On 9 April 2020, focused silica sands explorer Perpetual Resources Limited (ASX:PEC) announced the appointment of Mr. Julian Babarczy as Executive Chairman, effective from 1 April 2020. The announcement was welcomed by the Company and market participants. Mr. Julian has now released a detailed address to shareholders on ASX.

COVID 19 Commentary, PEC’s Pandemic Take

Mr Julian began his address acknowledging the current obvious extraordinary times amidst COVID 19 outbreak. Besides health crisis, pandemic has resulted in economic and social unprecedented limitations, like the constraints on social interaction and commerce by governments all over the world.

The current self-isolation requirements infer that most activities should be accomplished by the executive and consultant team working remotely.

PEC is ensuring that while conducting the necessary in-field activities, employees, consultants and contractors are provided the safest possible working environment.

Currently, the Company does not anticipate any COVID-19 related limitations to the completion of any of the required fieldwork. However, this remain subject to any government-levied amendments to personnel movements which may unpredictably impact PEC’s planned timeframes.

Mr Julian believes the direct effects of COVID-19 to be hopefully temporary, a situation wherein PEC can be well-positioned to maximise shareholder returns once financial markets begin to look to the future again.

Recent Equity Raising

Amid the COVID 19 situation, it is tempting for businesses to inculcate some form of corporate hibernation, to preserve scarce cash resources and merely “live to fight another day”. PEC believes that this strategy is ideal to prolong the virus impacts on a business for a prolonged period after the virus itself is contained.

PEC, therefore, resorted to capital raising program to secure its finances for the remaining year.

On 2 April 2020, PEC announced that it it has received commitments of at least $700,000 at $0.015 per share from sophisticated, high net worth individuals, along with material participation from current Directors.

The Board, including Mr Julian, contributed a significant amount to the capital raising, demonstrating very strong alignment between the Board and shareholders. The Company will shortly publish a notice of meeting for shareholders to approve the participation of the Board in this placement.

This Placement is likely to ensure funding for the Company through the remainder of CY 2020 and enable PEC to achieve meaningful milestones to maximize shareholder value over the medium to longer term.

The Placement also ensures that PEC is well placed to continue progress at its flagship Beharra High Purity Silica Sand Project, where the recently completed comprehensive air core drilling program showcased promising initial visual results.

To know about the air core drilling results, READ HERE- Perpetual Resources Completes Air Core Drilling; Undertakes Successful Capital Raising to Fund Future Growth

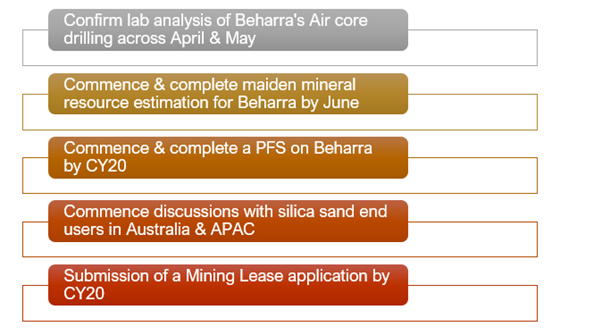

Specific Aims At Beharra Over The Quarter & Remainder 2020

In order to provide greater transparency to Company plans and offer shareholders with a meaningful way to measure what PEC ends up delivering versus what it currently plans to deliver, Mr Julian laid down the specific aims at Beharra over the course of the current quarter and the remainder of 2020-

The laboratory analysis of the recently completed air core drilling at Beharra will include completion of the drill hole logging and the sample compositing for delivery to PEC’s consultant laboratory (Nagrom) next week.

A topographic surface study and associated field work will be carried out in April with results available in May. Moreover, an in-situ density analysis will be undertaken in April with results available in May.

When the Company reaches the stage to undertaking discussions with silica sand end users, it will aim to confirm end market demand and pricing by way of MoUs and/or off-take agreements.

According to PEC, it is now adequately funded to deliver all the strategic objective and is well placed to continue to progress these activities despite the current self-isolation requirements. Additionally, it can also address the potential for few limited and early stage exploration on other highly prospective silica sand tenements which are in close proximity to the Geraldton port and also sit within established infrastructure corridors.

Comment on PEC’s Strategic Focus

The Company has a stated aim to acquire, explore and develop mining projects using relatively low capital and high potential margins, that is supported by exposure to commodities exhibiting much lower price volatility than base metals or bulk commodities.

The Company has been attracted to commodity markets that can best be described as comprising the industrial minerals complex. PEC opted for silica sand as its first commodity exposure based on its evident global under supply and evident strong, predictable growth in demand.

By focussing on a relatively less suggestive industrial minerals complex, PEC is likely to have an improved likelihood of building a company with more predictability and ultimately stronger and more reliable shareholder returns, in contrast to most smaller exploration and development companies that cast eyes on high impact single events.

PEC’s Stance

Mr Julian reminded shareholders that PEC remains to a high risk and speculative investment proposition until it is more advanced on Beharra or another project. As of now, the Company has not courted much public exposure as it has been focussed on bedding down the initial tenement acquisitions, cleaning up the capital structure, and moving to assess the quality and potential of the project portfolio.

A marketing initiative will possibly occur in the future with PEC becoming more visible in the various marketing channels used by likewise-sized companies.

Stock Performance

Reciprocating to Mr Julian’s much-awaited address, PEC zoomed on the ASX by 18.18 %, settling at $ 0.026.

To avail latest information on PEC, do visit the new website at the below link-