IPOs provide investors with a good opportunity to gain profits. Like other investments, IPOs also have unique risks associated with them. In order to choose the right IPO to invest, investors need to understand more about the associated risks of the respective IPOs and also about their advantages, background, track record and many other things. The below-mentioned IPOâs are soon going to be listed on ASX. Let us have a quick look at what these IPOâs are offering.

Mader Group Limited (Proposed ASX Code: MAD)

Mader Group Limited (Proposed ASX Code: MAD) is primarily involved in providing skilled tradespeople on flexible terms to support and improve the mobile equipment maintenance programs of mining companies. The company is considered as the largest independent maintenance labour service provider for heavy mobile equipment in Australia.

The company has a proven track record of sustained revenue and earnings growth. In the last 6 years to the end of FY2019, through organic growth alone, the companyâs revenue increased an average of 37% per year and NPAT an average of 28% per year.

Mader Group IPO: Recently on 16 August 2019, the company lodged a prospectus wherein it is offering a secondary sale by Existing Shareholders (through SaleCo) of 50 million Shares. The existing shareholders are selling a portion of their Shares to partly realise their investment in the company and to ensure an adequate free float, shareholder spread and liquidity after the listing on ASX. The shares being sold under the offer represent 25% of the total of 200 million shares on issue on completion of the offer. The remaining 150 million Shares on issue will be subject to voluntary escrow restrictions until 31 October 2020.

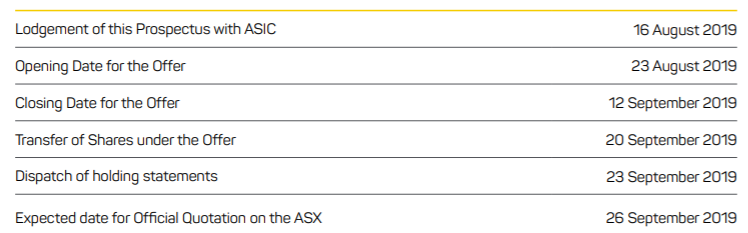

Indicative Timetable (Source: Company Reports)

The offer comprises the Retail Offer, Institutional Offer and Employee Offer. The Offer Price for the Retail Offer and the Institutional Offer is $1.00 per Share. There is a smaller Employee Offer, which is designed to encourage share ownership by the Mader Groupâs leadership team and employees. The Employee Offer Price is $0.90 per Share.

The company has a leadership position in the maintenance services sector, which allows it to service a broad and expanding global network of customers.

What makes Mader group unique?

The company believes it differs from its competitors in its combination of:

- Value â generally better value than OEMs;

- Quality â high-quality tradespeople supported by experienced leadership teams;

- Flexibility â large in-house pool of skilled employees with the ability to support multiple services and equipment brands; and

- Capacity â higher in-house capacity than competitors, including rapid response capability;

Magellan High Conviction Trust (Proposed ASX Code: MHH)

The Magellan High Conviction Trust is a unit trust, to be managed by Magellan Asset Management Limited, a wholly-owned subsidiary of Magellan Financial Group Limited (ASX:MFG), is expected to be listed on the ASXÂ under the proposed ASX code âMHHâ.

Details of MHH Offer: On 13 August 2019, Magellan lodged a Product Disclosure Statement (PDS) with ASIC. The Offer under the PDS, comprises an offer of Units at an offer price of $1.50 per Unit to raise a minimum of $250 million. The Offer comprises a Priority Offer, a Wholesale offer and a General Public Offer.

It is to be noted that all costs of the Offer will be paid for by the Magellan Group in cash, which means that investors will subscribe for Units in the Trust at a price equal to the pro forma NAV per Unit after completion of the Offer.

The investment objective of the Trust is to achieve attractive risk-adjusted returns over the medium to long-term. The Trust will hold investments in high quality businesses, as assessed by Magellan, at prices that represent a discount to the companyâs assessment of intrinsic value.

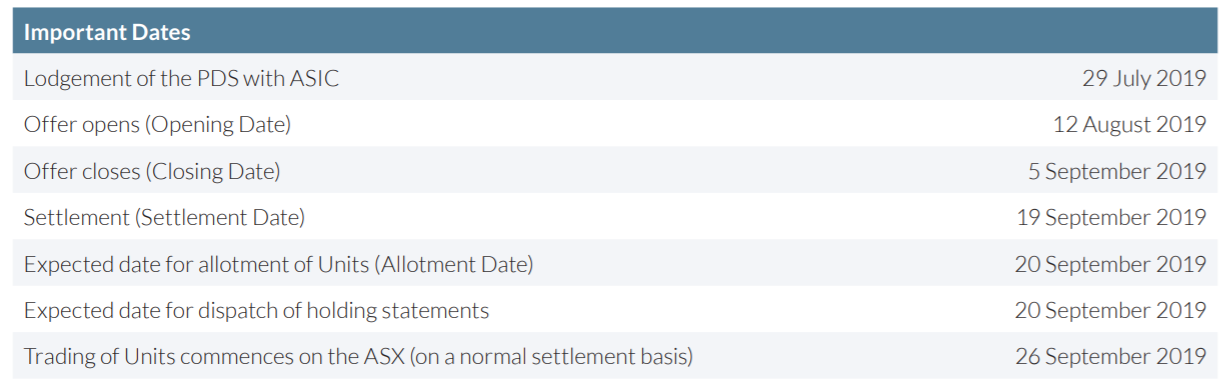

Indicative Timetable (Source: Company Reports)

