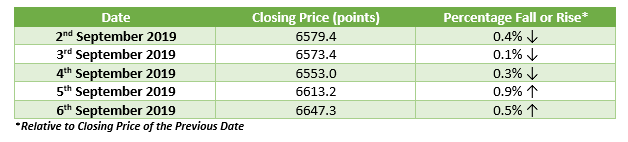

The S&P/ASX 200 Index closed this week in green at 6647.3, with a rise of 0.5 per cent or 34.1 points. The renewed hopes of easing trade tensions between the US and China majorly drove the Australian equity market this week. This positive development also strengthened the Australian dollar that rose to 68.14 US cents on Thursday from 67.97 US cents on a previous day.

This weekâs performance of the Australian equity was affected by some major developments, including:

- Developments in US-China Trade Talks

- Hong Kong's Withdrawal of Extradition Bill

- Blocking of a No-Deal Brexit

- US Manufacturing PMI

- GDP Data

- Announcement of Trade Surplus and Retail Turnover Figures

- Update on Australian Cash Rate

The S&P/ASX 200 Index closed in red throughout the week except on Thursday and Friday, powered by Hong Kong's withdrawal of extradition bill, blocking of a no-deal Brexit and positive development in US-China trade talks.

The below table summarizes the performance of the S&P/ASX 200 Index over the entire week:

It can be seen that the Index saw a turnaround on Thursday after experiencing losses in the first three sessions of the week.

Let us now discuss the factors that have majorly influenced this weekâs performance of the S&P/ASX 200 Index:

Developments in US-China Trade Talks

Taking a step ahead to ease the trade tensions, the United States and China agreed to hold trade talks in Washington in next month, offering a sigh of relief across the world. Chinaâs Commerce Ministry issued a statement on its website confirming the same.

The decision to hold trade talks in October generated a ray of hope, uplifting US stock market on Wednesday and Thursday, and the Australian stock market on Thursday and Friday.

The Dow Jones Industrial Average (DJI) soared by 1.41 per cent or 372.68 points on Thursday, closing at 26,728.15. The S&P 500 Index and the NASDAQ Composite Index also witnessed a gain of 1.30 per cent and 1.75 per cent, respectively. Following the trend, the S&P/ASX 200 Index was also trading in the green zone on Friday, ending the session with a rise of 0.5 per cent.

Amid ongoing US-China trade dispute, the Swiss multinational investment bank, UBS has recently released weaker gross domestic product (GDP) growth projections for the US. The bank expects US GDP growth to slip to 1.8% in the fourth quarter of 2019, then declining to 0.5% in the first quarter of next year and further 0.3% in the second quarter of 2020.

Hong Kong's Withdrawal of Extradition Bill

After about three months of mass protests in Hong Kong, the regionâs Chief Executive, Carrie Lam, announced the decision to formally withdraw the controversial extradition bill. The bill would have permitted the people residing in Hong Kong to be extradited for stand trial to mainland China. The ongoing protests ignited by the extradition bill was affecting the regionâs economy and raised concerns of a major economic slowdown. The turnaround in the Australian benchmarkâs Index on Thursday was partially driven by the prospect of easing tensions in Hong Kong.

Blocking of a No-Deal Brexit

British Prime Minister Boris Johnson suffered another parliamentary defeat on Wednesday over Brexit as all the opposition MPs supported a bill to block a no-deal Brexit. The bill backed by MPs could delay Brexit until the end of January 2020, in case no deal is signed between Europe and the UK by mid-October. The likely postponement of Brexit raised market sentiments on Thursday, driving the stock market higher.

US Manufacturing PMI

Amidst ongoing trade dispute between the US and China, the US Manufacturing Purchasing Managersâ Index (PMI) dropped to 49.1 in August this year (value below 50 shows contraction). The data was released by the Institute for Supply Management (ISM) that indicated a first such decline in PMI observed by the country in the last three years. The ISM report raised concerns, signaling negative impact on the economy of the U.S.-China trade turbulence.

On the one hand, the US Manufacturing PMI dropped in August, while on the other hand, Chinaâs Caixin/Markit Manufacturing PMI stood at 50.4 in August surpassing forecasts. The market experts were anticipating Chinaâs PMI to be at 49.8 in August. However, the data released by the National Bureau of Statistics (NBS) depicted a different story, with Chinaâs manufacturing PMI to be at 49.5 in August, 0.2 points lower than the figure reported in July.

