Provider of customer branded recruitment marketing platforms, ApplyDirect Limited (ASX:AD1) on 29 May 2019, reported the signing of two projects with the NSW Government to enhance the iworkfornsw talent platform further.

According to the announcement, the projects would enhance the machine learning, artificial intelligence capabilities of the government along with improvement in its online discoverability. Ultimately, improvements in capabilities would increase the relevance of the platform to the jobseeker community as talent engagement witnessed a 100% increase in the last two years.

Mr Bryan Petereit, CEO of ApplyDirect, said âAs AD1 continues to innovate, it gives our customers the confidence to invest further with ApplyDirect. Importantly, the ongoing investment by the NSW Government is a strong endorsement of the companyâs talent platform solution and its innovation roadmap. AD1 expects the innovations that it brings to the market will not only benefit the existing customers but will also enhance the companyâs value proposition which will help drive new business.â

Reportedly, since starting of this year, some developments within the company include, agreements with the Victorian government, which comprise of three separate agreements with departments wherein, the company would integrate the existing job portal with customer branded careers portal on a managed services basis.

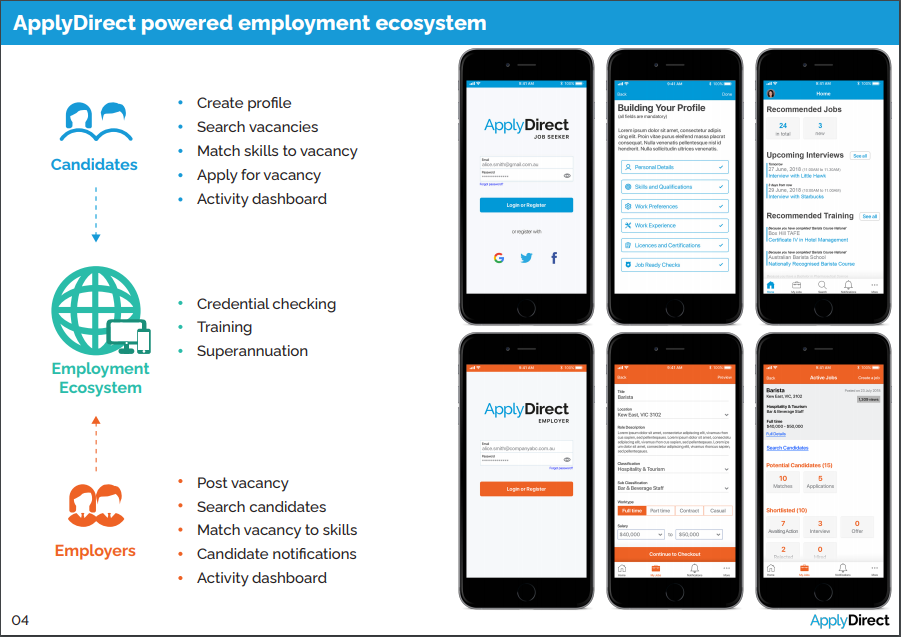

ApplyDirectâs Recruitment Solutions (Source: CEO's Presentation, Dated November 2018)

ApplyDirectâs Recruitment Solutions (Source: CEO's Presentation, Dated November 2018)

In March quarter, AD1 completed the acquisition of Utility Software Services Pty Ltd (USS) for the consideration of $3.588 million, in exchange for the issue of approximately 132.89 million shares in ApplyDirect to the USS shareholders. The company successfully raised $990,000 from the placement via the issuance of 36,666,666 new fully paid ordinary shares to Potentate Investments Pty Ltd and its Associates, as reported.

In March, the company also released its quarterly report and cash flow statements, wherein Cash and cash equivalents stood at A$1.87 million on 31 March 2019 against A$1.68 million in the prior corresponding period. Net cash flows from investing and financing activities were +839k and +900k respectively, +990k pertains to the placement and +838k held by USS at the completion of the USS acquisition. Also, Cash flows from operating activities witnessed outflow of -1.64 million during the quarter ended 31 March 2019. However, cash receipts from customers for March 2019 quarter were 416k up 98% on the previous quarter, and notable cash outflows from operating activities comprise -883k staff costs and -440k administration and corporate costs. AD1 expected its cash outflows for the next quarter at -2.41 million.

Further, in May 2019, AD1 reported the signing of an agreement with Pharmacy Guild of Australia wherein AD1 would manage the branded digital destination by hosting, development and management, digital destination bridges gap between employers and candidates.

ApplyDirect provides a wide range of services, which include utilities software billing services, customer branded utility technology platforms and management platforms. The company aims to provide employers with fast, direct access to high quality talent at a lower cost.

Employment Ecosystem (Source: CEO's Presentation, Dated November 2018)

Employment Ecosystem (Source: CEO's Presentation, Dated November 2018)

After the close of todayâs (29 May 2019) session on ASX, the stock of the company closed 22.22% higher from the prior close at A$0.022. The market capitalisation of the company is approximately A$7.67 million, with circa 425.86 million shares outstanding. The year-to-date return of the stock stands at -30.77%, along with +63.64% upside move on it in the past one month.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.