The silica sands market is currently enjoying healthy growth with massive demand in significant silica sand-consuming sectors-the hydraulic fracturing, glassmaking and foundry industry. Experts opine that the global accelerations in construction investment and manufacturing output would catalyse the growth of this granular material in these industries.

Tapping this lucrative opportunity is Australia-based Perpetual Resources Limited (ASX:PEC), a focussed explorer of silica sands that aims to produce high purity silica for the domestic and international market.

Its flagship asset, the Beharra Project, was confirmed for the presence of extensive, high purity silica sands. The Company has been conducting exploration activities at the Project, with an initial Auger drilling campaign completed suggesting that the Project hosts both white and yellow sands.

ALSO READ: A Flick Through Perpetual Resources’ Operational Activities During 1H FY20

As the test works proceed and continue to surprise to the upside, the Company has now reported robust results of the initial leaching and calcination test work-

Results of Leaching and Calcination Test Work

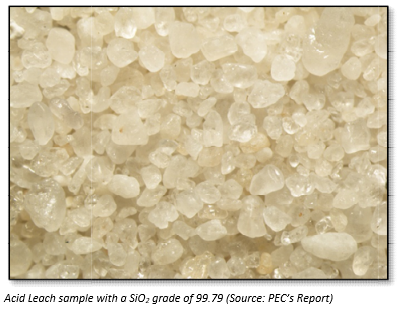

Continuing its impressive results spree, the Project’s initial leaching and calcination test work reported up to 99.94% SiO2 (99.992% SiO2 + LOI). Moreover, the test work demonstrated that the removal of heavy minerals by magnetic separation and spiralling is efficient and relevant to the sand tested.

The results have also depicted that PEC can additionally produce high-purity silica for specialist markets and eventually sell the silica sand product suite.

The best leach result was achieved with a sulphuric acid only leach and resulted in a final SiO2 grade of 99.79%. Subject to calcination, this resulted in a final SiO2 grade of 99.94%.

The results highlight that the Beharra silica sands can be treated with conventional processes to produce a high purity silica dioxide product, with reduced aluminium and iron oxides levels.

Earlier, on 30 January 2020, the company reported up to 99.85% SiO2 and considerable reduction of aluminium, iron and titanium, with overall product yield of 90% during the first round of beneficiation.

The recent petrology carried out on the non-magnetic concentrate depicts that the Beharra sand is very clean with minor slimes, with very few deleterious elements.

INTERESTING READ: Perpetual Resources Affirms Clean Geochemistry Results at Beharra Project, Further Beneficiation Test Work Underway

Initial Beneficiation Test Work Process

PEC’s beneficiation test work at the Project has been conducted by Nagrom Metallurgical Labs. 9 Auger drill holes samples (from depth intervals of 0.5 to 2m) were provided to Nagrom which generated a single 178kg bulk composite sample of the material. Below are the some of the key details:

- The Auger drill holes were evenly distributed along the strike length of the prospective target area within the Vacant Crown Land portion of the Project;

- Organic contaminants were visually identified in these intervals due to the proximity to surface;

- The first stage of laboratory testing was designed to establish responses to conventional processing methods; further test work will provide a guide towards final product specifications/ end user applications;

- The sample was wet screened to -1mm, scrubbed in an attrition cell and wet sieved to remove -0.075mm material. Consequently, ~2% of the feed mass (with a very clean in- situ and little slimes) were removed

- The +0.075mm fraction was spiralled, and the middlings and light fractions were combined and passed over a medium intensity magnetic separator. The non-magnetic fraction formed the final concentrate for this stage of testing.

Interestingly, PEC believes that the samples obtained from the upcoming Air core resource definition drilling program at greater depth will have less influence of organic content. This has a high probability of resulting in improved purity results in the future.

The acid leaching and calcification tests were conducted based on the treated silica sand medium intensity magnetic separator non-magnetic product.

- A variety of concentrations of sulphuric and hydrochloric acids were used for the same.

- Samples were heated to 90 degrees C and acid leached for 6 hours

- leached solids were pulverised and heated (calcined) to 1000 degrees C and later, assayed.

What’s in PEC’s Pipeline?

The upcoming resource definition drilling across Beharra is expected to provide further bulk samples for beneficiation studies. Based on Air core drilling, PEC will undertake optimisation of physical separation methods (attrition, scrubbing, spirals) and leaching test work.

Moreover, the Size fraction analysis remains underway and the initial product catalogue is likely to be finalised upon receipt of results. The Product marketing (based on the initial test work) is also underway.

PEC notified that the test work underway includes size fraction analysis of raw and beneficiated products. Post completion, a comprehensive specification sheet along with a product catalogue will be prepared. This will be the basis for initial discussions with end users, marking the Company’s product offtake strategy.

The PEC stock quoted $0.037 after market close on 24 February 2020 and has generated returns of 23.33% in the past six months.

PEC’s aim is to build a sustainable business by targeting the broadest markets for silica sands, inclusive of the huge glass manufacturing industry. At the back of test works propelling Project’s growth, successful results and robust strategies in place, PEC seems to be well-placed to pioneer the silica sands spectrum.