IPO or Initial Public Offering has become a buzzword in 2019, with many popular high-profile companies stepping into the public markets. The renowned global players including Uber, Lyft, Levi Strauss, Pinterest, Sezzle and Slack have already gone public and many more like Airbnb, Bumble and Robin Hood, are anticipated to join them soon.

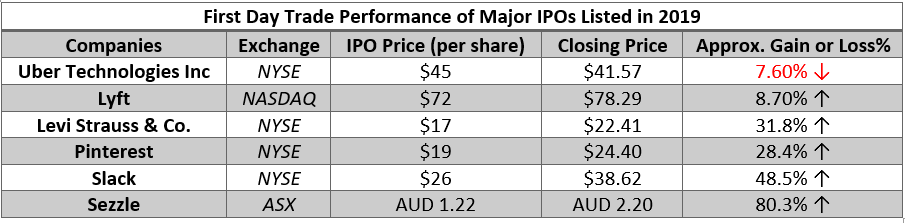

We have summarised the first day trading performance of some of the major players that went public in 2019 in the below table:

It can be inferred from the above table that most of the companies performed tremendously well on their first day of trading except the ride-hailing giant, Uber. The US-based financial-technology firm, Sezzle soared the most on the ASX, backed by the growing trend of Buy-Now-Pay-Later space in Australia.

Another key participant to hit the IPO headlines recently was Israel's only public stock exchange, the Tel Aviv Stock Exchange (TASE) that offered 31.7 per cent stake at $200 million valuation. The shares of TASE jumped by over 30 per cent within their opening hours of trading.

Guide to IPOs

In the contemporary world, there are numerous companies that take the route of IPOs to earn reputation and prestige in the corporate market and raise the required capital for business expansion. However, only some of them make a fortune while others fizzle out. Consequently, investing in an IPO requires careful analysis and detailed research of the company that is offering its stock to the public for the first time.

Before investing in an IPO, investors should:

- Examine Company's Financial Reports - In order to evaluate the prospects of a company, the most important thing to be taken care of is âa thorough analysis of companyâs financial statementsâ that contain ample information reflecting the state of the company. The financial statements contain several indicators that can assess the companyâs potential, like Operating Profit Margin, Dividend Payout Ratio, Debt-Equity Ratio, etc.

- Study Companyâs Prospectus in Detail â Before going public, the company releases a prospectus containing all the relevant information demonstrating the companyâs position. The prospectus also includes details stating proposed use of proceeds to be received with the offer.

- Watch Sectors in which IPO is Operating: A prudent investor should also track the performance of the sector in which the company going public is operating. The performance of a company is observed to be strongly influenced by the performance of the sector it is dealing in.

An investor can also understand the potential of a companyâs business considering its predictability of earnings, long term growth prospects and its anticipated balance sheet position after the float.

IPO Trends in Last Three Years

One of the worldâs leading securities exchange platform, on which shares of more than 2,200 companies trade electronically, is the Australian Securities Exchange or ASX. Headquartered in Sydney, the ASX operates as a clearing house, market operator and payments facilitator.

In the recent years, there has been a growth in the listing of international companies on the ASX including listings from Singapore, Ireland, New Zealand, Israel and Malaysia. There are over 250 international businesses listed on the ASX currently, including cross-border payment solution firm, Splitit (ASX:SPT) that joined the list recently in January 2019.

Top 10 IPOs (2017-2019)

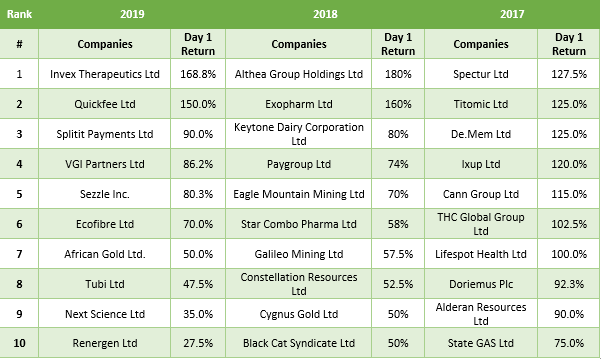

In this article, we have analysed the first-day trading performance of the companies that got listed on the ASX in 2017, 2018 and 2019 to-date. Let us first take a look at top 10 IPOs in each of these years based on their 1st Day return:

Of the above list, it can be deduced that Spectur Limited (ASX:SP3), Althea Group Holdings Limited (ASX:AGH) and Invex Therapeutics Ltd (ASX:IXC) had delivered maximum returns on their first trading day in 2017, 2018 and 2019 to-date, respectively.

However, it is to be noted that although SP3 and IXC had generated huge returns on 1st Day of trading; they have delivered negative returns of approximately 80.88% and 44.19%, respectively, since their commencement of trading on the ASX.

Sectoral Comparison (2017-2019)

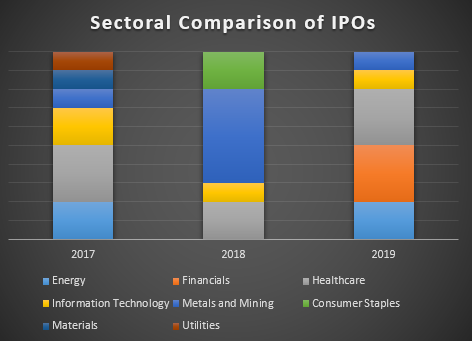

We have also performed a sectoral comparison of top 10 IPOs held in the last three years, as indicated in the figure below:

As shown in the above chart, the years 2017 and 2018 were dominated by Healthcare and Metals & Mining sectors, respectively. However, 2019 to-date has witnessed maximum 1st Day returns from IPOs of Financial and Healthcare sectors, followed by the Energy sector.

As per the recent Benchmark Report 2019 released by the government, Australiaâs stock market is 9th largest in the world and 3rd largest in the Asian region, that is currently valued at ~ US$1,088 billion. The report also mentioned that Australia hosts AUD 3.6 trillion of foreign investment stock, whose value has almost doubled in the last two decades.

The fair, orderly and transparent features of ASX have attracted several IPOs in the last few years including Australia's largest privately-owned provider of FTTP network solutions, OptiComm that has entered into the market on 22nd August 2019. The shares of the broadband network builder jumped by over 50 per cent on the first trading day, closing at AUD 3.080.

The news is doing rounds that the Australian online bank, Volt Bank Ltd is also planning to join the potent Australian stock market in 2020 in order to become a full-fledged bank.

The below table summarises the list of IPOs that are expected to be held in 2019:

ALSO READ: New Entrants On The ASX Charts â EOF & OSX

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.