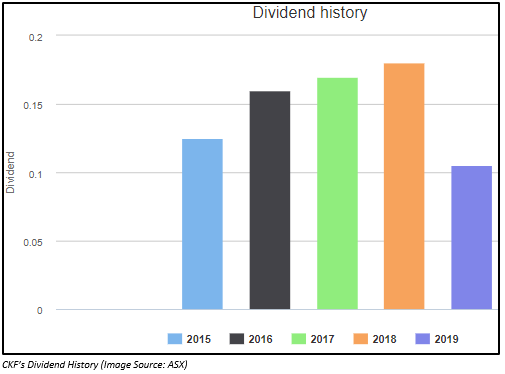

A survey conducted by Australian insurance company NobleOak has found that Australian citizens are in the habit of spending more than 30% of their weekly food budget on takeaways. Even though various studies have tried to bring light on the long-term health problems due to the consumption of fast food, the sale of junk food has increased three times since the early 1980s in the country.

Inclination towards junk food is more in females than males. Australian citizens while deciding what to eat give the highest priority to those food items that can be purchased easily and least priority to those food items that are recommended either by a nutritionist or a social media account.

Compared to other age groups, young generation within the age group of 18 years to 24 years is spending more of their weekly budget for food on takeaways, found the survey.

Due to unhealthy eating habits of Australian citizens, there is significant growth in health issues like obesity, cardiovascular disease, type 2 diabetes, chronic kidney disease, dental decay and dementia

In this article, we would be discussing four ASX listed companies operating in the fast food and food related business along with their recent developments and stock performance. All these stocks have delivered decent return in the last three months and six months.

Freedom Foods Group Limited (ASX: FNP)

Freedom Foods Group Limited (ASX: FNP) operates in the consumer staples sector and is engaged in sourcing, manufacturing, selling and marketing speciality cereal and snacks and plant and dairy beverages. Additionally, the company is in the business of selling and marketing canned speciality seafood. FNP is also engaged in the distribution of all its products. The company invests in dairy farming operations.

Freedom Foods Group aims to make food better by offering quality, nutrition and taste. FNP gives importance to the packaging of food to keep them healthy and nutritious.

FNP Performance in FY2019 ended 30 June 2019:

- Net sales revenue of the company in FY2019 increased by 34.9% to $476.2 million as compared to the previous corresponding period (pcp).

- Operating EBITDA went up by 40.9% year-on-year to $55.2 million.

- EBITDA margins grew from 11.1% in FY2018 to 11.6% in FY2019.

- Operating net profit increased by 40.1% to $21.9 million when compared with the same period a year ago.

- The company declared a final unfranked dividend of 3.25 cents per share.

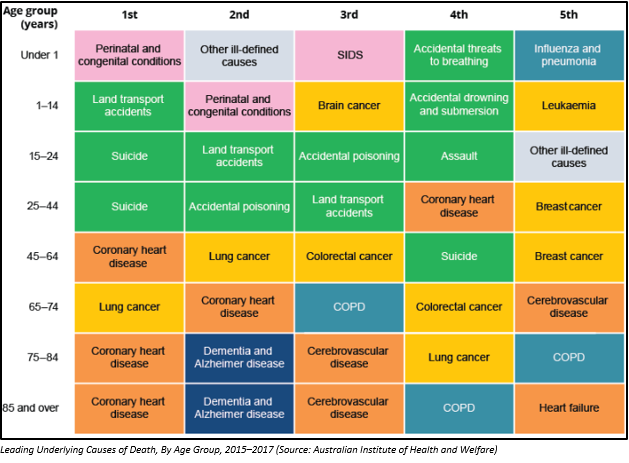

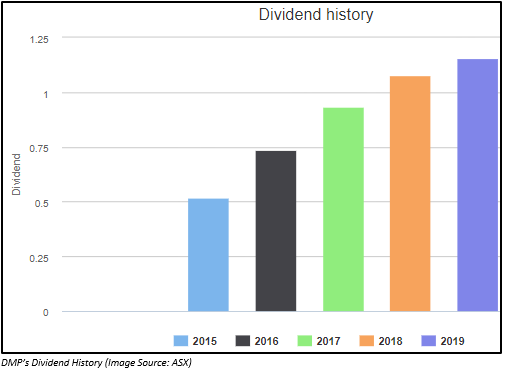

Over the last 5 years, the company provided its shareholders with increased dividend every year.

On 21 October 2019, the stock of FNP was trading at $5.540 (AEST 02:01 PM), down 1.599% from its previous close with a market cap of $1.54 billion. In the last three months and six months, the stock has delivered a return of 17.54% and 8.69%, respectively.

Restaurant Brands New Zealand Limited (ASX: RBD)

A corporate franchisee, Restaurant Brands New Zealand Limited (ASX: RBD) is engaged in managing multi-site branded food retail chains. The company operates the outlets of companies like Pizza Hut, Carl's Jr, Taco Bell and KFC.

The company has operations in Australia as well as New Zealand. It operates the KFC franchise in New South Wales along with Taco Bell and Pizza Hut franchise in Hawaii, Guam and Saipan in the United States.

