Whatâs happening in the Lithium market?

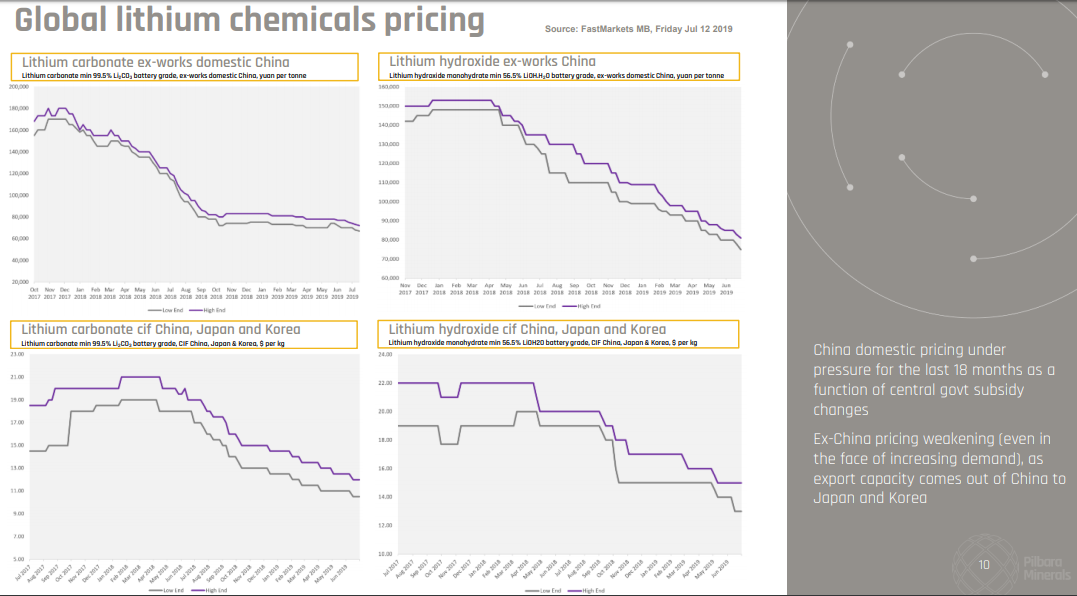

Orocobre Limited had recently on 24 July 2019, notified about the falling lithium chemical prices in the seaborne market in its latest Quarterly update for the period ended 30 June 2019. Accordingly, it was mentioned that customers reported high inventory levels, and the Chinese Electric Vehicle Subsidy was concluded in the late June after the âtransition periodâ. Besides, Chinese EVs suffered a series of battery fires, which impacted the production and the preference for battery formats that utilise lithium carbonate was on the rise.

US trade challenges has further added to the woes, and the spodumene producers suffered delays in shipments, as the Chinese converters delayed projects on account of aggressive project timelines, tightened credit, and interruptions in production due to environmental inspections and unplanned maintenance. In China, one more significant development occurred during the quarter wherein the list of approved EV suppliers was removed, which opens the Chinese market for international companies as well. In India, the government had introduced a series of initiatives with a budget to develop a dedicated battery supply chain over the three years.

Galaxy Resources had also recently on 16 July 2019, in the quarterly update, mentioned the tightened conditions, macro sentiment and un-resolved trade disputes between the US-China. Accordingly, the domestic prices fell in China during the Q2 2019 period. Galaxy Resources mentioned the potential weakness in the New Energy Vehicle (NEV) sales, and the Chinese transition from the China 5 to China 6 emissions standard made the distributors of the internal combustion engine to provide an aggressively discounted price to clear inventory, which increased the competition for NEV sales.

Also, in Europe, the demand for EVs escalated, and the region reported registration of approximately 227,330 units of the plug-in vehicle during the first five months of 2019, which depicts an increase of 55% on y-o-y basis. In the US, the plug-in vehicle deliveries during Q2 2019 were approximately 87,450 units, representing a 27% growth y-o-y, and for the H1 2019 period, the deliveries were approximately of 148,700 units.

