The Retail sector has profound significance in an economy since it forms the base of selling goods to customers and meeting their individual needs. Earlier this year, there had been fluctuations in the retail sector that became apparent due to a decline in consumer spending on retail items.

The per capita income of a consumer defines his ability to make purchases. Therefore, any sort of decrease in the purchasing power of the consumers makes it apparent on the economic front.

According to USDA Foreign Agricultural Servicesâ GAIN report,

- The value of food and liquor retailing in Australia grew by 3% in 2018 totalling USD 119.7 billion;

- Supermarket and grocery expenditures continue to account for the bulk of food retailing purchases with a share of 68%;

- Personal and social consumer aspirations like Sustainability, Waste reduction, Integrity of food production systems, and Healthy eating continue to be important influences on shopping choices.

Considering the above, we shall now discuss the performance of two Australian supermarket giants listed on ASX.

Woolworths Group Limited (ASX: WOW)

Woolworths is an Australian-owned company and a top player in the grocery sector with a significant share in the market and supermarket chain across New Zealand and Australia with around 3,292 stores.

Woolworths has been performing decently, maintaining its huge sales volumes across all its business.

Key sales highlights from the First Quarter Sales Results for the 14-week period to 6 October 2019 are as follows-

- Australian Food sales growth of 7.8% (comparable: 6.6%) driven by successful Lion King Ooshies and Woolworths Discovery Garden campaigns and Online;

- New Zealand Food sales growth of 4.6% (comparable: 4.8%) with customer metrics continuing to improve;

- Endeavour Drinks sales growth of 4.9% (comparable: 3.2%) with both BWS and Dan Murphyâs reporting solid growth;

- BIG W sales momentum continues with sales up 2.6% (comparable: 4.4%) with Apparel growth the highlight;

- Group Online sales growth of 37.4% driven by WooliesX and CountdownX;

- Hotels sales growth of 5.5% (comparable: 3.6%) driven by strong performance in Food and Bars.

Acknowledging the pleasing start to F20 with strong sales momentum across the Group; Woolworths Group CEO, Brad Banducci said:

âIn Australian Food, sales growth was driven by the success of Lion King Ooshies, Discovery Garden and the continued growth in Online;

Customer scores have softened slightly given higher than expected sales growth and the implementation of a new store customer operating model. We expect sales growth to moderate over the remainder of the financial yearâ

During the quarter, WOW opened one Woolworths supermarket and one Metro food store with a total fleet size of around 1,027 at the end of the quarter.

In addition to this, WOW continued to progress in the Renewal program with seven completed during the quarter, along with the roll-out of Fresh Made Easy continued during the period.

Hotelsâ strong sales in Food and Bars benefitted from recently refurbished venues and successful promotional activity.

With a material change agenda including the implementation of our new Customer Operating Model in Woolworths Supermarkets, the rollout of Fresh Made Easy and the ramp-up of the MSRDC, Woolworths looks forward to focusing on providing the best possible customer experience across all of its businesses.

Endeavour Group Restructuring on track

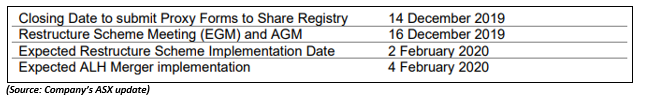

Currently, the Endeavour Group transaction is progressing well, with the approval from the Federal Court for the dispatch of the Restructure Booklet for a Restructure Scheme Meeting (scheduled to be held on 16 December 2019).

The Endeavour Group Transformation comprises of a three-stage transformation, beginning with Restructuring in the first stage, for the purpose of creating Australiaâs largest integrated hospitality and retail drinks business.

It is currently anticipated that the Restructure Scheme will be implemented early in 2020 and the schedule for the same is given below:

On 25 November 2019, WOW stock traded at a price of $ 39.950 (2:32 PM AEST), with a market capitalisation of $49.29 billion. During the past month, WOW stock has provided 4.35% return with the YTD return of ~34%.

Coles Group Limited (ASX: COL)

Supermarket specialist Coles Group Limited is another significantly large player in the grocery retail of Australia with exceptional growth from a variety store to a full-fledged retail company.

Over the years, Coles has made substantial progress in its business and has also gained a significant share in the industry.

The commitment to providing quality goods at attractive prices to Australian households has fuelled Coles to gel-in as an important part of the Australian landscape. Coles contribution in the Australian economy comprises of retailing of food, liquor and fuel through 2,400 outlets, supported by the growing significance of its online business.

Coles has also bagged two significant technology-based commitments to improve the product offering and competitiveness, which are:

- Using the world leading Witron automation technology from Germany, Coles anticipates building automated ambient temperature distribution centres in Queensland and in New South Wales.

- Focusing on its partnership with Ocado, the worldâs pre-eminent online end-to-end supermarket operation based in the UK, to gain a global field of engagement along with building new Customer Fulfillment Centres in Melbourne and Sydney to establish a world-leading customer website and home delivery system

First-quarter sales performance highlights (13 Weeks from 1 July to 29 September 2019)

- Group first-quarter sales revenue increased by 1.8% to $8.7 billion;

- Supermarkets comparable sales growth of 0.1%;

- Liquor comparable sales growth of 0.7% with a strong performance in First Choice;

- The first quarter of positive comparable fuel volume growth in four years;

- In the early part of the second quarter, Supermarkets comparable sales growth has trended toward the level achieved in the fourth quarter.

Being open to devising and implementing strategies, Coles is sought to reshape its store portfolio with new format convenience and efficiency-focused stores.

As a strong player in the retail sector of Australia, Coles has also undertaken initiatives to meet its commitment to become Australiaâs most sustainable supermarket. These include:

- an agreement with Metka EGN (renewable power generation company) to secure three new solar power plants for providing 10% of Colesâ national electricity usage,

- the first deal of its kind to be made by a major Australian retailer; and a 4-week trial of a zero waste to landfill supermarket in NSW.

Coles Group CEO, Steven Cain said:

âThe refreshed strategy we set out to Win in Our Second Century has helped us to deliver a positive set of results for our first quarter;

The increased sales momentum we are seeing in the second quarter demonstrates that the changes we are making to Inspire Customers are already making a differenceâ

Coleâs strategy is based on the following three pillars:

- The first is by inspiring customers through best-value food and drink solutions to make their lives easier;

- The second pillar of the strategy is Smarter Selling;

- The third is to Win Together with its team members, suppliers and communities;

On 25 November 2019, COL stock traded at a price of $15.645 (2:32 PM AEST) with the market capitalisation of $20.85 billion. The stock has delivered a 4.62% return over the last month with the YTD return of 34.62%.

Bottomline

Looking at the first-quarter performance of Woolworths and Coles, it would be fair to infer that Coles and Woolworths have the potential to embrace much bigger profits coupled with future expansion and acquisitions.

With an increasing number of independent working individuals, retail players currently have great potential in prepared food and outdoor eating products and services.

Moreover, the increasing conscience of the consumers towards healthy and organic products is another opportunity for retail players like Woolworths and Coles to deliver at and extend the market share.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.