Travel companies in Australia have experienced excellent growth driven by domestic demand. We are discussing a few stocks from the travel sector with good fundamentals. Letâs have a look at each of them-

Webjet Limited (ASX:WEB)

Webjet Limited (ASX: WEB) is engaged in the business of online sale of travel products, including flights and hotel rooms. The Consolidated Entityâs business consists of a B2C division and a B2B division (WebBeds). WEB is a leader in terms of the OTA (Online Travel Agency) in Australia and New Zealand. The Companyâs B2C division operates in two online travel businesses under the âWebjetâ and âOnline Republicâ brands. As per the annual report of FY18, Webjet OTA holds ~50% of the entire OTA flight market with Webjet Domestic Bookings at 8% and Webjet International Bookings at 14%, outperforming the market growth by more than three times. WebBeds, launched in 2013, is the worldâs second largest and fastest-growing accommodation supplier of the travel industry and operates across Europe, the Americas, Middle East and Africa (EMEA) and Asia Pacific.

In H1 FY19 results, TTV (Total Transactional Value) rose by 29%, accounting for 2% growth in B2C and a 65% growth in B2B division. Growth in the B2B division for H1 incorporated six months of Jac Travel as compared to four months in pcp. With the acquisition adjustment, the organic growth stood at 21% regardless of the slower bookings on the back of a hot European summer. The rise in directly contracted B2B inventory and greater cross-sell across B2C ancillary products supported the overall top line margin, which was up by 25 bps as compared to the corresponding period last year.

The group remains focused on further growth of its B2C business organically and anticipates to structure its B2B business through a combination of organic and inorganic growth. The management is of the view that the company remains on track to deliver at least $120 million EBITDA in FY19, including all start-up costs associated with Umrah Holidays International. As on 24th May 2019, the stock of the company was trading at $15.010, down 2.848% from its previous close with a market cap of $2.1 billion.

Flight Centre Travel Group Limited (ASX:FLT)

Leading travel agency group, Flight Centre Travel Group Limited (ASX: FLT) continue to witness strong performance and management expects future growth in the upcoming time. The company has been consistently investing in its corporate systems, platforms & network, which is quite visible by the recent acquisition of a 25% stake in the Upside Travel Company.

The management believes that the overall results for FY19 are expected to be disappointing. However, FLT is well positioned to witness further growth, going forward, on take back of its brand and geographic multiplicity, healthy balance sheet and capability to capitalise on the new prospects.

As on 24th May 2019, the stock of the company was trading at $42.580, up 0.377% from its previous close with a market cap of $4.29 billion.

Corporate Travel Management Limited (ASX:CTD)

Corporate Travel Management Limited (ASX: CTD) is a provider of innovative and cost-effective travel management solutions to the corporate market.

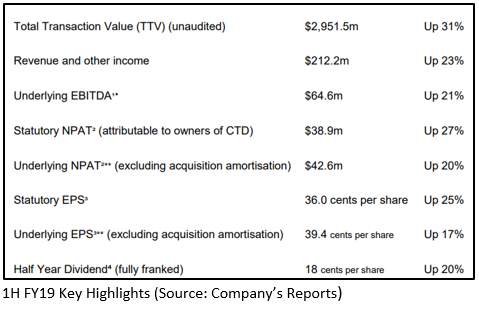

In H1 FY19, the company delivered another great set of results across all the operating regions. The exuberant performance reflected the strategy of the company to construct a global network by implementing a high-quality growth business model. CTM witnessed an increase in its market share, with organic growth as a key driver, contributing $9.4 million to bottom line growth in H1 FY19. CTM recorded an underlying EBITDA of $64.6 mn, reflecting a 21% growth on pcp. On CC (constant currency basis), the underlying EBITDA at $61.8 mnn recorded a growth of 16% on pcp.

Currently, the stock is trading at a price to earnings multiple of 30.240x. As on 24th May 2019, the stock of the company was trading at $22.850, down 4.95% from its previous close with a market cap of $2.61 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.