Silica sands explorer, Perpetual Resources Limited (ASX:PEC) has recently released robust operational results for the half-year period ended 31st December 2019. Perpetual is focussed on conducting exploration of silica sands for the production of high-grade silica for national and global markets.

During the period, the Company continued to focus on the exploration of silica sands at its areas of interest located in Western Australia, including Sargon, Eneabba, Beharra and Eneabba North.

Let’s take a quick peek into the key developments reported by the Company during the half-year:

Progressed Exploration Activities at Beharra Project

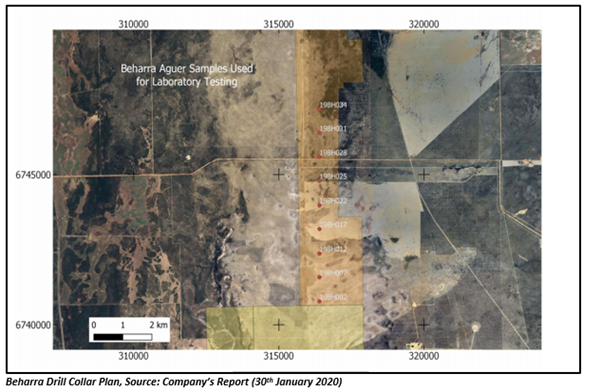

During the half-year period, Perpetual progressed with exploration activities at the Beharra Silica Sands Project, which is the Company’s flagship asset located 300km north of Perth and 96km south of the port town of Geraldton in Western Australia.

Marking a significant development, Nagrom, a Perth-based world-renowned metallurgical testing facility, was appointed by the Company to finalise initial mineral processing test work reliant upon a composite auger sample from Beharra.

With the test work, the Company intends to determine the amenability of a combination of gravitational and conventional screening methods to generate a beneficiated product. Moreover, the testwork is expected to offer guidance towards the end user applications and final product specifications.

In addition to the appointment of Nagrom, the Company reported the following developments at Beharra during the period:

- Submitted Program of Works to facilitate a maiden Aircore drill program, targeted to delineate maiden silica sands resource at Beharra.

- Engaged strategic consultants from Snowden Group to offer high level strategic advice with regards to exploration planning, program implementation, resource estimation and metallurgical test work.

- Appointed Limestone Park to manage permitting and approval processes in relation to clearing for bulk sampling and drilling activities at Beharra.

It is worth noting that the Company did not conduct any field exploration activities at Beharra during the period; however, the desk top reviews of all information about exploration programs future possible activities in 2020 were undertaken.

Continuing exploration activities at Beharra, the Company reported the following results subsequent to the half-year:

- Results of the initial beneficiation testwork conducted by Nagrom, which demonstrated high-purity silica sand product (99.85% SIO2) from Beharra, with an overall product yield of 90% along with the significant reduction of titanium, aluminium and iron.

- Findings of petrological and mineralogical examination of the beneficiated silica sand product from Beharra.

The Company is progressing with further beneficiation test work at the project.

Eneabba, Eneabba North and Sargon Projects’ Exploration Licenses Granted

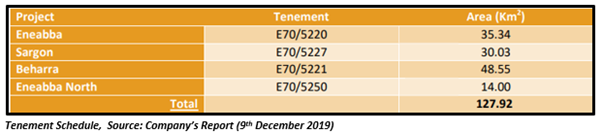

During the period, the Company was granted Exploration Licences for:

- Eneabba Project: Exploration licence E70/5220

- Eneabba North Project: Exploration licence E70/5250

- Sargon Project: Exploration licence E70/5227

In July 2019, the Company entered into an exclusive Option agreement to acquire a 100 per cent beneficial and legal interest in two silica sands projects, Eneabba and Sargon projects.

Subsequently, the Company acquired the Eneabba North Project in September last year. An initial auger drilling campaign has been completed at the project and results are presently pending. Moreover, the project appears prospective for hosting both yellow and white sands from observation of the auger drilling.

Signed a Contractor Agreement with Qube

The Company entered into a Contractor Agreement with Qube Bulk Pty Ltd (ASX:QUB) in December 2019 to assess options and carry out the logistic services for a project to end user transport and materials handling solution.

The agreement aimed at understanding the optimal pathway to transport the Company’s potentially high-grade silica sand projects to end user markets.

Half-Year Financial Updates

The Company’s net assets increased by ~$777k to ~$3.2 million during the half-year period, in comparison to ~$2.9 million as at 30th June 2019. Moreover, its working capital was noted ~$448k as at 31st December 2019.

The Company issued ~9.4 million fully paid ordinary shares for the exercise of ~9.4 million unlisted options and a further ~665k fully paid ordinary shares for the acquisition of exploration licences during the half-year.

With ~$200k utilised in the operational activities, cash and cash equivalents stood at ~$367k as at December 2019 end.

In a nutshell, the Company progressed substantially with exploration activities at its flagship Beharra project during the period, and is well-on track to produce high-grade silica for the international and domestic markets backed by attractive project portfolio.

PEC last traded at $0.037 on 18th February 2020.