Initial Public Offering

Initial Public Offering is the first sale of shares issued by any company to the public markets. The word public is used because the company has now intended to list its shares in a publicly traded stock exchange.

IPOs allow companies to raise capital, which could be used in the companyâs day-to-day business activities, growth strategy, or any other objective that needs capital requirement. Companies also apply for an IPO at the time when competitors have been applying for an IPO.

Letâs talk about the three upcoming IPOs:

Mader Group Limited (Proposed ASX Code: MAD)

Mader Group is a maintenance services company supplying labour to the companies engaged in the Resources industry across globe. It provides specialised contract workforce for maintenance of heavy fixed and mobile equipment.

Mader Group operates in the Resources industry, and key demand factors for its services include total commodity production, the average age of existing machinery stock, and frequency of mining companies outsourcing maintenance workforce requirements.

Industry Insights

According to the prospectus, in Australia, the expenditure on mining maintenance services totalled $7.9 billion in FY2018. The company focuses on the maintenance of earthmoving/extraction equipment within the mining maintenance market. It serves to key bulk and base metal commodities, and the forecast suggests continued production growth in FY2019 and FY2020.

Besides, the mining industry is transitioning from capital expenditure investment to operational expenditure investment, following the investments in new equipment reached a peak in 2011 & 2012. Miners are also emphasising on extending the equipment life rather than investments in new equipment.

The company competes against the original equipment manufacturers (OEMs), specialised contractors, and recruitment companies. Mader believes that its value, quality, flexibility and capacity provide a unique competitive position in the market.

Age & Profitability

Founded in 2005, the company has been operating for 14 years now combined with revenue and manpower growth.

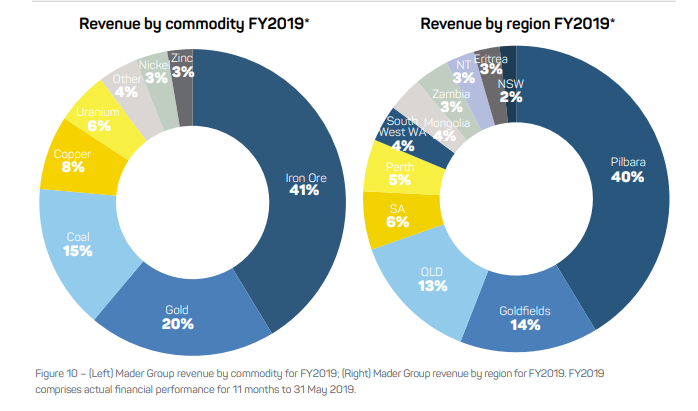

Revenue Attributes (Source: Mader Group Prospectus)

Revenue Attributes (Source: Mader Group Prospectus)

In FY2019 (May & June Forecasted), the company had generated a revenue of $226.22 million compared to $156.2 million in FY2018. Net Profit of the period was $14.77 million against $11.35 million in FY2018.

Offer

Reportedly, the equity offering is facilitated by the sale of stake by existing shareholders through a SaleCo. The offer is fully underwritten by Lead Manager and Underwriter, and the consideration for the offer is $1 per share.

Meanwhile, the company has a dividend forecast of 3 cents per share for FY2020, with 1.5 cents per share payable in March 2020, and 1.5 cents payable in September 2020.

Osteopore Limited (Proposed ASX Code: OSX)

Osteopore is a bone regeneration company, manufacturing devices that facilitate the natural stages of bone healing through a combination of 3D printing and bioresorbable material. Its products are fabricated within the company through proprietary 3D printing technology.

In addition, the company has successfully commercialised three products, namely Osteoplug, Osteomesh, and Osteostrip, with sales reaching over 20k units in the countries, including Singapore, South Korea, Vietnam, and Malaysia.

Industry Overview

The company operates in a natural bone & tissue regeneration market. Bone regeneration is a process to repair bone defects or engineer bone tissue for regeneration. Presently, the company is focusing on craniofacial reconstruction market, and it intends to enter dental orthopaedic and long bone market segments.