Magellan is planning to target a cash distribution yield of 3% per annum. For the first two years, Magellan intends to pay the following Target Cash Distributions:

- $0.0225 per Unit for the period from the Allotment Date to 31 December 2019;

- $0.0225 per Unit for the six months ending 30 June 2020;

- $0.0225 per Unit for the six months ending 31 December 2020; and

- $0.0225 per Unit for the six months ending 30 June 2021;

Osteopore Limited (ASX Proposed Code: OSX)

Osteopore Limited was incorporated on 11 December 2018 as a holding company to complete the acquisition of 100% of the issued capital of Osteopore International Pte Ltd. Osteopore has commercialised a number of products including Osteoplug, Osteomesh and Osteostrip and it has a number of products that have received FDA and CE Mark approval and are being sold to hospitals and thus generating revenue for the company.

Osteopore has licensed a range of technologies from Singaporeâs leading universities, NTU and NUS. The company has a highly credible and experienced team to progress the commercialisation and expansion of its technology.

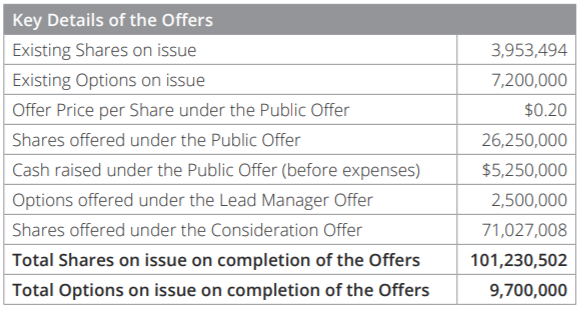

Osteopore Limitedâs Offer: The company has lodged a prospectus with ASIC wherein it is offering to issue 26,250,000 shares at an issue price of $0.20Â each to raise $5,250,000.

Key Details of the Offer (Source: Company Reports)

The proceeds of the Public Offer will be utilised to enable the company to support market penetration, fund the investment into new 3D printed microarchitecture and bioresorbable devices, provide general working capital and pay for the costs of the Offers.

Upon completion of the aquisition, completion of the offers and the admission to quotation of the shares on the ASX, the ompany will proceed with the business and expansion strategy. The company is planning to develop and commercialise its proprietary natural tissue regeneration technology to facilitate the natural stages of bone healing.

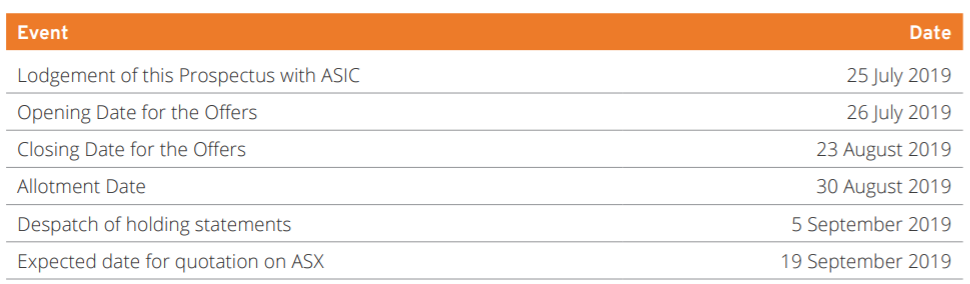

The indicative timetable of the IPO is as follows:

Indicative Timetable (Source: Company Reports)

Â

Partners Group Global Income Fund (ASX Proposed Code: PGG)

Partners Group Global Income Fund is a trust which is proposed to be listed on ASX under the code PGG and will be managed by Partners Group Private Markets (Australia) Pty Ltd, a wholly-owned subsidiary of a Swiss listed private markets investment manager- Partners Group Holding AG.

Key attributes of the Trust include:

- Regular income: The Trust will target a cash distribution of RBA Cash Rate + 4% per annum (net of fees, costs and taxes incurred by the Trust) and intends to pay cash distributions monthly;

- Diversification benefits: Provides Unitholders with access to a diversified portfolio of private debt investments, predominantly from outside Australia (focused on the US and Europe), which can complement existing defensive portfolio allocations;

- Low correlation to other investment types: Private debt investments can have a low correlation to other asset classes. This can provide diversification benefits in a Unitholderâs income-generating portfolio;

- Defensive features: Partners Group will deploy its investment selection process, policies and risk protocols developed over the last 15 years to seek to minimise capital volatility;

- Strong experience and track record: The Trust will be managed by the Manager, which is part of Partners Group, a highly experienced investment manager, with a proven track record of private debt investing;

PGG IPO Details: Equity Trustees Limited, which will act as the responsible entity of the Trust, is seeking to raise up to AUD$500 million through the issue of Units at a Subscription Price of AUD$2.00 per Unit. The investment objective of the Trust is to provide Unitholders with monthly income through exposure to a diversified pool of global private debt investments.

Indicative timetable of the offer

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.