European Governments have been maintaining an accommodative stance on the development of the EV market, and development includes emission regulation, vehicle electrification through incentives and capital investment. In Germany, the government extended that incentive program for EVs for an additional eighteen months. In Ireland, the government had decided to ban the sale of new petrol and diesel vehicle by 2030, under the new Climate Action Plan published in June 2019.

BMW had recently announced to accelerate the electrification plan by two years, and it intends to launch 25 EV models by 2023. Chinese battery giant CATL announced to increase investments in battery production, research and development Europe to EUR1.8 billion. Volkswagen reported its plan to install 36k electric car charge points across Europe by 2025 along with a EUR900 million investment in a Swedish battery manufacturer.

Letâs look at some of the lithium focused companies traded on ASX:

Orocobre Limited (ASX: ORE)

On 6 August 2019, the company reported that a ceremony was organised to commemorate the initiation of construction at the Naraha Lithium Hydroxide Plant. Accordingly, it is planned to convert primary grade lithium carbonate feedstock into purified battery-grade lithium hydroxide, and the primary grade lithium carbonate feedstock would be sourced from the Olaroz Lithium Facility.

As per the release, the representatives from Toyota Tsusho Corporation (TTC), Toyotsu Lithium Corporation, and Mr MartÃn Pérez de Solay â Orocobreâ Managing Director and CEO hosted the ceremony.

Ceremony (Source: Companyâs Announcement)

Besides, TTC would act as an exclusive sales agent consistent with the joint marketing arrangement in place for the Olaroz Lithium Facility and conduct the sales of lithium hydroxide. Further, it is expected that most of the produce would be delivered to the battery industry plying trade in Japan. Further, there is an operational cathode manufacturing plant within proximity, and plans are in place to develop a battery manufacturing facility nearby.

Orocobreâs Managing Director & CEO, Mr MartÃn Pérez de Solay, stated that the commencement of construction marked an exciting moment for the company and joint venture partners. He mentioned that the timing of the plant would enable the company to produce low-cost battery grade lithium hydroxide, while the demand was expected to rise. Further, the construction of the Naraha Plant exposes the company to invaluable product diversification.

On 7 August 2019, OREâs stock was trading at A$2.555, up by 0.591% (at AEST 12:06 PM).

Kidman Resources Limited (ASX: KDR)

Kidman Resources is amid an acquisition process by Wesfarmers Limited (ASX:WES). On 31 July 2019, the company reported that the Federal Court had approved the despatch of a Scheme Booklet to Kidman Shareholders regarding the Scheme of Arrangement with Wesfarmers Lithium Pty Ltd, a wholly-owned subsidiary of Wesfarmers Limited. Also, the Federal Court had also directed to organise the meeting of Kidman Shareholders to consider and vote on the proposed scheme.

Subsequently, on 1 August 2019, the company released the Scheme Booklet Registered with ASIC on the exchange. Accordingly, the Scheme Meeting has been scheduled at 10 AM on 5 September 2019 at the RACV Club, Level 2, Bourke Room 2&3, 501 Bourke Street, Melbourne Victoria 3000. Also, the company would hold a General Meeting following the close of the Scheme Meeting.

Timetable & Key Dates (Source: Companyâs Scheme Booklet)

Earlier in May, Wesfarmers had completed the due diligence regarding the proposal to acquire Kidman. Subsequently, on 23 May 2019, it was reported that the companies entered into Scheme Implementation Deed, which proposed to acquire 100% interest in Kidman for a consideration of $1.90 per share through the scheme of arrangement.

On 23 May 2019, the company also forwarded the announcement made by the Wesfarmers, which talked about the proposed offer. Accordingly, Wesfarmers had collaboratively worked with Kidman, and the Mt Holland lithium project JV company, Covalent Lithium to complete the confirmatory due diligence process.

