Collins Foods Limited (ASX:CKF)

Collins Foods Limited (ASX: CKF) operates, manages and administrates restaurants in Australia, Europe and Asia. At present, its business is comprised of three restaurant brands: KFC, Taco Bell and Sizzler.

The company, on 25th June 2019, released its FY19 financial results for the reporting period ended 28th April 2019. At the end of FY19, CKF, under the quick service restaurant market, held franchisee of KFC restaurants; 231 in Australia, 17 in Germany, 20 in the Netherlands, and 4 Taco Bell restaurants in Australia. The company, at the end of the period, within the casual dining restaurant market owned and operated 12 Sizzler restaurants in Australia. CKF also acts as a Franchisor of the Sizzler brand in South East Asia, with 77 franchised stores largely in Thailand and in China and Japan. The brands KFC and Taco Bell, the largest restaurant chains in the world, are owned by Yum!. CKF enjoys a position of the largest franchisee of KFC restaurants in Australia.

Financial and Operational Performance in FY19: Total revenue of the company saw an increase of 16.9% to $901.2 million, largely driven by like-for-like sales growth and new restaurant openings. The higher top line was accompanied by strong business controls resulting in further improvement in EBITDA to $112.2 million, up 25.2% (YoY) and net operating cash flow to $97.5 million, up 30.9% (YoY). The bottom line was impacted by significant items of $5.9 million in the period.

KFC Australia business performed well, with CKF now operating with a national footprint. Top line posted a Y-o-Y growth of 15.8% to $722.6 million, largely on the back of increased restaurant numbers, along with same-store sales growth. Underlying EBITDA for KFC Australia recorded a growth of 20.9%, to $120.0 million. The underlying EBITDA margin for the period came in at 16.6%. CKF spent $23.0 million on new restaurants and remodelling and maintenance program to boost the growth.

KFC Europe posted a top line of $123.8 million and underlying EBITDA of $6.8 million. The period saw 37 restaurants in operation, of which 20 restaurants were in the Netherlands and 17 in Germany. Costs associated with new restaurant openings, weak trading and increased support costs impacted the EBITDA. CKF spent $13.6 million on new restaurants, remodels and maintenance during the year.

Taco Bell ended the period with four Taco Bell restaurants across different locations.

Sizzler witnessed a de-growth of 8.0% in revenues to $46.7 million due to the closure of two restaurants in Australia. Same-store sales in Australia showed a growth of 4.4% against 0.5% growth in FY18. Underlying EBITDA at $4.9 million was slightly higher as compared to the pcp. CKF ended the period with 12 Sizzler restaurants in operation.

Sizzler franchise in Asia posted a growth of 12.2% in the top line on pcp. During the period, three restaurants were opened in Thailand and two in Japan, whereas one restaurant was closed in China, with the total restaurant count in Asia to 77.

Net debt at the end of the period stood at $212.5 million with the current facility of circa $365 million. Net leverage ratio at the end of the period was 1.87.

The company in the first half of FY19 posted revenue growth of 27.6%, with underlying NPAT growth at 25.9%.

At the current market price of $7.720, the stock is trading at a price to earnings multiple of 21.64x on 25th June 2019. With an annual dividend yield of 2.35% and market capitalisation of $893.64 million, the stock is trading towards its 52-week high level. The stock has yielded a return of ~41% in the last one year as on 24th June 2019.

Dominoâs Pizza Enterprises Limited (ASX:DMP)

Dominoâs Pizza Enterprises Limited (ASX: DMP) operates retail food outlets and franchise services.

The company recently advised that it has now been served with an unsealed class action proceeding filed Phi Finney McDonald on behalf of Australian Franchisee Employees in the Federal Court of Australia. DMP was alleged to mislead its franchisees and in-store workers.

The company also updated investors about on the media articles related to the potential legal action from the current/former team members for their pay rights.

DMP, in the recent past, communicated that Commonwealth Bank of Australia and its related bodies corporate became the initial substantial holder with voting rights of 5.00%.

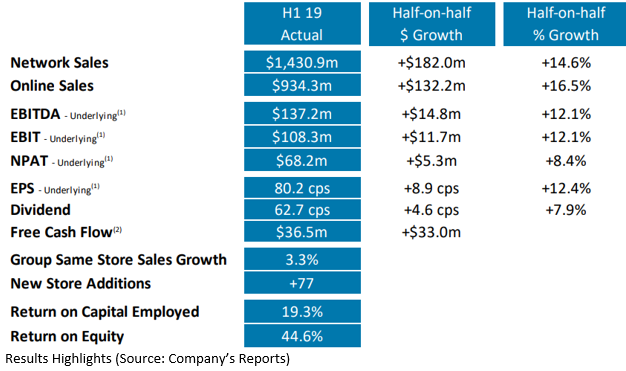

1H FY19 Performance: Global food sales posted a growth of 14.6% to $1.43 billion for the period, driving a 12.1% lift in EBIT to $108.3 million. Overseas markets of the company contributed more than half of the EBITDA with $71 million EBITDA contribution from Europe and Japan. Online sales saw a growth of 16.5%, $132.2 million higher than pcp, on track with the companyâs vision of Leading the Internet of Food in Every Neighbourhood. The online platforms of the company processed 32.4 million orders during the period, which implied more than two orders each second. Global network sales growth came in at 3.3%, reflecting strong performance by Germany, New Zealand, Benelux, fast food, whereas Australia witnessed a soft performance and France performed below expectations.

Underlying operating cash demonstrated growth of 26.2%, posting a decent rate of cash conversion. DMP reached important milestones in terms of Dominoâs stores and surpassed 1,000 stores in Europe, of which, 700 stores were established in Australia and 300 stores in Germany. Dominoâs ANZ inched up its market share in the fast food and pizza segments with NZ business performing well. Japan witnessed a standout performance with EBITDA growth of 34.3% on pcp. Benelux operations are growing stronger, with the conversion of Hallo Pizza shops in Germany exceeding the expectations.

Going forward, the management expects same-store sales for FY19 to be at the mid to lower end of 3% to 6% range. Earnings before interest and taxes are likely to be at the lower end of the guided range of $227 million to $247 million. Net capital expenditure to be between $60 million to 70 million.

At the current market price of $36.300, the stock is trading at a price to earnings multiple of 28.92x, with an annual dividend yield of 2.87% and market capitalisation of $3.35 billion as on 25th June 2019. The stock has generated a negative return of ~27% in the last one year and is currently trading near its 52-week low of $37.045.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.