Gold prices are elevated amid the demand push from the central banks. The prices of the gold spot are heading towards the market anticipated level of US$1,500, and the prices pinned a high of US$1,474.86 yesterday in the international market.

The second-quarter demand for gold has seen remarkable growth, particularly in demand from the global gold-backed ETFs and central banks, which in turn, is fanning the gold prices.

Apart from the push from the central banks, the gold prices are propelled by the actions of the United States Federal Reserve (or Fed). The United States Fed slashed the interest rate for the very first time after the financial crisis of 2008; however, post the announcement gold prices plunged in the market amid a spike in dollar prices.

If Fed Slashed the Interest Rate What fuelled both Dollar and Gold?

The mid-cycle adjustment explanation of the United States for the rate cut is what fuelled the dollar prices, despite the tighter fiscal conditions (as proclaimed by the United States premiers). The Fed chair Jerome Powell decided to explain the rate cut as a mid-cycle adjustment, which in turn, made it hard for the market participants to fathom the number of possible rate cuts ahead.

The opaqueness over the future interest rate environment along with the demand push from the central banks and global gold-backed ETFs brought gold back to merge with the normative estimations of the market.

Did Global Cues Play Any Role?

The U.S-China trade spat has taken an unprecedented path, which in turn, is increasing the global uncertainties and the probability of high systematic risk due to which the global stock markets are in a free-fall mode, and the global investors are now flocking under the safe-haven roof to safeguard their investments.

In the recent event, the United States President Donald Trump announced a fresh round of 10 per cent tariff on US$300 billion worth of Chinese goods, which in turn, led China to lay off its forex guards, which is allowing the five-starred flag nation to absorb the external shock of additional U.S. tariffs.

However, the devaluated $CNY is pushing the global trade balance off-road, which is estimated to hamper the global trade over the long-run.

Such uncertainties, elevated systematic risks, and further global affairs such as escalated tensions between North and South Korea, are providing gold prices with an impetus to move toward the psychological US$1,500 mark.

PCE deflator and The Federal Reserve:

In the Monetary Policy Report submitted by the Fed to the Congress on 5 July 2019 under the section 2B of the Federal Reserve Act. The United States Fed mentioned that the PCE deflator (or core inflation) was at 1.6 per cent in May 2019- down from a rate of 2 per cent from a year ago.

The Federal Reserve closely monitors the core index, and the targeted value of Fed for the index is at 2 per cent, which in turn, could allow the Fed to decide against the national government demand and is something the bullion investors should monitor to reckon the direction of the Fed balance.

While the gold prices are turning shiny in the international market, many investors are looking for smart ways to invest in gold, which in turn, is narrowing all eyes toward the gold mining stocks.

S&P Commodity Producers Gold Index:

The rise in gold value pulled the share prices of the gold mining companies globally amid their direct exposure in gold. The S&P Commodity Producers Gold Total Returns index delivered a strong return from the beginning of the year.