1H FY2020 Performance; Sales Up By 2.7%

Below are the highlights for the 28-week period ended 9 September 2019.

- Total sales of the group for 1H FY2020 which ended on 9 September 2019, increased by 2.7% to NZ$442.6 million.

- Net profit after tax decreased by 2% year-on-ear to NZ$20 million.

- Combined brand EBITDA before G&A increased by NZ$3.4 million to $72.6 million. The New Zealand business of the company delivered growth of NZ$1.8 million.

- Store number stood at 285, which was down 20 from the previous corresponding period.

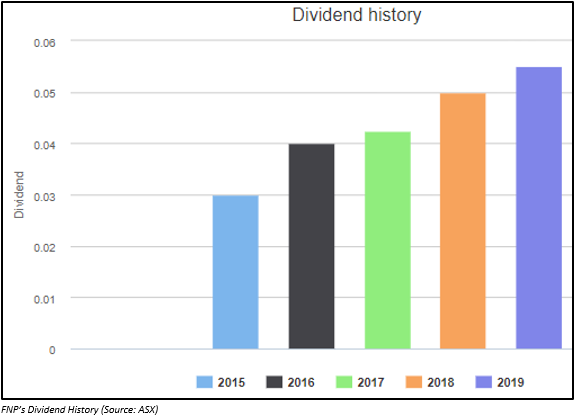

RBD in the previous two years has provided its shareholders with dividend.

On 21 October 2019, the stock of RBD was trading at $8.800 (AEST 02:03 PM), with a market cap of $1.1 billion. In the last three months and six months, the stock has delivered a return of 12.10% and 12.82%, respectively.

Collins Foods Limited (ASX: CKF)

Based in Brisbane, Queensland, Collins Foods Limited (ASX: CKF) is another company which operates in the fast food segment. The company is the operator of 233 KFC restaurants all over the country. In Queensland, it has 142 KFC restaurants. In other locations like New South Wales, Victoria, South Australia, Tasmania, Western Australia and Northern Territory, the company has 11, 4, 8, 14, 49 and 5 KFC restaurants, respectively.

Collins Foods has 17 KFC restaurants in Germany and 20 in the Netherlands. Apart from KFC, the company has 5 Taco Bell restaurants in Queensland along with 10 Sizzler company owned restaurants in locations like Queensland (6), New South Wales (1), and Western Australia (3).

FY2019 Results; Revenue up by 16.9%:

For the 12-month period ended 28 April 2019, the company announced

- Revenue of CKF for FY2019, which ended 28 April 2019, increased by 16.9% to $901.215 million.

- Net profit after tax for the period was $39.111 million, representing a growth of 20.4% on pcp.

- The company reported strong performance for KFC Australia. Over FY2019, there was a same store sales growth of 3.7% supported by initiatives taken by the company with respect to delivery, digital and operations.

- The company reported steady growth in the delivery channel. Many restaurants are now supporting delivering food via Deliveroo and Menulog. Sales growth continues to grow via a range of mobile apps.

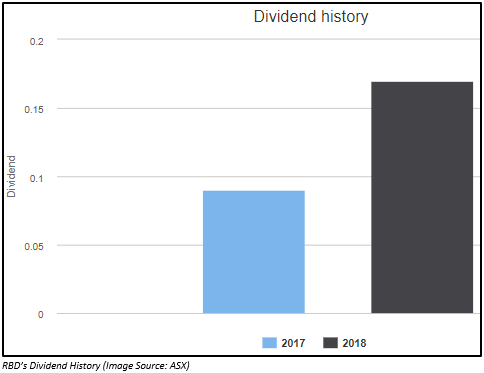

- Final franked dividend for FY2019 was 10.5 cents per share.

On 21 October 2019, the stock of CKF was trading at $10.010 (AEST 02:03 PM), with a market cap of $1.18 billion. In the last three months and six months, the stock has delivered a return of 22.30% and 39.94%, respectively.

Domino's Pizza Enterprises Limited (ASX: DMP)

Domino's Pizza Enterprises Limited (ASX: DMP) is a food retailer operating pizza chain which includes franchisee owned as well as company owned corporate stores. The companyâs goal is to connect with its people at a faster rate and deliver them with the best quality food. Thus, to meet this goal, the company has become the leader in the food-technology space. The company is the industryâs first engaged in offering drone delivery services. DMP also accepts orders via apps, voice assistants, artificial intelligence as well as augmented reality.

FY2019 Results; Global Sales increased by 11.9%

- For FY2019 which ended 30 June 2019, the companyâs network sales increased by more than 11.9% to $2.9 billion.

- Online sales went up by more than 18.2% to $1.9 billion.

- EBITDA increased by more than 8.9% to $282.4 million.

- Cash flow grew by more than 132.4% to $84.9 million.

- In ANZ, the companyâs sales increased by more than 4.6% to $1,169.0 million.

- Japan and Europe also delivered a double-digit increase in their sales.

On 21 October 2019, the stock of DMP was trading at $49.800 (AEST 02:04 PM), with a market cap of $4.28 billion. In the last three months and six months, the stock has delivered a return of 33.14% and 15.67%, respectively.

Australiaâs fast-food business is continuing to grow, and its influence can be assumed with the performance of these companies.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.