Value and Growth are fundamental approaches to investment. Growth investors look for companies offering earnings growth, whereas, value approach is based on identifying companies that are highly undervalued in the market.

Growth companies reported better than expected results in the preceding periods with gains in earnings during recent years and are expected to be delivering better than moderate results.

Value investing intends to look for companies that are heavily discounted in the markets. However, these companies tend to have strong fundamentals, lower price and a relatively lower valuation than their peers.

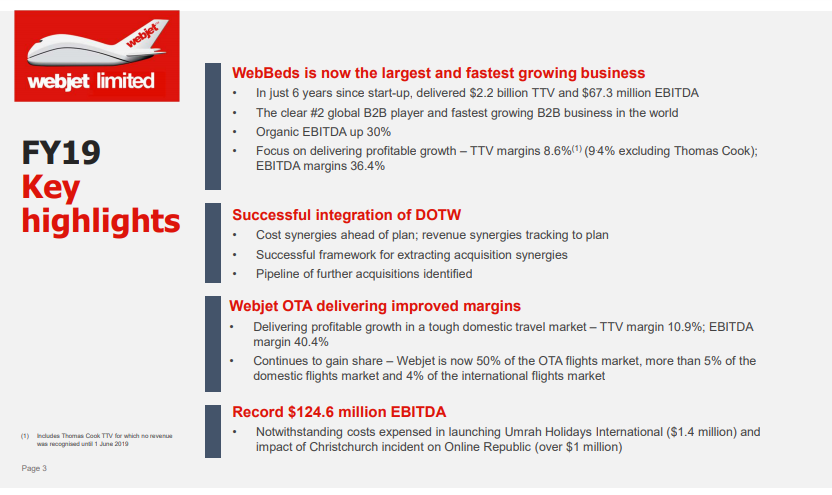

Webjet Limited (ASX: WEB)

Webjet operates an online platform for selling travel products, including flights and hotels. It provides services to both B2C & B2B clients. During FY 2019, the company had acquired Destinations of the World and its controlled entities (DOTW) â a pure-play B2B platform, based in Dubai.

Reportedly, the company had recorded a revenue growth of 26% to $367.4 million in FY 2019 compared to $292 million in FY 2018. Net profit after tax was up 45% to $60.3 million against $41.5 million a year ago.

FY2019 Highlights (Source: Investor Presentation)

Revenue was up primarily by B2B business along with increased scale via JacTravel acquisition in August 2017, and DOTW. The company had incurred costs related to acquisition and integration, and borrowing increased amid pursuing growth prospects.

On 20 September 2019, WEB last traded at $11.51, down by 2.54% relative to the previous close.

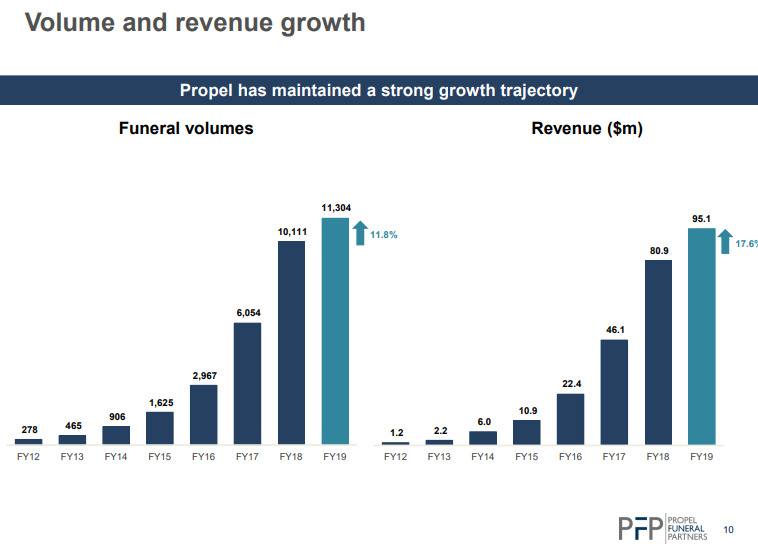

Propel Funeral Partners Limited (ASX: PFP)

Propel Funeral provides services pertaining to death care in the ANZ region. During FY 2019, the company completed acquisitions worth $27.58 million, which included businesses in Australia and New Zealand.

Reportedly, the company had secured senior debt facility of $50 million for a term of three-years. In December 2018, sales agreement to acquire Dils Group was executed for a consideration of NZ$ 21.45 million and stock. In addition, the company acquired seven free-hold properties for $9.33 million.

