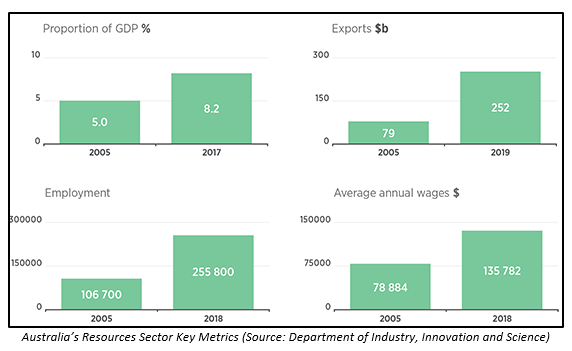

As per the Department of Industry, Innovation and Science, this financial year, the Australian Resources sector is expected to generate $264 Bn in exports, which will be more than 70% of Australiaâs goods exports. Five important resource sector stocks which are expected to contribute well in the Australian economy are Altura Mining Limited (ASX:AJM), Mineral Resources Limited (ASX:MIN), Lithium Australia NL (ASX:LIT), Galaxy Resources Limited (ASX:GXY) and Pilbara Minerals Limited (ASX:PLS).

Altura Mining Limited (ASX:AJM)

Altura Mining Limited (ASX:AJM) is involved in the construction of the mine and processing plant at Alturaâs 100% owned Pilgangoora Lithium Project in the Pilbara region of Western Australia. The company recently announced that is has signed a binding offtake agreement (BOA) with Guangdong Weihua Corporation, which is a reputed Chinese Lithium materials producer. The agreement states five-year term contract for 50,000 dry metric tonnes (dmt) per annum of Lithium Concentrate, commencing in August 2019. The pricing will be based on the content formula of Lithium Oxide (Li2O) with reference to pricing weighted for lithium carbonate and other process factors. The first shipment of ~10K dmt has been scheduled to load in August, with further deliveries of remaining 40K dmt to take place up until February 2020.

Further, the company has reached an agreement with Lionergy limited, and as per the agreement, Lionergy will be reducing its tonnage under its existing offtake obligation, which is expected to provide a minimum annual allocation of 65,000 dmt.

The agreement with Guangdong Weihua Corporation further states that:

- 1st contract period would have the confirmation of 50,000 dmt, which is expected to be delivered to Weihua by February 2020.

- For the first contract period, minimum price and maximum price on a cost, insurance and freight (CIF) basis have been reported at US$585 dry metric tonnes and US$695 dry metric tonnes, respectively.

- Minimum of 50,000 dmt per annum of SC6 spodumene concentrate.

- Term of the BOA expires on 31 December 2024.

- For the second and subsequent years, minimum price and maximum price on a free on board (FOB) basis was reported at US$550 dry metric tonnes and US$950 dry metric tonnes based on Lithium Oxide (Li2O) content per dry metric tonne on 6% Lithium Oxide (Li2O) content.

- Pricing will be based on lithium oxide (Li2O) content formula, with reference pricing weighted for (Li2CO3) Lithium Carbonate.

At the end of March â19 Quarter, AJM reported cash & cash equivalent of $17.53 Mn.

On 2nd August, AJM settled the dayâs trade at $0.099 up 1.02%, with the market cap of ~$208.3 Mn. Itâs 52-weeks high and 52-weeks low stand at $0.315 and $0.095, respectively. It has generated an absolute return of -66.67% for the last 1 year, -27.44% for the last 6 months, and -10.91% for the last 3 months.

Mineral Resources Limited (ASX:MIN)

Mineral Resources Limited (ASX:MIN) is involved in providing integrated supply of services and goods to the resource sector. The company on 1 August 2019 informed the market about revised arrangements with Albemarle Corporation for the sale of 60% Wodgina and acquisition of 40% interest in two modules at Albemarleâs Kemerton hydroxide facility. Both the companies have together been exploring ways to further increase alignment between the parties while leveraging each companyâs respective strengths and position in the global lithium industry. Under the changed agreement, Albemarle will be paying cash of USD 820 Mn at closing and transfer a forty percent interest in the first two 25 ktpa LiOH whose conversion units are being built by Albemarle in Kemerton, in WA. From this development, Albemarle and Mineral Resources will form a 60:40 joint venture (JV) to operate the battery grade lithium hydroxide production facilities and Wodgina Lithium Mine. Mr Chris Ellison, Managing Director of Mineral Resources stated that the revised relationship between both the companies will provide an opportunity for the Mineral Resources to participate in the development of the Kemerton lithium hydroxide plant.

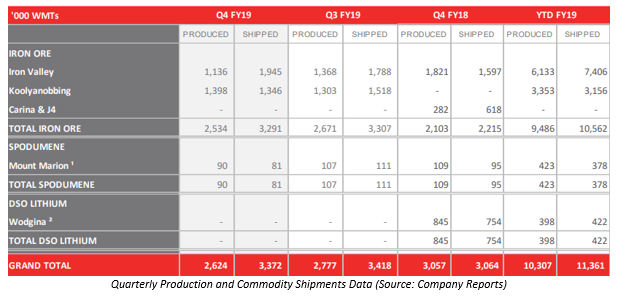

Q4FY19 Key Highlights: In the period, MIN completed a debut US$700 Mn, 8.125% 8-year senior unsecured notes offering, where the funds raised would be used to refinance certain of its existing credit facilities and will use the remainder for general corporate purposes, including capital expenditures. The iron ore shipments totalled 3.3 Mn tonnes (Mt) in Q4FY19, which is 49% up on the prior corresponding period in FY18.

