Understanding Penny Stocks

Penny stocks are generally priced at below one dollar. However, there can be cases when these stocks can be priced higher than one dollar, depending upon the dilution of issued share capital in the market. Companies with a larger number of shares relative to the market capitalisation are likely to have lower prices as well.

For instance, consider the market price of the company stock is $1 at a market capitalisation of $100 million, with $100 million shares outstanding, and the company intends to dilute the shareholding and then applies for a 2:1 stock split. This means that the total number of outstanding shares would be $200 million after the corporate action. Consequently, the market price of the stock would be quoted at $0.5/share post the completion of the stock split.

More importantly, considering no change in price after the stock is quoted in the market, the market capitalisation would be $100 million. In another way, the stock would start trading at a price of $0.5 after the completion of a stock split, and accordingly, subsequent trading quotes would determine the price and market capitalisation.

Penny stocks have the ability to generate multi-bagging returns in lesser time. As the companies having a market capitalisation of $20 million is likely to reach $40 million in lesser time as compared to the companies having a market capitalisation of $2 billion aiming to reach $4 billion.

It should be noted that investments in penny stocks are generally volatile, and abnormal movements in price are likely to happen on material announcements and developments or systematic shocks. Hence, an investor must consider their risk appetite prior to decision making.

Ziocom Group Limited

Ziocom was last quoted at A$0.11, equating to a market capitalisation of ~A$23.89 million with 217.14 million shares outstanding. Ziocom Group Limited (ASX: ZGL) is classified in the industrial sector, primarily trading in Singapore Dollar (SGD) and is engaged in industrial & mobile hydraulics, precision engineering & technologies, construction equipment and construction equipment.

The company is emerging to depict signs of recovery, after divesting its investments in the medical technology space through a demerger in November 2018. According to HY financial report for the period ended 31 December 2018, the demerged entity is trading under the name of ZIG Ventures Limited.

Meanwhile, the loss incurred by discontinued operations amounted to S$1.31 million, and now Ziocom would not face such losses following the demerger. In 1HY2019, the revenue was up 34%, net profit was up 194% recovering from loss, over the 1HY2018.

Recently, in its profit guidance notification to the market, the company recorded consolidated revenue of S$102.7 million, up 26% over FY2018. Ziocom expects to report consolidated net profits after tax in the range of S$1.0 million to S$2.0 million, an approximate improvement of 109% over the consolidated loss of S$10.87 million in the previous corresponding year.

The stock has delivered a return of +57.14% over the year-to-date period.

