What is an IPO?

An initial public offer comprises of a first-time public issue of shares by a private corporation. The primary purpose behind floating an IPO includes infusion of capital for the purpose of business development. The companies are able to reach a large number of investors, raising substantial capital for further growth of business in various forms including expansion, research or infrastructure.

Mader Group Limited

Mader Group Limited (ASX: MAD) is a maintenance services company supplying skilled trade persons to resource industry customers. The group has its operations in the USA, Mongolia, Australia, Senegal, Mauritania, Chile, Zambia and Democratic Republic of Congo.

Revenue: The company generates its revenue by providing contract labour services on an hourly basis per tradesperson provided. Approximately 88% of the revenue is generated from operations in Australia, with the remaining being sourced from overseas operations.

IPO Details: To enable its initial public offering, the company will issue 50,000,000 shares, representing 25% of the total shares on issue on completion of the offer. The balance 75% of the shares will be subject to voluntary escrow until 31 October 2020.

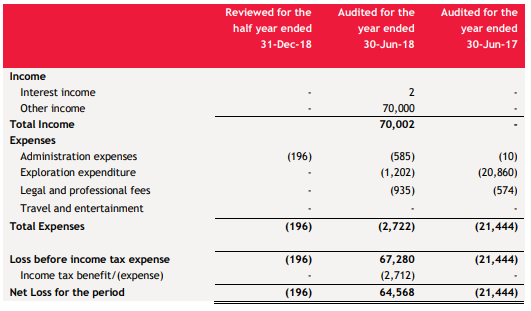

Financial Information: In FY18, the company generated revenue amounting to A$156.21 million, as compared to $99.25 million in FY17. FY18 EBITDA was reported at A$18.60 million, as compared to A$10.17 million in FY17. From inception to December 2018, the group generated retained earnings of approximately $54.3 million and paid dividends worth $19 million, representing a pay-out ratio of approximately 35%.

Financial Highlights (Source: Company Prospectus)

Dividend: The Board intends to pay a dividend between 25% and 50% of NPAT, franked to the maximum extent possible. In FY20, the company expects to pay a dividend of 3 cents per share, representing an annualised dividend yield of 3%. FY20 dividends are expected to be fully franked.

Magellan High Conviction Trust

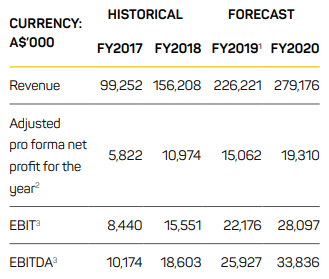

Magellan High Conviction Trust (ASX: MHH) is being launched by Magellan Financial Group Limited (ASX:MFG) for its successful high conviction strategy. The initial public offering of the trustâs units will include a capital infusion of a minimum of $250 million. The units will be offered at a price of $1.50 per unit. The offer is expected to expire on 27 September 2019.

Investment Strategy: The trust will operate on the investment strategy adopted by July 1, 2013 by the unlisted Magellan High Conviction Fund that has generated returns of 16.6% per annum since inception to 31 July 2019. As per media reports, the new trust will comprise of 8-12 global companies and will have a cash allowance of up to 50%. The trust will target a cash distribution yield of 3% per annum.

Offer Details (Source: Company Website)

Nemex Resources Limited

Nemex Resources Limited (ASX: NXR) aims at exploration and development of mineral exploration projects prospective for gold and base metals in Western Australia. Previously, the company was focused on exploration and development of iron ore and gold projects in West Africa and Australia, which were later disposed off.

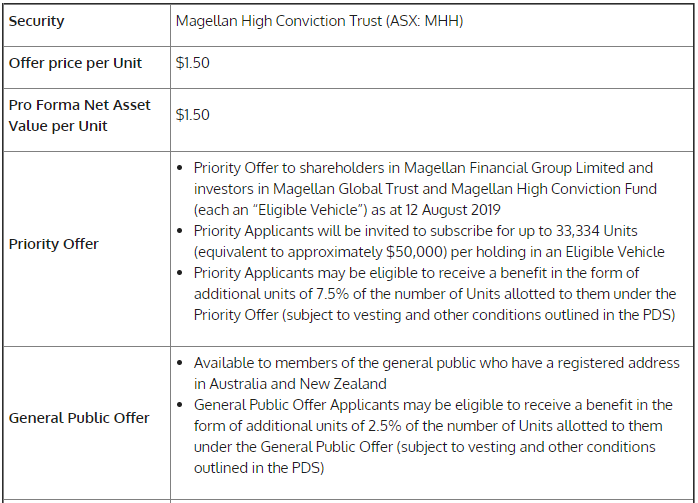

IPO Details: Through the IPO, the company is expecting to raise up to $5,000,000 via issue of 25,000,000 shares at a price of $0.20 per share. The offer terminates on 30 September 2019. The funds raised through the initial public offer will be utilised for systematic exploration programs for each of the projects of the company. The proceeds will also help in funding the costs of acquisitions, working capital and administration costs & costs of the offer.

