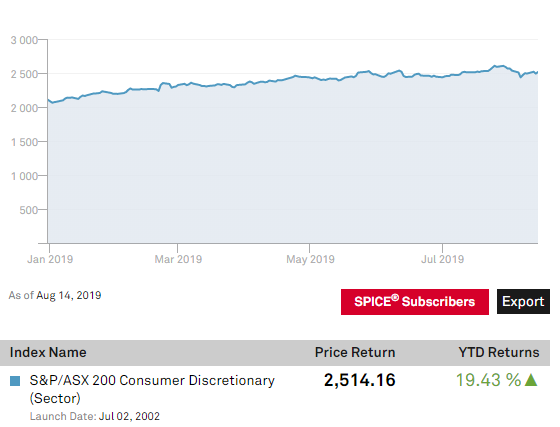

This article talks about the four companies from the Consumer Discretionary sector. These companies are the component of the benchmark S&P/ASX 200 Index and S&P/ASX 200 Consumer Discretionary Index (Sector). Among these four companies under discussion, the lowest market capitalisation - ~A$5.3 billion of Harvey Norman Holdings Limited (ASX: HVN).

YTD Performance (Source: S&P Website)

Tabcorp Holdings Limited (ASX: TAH)

On 14 August 2019, the company announced results for the full-year ended 30 June 2019. Accordingly, the revenues were up by 45.9% to $5,482.2 million in FY19 compared with statutory revenues of $3,757.3 million in FY18, and the revenues based on pro-forma terms were up by 8.7% over the previous corresponding period (pcp).

Reportedly, the EBITDA before significant items for the period was $1,064.7 million in FY19, up by 38.4%, and up by 7.6% over the pro-forma EBITDA before significant items in FY18. Meanwhile, the statutory NPAT was $362.5 million for the period, up by over 100% from $28.7 million in FY18.

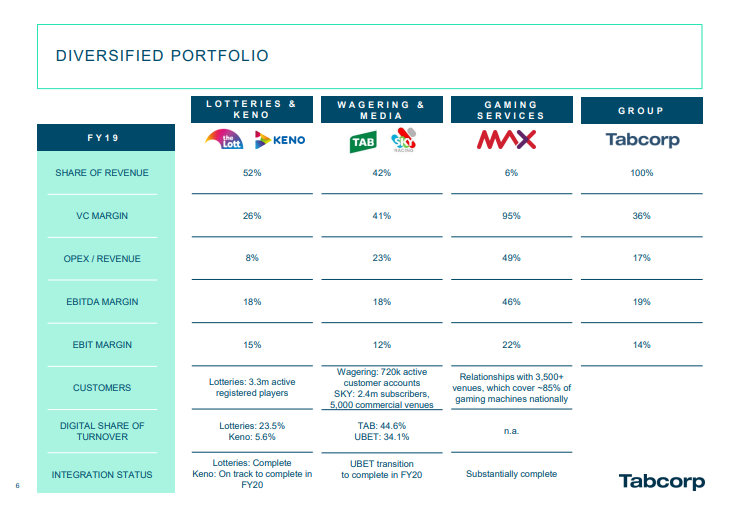

Lotteries & Keno

As per the release, the revenues of the segment were up by 22.8% to $2,864.9 million over the pro-forma-based revenues in pcp, and the EBITDA was $509 million, up by 28.9% over pro-forma-based EBITDA in pcp. The performance in the segment was driven by innovation, increased investment in technology and data-led capabilities, and the digital turnover was up by 73.5% while retail turnover improved by 17.7%. Besides, the new Powerball game led to escalated demand, and active registered players were up by 22.2%.

Portfolio (Source: Full Year Results Presentation)

Wagering & Media

Reportedly, the revenues of the segment were down by 3.6% to $2,312.2 million over the pro-forma-based revenues in pcp, and the EBITDA was $416 million, down by 7.9% over pro-forma-based EBITDA in pcp. The revenues were down due to increased customer generosities and lower gross yields, and the turnover in the ex-UBET business was down by 9.5 percent due to the legacy offering. Besides, the company launched Same Game Multi, Venue Mode, Trio and Odds & Evens.

Gaming Services

Reportedly, the revenues in the segment came down by 3.5% to $304 million over the pro-forma-based revenues in pcp, and the EBITDA was down by 8.1% to $139.7 million over pro-forma-based EBITDA in pcp. The company has restructured the segment, which now operates under MAX brand, and the new brand includes MAX Venue Services & MAX Regulatory Services. Besides, the revenues were impacted Venue Services due to the expiry of some contracts in Victoria and contracts were renewed of 40% Victorian electronic gaming machines.

Dividend

As per the release, the company announced a fully franked dividend of 11 cents per share, which takes the full-year dividend to 22 cents per share. The dividend would be paid on 20 September 2019 to the shareholders on the register on 22 August 2019, and the ex-date for the latest dividend is 21 August 2019.

Integration

Reportedly, the integration of Tabcorp & Tatts remains ahead of schedule, and cost synergies and business improvements resulted in $64 million of EBITDA in FY19. Besides, the company has initiated strategies to deliver benefits worth $90 million to EBITDA in FY20.

On 16 August 2019, TAHâs stock was trading at A$4.435, down by 0.337% (at AEST 12:08 PM).

