Consumer Discretionary sector

Consumer spending on Non-essential goods and services or items which are not strictly necessary fall under the category of Consumer discretionary Sector. The economy of any country is largely affected by the buying behaviour of the consumer. Economic conditions of a country greatly influence the performance of consumer discretionary stocks, as there is a direct relationship between customer income level and demand for these goods and services (consumer discretionary). Non-essential goods and services like premium smartphones, internet services, laptops, computers and speakers are some of the examples of this category.

Consumer Service Sector

The two broad industries are being categorised under this sector, i.e. restaurants, leisure, hotels and everything else ("diversified consumer services"). Travel agencies, casinos, cruise lines, fitness centres, stadiums, golf courses and theme parks are a part of the restaurants, leisure and hotels industry segment. The consumer services which do not fall under any restaurants, hotel, and leisure industry are referred to as diverse consumer services, which includes sectors like interior design, funeral services, legal and educational services, wedding services, auctions, and home security services.

On 30 September 2019 (AEST 01:41 PM), the S&P/ASX 200 Consumer Discretionary (Sector) was trading at 2,626.3 points, down by 1.8 points or 0.07 per cent compared to the last close. Let us discuss two consumer stocks, which delivered positive returns in the last six months and on a year-to-date basis.

Woolworths Group Limited

Woolworths Group Limited (ASX:WOW) is an Australian based company, operates in supermarkets stores for consumers, is involved in procurement of food, liquor and other products and is a general merchandise retailer in the region of New Zealand and Australia with a total of approximately 3000 stores. The company was officially listed on Australian stock exchange with âWOWâ as a ticker. It consists of 201,000 team members serving across 29 million customers in different region.

Marley Spoon Secures A$8 million Funding Deal

On 26 September 2019, Marley Spoon announced that it has approved a debt transaction from two existing investors of $8 million in aggregate. Union Square venture and Woolworths Group increased their current investment in Marley Spoon by $4 million each.

Key Terms of Union Square venture (USV) are as follows:

- The maturity date of a bond is of 3 year from the date of issue

- US$ LIBOR + 5 per cent per annum and payable at maturity and conversion price of $0.50 per CDI

- Additional prepayment fees of US$2,776,487.50 will be paid by the company if prior to conversion, it terminates or redeem the USV convertible bonds.

Dividend

On 20 September 2019, fully franked ordinary dividend of $0.57 per share pertaining to six months was declared by the company. Dividend is payable on 30 September 2019 with a DRP Price of $37.04630.

Change in Director Interest

On 17 September 2019, the company released a notice for the change in Directorâs interest, Gordon Cairns. After the change 5,171 shares were held under NED plan and 28,058 Shares were held for superannuation fund.

Consolidated Financial Highlights for year ending 30 June 2019

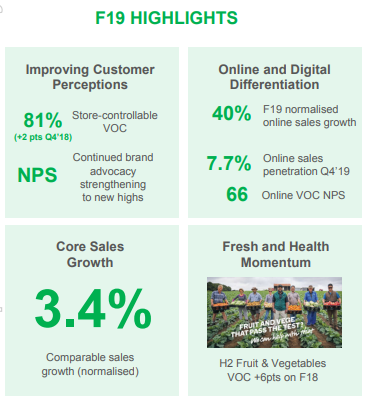

- The companyâs sales were increased by 3.4 per cent to $59,984 million compared to the previous corresponding year

- EBIT from continuing operations was increased to $2,724 million compared to PCP

- Net profit after tax from continuing operations was increased by 7.2 per cent to $1,752 million.