Key Offer Details (Source: Company Prospectus)

Acquisitions: The company has entered into an acquisition agreement to acquire 80% interest in the Leonora South East Project, the Pavarotti Project and the Ballard Project, knows as the Legendre Acquisition Agreement. Another deal involves the Lake Roe North Acquisition Agreement to acquire the Lake Roe North Project.

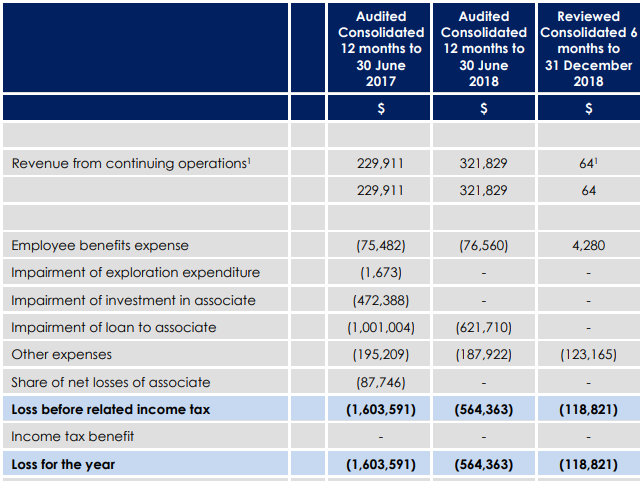

Financial Information: For the 12 months ended 30 June 2018, the company generated revenue from continuing operations amounting to $321,829, as compared to $229,911 in prior corresponding period. Loss for the year amounted to $564,363, as compared to a loss of $1,603,591 in the prior corresponding period.

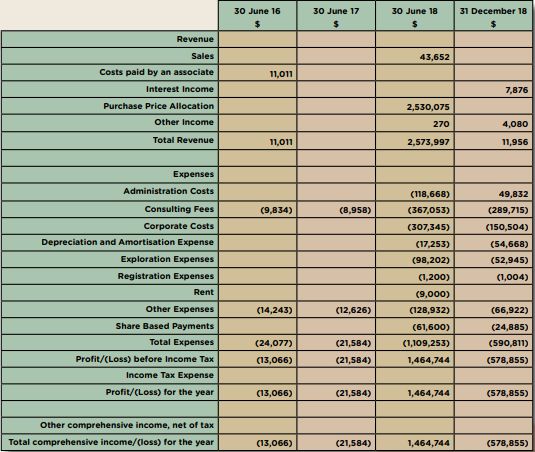

P&L Statement (Source: Company Prospectus)

Nicheliving Holdings Limited

Nicheliving Holdings Limited provides services in relation to land development, construction, real estate sales, property management and financial services. It manages residential developments that offer affordable housing options within the Perth metropolitan area.

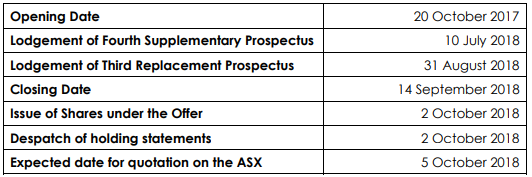

IPO Details: As per the fourth supplementary prospectus issued, the company notified on the extension of the offer closing date to 14 September 2018. The company also proposed to appoint PricewaterhouseCoopers as the auditor for FY18. The prospectus notified that the offer will comprise issue of shares at a price of $0.50 per share with minimum investment size of $2000 worth of shares.

Usage of Funds: Proceeds from the offer will be utilised for investment in future property developments via equity investment in SPV entities, debt repayment, payment of offer expenses and working capital requirements.

Minimum Subscription Condition: As on the date of prospectus, the company had raised $4,742,500, representing applications for 9,485,000 shares. The company extended the period for minimum subscription to four months from the date of Fourth Supplementary Prospectus i.e 10 November 2018.

