The below-mentioned stocks have released their FY19 results today (i.e., 26 August 2019). Letâs take a look at the results of these results.

Adairs Limited (ASX:ADH)

Adairs Limited (ASX: ADH) is primarily involved in retailing of homewares and home furnishings in New Zealand and Australia. On 26 August 2019, Adairs Limited unveiled its full year results for FY19.

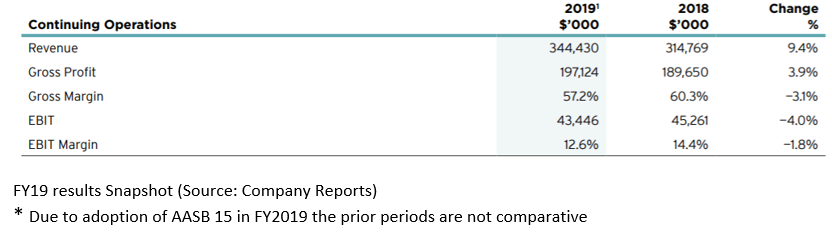

As per companyâs Managing Director & CEO Mark Ronan, FY19 was a year of significant progress for Adairs Limited. The company experienced growth in both revenue and market share of its online and store channels. FY19 was another year of strong cash generation and healthy dividends for shareholders. However, this growth also contributed to significant cost increases in the companyâs supply chain and contributed to a reduction in its margins. These costs, coupled with a weaker Australian dollar and a softer trading environment late in FY19, collectively contributed to a modest decline in the companyâs EBIT (from Continuing Operations) which reached to $43.4 million in FY19, down by 4% on pcp. The company recorded a gross profit of $197.1 million (from continuing operations) in FY19, up 3.9% on FY2018, resulting in a gross margin rate of 57.2%, down from 60.3% in the prior year.

Following the release of the full year results, the companyâs stock witnessed an uplift of 11.783% during the intraday trade as on 26 August 2019.

In FY19, the company witnessed record sales with revenue of $344.4 million, up 9.4% on pcp, mainly driven by the companyâs online channel where sales increased by 41.8% while like for like sales in the companyâs stores finished up 1.5%.

The Adairsâ online business continues to be its fastest growing channel and now accounts for 17% of total company sales, reflecting a significant focus and investment in the companyâs digital strategy. As the online business becomes a more material component of both the companyâs sales and profitability, Adairs intends to continue making investments in key areas to further drive this business in the coming years.

In New Zealand, the companyâs business was profitable in FY19 with solid growth in sales across all stores and online. The work undertaken on the companyâs supply chain in New Zealand significantly assisted its sales potential over the year.

In FY19, the company exceeded capacity in its primary distribution centres and activated overflow capacity in secondary centres, causing considerable inefficiencies and resulting in materially higher operating costs.

The company has declared a final dividend of 8.0 cents per share (100% franked), taking total dividend for FY19 to 14.5 cps, up 7.4% on FY18.

Outlook: After a strong year for revenue growth in FY2019, the company is expecting to continue to grow revenue and return to growth in profit by remaining focussed on the execution of its strategies, including its new supply chain initiative. The company is expecting to deliver continuing like for like sales growth across all store formats, continued store roll out in Australia and New Zealand, and ongoing product expansion and differentiation. The company will continue to invest in improving its digital presence and execution to complement and enhance its traditional store experience. These ongoing strategies are forecast to deliver sales in FY2020 in the range of $360 million to $375 million.

FY2020 Outlook (Source: Company Reports)

Stock Performance: In the past six months, ADHâs stock has witnessed a decline of 16.93% as on 23 August 2019. At market close on 26 August 2019, ADHâs stock was trading at a price of $1.755 with a market capitalisation of circa $260.42 million. The stock has a 52 weeks high price of $2.710 and 52 weeks low price of $1.250 with an average volume of ~730,438.

Evans Dixon Limited (ASX:ED1)

Evans Dixon Limited (ASX: ED1) is mainly involved in providing high-quality market leading financial advice to its clients. On 26 August 2019, Evans Dixon Limited released its FY19 results along with the Annual report.

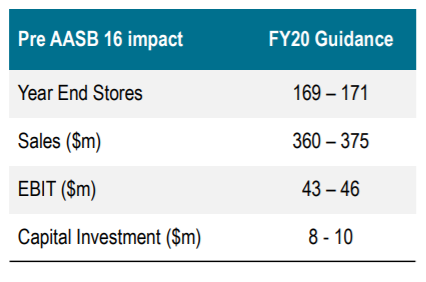

For FY19, the company reported an underlying EBITDA of $37.1 million and NPATA of $21.8 million, representing a reduction in profitability from the prior year. The companyâs net revenues decreased by 5% to $212.1 million in FY19, while its underlying earnings per share decreased by 32% to 9.8 cents in FY19.

FY19 Results snapshot (Source: Company Reports)

The FY19 results were impacted by the decline in transaction-related revenues, the reduced number of new Funds Management investment strategies launched and increased corporate and compliance costs.