As per the prospectus, the company has a number of competitors in various stages of development, and the list includes Anatomics, Medtronic, KLS Martin, Stryker, Zimmer Biomet and J&J Synthes. The company believes its competitive advantage lies in unique products backed by intellectual property rights, and 3D printing capabilities of the company have distinguishing features as well.

In addition, the products of the company are cleared by US FDA (510k) and bear the CE Mark of conformity. Itâs 3D printing allow products to be tailored to specific patientâs needs and requirements. Osteoporeâs technology is bioresorbable, so it does not have any long-term regenerative problems.

Age & Profitability

Osteopore came into existence in the year 2003 in Singapore. However, the research was initiated in the year 1996. As per the prospectus, the company has recorded revenue of $934k in FY2018 compared to revenue of $610k in the FY2017.

Also, the gross profit of the company for the year ended FY2018 was $718k against $467k in the previous year. Selling & distribution expense totalled 163k in the year FY2018 compared to 60k in the previous year. Looking at the liabilities, the company had $369k amount due to directors, $283k amount due to related party, and 13k amount was due to the shareholders.

It appears that the company is in a growing stage with robust growth in revenues and increasing S&D expense along with administrative expenses.

Offer

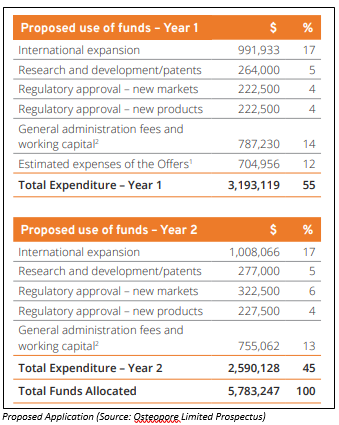

Reportedly, the company had invited investors to apply for 26,250,000 Shares at an issue price of $0.20 each to raise $5.25 million before costs. In addition, the offer was closed after being fully subscribed, and the company is not accepting further applications under the Public offers.

Nemex Resources Limited (Proposed ASX Code: NXR)

Overview

Nemex Resources was admitted to ASX in May 2011, and the company was focused on the exploration and development of iron ore and gold projects in Australia and West Africa. Due to the Ebola virus outbreak in Guinea and fall in iron ore prices, the company was forced to halt the key project â Coastal Iron Project in Guinea.

Nemex undertook staged investments in a Sydney-based company, developing a bio-metric technology. By October 2015, the company ceased staged investment funding to the bio-metric technology venture. In December 2018, the company was removed from the official list of ASX, following a trading suspension that lasted three years.

At present, the company is looking for a relisting to ASX. Nemex has entered into an acquisition agreement to acquire an 80% stake in the Leonora South East Project, Ballard Project and Pavarotti Project. Besides, it will acquire 100% in the Lake Roe North Project pursuant to the agreement, after the satisfaction of conditions.

Age & Profitability

Nemex Resources was incorporated in the year 2010, and it was a listed entity for a brief period. As per the prospectus, the company had recorded revenue of $321k for the 12 months ended June 2018 against revenue of $229k for the period ended June 2017.

Meanwhile, the company had recorded a loss of $1.6 million in the 12 months ended 30 June 2017, and it recorded loss of 564k in the 12 months ended 30 June 2018.

Offer

Reportedly, the company has issued supplementary prospectus following the issue of prospectus dated 27 May 2019. The prospectus had a date of 26 August this year. The company will return the application money within 4 months after the date of Supplementary Prospectus, if the minimum subscription is not met.

As on 26 August this year, the company had raised $40,250 and the minimum subscription for the offer is $4.5 million. In addition, the minimum subscription condition must be satisfied by 26 December 2019.

More importantly, the company has invited applications for 25 million shares at an issue price of $0.20 per share to raise up to $5 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.