Investment in the health care stocks offers innovation, diversification, and opportunities for economic advancements. The health care sector comprises of providers of medical services, medical insurance, and medical equipment, as well as companies dealing in drug development and research and development activities. Despite, global trade worries and lower returns on investment, investors are eyeing on capitalising money in the health care stock market.

Let us have a look at 4 health care stocks and their latest ASX updates:

CLINUVEL PHARMACEUTICALS LTD

CLINUVEL PHARMACEUTICALS LTD (ASX: CUV) is a global biopharmaceutical entity aimed at advancement and supply of medication options for patients suffering from an array of acute genetic and skin diseases.

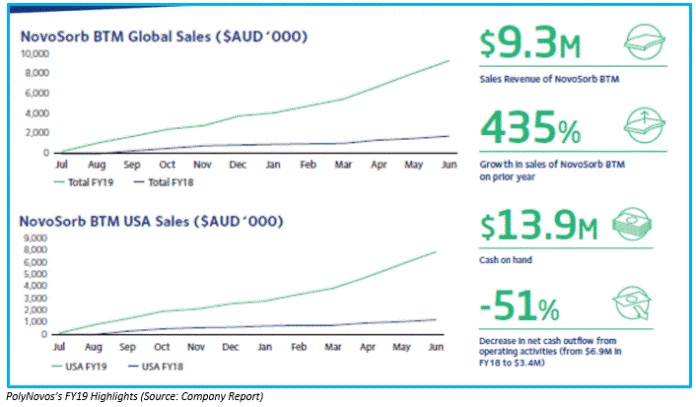

Product Pipeline (Source: CUVâs Presentation Jefferies Healthcare Conference, June 2019)

Appointment of New Director

As per the latest market announcement dated 23 September 2019, the company appointed Susan (Sue) Smith, as Non-Executive Director of the Groupâs Board of Directors. Mrs Smith is an accomplished, all-rounder health care executive having several years of experience, with her expertise in execution of operational strategies in a complex and critical care environment also in the interaction with health care authorities and UK regulators.

Mr Stan McLiesh, CLINUVELâs Chair was pleased to welcome Mrs Smith on Board and stated that her diverse skill and extensive experience would add to the depth of experience of the existing CLINUVEL Board, and would guide the companyâs future growth, as well as aid in progressing the operational strategy predominantly within the context of the ongoing European commercialisation program.

CUV to Present SCENESSE®

The company also announced recently, that the safety and effectiveness data acquired from erythropoietic protoporphyria (EPP) patients treated with CLINUVELâs principal candidate, SCENESSE® (a formulation of synthetic peptide afamelanotide 16mg), would be presented at a biennial rare disease conference, the International Conference on Porphyrins and Porphyrias (ICPP), in Milan, Itlay in September 2019. SCENESSE® is a first-in-class drug targeting erythropoietic protoporphyria (EPP) with Phase II and III trials being completed in the US and Europe.

Stock Performance: CUVâs shares last traded at $25.00, down by 2.114% from the last close, with a market capitalisation standing at $1.25 bn and 48.96 mn outstanding shares. CUV has produced a YTD return of 41.89 percent.

PolyNovo Limited

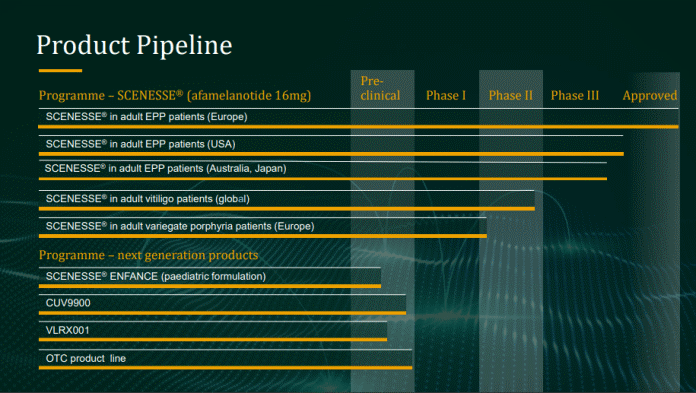

Melbourne headquartered biopharmaceutical company, PolyNovo Limited (ASX: PNV), that recently secured its place in S&P/ASX 200 Index during the periodic index rebalancing, is focused on developing innovative, biodegradable, patented polymers used in the manufacturing of medical devices. At present, PolyNovo is engaged in the development and marketing of its lead device, NovoSorb, used for treating surgical cuts, burns, hernia reparation, orthopedic and reconstructive surgery.

In an announcement dated 16 September 2019, the company appointed Mr Ed Graubart as Senior Vice President of PolyNovo North America LLC replacing Mr Kevin Whiteley. Mr Graubart with more than 29 years of experience in the orthopaedic medical business, would directly look after all sales and marketing related activities in the United States business, allowing PolyNovo to rapidly scale up its American sales and marketing. Considering his vast experience in sales, PolyNovo had issued him with one million share options at a striking price of $1.55 that would be vesting over the next 5 years period, with options vesting to 250,000 on 13 August 2021 then a further 250,000 each year in August up until 13 August 2024.

