Diversification is an attempt towards reducing or spreading risks by allocating investments in different asset classes or in securities of several players, industries and other categories. The diversification strategy gives peace of mind to investors, as it helps them in managing some level of risk to their investments. A typical diversified portfolio of investors is expected to aid them in achieving a higher return with a low level of risk.

Why Diversification?

- There is always uncertainty attached to single investment, and diversification helps in balancing such surprises;

- Diversification offers the investor with advantage of attaining positive returns in one asset or market when another asset or market is delivering negative results;

- It helps in spreading the risks across a range of assets, in order to ensure that any fluctuation in the economy may have a less impact on an individual investor;

- The risk factors per security could be reduced by means of diversification.

Let us now discuss few diversified stocks that could be attractive for investors.

Webjet Limited

Webjet Limited (ASX: WEB) is an online platform engaged in selling travel products, including flights and hotels across Australia and New Zealand. Recently, the company made several announcements with respect to change in the interest of its directors including

- John Guscic, who acquired 26,500 fully paid ordinary shares at a consideration of $283,253.20, according to a company announcement on 4 October 2019.

- Don Clarke, who acquired 3,000 fully paid ordinary shares for $34,230. Post change, Mr Clarke holds 37,519 (indirect) shares.

Thomas Cook Enters Compulsory Liquidation

On 23 September 2019, the company announced an update related to the impact of Thomas Cook entering liquidation process, as Thomas cook is a customer of the WebBeds B2B business of Webjet Limited. The latest development of Thomas Cook would impact WEBâs FY2020 results.

- The projected loss of total transaction value (TTV) of $150-$200 million from Thomas Cook in the FY2020 period.

- Thomas Cook owed an amount of ~â¬27 million in outstanding receivables to WEB. The impairment of any non-paid receivables would be considered as a one-off expense to the income statement.

- There would be no impact on the 3000 hotels contracts acquired by Webjet from Thomas Cook.

In another market update on 2 September 2019, the company unveiled a change in the interest of substantial holder - UBS Group AG and its related bodies corporate from a voting rights of 7.88 per cent to 6.64 per cent.

Financial Highlights for the year ended 30 June 2019 (FY2019)

On 22 August 2019, the company declared financial results for FY2019. Major highlights from the release are as follow:

- Revenue increased by 26 per cent to $366.4 million compared to the previous corresponding period (PCP)

- Earnings before interest, tax, depreciation and amortisation went up by 43 per cent to $124.6 million when compared with the same period a year ago

- Net profit after tax also grew by 46 per cent year-on-year to $81.3 million

- Total transaction value reported an increase of 27 per cent to $3.8 billion on pcp

- CAPEX for FY2019 increased by 17 per cent to $32.7 million, due to DOTW

- Cash and cash equivalents stood at $211.4 million at the end of the year FY2019

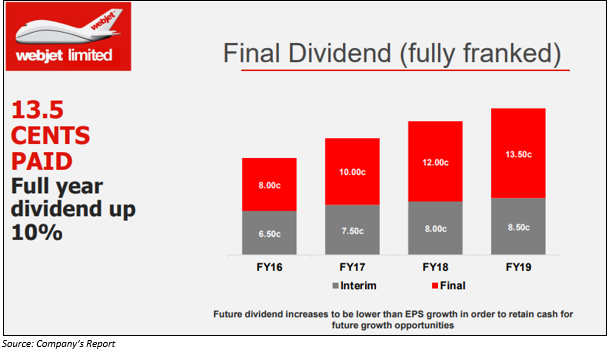

- The company also declared a final dividend of 13.50 cents per share (fully franked), bringing the total dividend for the year to 22 cents per share, which is up by 10 per cent from the previous year (FY2018)

Webjet Limited is scheduled to unveil guidance range for FY2020 at its annual general meeting on 20 November 2019.

Stock Performance

The stock of WEB closed the dayâs trading at $10.150 on ASX on 4 October 2019, down by 0.595 per cent from its previous closing price. The company has approximately 135.6 million outstanding shares and a market cap of $1.37 billion. The companyâs 52-week low and high value is at $10.030 and $17.190, respectively. In the last three months and six months, the stock has delivered a negative return of 23.96 per cent and 33.92 per cent, respectively.

Clinuvel Pharmaceuticals Limited

Clinuvel Pharmaceuticals Limited (ASX: CUV) is a biopharmaceutical company that is into the development of drugs targeted towards the treatment of a wide range of severe skin disorders. The company, which is headquartered in Melbourne, Australia, came into existence following two decades of testing the SCENESSE® technology.

