About IPO

IPO stands for the initial public offering in which the shares of a private company are made available to the public on stock exchanges for the first time. After IPO, these companies get transformed from a private to a public company. The companies which participate in an IPO are generally in their growth phase, and they require money for expansion and to become a publicly traded company. The company hires an underwriter, a lead manager and a merchant banker who structure the IPO and market it to potential investors. The investors can purchase the shares offered in the IPO from the company at the offer price.

Offer Price: Offer price of an initial public offering is the price at which the company sells its shares to the investors. However, it may differ from the opening price of the share once the shares start trading on the stock exchange. The opening price of the share refers to the price at which the shares start trading on the stock exchange on any given day.

Now the question arises as to who sets the offer price and on what basis the price is set. The answer to this question is an underwriter. Underwriter checks the amount of capital required by the company, the analysis of company value and also the demand of the shares from the investors. Based on these parameters, the offer price is set.

Once the shares get listed on the stock exchange, the opening price of the share is based on the demand and supply of that share at that particular point of time.

Both the opening price and offer price together helps in identifying the near-term price direction of the stock. In other words, if the offer price of the share is above its opening price, it indicates that there is a weak demand for the shares at the offer price and there are chances that the prices may fall in the upcoming period and vice versa.

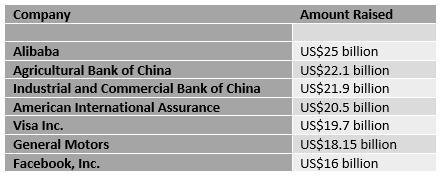

Largest IPOs in the world:

When do we say that an IPO is successful?

The success of an IPO depends on the achievement of the expected results. IPOâs success is measured at various levels. These include sponsors, directors and investors. From the Sponsorâs point of view, an IPO is said to be successful, if it can help the company to reach the next stage. For the directors, who are the guardians of the companyâs interests, if the IPO supports running the business in the desired manner in the interest of all shareholders, then it is successful. Success of an IPO also refers to how well the IPO is able to support in the delivery of the managementâs strategic vision. For Investors, success is measured by the overall return that they would be looking at from owning the companyâs shares for a particular period of time.

Tech IPOs in 2019 in Australia

- AppsVillage Australia Limited: AppsVillage Australia Limited (ASX:APV) is a software-as-a-service company which got listed on ASX on 27 August 2019. The company was established on 1 June 2018 with an aim to identify technology acquisitions which has potential to grow as well as to develop. The company has a SaaS cloud-based platform which offers small to medium size businesses with the latest and inexpensive methods to generate, launch and manage mobile applications for their businesses for promotion and marketing. For more details click here.

- FINEOS Corporation Holdings Plc: FINEOS Corporation Holdings Plc (ASX: FCL), an Irish company into the research, development, marketing and supply of the software products in the Health, Accident and Life insurance industries. FCL got listed on 16 August 2019 on ASX. For more details on FCLâs IPO click here.

- QuickFee Limited: QuickFee Limited (ASX: QFE) provides payment platform and SME lending through financing. Quickfee Limited got listed on 11 July 2019 on ASX. The company issued 67,500,000 shares under the IPO to raise $13,500,000. For more details on QFEâs IPO click here.

- Whispir Limited: Whispir Limited (ASX: WSP) is a SaaS company which offers a communications workflow platform. This is used to automate communications amongst businesses as well as people. Whispir Limited got listed on 19 June 2019 on ASX. To know about WSPâs IPO click here.

- Life360 Inc: Life360 Inc (ASX: 360), a company which offers location-based services application to its clients to keep track of members in their contact list. It also provides a unified driver-protect service that contacts emergency services. Life360 Inc got listed on 10 May 2019. To know more about Life360âs IPO click here.

Market Reaction:

Upcoming Tech IPO:

Damstra Holdings Limited:

Damstra Holdings Limited (proposed ASX code: DTC), provides world-leading cloud-based workplace management platform used for tracking, managing as well as protecting the workers and assets of its clients. It also manages workforce, assets, site access, learning along with HSE compliance. It has real-time dashboards and predictive analytics for driving improvement in security, compliance, as well as effectiveness.Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.