Volume & Revenue Growth (Source: FY19 Presentation)

During FY 2019, the company recorded revenue of $95.12 million in FY2019, up 17.6% over FY2018. Gross profit margin improved to 70.7% from 69.7%. More importantly, the company made a net profit after tax of $12.34 million against a loss of $14.27 million a year ago.

On 20 September 2019, PFP last traded at $3.14, up by 1.62% relative to the prior close.

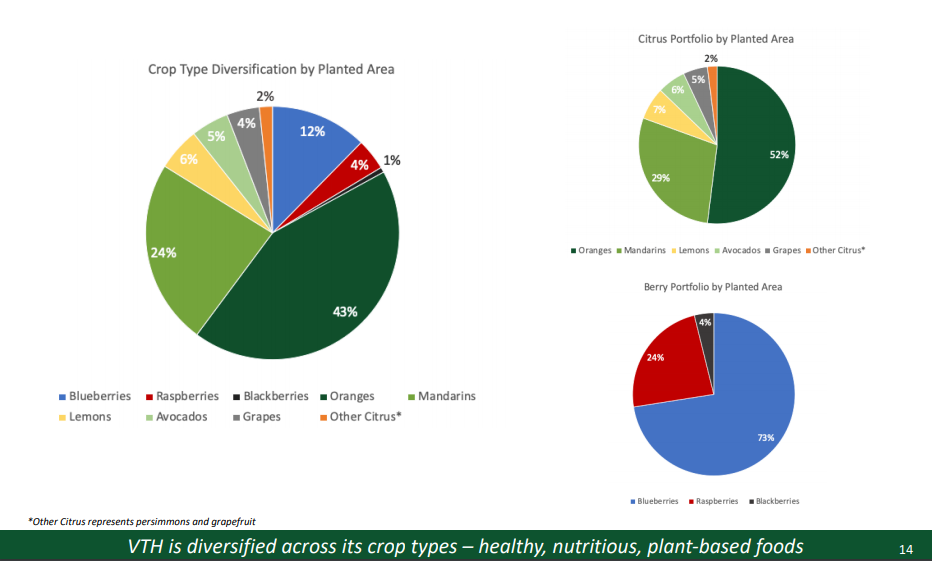

Vitalharvest Freehold Trust (ASX: VTH)

Registered managed investment scheme, Vitalharvest Freehold Trust provides investors with an exposure to real agricultural property assets with significant earnings profile and underlying value.

The trust was listed on ASX in August 2019. Reportedly, in FY 2019, the trust recorded revenue of $15.43 million. It had posted a loss of $5.53 million during the period. More importantly, the loss was predominantly attributed to IPO costs of $7.24 million in FY 2019.

Portfolio (Source: FY 2019 Presentation)

In addition, it had incurred a net loss in fair value of interest rate swaps amounting to $8.4 million, while the loss on disposal of non-current assets was $1.56 million.

On 20 September 2019, VTH last traded at $0.895, up by 2.286% relative to the previous close.

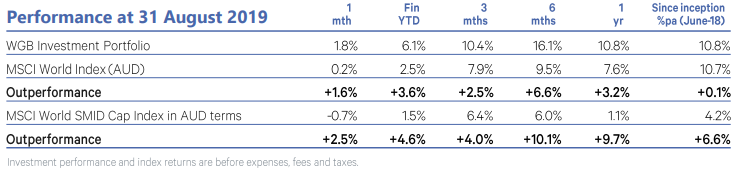

WAM Global Limited (ASX: WGB)

WGB invests in most undervalued growth companies in the world. In its August Investment Update, the portfolio of the company grew 1.9% outperforming MSCI World Index (AUD) which increased 0.2%, and MSCI World SMID Cap Index (AUD) which fell 0.7%.

Accordingly, consumer staples, real estate, and utilities were the top performers, and energy, financials, and material depicted underperformance. August had been a challenging month amid escalating uncertainties.

Performance (Source: WGP August Release)

Businesses with significant contribution in August were Entertainment One and CTS Eventim. Entertainment One had received a takeover offer, while CTS Eventim, a ticketing & live entertainment business, delivered a strong second quarter performance.

At August end, the portfolio was largely skewed towards the US with 59.6% exposure, followed by France, UK, Germany, Japan and more. NTA after tax and before tax on unrealised gains for the period was 245.55 cents.

On 20 September 2019, WGB last traded at $2.13, down by 0.47% relative to the previous close.

NAOS Emerging Opportunities Company (ASX: NCC)

NCC is a listed investment company seeking to provide investors with conservative capital growth above the benchmark, and a stream of fully-franked dividends. During FY 2019, the company had posted first loss since inception, recording $7.5 million in net profit after tax.

