In this article, we would discuss two stocks from the Consumer Discretionary sector. On 29 July 2019, the S&P/ASX 200 Consumer Discretionary (Sector) index was at 2,597, up by 6.9 points or 0.27% (at AEST 12:51 PM).

Webjet Limited (ASX: WEB)

Digital travel provider, Webjet Limited operates the business in the global consumer market and wholesale markets with offerings for B2B and B2C channels. In its B2C channel, Webjet operates through Webjet (website) and Online Republic. In its B2B channel, it runs with brands like lots of hotels, sunhotels, FIT RUUMS and JacTravel. Last Month, Webjet Limited presented Rezchain and Rezpayments in its Investor Session.

Blockchain Powered - Rezchain (Source: Companyâs Presentation, June 2019)

Rezchain

As per the presentation, Rezchain is a part of the B2B division of Webjet Limited â WebBeds, and it was launched in 2016, which made Webjet the first company to leverage blockchain for processing transaction between the two parties. Previously, the settlement between the hotel suppliers and travel partners was a complex, time consuming and ultimately costly process. Also, the differences in the operating languages of numerous IT systems have led to long and time-taking reconciliation process with escalated chances of error. Subsequently, it might lead to a mismatch of price, duration, booking status, currency, board basis etc.

Problem

Reportedly, up to one in every twenty five bookings results in a situation where the service is provided but never invoiced. Also, close to one in every three hotel bookings are amended after the initial reservation. Besides, one in every ten bookings experiences some kind of manual intervention that could break the chain and cause a discrepancy.

Solution

Accordingly, Rezchain is a solution developed to enable the two parties to verify that booking data is reconciled, and if any discrepancies occur, the parties are notified subsequently. Further, it provides a scope to correct any erroneous data while mitigating losses, and it does not require coding or integration.

Blockchain Rationale

Admittedly, there is no single owner of the Blockchain and processing power can be contributed by any of the relevant parties, which leads to a greater level of trust. Also, the solution is inherently robust as copies of the ledger are held across multiple processing nodes. If one fails, the others keep working, and the ledger lives on.

Webjet also conducted a case study and evaluated 40 randomly selected âin-disputeâ bookings. Accordingly, 11 hours of labour was invested in investigating the bookings, and 70% of these bookings resulted in a hard loss. Subsequently, it was found that 90% of the loss could have been mitigated using Rezchain technology to flag such discrepancies before travel/invoice.

Rezchain Effect

Accordingly, the version 5 of the Rezchain have been implemented across all WebBeds platforms. Also, it has helped in streamlining the reconciliation processes, improving data integrity and cost reduction. Besides, technology is offering a significant competitive advantage potential.

Rezpayments

As per the presentation, Rezpayments is a tool to comply with Payment Card Industry (PCI) Data Security Standard, and the company built in-house solution due to the lack of suitable solutions. Also, Rezpayments allows a company to easily implement a solution that captures the customerâs credit card data, directs it to Rezpayments where it is exchanged for a token, and that token is stored in the userâs systems.

Presently, it is implemented in the Webjet OTA and Online Republic businesses, and it lowers the scope of risk impact in our overall environment by isolating our impacted environment for PCI compliance testing

FY19 Guidance

It was also reported that the company is on track to deliver at least $120 million EBITDA; this includes all start-up costs associated with Umrah Holidays International while it excludes one-offs associated with the acquisition of DOTW.

On 29 July 2019, WEBâs stock was trading at A$13.81, up by 1.877% (at AEST 12:33 PM).

Aristocrat Leisure Limited (ASX: ALL)

Aristocrat Leisure Limited is a gaming entertainment company. It operates in over 90 countries backed by the licences for around 300 gaming jurisdictions. Besides, the stock of the company is a constituent of S&P/ASX 50, S&P/ASX 100, S&P/ASX 200, S&P/ASX 200 Consumer Discretionary (Sector) and a few more indices.

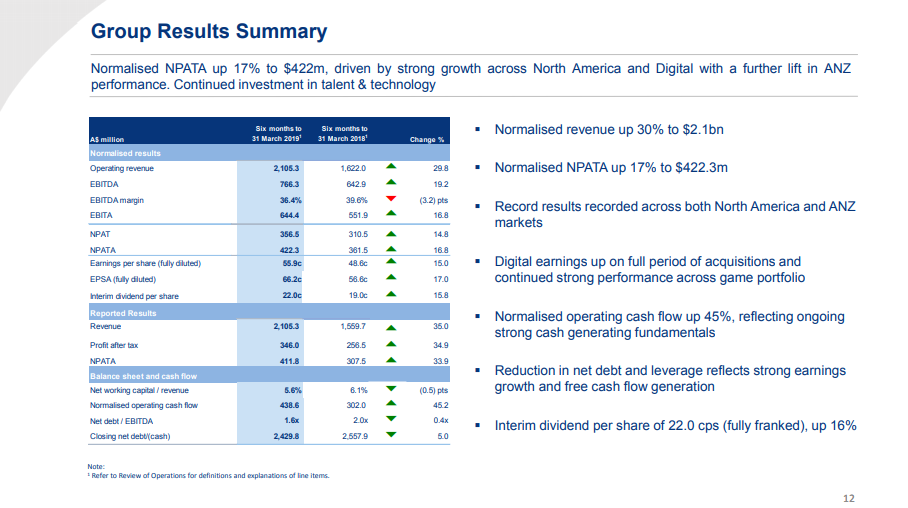

Results Summary (Source: Companyâs Presentation to Analysts and Investors, May 2019)

On 4 July 2019, the company forwarded an announcement made by Ainsworth Game Technology Limited (ASX: AGI) on 3 July 2019, which claimed that Aristocrat Leisure Limited had commenced proceedings against Ainsworth Game for the infringement of Aristocratâs intellectual property rights and breach by Australian Consumer Lawâs AGT. AGI stated that it would strongly defend the claims made by ALL during the proceedings.

Previously, on 23 May 2019, the company announced the financial results for the half-year ended 31 March 2019. Accordingly, the company had recorded a growth of 16.8% in reported terms in the normalised profit after tax and before amortisation of acquired intangibles (NPATA) at $422.3 million, which was $361.5 million in the six months to 31 March 2018. Also, this was driven by prolonged strong performance in the Groupâs Americas and Digital businesses along with lift in the performance across ANZ region.

Reportedly, the company had directed an interim fully-franked dividend of 22 cents per share, up by 16% for the six month period ended 31 March 2019. Also, the record date for the dividend was 30 May 2019, and the payment date for the dividend was of 2 July 2019. Besides, the normalised revenue increased by 20.8% in constant currency terms and 29.8% in reported terms, compared to the prior corresponding period; this was new reported record for the company at over $2.1 billion.

Outlook

As per the release, ALL anticipated increased gains in appealing North American adjacencies in the land-based Outright sales. Also, the company expected to maintain the market leading share positions, and no major casino expansions were planned for the FY19. Further, in the land-based gaming operations, ALL anticipates growing the total gaming operations installed base. Moreover, it is also expecting growth from the digital bookings underpinned by the new games launches. Aristocrat Leisure also anticipates an additional 100bps â 150 bps decreases in the companyâs effective tax rate compared to the financial year 2018. Also, it expects moderate growth in corporate costs due to the developments in infrastructure to grow a more complex and diverse business.

On 29 July 2019, ALLâs stock was trading at A$30.78, up by 1.051% (at AEST 12:51 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.