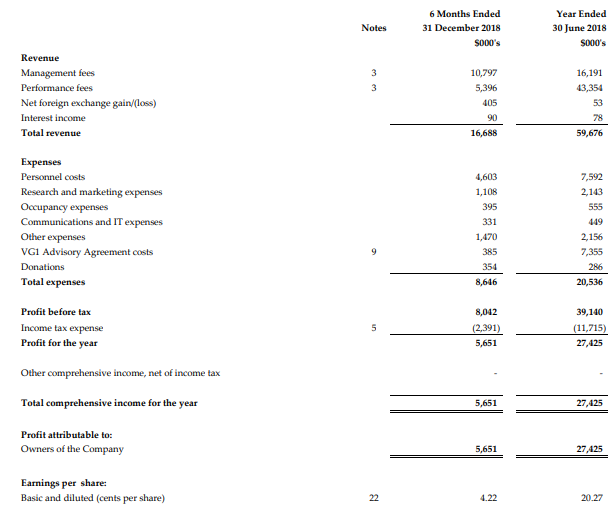

Financial Update: In its Consolidated Financial Statements for the six months ended 31 December 2018, VGI stated that dividends worth $5,452,000 were declared and paid for the period. The profit for the period amounted to $5,651,000. Cash and its equivalents were recorded at $7,799,000.

VGIâs Financial Update (Source: VGI Report)

Let us now have a look at a few upcoming IPOâs that investors and the market are waiting for:

| Company Name | ASX Ticker | Proposed Listing Date | Principal Activities |

| AppsVillage Australia Limited | APV | 23 July 2019 | SaaS Company |

| OptiComm Limited | OPC | 22 August 2019 | Carrier and Infrastructure |

| Sezzle Inc. | SZL | 30 July 2019 | Payment Platform |

| Tartana Resources Limited | TNA | 13 August 2019 | Mining and Exploration |

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.