Bod Australia Limited

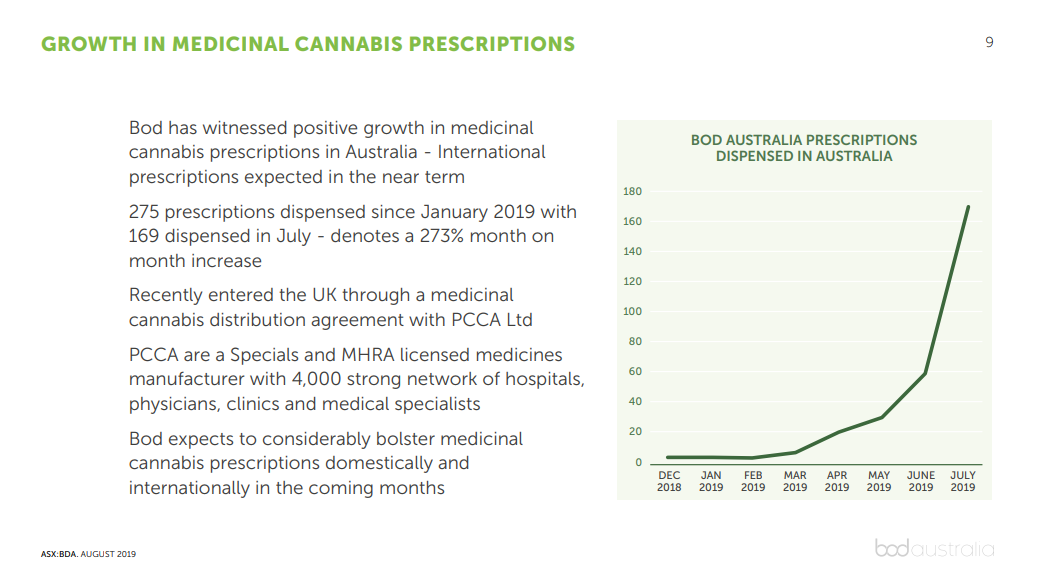

BOD Australia Limited (ASX: BDA) is engaged in the development, distribution and marketing of health products derived from medicinal cannabis and hemp. It is also engaged in herbal products outside cannabis and hemp.

Hong Kong listed, Health & Happiness Group Ltd had acquired 17.64% stake in the company through its innovation subsidiary. Reportedly, the company would enter the UK market following the completion of agreements.

Meanwhile, the clinical trial has depicted potential positive pipeline growth; domestic business is recording substantial growth; and the Board of the company has seen some strengthening after the inclusions from the Health & Happiness Group.

On 29 August 2019, BDA last traded at A$0.5, up by 2.041% from the previous close.

Swift Media Limited

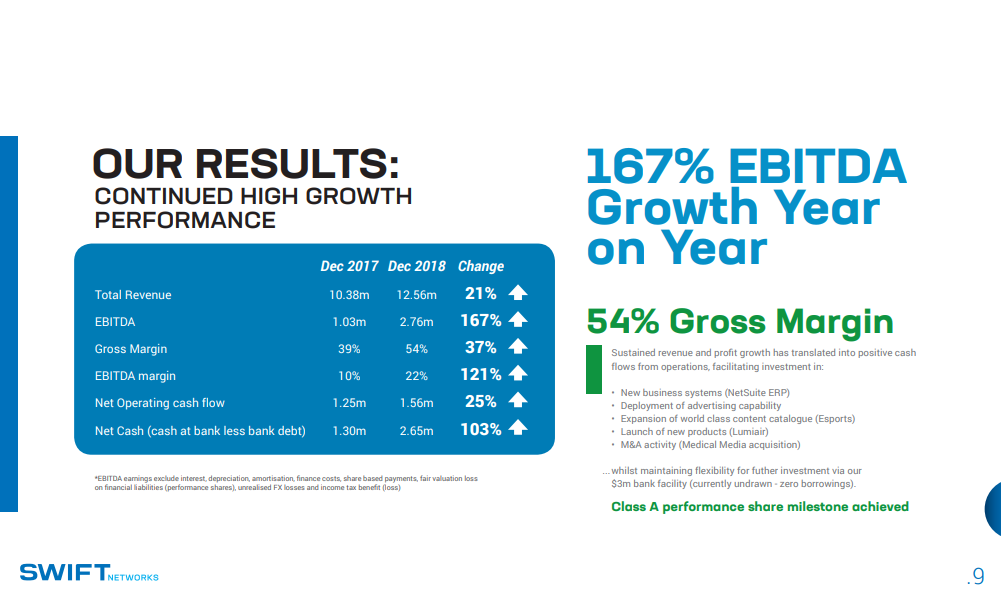

Swift Media Limited(ASX: SW1), is a diversified provider of telecom, content and advertising solutions. Recently, the company issued Class B Performance Shares following the milestone wherein it reached 53k rooms with revenue generating service from the company. SW1 also reached consolidated revenue of $29,000,000 in any rolling 12-month period.

Reportedly, SW1âs audited results would be provided by 31 August 2019. In its FY19 preliminary results, the revenue was up 11% to $24.8 million over FY2018, and annualised recurring revenue of $18.5 million was up 18% over FY2018.

HY Highlights (Source: SW1âs Investor Presentation, January 2019)

At the year end, the cash balance was $1.4 million along with unused working capital facility of $1 million. Besides, the company had invested $3.2 million in new systems and capex, and $2.3 million in integration and acquisition costs.

