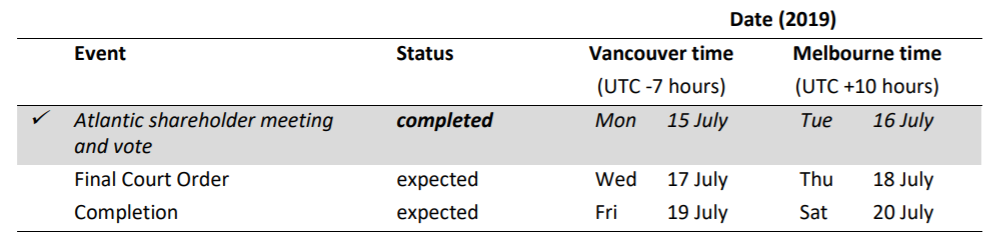

Australian-based gold producer and explorer, St Barbara Limited (ASX: SBM) has reached one step closer in acquiring Atlantic Gold Corporation. At a special meeting held in Vancouver on Monday, 15th July 2019, the shareholders and option holders of Atlantic greenlighted the Canadian plan of arrangement, under which, an entity controlled by St Barbara will acquire all of the shares and options in Atlantic for a total value of $779 million.

It is expected that the transaction will be completed by 19th July 2019, subject to necessary conditions.

Transaction Timetable (Source: Company Reports)

This transformational acquisition is in line with St Barbaraâs "Stronger for Longer" strategy.

Key highlights of the Transaction include:

- Diversification of St Barbaraâs production base by adding a low-cost asset in a favourable jurisdiction;

- This acquisition will further improve St Barbaraâs cost profile with MRCâs low AISC position;

- Acquisition provides St Barbara with a platform for future growth in an attractive mining jurisdiction with low geopolitical risk;

- Addition of a sustainable long-life operation, with an existing mine life of 12 years and substantial reserves and resources;

- Significant growth potential at MRC through planned resource and reserve expansion as well as near mine exploration;

- Retention of key Atlantic executives and the operating team to ensure continuity of operations and relationships with key Canadian stakeholders; and

- Opportunities for St Barbara and Atlantic to leverage existing strengths and capabilities and establish a platform for growth in the region.

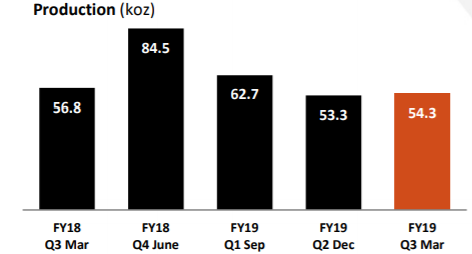

March Quarter Results: The company reported the production of 54,261 ounces in the March quarter. Average mined grade for the quarter was 11.7 g/t Au (Q2 Dec FY19: 10.4 g/t Au).

Production for March Quarter (Source: Company Reports)

All-In-Sustaining Cost (AISC) for the 2019 March quarter was $1,229 per ounce (2018 December quarter: $1,146 per ounce), due to a weaker Australian dollar and increased costs arising from the previously planned and announced:

- 6 week shut of the Aerial Rope Conveyor (âRopeconâ) to replace guide ropes, which was completed under budget and ahead of time;

- 100-hours processing plant maintenance shutdown, involving a SAG mill reline, deep sea tailings pipeline inspection and maintenance works, leach tank hopper replacement, apron feeder pulley replacement and ancillary maintenance works;

- Higher sustaining capital mainly related to the refresh of the mining fleet, which will extend into Q4 June FY19.

During the March quarter, the company continued the construction of the underground crushing and mixing âPAFâ infrastructure at the Project. Mechanical and electrical work on the crushing circuit on the 1,420 level PAF chamber is complete. Besides that, development on the 1,460 level is complete, with civil work well advanced and mechanical installation also well progressed. The high voltage power cable hole for the PAF component was completed in March and the cable lowering for this infrastructure is scheduled for Q4 June FY19. Dry commissioning of sections of the PAF circuit will commence during Q4 June FY19.

Gwalia Extension Project Update: During the March quarter, the company continued its work on the Gwalia Extension Project. The overall project is currently on track, albeit the overall project budget has increased to $112 million from $100 million. The project costs were within 3% of the budget at the end of Q2 December FY19. In 2019 March quarter, a number of project related items were encountered with an aggregate cost of $9 million, driving the increase in budget. The primary contributor was contract negotiations with the PAF contractor to ensure timely completion of the project, together with some project infrastructure scope changes.