Aristocrat Leisure Limited (ASX: ALL)

Earlier last month, the company had reported that it had begun a legal proceeding against the entity-Ainsworth Game Technology Limited (ASX: AGI) related to the breach of IP rights. Besides, in May 2019, the company had announced half-year results for the period ended 31 March 2019.

Portfolio (Source: ALL Presentation to Analysts and Investors)

Subsequently, the company had declared a fully franked dividend of AU 22 cents per share, which was paid on 2 July 2019. Reportedly, it achieved a normalised operating revenue of $2,105.3 million for the period, up by 29.8% from $1,622 million in March 2018.

Meanwhile, EBITDA margin slipped by 3.2% to 36.4% in H12019 compared with 39.6% in H12018. Besides, the normalised EBITDA increased by 19.2% to $766.3 million in H12019 against $642.9 million in H12018. The company recorded normalised NPAT of $356.6 million in H12019, up by 14.8% from $310.5 million in H12018.

Outlook

Reportedly, the company expected that land-based outright sales would see incremental gains in North America while maintaining the pole market share position across the key segment. In land- based gaming operations, the company expected to expand total gaming operation installed base while sustaining market-leading average fee per day performance.

On 16 August 2019, ALLâs stock was trading at A$27.97, down by 0.143% (at AEST 12:19 PM).

Crown Resorts Limited (ASX: CWN)

Recently, the company had reported that an official body of the NSW Government would be conducting inquiry under the Casino Control Act 1992 (NSW). Accordingly, the notice issued by NSW Independent Liquor & Gaming Authority noted that the inquiry relates to the proposed sale of an interest in Crown Resorts from CPH Crown Holdings Pty Ltd to Melco Resorts & Entertainment Limited.

Upcoming Project (Source: CWN 2019 Half Year Results Presentation Slides)

Reportedly, the CPH Crown is the company of James Packer, and Melco is owned by Lawrence Ho, which is Hong Kong based casino operator. Besides, the inquiry was constituted following the media reports, and the authority has issued notices to relevant parties for the documents and information to investigate the matter.

On 30 July 2019, the company had acknowledged the allegation by media related to the companyâs business dealings. Accordingly, it was asserted that the company maintains comprehensive policies to counter illegal business activities. It was further noted that the company undertakes reviews related to junket operators. Meanwhile, the company has been actively pursuing a class action suit China related to the detention of its employees.

On 31 July 2019, the company had denied allegations directed towards the business dealings, and it was noted that the junket operators work independently to arrange customersâ visit to casinos globally. Besides, the company also clarified on allegations related to the detentions in China in 2016 and anti-money laundering.

On 16 August 2019, CWNâs stock was trading at A$11.29, up by 1.256% (at AEST 12: 25 PM) .

Harvey Noman Holdings Limited (ASX: HVN)

On 9 August 2019, the company reported regarding the sale of a stake in the Byron at Byron Bay Resort. Accordingly, the company, controlled entities and entities controlled by Gerald Harvey, as owners of the property & business known as the Byron at Byron Bay Resort entered into agreements regarding the sale of Resort.

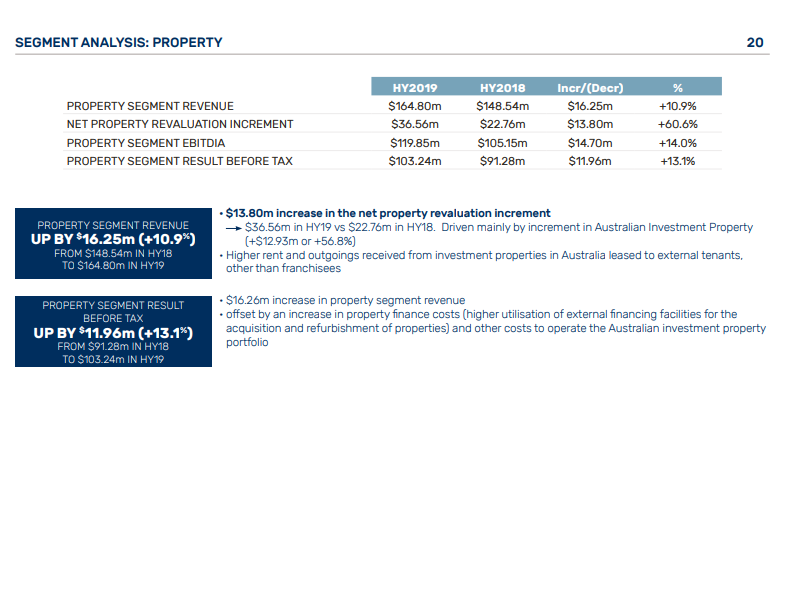

Property Segment (Source: HVNâs Presentation of Results)

Reportedly, the consideration price of the sale is $41,764,000 (ex GST), subject to terms & conditions for completion. Besides, the purchasers under the agreement are GAG Byron on Byron Property Co Pty Ltd & GAG Byron on Byron Business Company Pty Ltd.

Further, the completion of the sale would occur on 16 September 2019, and the second Monday after the grant of a liquor license by the relevant authority. Importantly, the purchaser has the right to terminate the agreement, in certain circumstances, and if the terms & conditions are not satisfied.

On 16 August 2019, HVNâs stock was trading at A$4.505, up by 0.334 percent (at AEST 12:25 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.