The company also provided an update on the pivotal trial as announced on 13 September 2019.

- On 5 September a pre-submission meeting was held with US FDA regarding the full thickness burns study.

- US FDA provided a confirmation that it perceives NovoSorb BTMâs potential for this burn population.

- US FDA also provided directions regarding the primary goals of the pivotal trial.

- Moreover, US FDA advised the submission through the âBreakthrough Technologyâ pathway.

- PolyNovo is currently reviewing the protocol design to integrate inputs given by US FDA with FDA submission expected in December 2019 and patient recruitment scheduled for Q4 FY20 as per the revised timelines.

- It was further reported that BARDA is in favour of this process. The protocol and budget for the pivotal trial will be announced in Q3 FY20 period.

- Successful completion of the pivotal trial is what the company believes will pave the way to a US FDA application, for PMA approval of NovoSorb BTM for its use in full thickness burns in the United States.

Stock Performance: PNVâs shares last traded flat at $2.24, with a market capitalisation standing at $1.48 bn and 661.09 mn outstanding shares. The company has generated a tremendous YTD return of 273.33%.

Summerset Group Holdings Limited

Summerset Group Holdings Limited (ASX: SNZ) operates a retirement village in NZ and is one of the largest retirement village operators in the country, with its first village opened in 1997.

In the recent announcement, Summerset Group Holdings Limited issued 928,017 Ordinary Shares to the shareholders elected to participate in the Dividend Reinvestment Plan on 9 September 2019. The issue price per security amounts to $5.8336. The percentage of total class of financial products issued is 0.4108%. Total number of Financial Products of the Class after the issue (excluding Treasury Stock) and the total number of Financial Products of the Class held as Treasury Stock after the issue stands at 226,827,675 Ordinary Shares (nil held as treasury stock). Issue of 928,017 Ordinary Shares is in accordance, with the terms of the Dividend Reinvestment Plan Offer document dated 29 April 2016.

Summerset Group Holdings Limited recently in mid-August, appointed Robyn Heyman as Head of Legal and Company Secretary who replaced Leanne Walker, Deputy CFO, and Company Secretary.

In another announcement, the company reported that it had paid dividend equivalent to NZD 0.064 per ordinary share to its shareholders, on 09 September 2019.

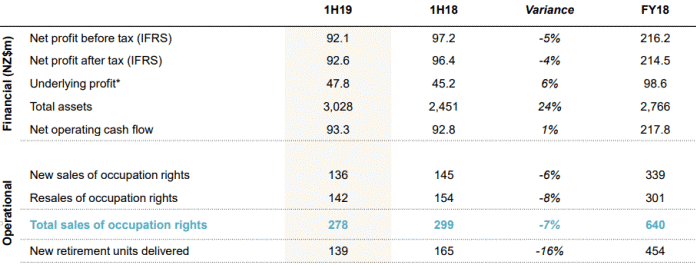

As per the 1HFY19 results for the period closed 30 June this year, released on 13 August this year, the company generated a profit of NZ$47.8 million, which increased by 6% on the previous corresponding period. The stated PAT for the given duration was NZ$92.6 million, which decreased by 4% as compared to the pcp. The companyâs total assets for the period amounted to NZ$3.0 million, which is an increase of 24% compared to pcp. An interim dividend amounting to NZ 6.4 cps had also been reported by the company.

1HFY19 Results (Source: Companyâs Report)

Stock Performance: SNZâs shares traded at $5.960, up by 0.846%, with a market capitalisation standing at $1.34 bn and 226.83 mn outstanding shares. SNZ has given a YTD return of 1.55 percent.

Metlifecare Limited

New Zealand Headquartered, a leader in the healthcare space, Metlifecare Limited (ASX: MEQ) owns and manages retirement villages, which offers rewarding lifestyles and outstanding care to above 5,600 New Zealandâs natives. The company, established in 1984, presently owns and operates a group of 25 villages situated largely in New Zealandâs upper North Island, in areas with strong local economies, supportive demographics and high median house prices.

An Overview of MetLifeâs track record and financial position. (Source: Companyâs Presentation)

In an announcement dated 20 September 2019, on ASX Metlifecare acquired fixed-rate bonds offer with a set interest rate.

- It was updated that after the successful bookbuild for the companyâs offer of seven-year fixed bond rate have been secured.

- In this bookbuild process, $100 million of bonds were assigned to the participating members, without any public pool for the offer.

- Bondsâ interest rate had been set at 3.00% per annum, which is the lowest interest rate.

- Issue date for bonds will be of 30 September 2019.

- Bondsâ maturity date will be 30 September 2026.

- It is predicted that the Bonds would be offered on the NZX Debt Market within the code - MET010.

Stock Performance: Metlifecare Limited, trades under the code MET on NZE (NZE: MET). METâs stock last traded on 23 September 2019, at a price of NZ$4.46, moving down by 0.22 percent from the previous close. Metlifecare has a market cap of NZ$953.47 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.