This article talks about two companies focused on retirement living in New Zealand & Australia. Both of these companies operate numerous retirement housing infrastructure across the countries. Besides, the market capitalisation of both the companies is over $1 billion as on 15 August 2019.

Summerset Group Holdings Limited (ASX: SNZ)

A retirement village operator in New Zealand, the group had opened its first village in 1997, and is one of the largest retirement village operators in the country. Some of the locations in which the group operates villages are New Plymouth, Papamoa Beach, Dunedin, Rototuna, Warkworth and Wigram.

First Half Highlights (Source: Half Year Results)

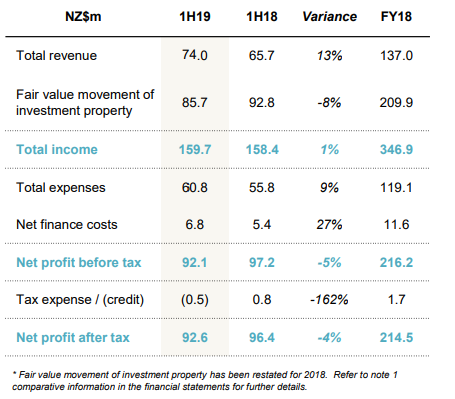

On 13 August 2019, the group declared the half-year report for the period ending 30 June 2019. Accordingly, the reported net profit after tax stood at NZD 92.6 million in 1H19, down by 4% from NZD 96.4 million in 1H18. The total assets of the group increased by 24% to reach NZD 3,028 million in 1H19 compared with NZD 2,451 in 1H18.

As per the release, the total revenue of the group during the period was NZD 74 million, up by 13% over the previous corresponding period. The expenses grew by 9% for the period, which is lower than average growth over the last three years of 25%. Besides, the total expenses increased by NZD 5 million over the 1H18 due to increasing occupancy at Ellerslie and Hobsonville care centres and pay increases of NZD 2.5 million driven by increases Caregivers and Registered Nurses.

Balance Sheet

Reportedly, the retained earnings increased from NZD 590 million in 1H18 to NZD 770 million in 1H19, and investment property valuation of NZD 2.8 billion was by 24% over the 1H18. The gross debt of the company stood at NZD 489.3 million as on 30 June 2019, up by NZD 110.1 million from the previous corresponding period. Besides, the increase in gross debt was due to construction spending and land acquisition in 2H18, and the bank facility of NZD 500 million had an undrawn capacity of NZD 235.7 million as on 30 June 2019. The retail bonds of the group stood at NZD 225 million as on 30 June 2019. Importantly, all debt of the group is associated with development activities.

Development Activity

Sales of Occupation Rights (Source: Half Year Results)

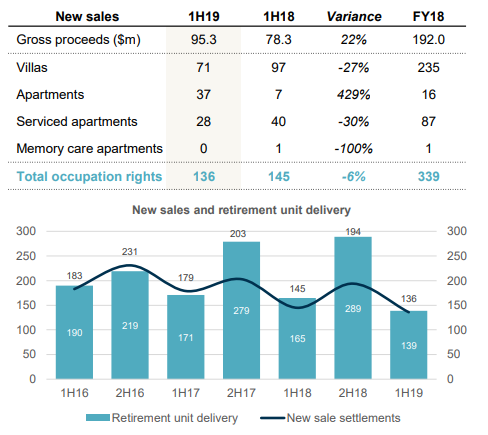

Reportedly, the group delivered 139 retirement units during the period. The group is operating a portfolio of 3,871 retirement units and 858 care bed, which includes villas, apartments, serviced apartments and memory care apartments. Besides, the groupâs units are home to over 5300 residents, and it acquired six new greenfield sites during the period.

As per the release, the groupâs first half realised margin of NZD 27.1 million in 1H19 was up by 5% from NZD 25.8 million in 1H18 with a development margin of 28.4% during the first half. Besides, the sale of new occupation rights was 60% in the Auckland region and 40% across the rest of developing villages. Further, the company recorded sales of 136 new occupation rights during the first half period, and gross proceeds were NZD 95.3 million, up by 22 over the 1H18.