October and September Updates

On 2 October 2019, CUV announced that the US Food and Drug Administration has clarified the PDUFA goal date for review of the submission of SCENESSE® scientific dossier to 8 October 2019. Prescription Drug User Fee Act is the full form of PDUFA.

Additionally, on 30 September 2019, the company announced that it will hold its annual general meeting of shareholders on 20 November 2019. In another market update on 23 September 2019, Clinuvel Pharmaceuticals unveiled the appointment of a non-executive director to the board. Mrs Susan (Sue) Smith is an experienced senior healthcare executive.

Moreover, in the beginning of September 2019, the company announced a change in the interest of its director (Karen Agersborg) after he acquired 1,400 CL VLY ADRâs. The number of securities held by Mr Agersborg after the change was 2,900 ordinary shares and 2,600 CLVLY ADRs.

Financial Performance for the year ended 30 June 2019

On 28 August 2019, the company declared financial results for FY2019, unveiling

- Total revenue increased to $31.05 million for FY2019 from $25.49 million in FY2018)

- Net profit before tax surged to $18.12 million in the reported year from $12.94 million in the same period a year ago

- The company was included in the S&P / ASX 200 Index in June 2019

- Cash and cash equivalents of the company stood at $54.27 million at the end of June 2019

Stock Performance

The stock of CUV closed the dayâs trade at $26.020 on 4 October 2019, up by 5.387 per cent from its previous closing price. The company has approximately 48.96 million outstanding shares and a market cap of $1.21 billion. The 52-week low and high value of the stock is at $14.100 and $39.850, respectively. The stock has generated a positive return of 0.27 per cent in the last six months and a positive return of 42.28 per cent on a year-to-date basis.

NIB Holdings Limited

Focusing on Australia and New Zealand, NIB Holdings Limited (ASX:NHF) is an international health care service provider. The company provides health insurance to more than 19k international students as well as workers in Australia. Moreover, NHF is engaged in providing insurance (health and medical) to ~1.6 million people in New Zealand and Australia. The company, which has its registered office in NSW, was listed on the ASX in 2007.

Change in Directorâs interest

On 3 October 2019, the company announced a change in the director interest (Mr Mark Fitzgibbon). The director of the company sold 70,000 nib shares during 30 September 2019 to 1 October 2019, aimed toward fulfilling an income tax obligation (personal), owing to the awards of remuneration for his role.

Financial highlights for the year ended 30 June 2019

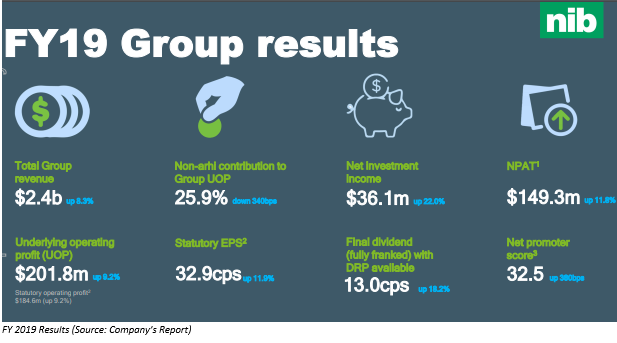

- Total underlying revenue of the company increased by 8.3 per cent to $2.4 billion compared to the previous year

- Underlying operating profit grew by 9.2 per cent year-on-year to $201.8 million

- Statutory earnings per share surged by 11.9 per cent to 32.9 cents per share

- Net profit after tax of the company increased by 11.8 per cent to $149.3 million

- Net investment income stood at $36.1 million, an increment of 22.0 per cent over the same period of the previous year

Guidance

- The company expects Australian Residents Health Insurance (arhi) organic growth of 2 per cent to 3 per cent per annum

- FY2020 arhi net margin is anticipated to be in the order of 6 per cent

- The ordinary dividend pay-out ratio is likely to come between 60 per cent and 70 per cent of full year net profit after tax

- Financial performance of other group businesses is expected to be consistent with recent years.

Stock Performance

The stock of NHF settled at $6.980 on 4 October 2019, down 0.428 per cent from its previous closing price. The company has approximately 456.08 million outstanding shares and a market cap of $3.2 billion. The 52-week low and high value of the stock is at $4.640 and $8.200, respectively. The stock has generated a positive return of 30.78 per cent in the last six months and 36.38 per cent on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.