The Board of the company is dedicated to providing a stream of fully-franked dividends, and despite suffering losses, the company had declared the dividend. NCC aims to provide long-term concentrated exposure to micro-cap industrial businesses.

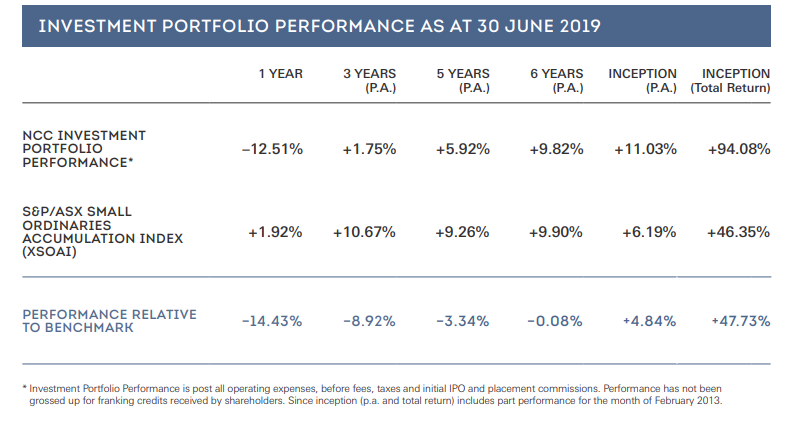

In FY 2019, the investment performance of the company was -12.51%, and the year had proved to be a challenging year. However, the board believes that the underlying companies offer good value.

Investment Performance (Source: Annual Report)

Also, the company had focused on improving transparency and quality of its investment communications, which resulted in an increasing number of new shareholders. Besides, the revenue of the company was down 236% to -$8.81 million.

On 20 September 2019, NCC last traded at $1.045, down 1.415% relative to the previous close.

Bapcor Limited (ASX: BAP)

Bapcor Limited is a seller & distributor of motor vehicle aftermarket parts and accessories and caters to motor vehicle servicing as well as services related to automotive equipment. It has a network of 900 sites offering services to customers.

In FY 2019, the company had sold the TRS Tyre and Wheel business in New Zealand for NZ$ 20 million, which contributed $1.8 million in NPAT during FY2018. In December 2018, Bapcor acquired Commercial Truck Parts, as well as numerous businesses. It also established its presence in Thailand.

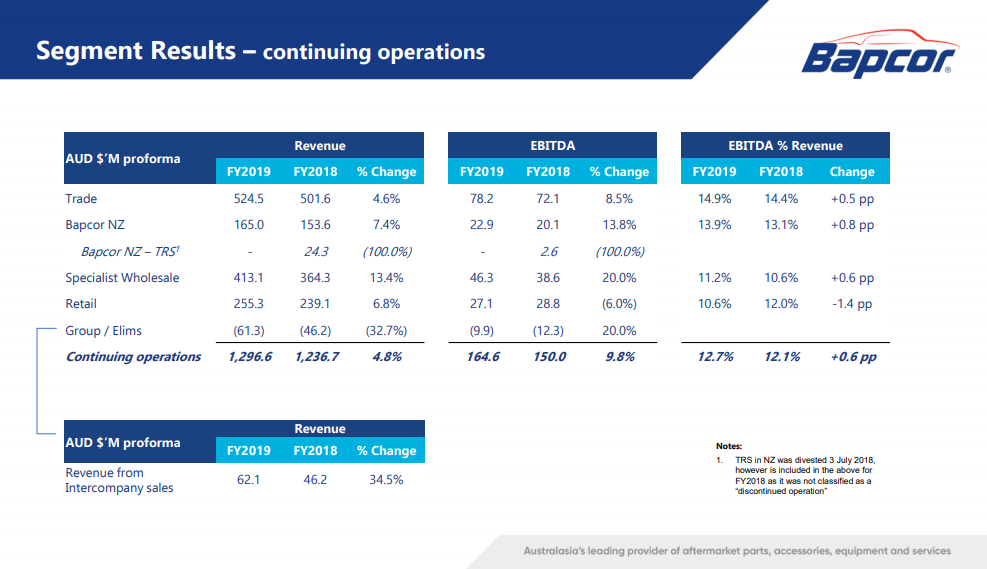

Segment Results (Source: FY 2019 Presentation)

Bapcor believes that its human resource, supply chain, diversified business provides competitive advantages. During the year, the company had registered a growth of 4.8% to record $1.29 billion in revenue from continuing operations compared to $1.23 billion a year ago.

During FY2019, the company recorded a net profit after tax of ~$97 million compared to $94.32 million.

On 20 September 2019, BAP last traded at $7.05, down by 0.7% relative to the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)