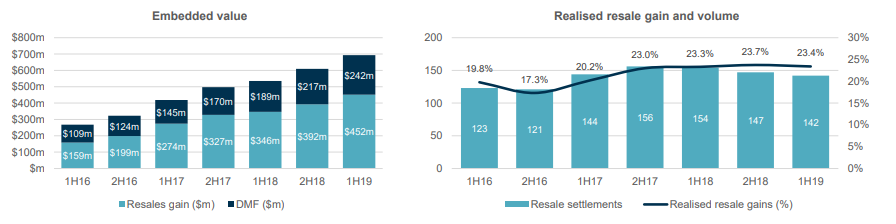

Reportedly, the group recorded a resale gain of 23.4% in line with 1H18, which included resale of 142 occupation rights in the first half. Besides, the average gross proceeds per resale settlement of NZD 430k were up from NZD 415k in 1H18. Further, the embedded value of NZD 179k per retirement unit at the half year was up from NZD 156k in the previous corresponding period.

Embedded Value & Realised Gain (Source: Half Year Results)

Community

Reportedly, the group become the first New Zealand CarboNZero certified retirement group, and it signed up to the Climate Leaders Coalition alongside over 100 NZ business leaders to tackle climate change while reducing carbon emissions in New Zealand.

As per the release, the group launched a Community Connect Pilot to help its residents to solve their tech problems through the support of local school students. The groupâs new care centre in Hobsonville received a four- year certification, and Wanganui also received four-year certification.

Dividend

As per the release, the group announced an interim dividend of NZ 6.4 cents per share, up from 6 cents per share in 1H18. Further, it provides a dividend reinvestment plan with a discount of 2%, and eligible shareholders should register by 5 PM NZT on 28 August 2019. The Ex-date for the dividend was mentioned as 26 August 2019, along with 27 August 2019 as the record date, to be paid by 9 September 2019.

On 15 August 2019, SNZ last traded at A$5.47, down by 1.80% from the previous close. The stock is down by 6.8% over the year-to-period. The market capitalisation of the company was ~A$1.25 billion, with ~225.9 million shares outstanding (as at AEST: 1:34 PM)

Aveo Group (ASX: AOG)

On 14 August 2019, Aveo notified the market on inking a SID or Scheme Implementation Deed with BidCo and TopCo, the companies controlled by Brookfield Property Group, wherein BidCo had undertaken to obtain hundred percent of the outstanding shares of AOG by way of trust scheme and a company scheme of arrangement for a value of$2.195/security.

Recently, on 6 August 2019, Aveo updated on the strategic review of the group. Accordingly, the group has been negotiating with the preferred party â Brookfield Property Group. Itâs Independent Board Committee (IBC) has been working with Brookfield to obtain resolution on several matters.

Subsequently, following the resolution, the group would give effect to non-binding & conditional indicative proposal, and then a definitive agreement leading to a Scheme of Arrangement could be agreed for a whole-of-group transaction.

Reportedly, the group has been proposed with an indicative cash offer price under ongoing discussion with Brookfield, which is $2.195 in cash for each stapled security of the group. The company noted that the indicative cash offer would be decreased by the value of any distribution after the entry into a definitive agreement, including the recently announced dividend of 4.5 cents per share on 24 June 2019.

Nevertheless, the ongoing discussions with the preferred party have not been completed while the entry into definitive agreement depends upon the approval from the Board of the group. It was asserted that entering into a definitive agreement is uncertain, and the uncertainty extends to acceptance of the indicative offer as well as the completion of the transaction.

FY19 Projects (Source: AOG Half Year Results Presentation, February 2019)

On 24 June 2019, the group had announced a fully-franked dividend of 4.5 cents per share. The dividend had ex date of 27 June 2019, and 28 June 2019 as the record date, and it has to be paid by 30 September this year.

On 15 August 2019, AOG last traded at A$2.125, up by 0.236% from the previous close. The performance of the stock over the year-to-date period has been +39.45%. The market capitalisation of the company was ~A$1.23 billion, with ~580.74 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.