On 29 August 2019, SW1 last quoted A$0.18, and traded flat from its prior close.

ApplyDirect Limited

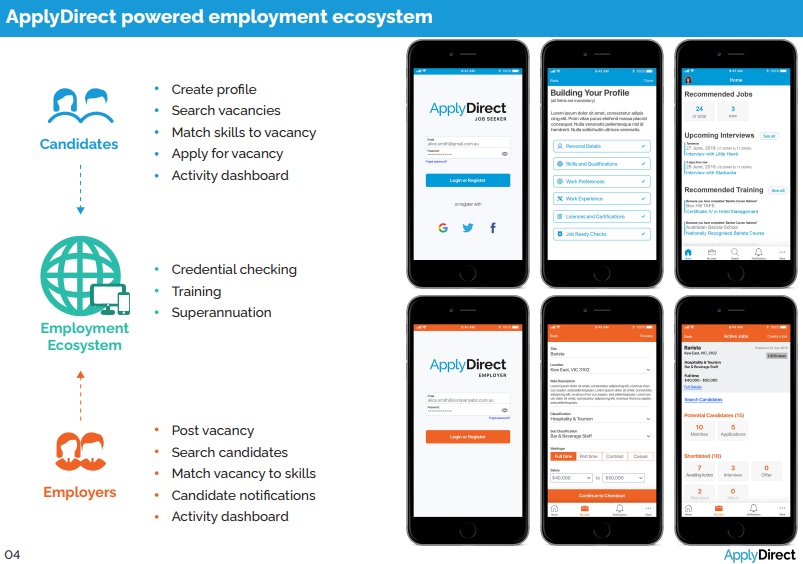

Aimed at simplifying the connection between the job seeker and the employer, ApplyDirect Limited (ASX: AD1) is the owner of the Next Generation Job Search tool. Recently, the company reported that an agreement was signed to provide strategic services for the establishment and ongoing operations of 3P Energy Pty Ltd. As per the release, Utility Software Services â subsidiary of ApplyDirect would provide required services related to solutions in the retail energy market.

In July 2019, the company released June quarter 2019 highlights. Accordingly, it was noted that cash receipts were up 176% over the previous quarter.

(Source: CEO's Presentation, November 2018)

Meanwhile, a multi-year agreement was signed with the Pharmacy Guild of Australia, and the Victorian Government extended the contract by another twelve months.

AD1 last traded at A$0.015 on 22 August 2019.

Ava Risk Group Limited

A market leader of risk management services and technologies, Ava Risk Group Limited (ASX: AVA) released Appendix 4C for the quarter ended 30 June 2019 , in late July 2019. Accordingly, the company optimised the operating cash outflows in the quarter and improved net operating cash flows by $1.2 million compared to the previous quarter.

Customers (Source: AVAâs Investor Presentation, May 2019)

Reportedly, the cash receipts from the customers were $7.2 million down by $0.2 million over the previous quarter. Meanwhile, the companyâs services division Ava Global DMCC LLC has recorded revenue growth of 117% over the previous year.

Besides, in early July 2019, the company had expected to report revenues of ~A$31.5 million in FY2019.

On 29 August 2019, AVA last traded at A$0.115, down by 4.167% from the previous close.

Esports Mogul Limited

A player of the e-sports business with its focus on Australia and South East Asia, Esports Mogul Limited (ASX: ESH) recently secured a partnership with SARENA, one of the leading esports venue operators in the Middle East, with exclusive rights to run high profile tournaments, including ESaudi Professional League, Electronic Prince Mohamed Bin Salman Cup.

In its latest quarterly update, it was noted that the company is close to the commercial launch of Organiser Hubs technology and subscription model, which would unlock significant strong revenue streams from the Mogul platform.

Overview (Source: ESHâs Company Presentation)

Meanwhile, the company has partnered with Alliance, and it expects to be launching the service at US$5 per month. Besides, Esports has partnered with Avant, Melbourne Melee, and Australian Esports League as well.

On 29 August 2019, ESH last traded at A$0.012, up by 9.091% from the previous close.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.