In an ideal scenario and as per industry experts, companies are likely to be profitable within 18 months or so, after they have gone public. However, with the unconventionalities of the economic world and the dynamic nature of business, this ideal scenario ceases to exist, although temporarily.

In todayâs article, we would discuss the slump witnessed lately in the US stock exchanges, regarding IPOs and look at the upcoming floats closer to home, in Australia on the Australian Securities Exchange. But foremost, let us acquaint ourselves to the concept of an IPO:

The IPO Concept

The stock exchange and investor buzz word for decades, an Initial Public Offering, often referred to as a Stock Market Launch, a float or going public, is a process wherein a private companies (issuer) goes public by the sale of its stocks to the general public (institutional investors and retail investors). Underwritten by investment banks, an IPO aids private investors to fully realize gains from their investment and the process can be used to raise new equity capital.

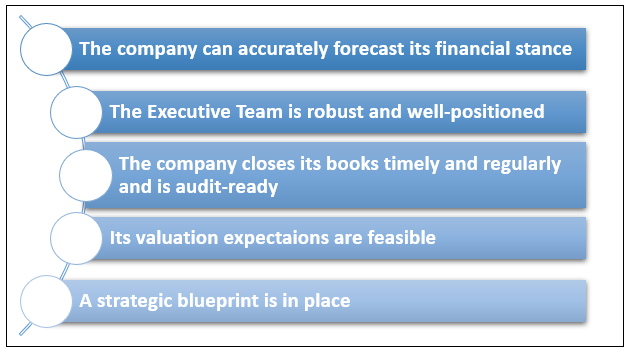

The below depiction summarizes the right time and situation when companies are IPO-ready:

Now that we understand the meaning of IPO, let us understand the recent plummet that is keeping the buzz word a hot topic of discussion amongst investors:

The IPO Slump at Wall Street

2019 in the wall street has been like a harvest year for IPOâs with a lot of hot debuts, but what followed did not meet the optimistic expectations. The unimpressive market performance of few IPO debutants has cast aside the anticipation from this yearâs IPOs. Taking a few examples, let us understand what went in an unintended direction:

Peloton Interactive Inc.- The latest player to go public (on 26 September 2019) and a fitness startup, Peloton Interactive Inc. witnessed its shares dropping approximately 11% on the debut day of trading. Experts believe that the timing and positioning of this IPO were not well thought out and planned. High growth rate in revenues but losses on the operating and net levels are not ideally entertained in the IPO market, but good growth with dividends and paybacks are. The disappointing debut is amongst the worst-trading debuts for the year.

Endeavor Group Holdings- What is likely to be a consequence of the above and a decision made at the eleventh hour, global entertainment, sports and content company Endeavor Group, which is Hollywoodâs biggest talent agency owner, scrapped its plan to go public on 26 September 2019, driven by the weak stock market sentiments. The company was expected to raise over US $600 million through the IPO.

WeWork- The American real estate player that offers shared workspaces for tech start-ups, and services for other businesses, has been in news since over a week, after WeWork owner The We Company postponed its IPO after a dull response to its plans from investors. Moreover, the company is in need to secure funding for its operations and is battling with concerns on standards of corporate governance. Given the current economic slowdown, the company needs to vigilantly analyse the sustainability of its business model.

SmileDirectClub Inc.- Earlier in September, the shares of SmileDirectClub Inc., a teeth-straightening startup tumbled by approximately 28% on its debut trade day and was referred to as the yearâs worst stock-market debut for a U.S. company valued at over US$1 billion, by a few industry experts.

Uber Technologies Inc.- In May 2019, the American multinational transportation network player which provides peer-to-peer ridesharing, food delivery, bicycle-sharing system and, ride hailing services had joined this bandwagon of first-day flop IPOs. The companyâs shares were down by over 7.6% on the day of its debut, and still trades below its IPO price.

This declining trend in prices of stocks listed through high-flying IPOs has raised a lot of brows and queries regarding the setting in of a market meltdown, with investors depicting cautious behaviour.

The Experts Comment

Every IPO is launched adhering to a certain set of principles which are unique to the business. Investors sometimes focus on growth and sometimes on profitability. The current times bring out an anxious investor sentiment where markets are on the edge, making the IPO investors increasingly skittish since the past few months.

Given the bleak outlook of IPOs on Wall Street, the investor sentiment has been a topic of great observation and discussion. Wrong markets, inappropriate timings and the brokerâs intention to make money are some reasons for this slump. The IPO debacle suggests that debuts will be on a downtrend for highly innovative companies incurring losses.

It is believed that the global economic slowdown and the jittery market conditions have made investor sentiments very sensitive, especially about overpaying in the current market, which eventually leads to IPO contractions.

Some experts state that even if the company coming out with an IPO on an exchange is relatively good, high prices are not considered as good investments. This is because investors are looking out for companies with strong balance sheets and profits.

A major reason behind the investor vigilance has been the intensifying of the U.S.-China trade war, heightened recession fears across the globe and roll out of depressed economic data.

Does IPO Failure Suggest That the Market Is Striding Forward?

Amidst the pessimism and anxiety from the IPO debacle there is a section of experts who are forecasting a good turn of events in the long run. This segment of people believes that considering the investor appetite favoring strong companies with sound business plans, a vibrant and healthy market might be staring at us.

The above-mentioned IPOs have faced investor wrath and greater scrutiny, and this has exposed the weaknesses in the companiesâ business models, which in-turn have made investors aware of the consequences of investing in these stocks. This proves that investors in the current times are much more mindful of profitability and accretion of cash as major metrices for value-hunting, than they were even a few years back.

Hence, the recent failures are a sign that sanity in the IPO markets is on a comeback mode, with an appetite to support young and profitable companies with sound business plans.

The Australian IPO Landscape

In 2018, there were close to 100 listings on the ASX, with an increase of over 100% of funds raised, compared to 2017, amid the volatile market conditions which dampened Australian IPO activity. 2019 began with the same sentiment. Apart from the trade war, Brexit, state and federal elections, the regulatory fallout of the Royal Commission tested market confidence in the first half of the year.

However, with time, the volatility has calmed down, and experts are anticipating a better and solid end to 2019, with the tech space dominating the marketplace.

The below table highlights few of the upcoming floats to occur on the ASX:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.