The casino and gaming entity, Crown Resorts Limited (ASX:CWN), which is counted amongst Australiaâs largest entertainment groups, has been the latest victim of allegations. There are media allegations on the company regarding its dealings with few Chinese VIP gamblers, attracting them into its Australian casino properties. Making the situation shoddier is the companyâs connection with a Hong Kong crime group and the import of illegal drugs into Australia, which it is alleged to have laundered through proceeds of transactions in its casinos.

Besides, the company is facing the possibility of a federal parliamentary inquiry, on the accusations of fast tracking of Chinese gamblersâ visas.

Further, links to junket operators has taken Crownâs reputation at risk. A leak of conversations between the companyâs prior reps and government officials had whistle-blown the incident; to which the company justified that the event was related to marketing its hotel properties and not gambling options. However, the discussions are mounting on the grounds that the company had breached national security concerns by permitting the entry of criminals on Australian grounds.

In this context, it is important to comprehend the meaning of junket operations. It can be expressed as an arrangement wherein a person or a group is introduced to a casino operator by an individual or group (the junket, a middleman between the two involved parties), who performs the deed in return of a commission, or any other form of agreed payment that is received by the casino operator.

The company has notified the market that it does not publicly comment on its arrangements with junket individuals or operators, and the junket operators are scrutinized by the company and regulators.

Market experts believe that the company needs to address these prying issues as they catch further heat, to ensure the smooth, effective and efficient functioning of its business in the market.

CWN Tumbles on ASX

CWN tanked down by 3.23 per cent, settling the dayâs trade at A$12.260, down by 3.24 on 29 July 2019. Today, at 2:07 PM AEST, 30 July, the stock is trading at A$11.895, down by ~3% with a market capitalisation of A$8.3 billion and approximately 677 million outstanding shares. The stock has delivered returns of -1.84 per cent and 1.41 per cent, in the last one and six months, respectively. The YTD return of the stock is 8.29 per cent and its annual dividend yield stands at 4.79 per cent.

Recent Events

On 31 May 2019, the company notified that CPH Crown Holdings Pty Limited (subsidiary of Consolidated Press Holdings) had signed an agreement with Melco Resorts & Entertainment Limited regarding the sale of 19.99 per cent of the issued capital of the company, with the intention to diversify CPHâs investment portfolio. James Packer sold ~50% of his stake in Crown Resorts for ~A$1.8 billion.

In April, the company was in discussion with Wynn Resorts, who had laid down a confidential takeover proposal to Crown. The discussion was regarding a potential change of control transaction, which did not materialise and soon ended.

2019 Half Year Results

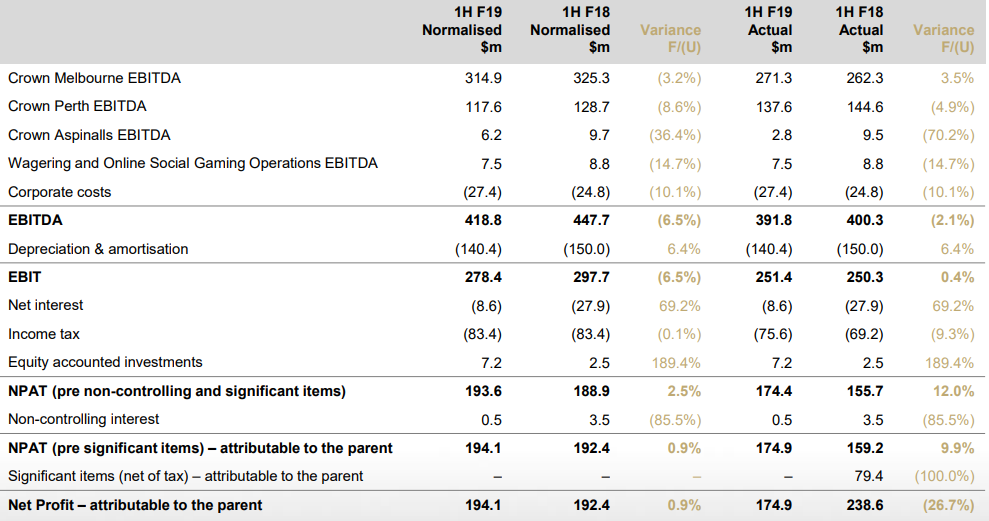

On 20 February 2019, the company announced its 2019 Half Year Results, stating that it had recorded a Normalised NPAT of $194.1 million, up by 0.9 per cent on pcp. The company had declared an Interim dividend of 30 cents per share.

Crown Resorts Limited Group Result (Source: CWNâs Report)

Crown Resorts Limited Group Result (Source: CWNâs Report)

In the resorts segment, the Normalised revenue was $1,536.7 million, down by 1.2 per cent. Reported EBITDA was $408.9 million, up by 0.5 per cent. The companyâs digital business reported total revenue of $65.9 million, crashed down by 65 per cent when compared to the $191.5 million of 1HFY18. However, the expenses were $58.4 million, down from the $182.7 million of pcp, showcasing a variance of ~68 per cent.

CWN and its Projects

Crown is a major contributor towards Australian tourism, training, social responsibility programs and employment. Its core businesses and investments lie in the integrated resorts sector.

In Australia, the company owns and operates Crown Melbourne Entertainment Complex and Crown Perth Entertainment Complex, both of which are tagged as Australiaâs leading integrated resorts. Besides this, the company has complete ownership and operational rights of casino, Crown Aspinalls in London.

Few of the companyâs projects include the proposed One Queensbridge project (Melbourne)and the Crown Sydney Hotel Resort at Sydney Harbour. Its digital segment includes DGN Games, Betfair Australasia and Chill Gaming. It also has stakes in UK-based Nobu and Aspers Group.

In its half-yearly report from February, the company notified that it had made significant progress with the construction of the Crown Sydney Hotel Resort. It is expected to be completed by 1H of 2021 and is on the right track. The total gross project cost is projected to be ~ $2.2 billion, with a net project cost of ~ $1.4 billion.

The companyâs One Queensbridge project, a JV between Crown and the Schiavello Group, IS still eyeing on financing. Both parties had formally applied to the Victorian Government for an extension to the construction commencement date, which was supposed to be March 2019.

Undoubtedly, controversies shun down the performance and reputation of the company. But as market participants, one should be constantly vigilant about the occurrences and news that surrounds companies, as awareness of macro and micro factors is vital before one decides to invest.

Controversies and accusations are an inappreciable yet inevitable part of the business world. With the number of involved personnel, global trade relations, communication hiccups and the heightened exposure and role of media hovering over the global corporate operations, it is difficult to escape the slightest glitch in the business ethics.

Amid the controversies but robust stature that the company holds in the Australian market, it would be fascinating to witness the course of actions that the company further undertakes to clear the controversy, in order to mint some good business and cater to the shareholdersâ interest.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)