During the year, the Net client numbers of the company increased by around 300. The company witnessed strong growth in the Evans & Partners high net wealth client base in FY19 as well as in its Funds Under Advice which increased by around 10% over the year.

The companyâs Funds Under Management (FUM) increased by 21% in FY19 as compared to FY18. The company experienced strong outperformance across the majority of its domestic and international equity funds. Significantly, the Funds Management business successfully completed a US$200 million IPO on the London Stock Exchange (LSE) for the US Solar Fund.

The companyâs Board has declared a final fully franked dividend of 3.0 cents per share, taking the full year dividend to 8.0 cents per share for FY19, reflecting a payout ratio of 85% of NPATA for the FY19 year.

Significant key achievements during FY19 include:

- The expansion and rebranding of the Companyâs Corporate and Institutional division following the acquisition of Fort Street Advisers; and

- the launch of the groupâs first internationally listed, institutionally focused fund, the US Solar Fund listed on the London Stock Exchange.

Stock Performance: In the past six months, ED1âs stock has witnessed a decline of 61.45% as on 23 August 2019. At market close on 26 August 2019, ED1âs stock was trading at a price of $0.680, up by 2.256% intraday, with a market capitalisation of circa $155.41 million. The stock has a 52 weeks high price of $2.320 and 52 weeks low price of $0.615 with an average volume of ~123,803.

Propel Funeral Partners Limited (ASX:PFP)

Funeral service provider, Propel Funeral Partners Limited (ASX: PFP) owns and operates businesses, properties, infrastructure and related assets in the death care industry.

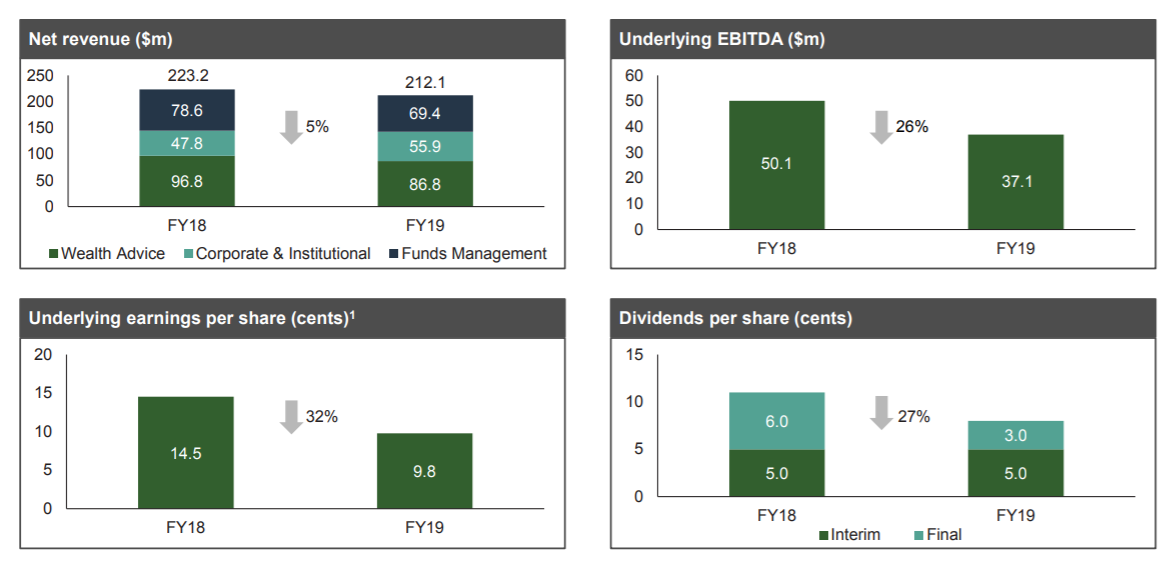

For FY19, the company provided resilient financial results, despite below trend death volumes in most markets in which it operate. The companyâs revenue grew by 17.6% to $95.1 million, while its operating EBITDA increased by 10.6% to $23.8 million. The company generated 46% of its revenue from metropolitan areas, in line with FY18. The increase in revenue was driven by a 13.9% increase in revenue from funeral operations; and a 54.3% increase in revenue from cemetery, crematoria and memorial gardens.

The funeral volumes over the year increased by 11.8% to 11,304.

Propelâs Strong Growth Trajectory (Source: Company Reports)

The company has declared a final dividend of 5.8 cents per share fully franked, taking the full year dividend for FY19 to 11.5 cents per share.

The company recently expanded its debt facilities with Westpac Banking Corporation to $100 million and currently has uncommitted debt capacity of around $26.2 million.

While providing the outlook, the company informed that it is well placed to benefit from:

- Acquisitions completed and announced during and since FY19;

- Other potential future acquisitions (although timing is uncertain);

- and â funeral volumes reverting to long term trends.

Stock Performance: In the past six months, PFPâs stock has witnessed a decline of 2.94% as on 23 August 2019. At market close on 26 August 2019, PFPâs stock was trading at a price of $3.050, down by 3.175% intraday, with a market capitalisation of circa $310.3 million. The stock has a 52 weeks high price of $3.340 and 52 weeks low price of $2.420 with an average volume of ~123,803.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.