On 2nd August, MIN settled the dayâs trade $15.655 down 4.543%, with the market cap of ~$3.08 Bn. Its current PE multiple is at 25.150x, and its last EPS was noted at $0.652. Its annual dividend yield has been noted at 3.23%. Itâs 52-weeks high and 52-weeks low stand at $18.120 and $12.390, respectively. It has generated an absolute return of -4.65% for the last 1 year, 6.49% for the last 6 months, and 5.53% for the last 3 months.

Lithium Australia NL (ASX:LIT)

Lithium Australia NL (ASX:LIT) has an engagement in the project acquisition, mineral exploration and process development, primarily for the extraction and recovery of lithium. The company on 1 August 2019, published its quarterly activities and cashflow report, where it highlighted that it intends to develop an integrated business capitalising on all major sectors of the lithium supply chain. Its strategies include:

- Advancing its recycling technology to recover valuable metals, including li and Co, from used up batteries, protecting the environment in the process.

- Employing its VSPC technology to convert li chemicals into lithium-ion battery cathode materials of higher quality.

- Sourcing suitable raw materials.

- Advancing its 100%-owned LieNA® and SiLeach® technologies, both of which are capable of altering mine waste to li chemicals.

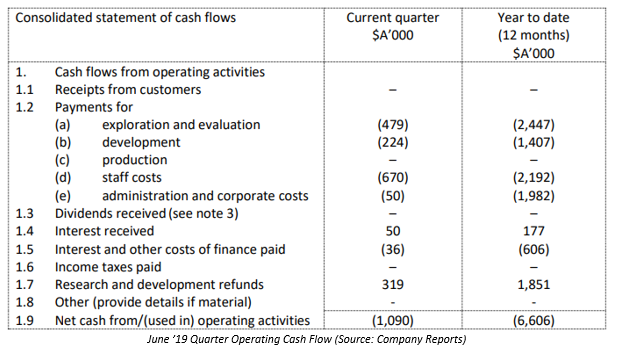

LIT reported cash outflow from operating activities of $1.09 Mn, the contributing factors for the same are as depicted below. At the end of June 2019 Quarter the cash & cash equivalents stood at $2.71 Mn.

On 2nd August, LIT settled the dayâs trade at $0.050 down 1.961%, with the market cap of ~$27.19 Mn. Itâs 52-weeks high and low stands at $0.124 and $0.044, respectively, with an annual average volume of 1,100,321. It has generated an absolute return of -55.25% for the last 1 year, -41.53% for the last 6 months, and -34.86% for the last 3 months.

Galaxy Resources Limited (ASX:GXY)

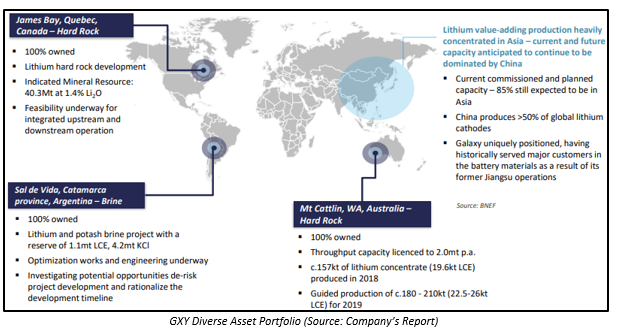

Galaxy Resources Limited (ASX:GXY) is involved in the exploration for minerals in Australia, Argentina and Canada along with the production of li concentrate. The company recently published its corporate presentation where it highlighted that its Mt Cattlin is one of the lowest costs spodumene operations, producing a high-quality lithium concentrate and positive cash margins. Its project portfolio provides diversified exposure across lithium assets in different countries such as Canada, Argentina and Australia. Its strong balance sheet projects cash of US$176.3 Mn with no debt as on June 30, 2019.

At Sal de Vida project, the revised feasibility study in Argentina supports long life, low-cost project with strong economics. Its James Bay feasibility is in advanced stage outlining a high-quality development asset in the emerging high growth market of North America.

Outlook: Operational optimization at Mt Cattlin and a strong balance sheet underpin Galaxyâs continued commitment to the development of Sal de Vida and James Bay.

On 2nd August, GXY settled the dayâs trade $1.245 down 1.581%, with the market cap of ~$517.82 Mn. Its current PE multiple is at 2.420x and its last EPS was noted at $0.522. Itâs 52-weeks high and low stands at $3.070 and $1.210, respectively. It has generated an absolute return of -55.46% for the last 1 year, -36.11% for the last 6 months, and -14.24% for the last 3 months.

Pilbara Minerals Limited (ASX:PLS)

Pilbara Minerals Limited (ASX:PLS) is a exploration company . The company recently published its quarterly activities report where it highlighted that its June â19 Quarter production of spodumene concentrate increased from 52,196 dry metric tonnes (dmt) in the March â19 Quarter to 63,782 dry metric tonnes (dmt) in the June â19 Quarter. It shipped spodumene concentrate of quantity 43,214 dmt as compared to 38,562 dmt in the March â19 Quarter. It is expected that September Quarter production would be moderate as per the customerâs revised production requirements. The company reported that it would utilise this period to undertake continued refinement of prior works of the EPC contractor, draw-down the final product stocks and further plant improvement works.

At the end of the June â19 Quarter, PLS reported net cash outflow from operating activities and investing activities at $3.15 Mn and $43.04 Mn, respectively, whereas net cash inflow from financing activities was reported at $5.93 Mn. The cash & cash equivalents were reported at $63.58 Mn, at the end of the June â19 Quarter.

On 2nd August, PLS settled the dayâs trade $0.475 down 2.062%, with the market cap of ~$897.94 Mn. Itâs 52-weeks high and 52-weeks low stand at $0.940 and $0.450, respectively. It has generated an absolute return of -45.20% for the last 1 year, -29.71% for the last 6 months, and -19.83% for the last 3 months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.