Key Dates (Source: Company Prospectus)

Osteopore Limited

Osteopore Limited (ASX: OSX), through a combination of 3D printing and bioresorbable material, is engaged in manufacturing devices incorporating biomimetic microarchitecture that augments the natural stages of bone healing. The company was incorporated to complete the acquisition of 100% of the issued capital of Osteopore International Pte Ltd.

Business Objective: Post IPO, the company aims at funding a research and development program along with investment into new 3D printed microacrchitecture and bioresorbable materials. It aims to increase market share of of the Osteoplug, Osteomesh and Osteostrip products. In addition, it aims to invest in sales and marketing activities in USA, Australia, Asia and EU. Product expansion will be specifically focused at dental, orthopaedic and long bone market segments.

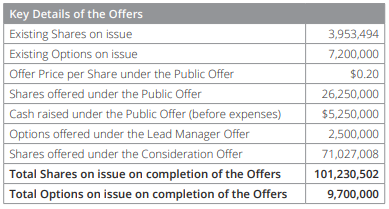

IPO Details: The company expects to raise an amount of $5,250,000, through issue of 26,250,000 shares at an issue price of $0.20 per share. The expected date for quotation of shares on ASX is 19 September 2019.

Key Offer Details (Source: Company Prospectus)

Indicative Time-Table (Source: Company Prospectus)

Partners Group Global Income Fund

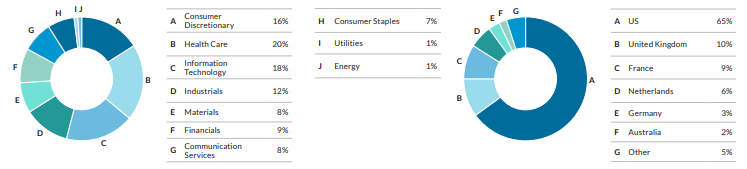

Partners Group Global Income Fund (ASX: PGG) is a global leader in private debt investing and is currently managing more than AUD 118 billion for its clients globally. The fund is aimed at investment in debt instruments globally, producing an attractive monthly income with a focus on capital preservation.

Fund Details: The fund is being managed in Partners Group Private Markets (Australia) Pty Ltd and is targeting a cash distribution of RBA Cash Rate plus 4% per annum, net of fees, costs and taxes. The maximum offer size for the fund will be AUD$500 million, with an additional AUD$50 million pertaining to over-subscription allocation.

Fund Portfolio Composition (Source: Company Website)

Tartana Resources Limited

Tartana Resources Limited (ASX: TNA) carries out mining and exploration activities.

Projects: Key projects of the company include Zeehan Zinc Slag Project in Tasmania, Tartana Copper and Zinc Project & Amber Creek Molybdenum-Tin-Tungsten Project in North Queensland and Mount Hess Copper-Gold Project in Central Queensland.

IPO Details: The company issued ordinary shares at an issue price of $0.20, raising a total capital of $6,000,000. The funds raised through the IPO will help in carrying out drilling on the projects.

Financial Highlights: During the year ended 31 December 2018, the company reported loss for the year amounting to $578,855. No operating revenue will be generated before successful development of its projects and commencement of production.

Financial Highlights (Source: Company Prospectus)

Trigg Mining Limited

Trigg Mining Limited (ASX: TMG) engages in identification of mineral exploration projects. The business engages in exploration of potassium mineral fertiliser and potassium sulphate, which contain necessary nutrients for agricultural food production and human health. Two major assets of the company include the Laverton Links and Lake Throssell Potash Projects.

IPO Details: Through the IPO, the company raised $4,500,000 through issue of ordinary shares and options at an issue price of $0.20 per security. The funds raised will go into exploration and evaluation work on the companyâs projects.

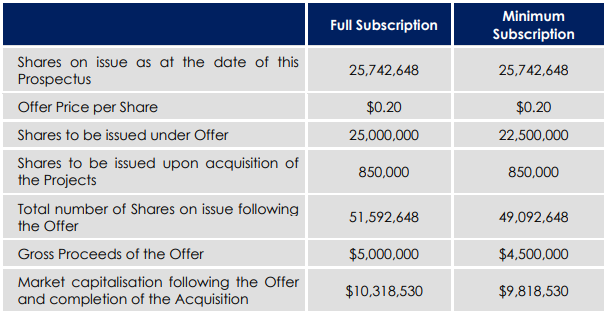

Revenue Generation: As on the date of prospectus, the company did not have any revenue and is unlikely to report any revenue before successful development of any of the projects.

Statement of Profit & Loss (Source: Company Prospectus)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.