As soon as we think of food and retail, technology is may be not the first thing that occurs to our thoughts. However, in recent years, technology has changed the way people think and plays an integral role in the progress of numerous sectors, retail and food being renowned among them.

These two sectors are constantly implementing and executing technologies like the Internet of Things (IoT), cloud computing, artificial intelligence (AI), blockchain, machine learning and advanced data analytics.

Restaurants and retail shops are also gearing up to review the worldwide businesses, which include supply chain, treasury, distribution, sales and marketing and finance, in order to operate more successfully.

However, shortage of experienced workers has been troubling the sector participants quite often. The continuing trade war tension between the United States and China is another cause of concern.

Letâs delve deeper and understand the important of Technology in each of these sectors:

Importance of Technology in Retail Sector

The retail environment has been witnessing a vast change with its focus moving steadily from brick-and-mortar to online shopping. Industry participants are slowly expanding omni-channel facilities, which include high-tech updates and store renovations.

They are working on brand improvement attempts with heavy discounts and ground-breaking customer-friendly methodology such as delivery choices on the same-day. This helps the industry players to make more profits for the forthcoming holiday period.

In recent times, many technology trends have grown and significantly changed the shape and scope of the retail industry. In order to have a competitive advantage, todayâs merchants and retailers have to provide customers a smooth shopping experience via all channels and should enhance customer experiences.

The whole retail environment has accelerated with the advanced technology know-how.

There are number of diversified areas retailers can experiment if they use technology, such as: in-store services, smart shelves, smart displays, option of home delivery, brand enhancement options, supply chain augmentation, to mention few of them.

Amazon.com Inc. has been a hot spot in the recent days, as changing customer preferences have compelled the retail industry to depend more on e-Commerce.

Importance of Technology in Food Sector

Technology is steadily assisting investigators and researchers to come up with new findings that are enhancing our awareness of nutrition and healthy food. Big data, Artificial intelligence and machine learning is exposing the effects of some staples that experts did not earlier comprehend.

In the recent times, as population is increasing day by day, technology aids food makers more effectively to produce healthier food. Demand for food is increasing every year with more than 7.5 billion people in the world. Hence, by applying technology for enhancing, packaging and processing, the food sector players aim to improve the quality and safety of food.

Several restaurant players have overcome the hindrance of increase in food and wage expenses, stiff rivalry in the market, changing consumer spending etc, courtesy of a constant shift towards modern technology.

Consumer preferences have been changing with time, which calls for a need to adopt digital and delivery services. Also, loyalty programs, kiosks, kitchen display system and table-side ordering are much in request.

Few Numbers to Put in Limelight

According to Australian Bureau of Statistics (ABS), Australiaâs turnover in retail sector stayed comparatively stable in October this year. The report also showed that Australian retail turnover rose 0.2% in September and 0.4% in August.

The report also suggested cafes, restaurants and takeaway services rose 0.6%, food retailing inched up 0.1% whereas other retailing was up 0.8%. There was a marginal dip of 0.5% in clothing, whereas footwear and personal accessory decreased slightly 0.2% in connection with the departmental store. Household goods remain untouched.

Sales from online retail was 6.3% in September this year as compared to 5.6% to total retail seen in the last year same month.

As per economists, the retail sales did not pick up despite increased purchasing power and relief on wage pressure with tax cuts and rate cuts. However, with the Black Friday and Cyber Monday and the upcoming festive/holiday season, retail sector shows promising prospects of growth.

Top Picks

We have, therefore, selected two companies that are well-poised to gain from the above-mentioned trends.

Super Retail Group Limited (ASX: SUL)

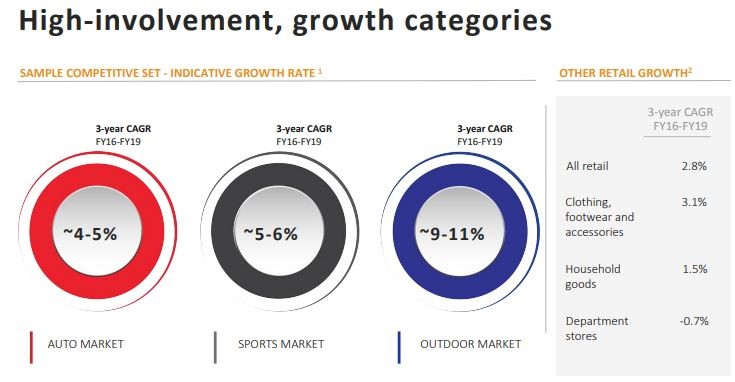

Super Retail Group Limited is involved in retailing of automotive, tools, leisure, retailing of boating and sports apparatus. The key brands are Amart Sports, Rebel, Supercheap Auto, BCF and Rays.

Financial Highlights: Super Retail Group recently provided the financial results for fiscal 2019, for the period ended 29 June 2019 and some of the highlights are as mentioned below:

- Total revenues increased 5.4% to $ $2.71 billion.

- Recorded a robust growth in operating cashflows of $36.2 million.

- Retained a strong and moderate balance sheet with Net debt/EBITDA below 1.5x.

- Total Segment EBITDA for the period was $314.7 million, an increase of 7% year over year.

- Total dividend for the full year was 50 cents per share. This represented a payout ratio of 65% of underlying NPAT.

(Source: Company Report)

What to Expect: The company expects to ride on its leading brands in the growing demand of Automotive vehicle, Leisure, Sports and Adventure. The company stands to gain by focusing more on developing brands that are as strong for selling, more digitisation, supply chain integration and a smooth omni-retail capability. The company expects dividend pay-outs (fully franked) to be in the range of 55%-65% of underlying NPAT.

SUL Stock Performance: Super Retail Group has a market cap of $1.98 billion with 197.54 million outstanding shares. The stock closed at $9.970, down by 0.7% relative to the previous close on 11 December 2019. The stock has generated a YTD return of 47%.

Freedom Foods Group Limited (ASX: FNP)

Freedom Foods Group Limited is involved in obtaining, producing, selling and marketing cereal, snacks and dairy beverages. Also, the company sells, and markets packed canned seafood. The company seeks to enhance the quality of food, nutrition and taste.

Digging Into the Financial Details: Freedom Foods Group Limited recently provided the financial results for fiscal 2019, for the period ended 30 June 2019 and some of the highlights are as mentioned below:

- In FY19, net sales came in at $476.2 million, up 34.9% year over year.

- Operating EBITDA stood at $55.2 million, up 40.9% from the prior year.

- EBITDA margins recorded at 11.6% as compared to 11.1% in FY2018.

- Operating net profit stood at $21.9 million, up by 40.1% year over year.

- The company declared a final unfranked dividend of 3.25 cents per share.

Over the last 5 years, the company provided its shareholders with increased dividend every year.

Financial Highlights (Source: Company Report)

Operating Details: During the year, the company created a team in SE Asia, which recorded a sales growth of approximately 178.8%. Revenue from Australia increased 37.5% year over year, improving revenues by $103.4 million. Grocery recorded a strong growth of around 37.8% year over year.

Expect What?

In FY20, FNP is expecting to produce over 150 million litres of dairy products. The company is strengthening its footprints of dairy products and will concentrate more on value-added protein-based products during the same time period. The company expects capital expenditures to be approximately $100 million in FY20. The company targets to produce 2-litre layouts of processed milk in FY20.

FNP Stock Performance: Freedom Foods Group has a market cap of $1.39 billion with 273.46 million outstanding shares. The stock settled the dayâs trade at $5.040, down by 0.79% relative to the previous close. The stock has offered a YTD return of 9.72%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.