Segmental Reporting â Australian & New Zealand Food

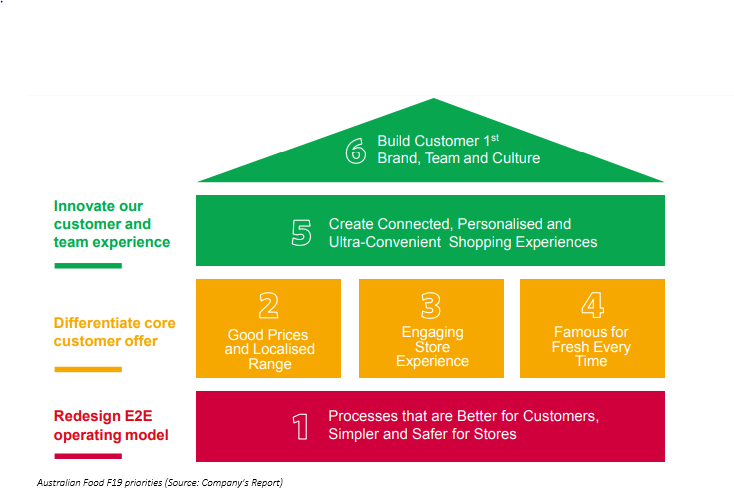

Australian Food

- Sales for this segment improved by 5.3 per cent to $39,568 million compared to PCP

- EBITDA was increased to 7.5 per cent to $2,613 million

- EBIT increased to 3.8 per cent to $1,857 million

New Zealand Foods

- Sales for the segment increased to 4.3 per cent to $6,712 million compared to PCP

- EBITDA was increased to 3.0 per cent to $425 million

- EBIT was increased by 3.9 per cent compared to last year

Outlook

The companyâs online sales for Australian Food is expected to grow stronger together with an increase in the roll-out of planned Metro store and New Zealand food focused on fresh quality and experience. Further reduction in loss is expected as BIG W continues, and unprofitable stores are closed.

Stock Performance

The stock of WOW was trading higher at $37.655 on ASX on 30 September 2019 (AEST 01:42 PM), high by 0.306 per cent from its previous closing price. The company has approx. 1.26 billion outstanding shares and a market cap of $47.25 billion. The 52-week high and low value is at $38.100 and $27.030, respectively. The stock has generated a positive return of 24.18 per cent in the last six months and a positive return of 28.78 per cent on a year-to-date basis.

Collins Foods Limited

Collins Foods Limited (ASX: CKF) owns Sizzler restaurant in Australia and Sizzler franchisee in Asia; franchisee of Taco Bell in Australia; and KFC franchisee in Europe and Australia. The company currently operate 5 Taco bells restaurant in Queensland; 10 company-owned Sizzler restaurants in Australia, 233 KFC restaurant in Australia and 76 franchisee Sizzler restaurants in Asia.

Refinancing of Debt Facilities

On 26 September 2019, the company announced that it has entered into the agreement to refinance its existing debt facilities. The existing debt facilities (â¬60 million and $270 million) will be refinanced to the new syndicated debt facilities agreement (revolving facilities of â¬80 million and $265 million). The tenor of the new facilities is of 3 years and 5 years with â¬50 million and $180 maturing on 31 October 2022 and other â¬30 million and $85 million maturing on 31 October 2024.

Updates from AGM Presentation

On 5 September 2019, the company has released the AGM presentation, few snapshots from the presentation are as follows:

KFC Australia

- The company same store sales, show a growth of 3.7 per cent in all states

- There are 70 restaurants providing the home delivery services

- The company has built 7 new restaurants during FY 2019 and closed 2 restaurants

- Opening of 9 to 10 restaurants in FY 2020 is in pipelines

KFC Europe

- The Europe segment generated the revenue of $123.8 million and underlying EBITDA of $6.8 million during FY 2019

- The company has built 4 restaurants during FY 2019 and 3 restaurants were in the pipeline for FY 2020

Taco Bell

- The company has opened 5th restaurant in Southport and all the restaurants are trading in line with expectation

- Plan to roll out the new products in the market and expected to open 10 new restaurants in FY 2020

Sizzler

- Same Store sales show a growth of 4.4 per cent

- Royalty revenue up by 12.2 per cent in Sizzler Asia driven by 5 new restaurant openings

- The company has generated EBITDA of $4.9 million for the year at a margin of 10.5 per cent and continue to manage Sizzler Australia as a non-core business.

Stock Performance

The stock of CKF was trading lower at $10.090 on ASX on 30 September 2019 (AEST 01:44 PM), down by 0.296 per cent from its previous closing price. The company has a market cap of $1.18 billion and approx. 116.58 billion outstanding shares. The 52-week high and low value of the stock is at $10.310 and $5.940, respectively. The stock has generated a positive return of 40.75 per cent in the last six months and a positive return of 68.39 per cent on a year-to-date basis

The Consolidated results for the year ending 30 June 2019 can be viewed here

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.