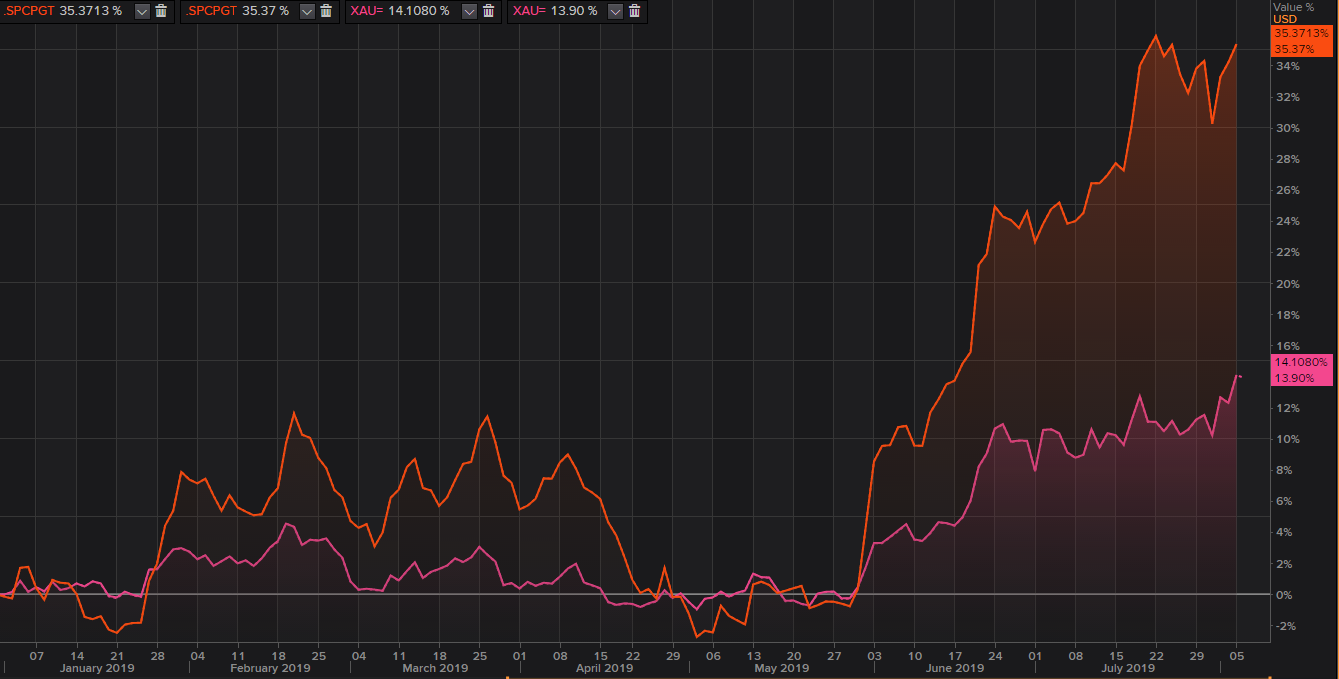

SPCPGT Total Returns (YTD) (Source: Thomson Reuters)

The index, which tracks the performance of stock exchange-listed global gold miners delivered a total return of 35.3713 on a YTD basis amidst the gold rush.

The index even outperformed the total returns for gold, which in turn, more than compensated the investors for bearing the additional idiosyncratic risk.

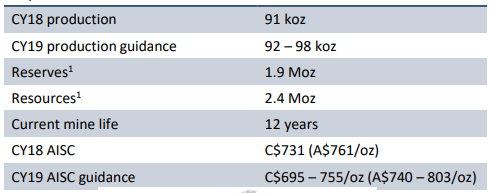

SPCPGT Total Returns and XAU (YTD returns) (Source: Thomson Reuters)

While the spot gold delivered the total return of just 14.1080 per cent on a YTD basis, the stock index, which tracks the gold miners stock performance, outperformed the return from spot gold.

ASX-Listed Gold Miners:

Newcrest Mining Limited (ASX: NCM)

The share prices of the company are encashing the gold rush, and the shares rose today on ASX to mark a new 52-week high of A$37.450, before settling at A$35.980, down by 0.854 per cent as compared to its previous close.

NCM holds high gold prospects such as Cadia, which hosts over 50 million ounces of gold reserves, Gosowong, which contains 6.6 million ounces of gold, Telfer, which hosts 20 million ounces of gold, and Wafi-Golpu, which hosts 13 million ounces of gold.

The company has unique mining abilities, which allows it to process all forms of gold and copper orebodies along with a unique search for space and more opportunities.

NCM though existing infrastructure is unlocking value for its investors, one such example of the value addition is through the identification of Havieron- which is 45km east to the Telfer and contains potential high-grade to serve as mill feed for Telfer operations.

The continuous uptrend movement in the share prices of the company has drawn the attention of the market participants.

St Barbara Limited (ASX: SBM)

The share prices of the company touched its 52-week high of A$5.152 on 20 February 2019 from where the operational discrepancies dragged the prices down. Post the company slashed the production guidance the shares plunged to the level of A$2.480 on 11 June 2019.

The share prices are on recovery since then, and currently, the prices are trading at A$3.690, which is at the middle of the 52-week low to high range of A$2.480 to A$5.152.

SBM produced 362 koz of gold during the 2019 financial year with an AISC of A$1,080 per ounce. The Simberi operations of the company noticed a strong performance during FY19.

The recent acquisition of Atlantic Gold adds a low-cost operation with expansion pipeline and exploration potential.

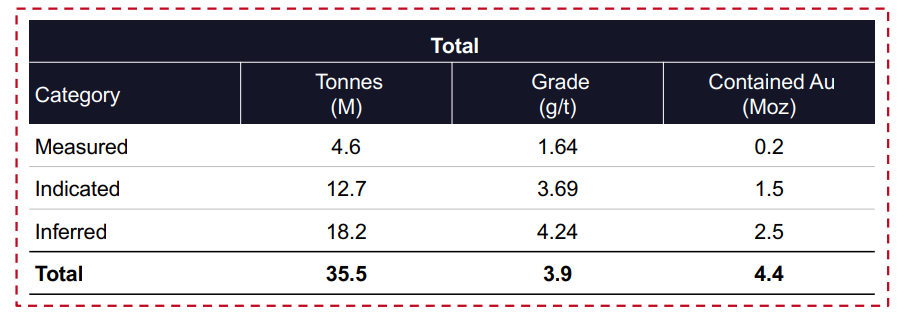

The Key statistics of the Atlantic Gold prospect are as:

(Source: Companyâs Report)

The lower prices and recovery in operations along with the recent acquisition has caught the attention of the market participants.

