On the other hand, IXC recently on 5 July 2019, made its debut on ASX. On 11 July 2019, IXCâs shares last traded at A$1.38, slipping by 7.383% from its prior close.

Also, if we look at the health care sector, the Australian healthcare benchmark index, the S&P/ASX 200 Health Care (Sector), on 11 July 2019, by the end of the trading session was up by 0.51%.

Let us now find out, the reasons behind the three stocks being so popular amongst the investors:

Invex Therapeutics Ltd

Invex Therapeutics Ltd (ASX: IXC) a biopharmaceutical company, concentrates on developing effective treatments for neurological conditions, which is caused by raised intracranial pressure (ICP). ICP is considered as a serious issue in a range of neurological conditions, which includes idiopathic intracranial hypertension (IIH), traumatic brain injury or severe stroke. The company was established in March 2019 and is headquartered in Australia.

Recent update/s:

As per the companyâs announcement on 3 July 2019, it got admitted to the Official List of ASX Limited, effective 3 July 2019 as well. Also, the Official quotation of ordinary fully paid shares of IXC started on 5 July 2019. The company was able to raise $12,000,000 pursuant to the offer under its replacement prospectus dated 29 May 2019 by issuing 30,000,000 fully paid ordinary shares of the company at an issue price of $0.40 per share.

For the period between 8 March 2019 To 31 March 2019, the company made a net loss of $11,190, which was due to the establishment costs of a public company. In order to get listed on ASX, the company raised a seed capital of $500,000. The company would also be raising adequate capital so that it could finalize the assignment of the Intellectual Property from the University of Birmingham and fund the research and development programme.

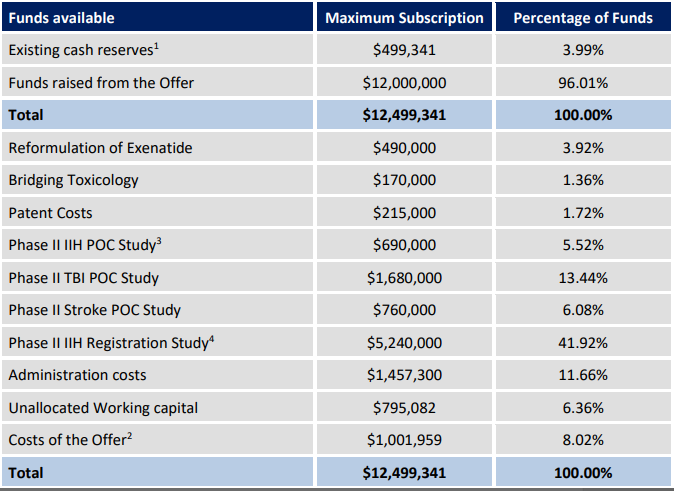

On 3 July 2019, the company further released an announcement where it highlighted that it intended to apply capital raised from its initial public offer worth $12,000,000 along with the present cash balance over the initial two years.

Source: Companyâs Report

Based on the actual funds raised by the company, the net assets of the company by 30 June 2019 stood at $11,441,228. The company had net cash and cash equivalent worth $12,170,247 for the period.

On 5 July 2019, IXC released an Investor presentation where it mentioned the IPO Investment Highlights, as follows:

- The company has completed the proof of concept preclinical in-vitro and in-vivo

- The Orphan Drug Designations are granted for IIH in Europe (EMA) and in the US (FDA).

- The Phase II Study in IIH is underway.

- Key patent applications have been lodged in 2014 (UK, US, EU).

Next Science Limited

About the company:

Next Science Limited (ASX: NXS) is a company from the healthcare sector which got listed on ASX on 18 April 2019. The company is into the business of Commercialising as well as developing its XbioTM technology, which is a non-toxic technology and is efficient enough in eliminating both biofilm-based and free-floating bacteria in various products that are used for the treatment of biofilm-based infections. The company is focused on creating high-quality solutions for a global impact. Next Science Limited was founded in the year 2012 and is headquartered in Chatswood, New South Wales.

Update/s:

Since the time, the company got listed on ASX, its shares have been giving a positive return.

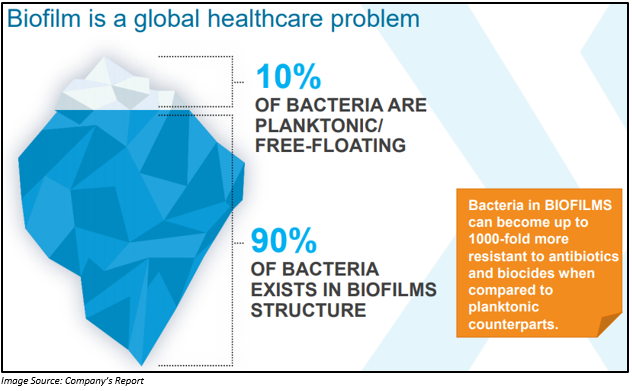

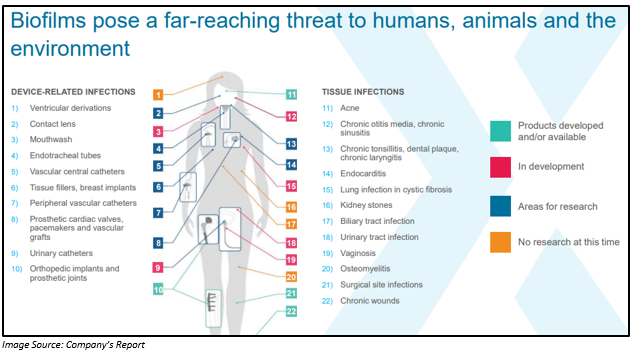

In the investor presentation, which was released on 27 May 2019, the company highlighted about Biofilms, which is a global health care problem. Biofilms can give rise to extensive threat to humans, animals as well as the environment. The treatment of these resistant forms of bacterial infections is quite difficult. Around 10 percent of bacteria are free floating, and rest of the 90 percent organically of them form colonies, which is known as biofilms.