The Gwalia Extension Project was announced on 27th March 2017, with an overall budget of $112 million and is expected to be completed in Q2 December FY2020.

On the stock performance front, SBMâs stock has provided a negative return of 28.24% for the past six months as on 17th July 2019. At market close on 18th July 2019, SBMâs stock was trading at a price of $3.370, up 2.744%, with a market capitalisation of circa $2.28 billion. Its 52 weeks high price is set at $5.152 and its 52 weeks low price is set at $2.480, with an average volume of ~6,725,926.

Gold mining position in the Australian industry is impressive as it is the third biggest industry behind iron ore and coal. Gold is the sixth largest industry overall, with revenues larger than beef, wool, wine and cheese put together. Everywhere, gold miners face the challenge of dealing with ever-rising costs, resulting in margin pressure. In this scenario, gold producers must aim to operate more cheaply each year. Let us now look at few other gold players trading on ASX.

Ramelius Resources Limited (ASX:RMS)

Western Australian gold producer, Ramelius Resources Limited (ASX: RMS) recently achieved its production guidance by producing 47,342 oz of gold in the 2019 June quarter.

The company has continued to progress its activities across mining, development, and exploration during the quarter with key accomplishments including:

- Commencement of mining at Eridanus open pit (Mt Magnet)

- Greenfinch (Edna May) open pit revised Clearing Permit application submitted

- Processed first development ore from the Hill 60 underground mine (Mt Magnet)

- Processed first development ore from the Edna May underground mine

- Commenced decline development at the Shannon underground mine (Mt Magnet), following the establishment of surface infrastructure and the portal

- Released new Resource/Reserve estimates for the Marda and Tampia development projects

- Tampia project strategic review confirmed the decision to process ore through the Edna May processing facility.

At the end of June quarter, the companyâs forward gold sales consisted of 240,900 oz at an average price of $1,834 per ounce over the period to August 2021. As at 30th June 2019, cash and gold at hand was $106.8 million.

On the stock performance front, RMSâs stock has provided a return of 40.59% for the past six months as on 17th July 2019. At market close on 18th July 2019, RMSâs stock was trading at a price of $0.755, up by 6.338%, with a market capitalisation of circa $467.09 million. Its 52 weeks high price stands at $0.985 and 52 weeks low price at $0.380, with an average volume of ~2,987,526.

Dacian Gold Limited (ASX:DCN)

A gold miner, Dacian Gold Limited (ASX: DCN) has also achieved production guidance in June quarter, by producing 36,658 ounces over the period. The companyâs All-in-Sustaining Cost (AISC) for the June quarter was $1,519/oz. It is estimated that at the end of June quarter, the company had around $45 million of cash and bullion.

Recently, in the month July, Dacian Gold Limited released to the ASX an updated Life of Mine (LOM) plan and FY2020 guidance for MMGO detailed:

- Average annual production of 170,000 oz over the first five years (FY2020-FY2024) at an MMGO All-in Cost (AIC) of $1,340-$1,440/oz;

- Total gold production over an eight-year LOM (FY2020-FY2027) of 1.1 million ounces at an MMGO AIC of $1,280-$1,380 (including all MMGO capital spend);

- At $1,800/oz gold price, discounted (5%) pre-tax MMGO cash flows exceed $420 million based on the eight-year LOM;

- Consolidated AIC over an eight-year LOM is $1,330-$1,430/oz (including all capital, corporate and exploration expenditure);

- FY2020 production guidance of between 150,000 to 170,000oz at an MMGO AIC of $1,400-$1,500/oz (including all MMGO capital spend); and

- Consolidated AIC for FY2020 is $1,450-A$1,550/oz (including all capital, corporate and exploration expenditure).

On the stock performance front, DCNâs stock has provided a negative return of 73.55% for the last six months as on 17th July 2019. At market close on 18th July 2019, DCNâs stock was trading at a price of $0.750, up by 17.188%, with a market capitalisation of circa $144.46 million. Its 52 weeks high price stands at $3.010 and 52 weeks low price at $0.375, with an average volume of ~4,640,838.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.