Resolute Mining Limited (ASX: RSG)

The share prices of the company reached a new 52-week of A$2.070 today on ASX, before ending the dayâs session at A$1.895, down by 2.32 per cent as compared to its previous close.

The company is extending the footprints in Africa for gold production. The Syama operations in Mali, Africa delivered strong quarterly and yearly performance, and RSGâs recent acquisition of Mako Gold Mine gives the company excessive footprints in Africa.

The production rate of Toro Goldâs Mako Gold Mine stands at 160k ounces per annum with a low AISC of US$780 per ounce, which now belongs to RSG.

The estimated Mineral Resources of the prospect stands at 1.2 million ounces with a total Ore Reserve of 0.9 million ounces, which in turn, provides the Senegal-based mine life of 7 years.

The recent acquisition of a low-cost operation along with the extending footprints in Africa makes the company ready to capitalise on the gold rush.

Dacian Gold Limited (ASX: DCN)

The share prices of the company reached the 52-week high of A$2.880 on 27 February 2019 and plunged to the level of A$0.375 (Dayâs low on 7 June 2019). Post hitting the level of A$0.375, the shares of the company started recovering, and the stock currently closed at A$0.980, down by 4.39 per cent as compared to its previous close. The current 52-week range of the shares is A$0.375 to A$2.880.

DCN recently updated the current life of mine (LOM) plan for its MMGO operations, which in turn, underpinned a sustainable average annual production of 170,000 ounces over the first five years with an All-in-Cost (or AIC) of A$1,340-A$1,440 per ounce. The updated life of mine plan suggests the production of over 1 million ounces of gold at an AIC of A$1,280-A$1,380 per ounce over eight years.

Post considering an average gold price of A$1,800 per ounce and further discounting it with a 5% rate, the pre-tax cash flows for MMGO exceed A$420 million over the eight-year LOM. The company utilised 88% of the 2018 Ore Reserves of the prospect to update the LOM plan.

Dacian forecast that in the 8-year LOM period (FY2020-FY2027) the MMGO gold output will stand at 1.08 million ounces with an AIC of A$1,280-A$1,380 per ounce. The production guidance of the company for FY2020 is in the range of 150,000-170,000 ounces with an MMGO AIC of A$1,400-A$1,500 per ounce and consolidated AIC of A$1,450-A$1,550 per ounce.

The recently upgraded mine of life and high-grade gold discovery, which includes significant intersections such as 1.7m @ 127.0 g/t of gold brings the company at to an interesting path.

West African Resources Limited (ASX: WAF)

The share prices of the company recently scaled a new 52-week of A$0.400 on 19 July 2019 from where the shares dropped to the level of A$0.350 (Dayâs low on 1 August 2019). Presently, the shares of WAF closed at A$0.370, down by 3.896 per cent as compared to its previous close. The current 52-week range of the shares is A$0.212 to A$0.400.

Till June 2019 quarter, the company approximately completed 45 per cent work over its flagship Sanbrado Gold Project, which is on track to pour first gold in mid-2020.

A grade control drilling at a deposit (M5) resulted in significant grades, which includes:

27m at 14 g/t Au, 29m at 13.2 g/t Au, 28m at 6.2 g/t Au, 20m at 7.8 g/t Au, 25m at 6.2 g/t Au, and 8m at 13.1 g/t Au.

The on-track development of flagship projects along with significant grades at the deposit makes the stock of the company attractive for the investors.

Pantoro Limited (ASX: PNR)

The share prices of the company reached a new 52-week high of A$0.295 on 15 August 2019 after which the share plunged on ASX. However, the recent gold rush provided some cushion to the share prices of the company.

The shares of the company ended the dayâs session today on ASX at A$0.220, up by 4.762 per cent against its previous close.

The company holds a decent position with 19 million tonnes of Mineral Resources at an average grade of 4.2g/t of gold, attributable to 2.6 million ounces.

PNR holds two province scale gold assets in Western Australia and hosts an asset for development at its 50 per cent owned Norseman Gold project.

Norseman JORC compliant resources:

Source: Companyâs Report

The acquisition of Norseman Gold project along with the lower prices makes the company ready for future opportunities.

There are many other stocks on ASX such as Blackham Resources Limited (ASX: BLK), and MACA Limited (ASX: MLD) that are trading at the lower end of their 52-week range.

The continuous appreciation in gold value could support the share prices of these miners, which, in turn, makes them attractive for the investors.

However, the stocks presented and selected here only pins out few interesting and specific points, and investors should dig out for fundamentals and other valuation-related methods to decide which stock to add to the bucket and which they should not.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.