XbioTM formulations use a patented composition-of-matter as well as the method of action which include the non-toxic technology, which is designed in such a manner that it would physically break down the protective structures of biofilm. It helps in exposing and removing bacteria that are enclosed within the technology and at the same time, offers targeted therapy with no known antimicrobial resistance.

The Current products under the XbioTM Family comprises of Bactisure TM, SurgX TM, BlastX TM, TorrentX TM and Acne Gel.

The presentation also highlights various case studies, where in one of the cases a 67-year old diabetic female, with the history of trauma to the lower leg with Recalcitrant chronic wound 3.5 cm wide reported a total closure of the wound post 4 weeks of treatment. Another case was of an eighty-four-year-old male, with TYPE II diabetes, kidney failure, hypertension and multiple cancers. His right forearm loop graft was Infected. Also, his wound was of 4.7 cm, indifferent to standard care, surgery as well as antibiotics for more than 8 months. With the application of BlastX with dressing changes in every 2 days, the wound got healed within two weeks.

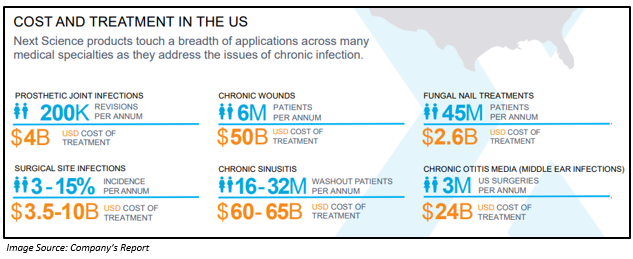

Besides, in the US, the company has a huge market opportunity.

The Development Plan:

The development plan of the company for Medical Device Products till 2023 is as mentioned below:

| Medical Device Products | Timeline |

| SINUS WASH | Development is expected to complete in 2020 |

| MIDDLE EARWASH | Development is expected to complete in 2020 |

| MIS LAVAGE | Development is expected to complete in 2020 |

| NASAL STENT | Development is expected to complete in early 2021 |

| ADHESION BARRIER | Development is expected to complete in early 2022 |

| SOFTIMPLANT COATING | Development is expected to complete in early 2023 |

| MOUTHWASH | Development is expected to complete in early 2023 |

The development plan of the company for Pharmaceutical Products till 2024 is as follows:

| Pharmaceutical Products | Timeline |

| IMPETIGO | Development is expected to complete in the mid of 2022 |

| ATOPIC DERMATITIS | Development is expected to complete in the early 2023 |

| FUNGAL NAIL | Development is expected to complete by the end of 2023 |

| KELOID PREVENTION | Development is expected to complete by the end of 2023 |

| BACTERIAL VAGINOSIS | Development is expected to complete beyond 2024 |

The company on 27 May 2019, announced that it had appointed Grace Medical (a recognized global market leader in ENT space) as an exclusive distributor of Sinus Lavage in USA, Europe, Australia & other key markets.

Outlook:

The company expects its sales growth via compounding growth drivers which includes:

- Increase its market penetration of the existing products in the US market.

- Focus on global wound care products.

- Expansion of sales beyond the US region.

- Development and commercialization of new products and application in human health.

- The company expects to launch the Acne product in Australia in 2H FY2019.

- The distribution agreement for TorrentX and SurgX is under the negotiation phase.

- The company expects regulatory approvals in the US, Europe, Canada and Australia.

Pro Medicus Limited

About the company:

Pro Medicus Limited (ASX: PME) is from healthcare sector and a medical imaging IT provider which specializes in Enterprise Imaging and Radiology information system.

Recent Update/s:

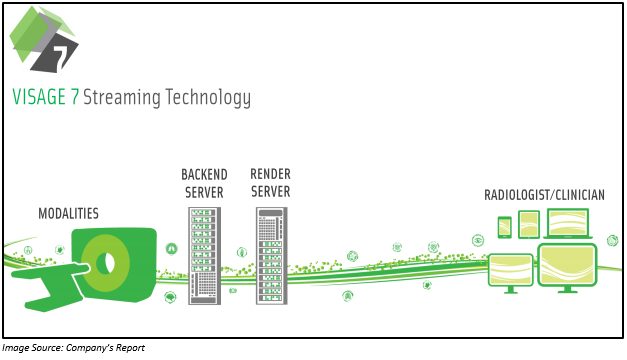

On 24 April 2019, the company notified that its wholly owned U.S. subsidiary, Visage Imaging, Inc had signed a contract with Duke Health for a period of seven years under which Visage 7 technology would be implemented across all the radiology departments of Duke Health.

Duke Health is one of the top twenty hospitals in the US and is the most respected health provider in North America. The above-mentioned implementation will be done in three hospitals and further locations across Duke Health, which includes 957-bed academic medical center. Also, Visage 7 technology helps in delivering fast and powerful enterprise imaging.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.