Subsequently, the acquisition of Kidman depicts an opportunity to develop a lithium hydroxide project in Western Australia, which would be a large-scale, long-life and high-grade project. Also, WES had formulated its own plan for the development of the Mt Holland lithium project (Project), which would be proposed post the completion of the acquisition. Reportedly, WES also executed a commitment deed with Sociedad QuÃmica y Minera de Chile S.A. (SQM) regarding the Project joint venture agreement (JVA) between Kidman & SQM. Also, the commitment deed includes the amendments related to commercial, technical matters, which would become binding upon the completion of the acquisition. Besides, SQM had agreed to not enter into discussions with parties proposing to initiate another offer for Kidman.

KDRâs stock was trading at A$1.9, up by 0.264 percent (as on 7 August 2019, at AEST 12:06 PM).

Galaxy Resources Limited (ASX: GXY)

Galaxy Resources is an ASX-listed lithium-focused company. It operates three wholly owned projects in Australia, Canada and Argentina. Recently, in the latest Quarterly Activities Report, released on 16 July 2019, for the period ending 30 June 2019 announced that Mr Cattlin Project in Australia had a record quarter production. Accordingly, the project produced a volume of 56, 460 dry metric tonnes (dmt) with a grading of 6.0% Li2O, which exceeded the production guidance of 45-50k dmt.

Letâs now look at the assets held by the company:

James Bay, Quebec â Canada

James Bay is a hard rock lithium development Project, with an Indicated Mineral Resource of 40.3Mt at 1.4% Li2O. Also, the company is undertaking a plan for the feasibility study to consider a combined upstream & downstream operation. Besides, the feasibility study would acquire synergies from Mt Cattlin and Jiangsu for engineering and process flow sheet design. Further, the stage 2 downstream test works are underway, which are expected to underpin feasibility.

Sal de Vida, Catamarca Province â Argentina

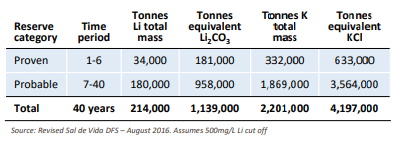

Reserve Estimates (Companyâs Corporate Presentation, July 2019)

Sal de Vida contains undeveloped brine deposits with significant expansion potential, and it is considered premier lithium and potash brine development project globally. The company had updated feasibility, which was concluded in May 2018, which confirmed the potential of the project as a profitable operation and technical superiority.

Mt Cattlin, WA â Australia

Mt Cattlin is a hard rock deposit situated in Western Australia. Recently, it produced record quantities, and the company reported production guidance of 45k to 50k dmt for Q3 2019 along with 180k to 210k dmt for the full year.

On 7 August 2019, GXYâs stock was trading at A$1.12, down by 1.754% (at AEST 12:07 PM).

Pilbara Minerals Limited (ASX: PLS)

On 25 July 2019, the company released the June quarterly report for the period ending 30 June 2019. Accordingly, the company produced 63,782 dry metric tonnes (dmt) of spodumene concentrate and shipped 43,214 dmt of spodumene concentrate during the June quarter.

Reportedly, the Pilgangoora spodumene concentrates shipped achieved customer requirement, and it shipped 6.0% Li2O and 1.2% Fe2O3 with minimal variation per vessel. Also, the company had notified earlier regarding moderate production from Pilgangoora Project to consider customerâs revised production requirements.

Besides, PLS executed an offtake agreement with Chinaâs Great Wall Motor, and the initial shipment is anticipated to be delivered in August this year. Further, the deliveries would be at the rate of 20k dmt per annum for approximately six years.

Lithium Pricing (Source: Corporate Presentation, June 2019)

Lithium Pricing (Source: Corporate Presentation, June 2019)

As per the release, the company completed due diligence with South Korean company, POSCO, regarding the downstream joint venture, and the company expects to finalise the formal documents, licensing agreement in the coming weeks. Also, it is anticipated that the final investment decision and respective approvals from the Boards of both companies would be finalised by the September quarter.

On 7 August 2019, PLSâ stock was trading at A$0.432, up by 1.647% (at AEST 12:10 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.