GDP Data

The factors discussed above were the global elements that affected the performance of the Australian equity market during the week. On the domestic front, there were some significant developments that caused variations in the equity market. The Australian Bureau of Statistics (ABS) announced June quarterâs figures of GDP growth on 4th September 2019.

The Australian economy rose by 0.5 per cent in the quarter in seasonally adjusted chain volume terms, dragging year-on-year growth to 1.4 per cent. The year-on-year GDP growth was the worst such growth recorded by the country since the global financial crisis. The discouraging GDP figures drove the S&P/ASX 200 Index down by 0.3 per cent on Wednesday.

Announcement of Trade Surplus and Retail Turnover Figures

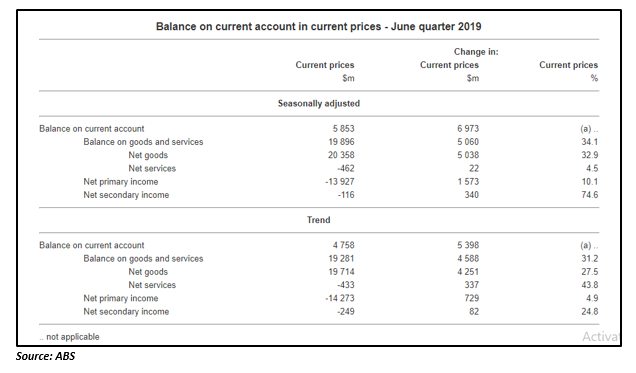

Recently, the ABS also released data on Australiaâs Balance of Payments and International Investment Position, and Retail Turnover during this week.

Australiaâs Balance of Payments and International Investment Position

Surprisingly, the country recorded its first current account surplus in 44 years during this yearâs June quarter. As per the ABS, the countryâs current account surplus was at $5.9 billion during the quarter, backed by a fall in net income deficit to $13.9 billion and a rise in quarterly goods and services surplus to $19.9 billion. Chief Economist of the ABS, Bruce Hockman, believes that the countryâs first current account surplus since the June quarter 1975, was driven by six consecutive quarters of goods and services surpluses. He also mentioned that continued global supply interruptions sustained high iron ore prices during the quarter, boosting the countryâs export receipts to record levels.

The rise in export volumes of key bulk commodities including coal, iron and liquid natural gas, and the fall in import volumes of several categories drove the June quarterâs trade surplus. During the quarter, the exports of non-rural goods, including metal ores and minerals (21 per cent up), metals excluding non-monetary gold (6 per cent up), other non-rural goods (12 per cent up) and other manufactures (4 per cent up) witnessed a significant improvement.

Australiaâs Retail Turnover

The ABS also released retail turnover statistics for July 2019 this week, highlighting a drop of 0.1 per cent in retail turnover during the month in seasonally adjusted terms. The retail turnover improved by 0.4 per cent in June this year, while market experts were eyeing for a 0.2 per cent rise in retail turnover in July. But the July 2019 figures came as a disappointment, providing a gloomy picture for consumer spending in the Australian economy. Sluggish household consumption has been a cause of worry for the RBA for a long time and was also partially responsible for the reduction in interest rates this year.

The retail turnover fell in all the Australian cities except Western Australia and the Northern Territory, that saw a rise of 0.6 per cent and 0.3 per cent, respectively. The fall in retail turnover was driven by Cafes, restaurants and takeaway services that was 0.6 per cent down in July.

Update on Australian Cash Rate

Against the speculations of market experts, the RBAâs Governor, Mr Philip Lowe, kept the cash rate unchanged at 0.1 per cent in a September meeting. The decision followed two back-to-back cuts of 25 basis points in interest rates in June and July this year. Although Mr Lowe held the interest rates at 1 per cent, he mentioned that if required, the central bank will ease the monetary policy further to support consistent growth in the Australian economy and the achieve medium-term inflation target over time.

It can be seen that these major developments have made this weekâs performance of the Australian equity market âa bumpy rideâ. However, the S&P/ASX 200 Index improved from Thursday amid renewed hopes of US-China trade talks. It would be interesting to watch further developments in the Australian as well as global markets in the existing see-saw scenario of the world economy.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.