In the year 2019, marijuana stocks were among the hot picks for investors, despite the general market impulsiveness, strong competition and economic pressures. Recently, a green signal has been given to a bill legalising marijuana on the state level by the U.S. House Judiciary Committee. This approval has eliminated marijuana from the schedule 1 under the Act of controlled substances. However, legalising marijuana might face opposition in the Republican-controlled Senate. In the U.S. cannabis stocks also came under pressure, in the wake of the soaring death toll from vaping (that reached 42, so far in 2019), as per certain media reports.

In Canada, the marijuana stocks gained tremendous attention following its legalisation. However, of late, the largest cannabis company in terms of market value globally - Canopy Growth revealed that its cannabis oil products were returned following the rejection from retailers and thus, incurred a loss of USD 20.3 million.

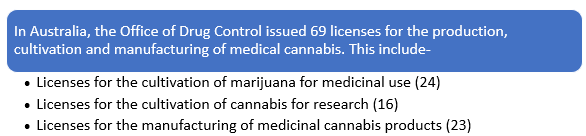

Meanwhile, in Australia, it has become an active and quickly expanding sector with solid prospects of growth. Marijuana was legalised in Australia in February 2016 and ever since, Australiaâs medicinal cannabis industry is rapidly growing and gaining enormous attention from collaborators and investors.

It is also expected that Cannabis Industry in Australia would expand to a net worth of ~ $55 million by 2025. In this piece, we will be talking about four ASX-listed marijuana stocks. Letâs try to find out if the smoke is back.

In this article we would be discussing four ASX-listed medicinal cannabis

Cann Group Limited (ASX: CAN)

On 21 November 2019, Cann Group Limited updated the market that the Company was planning to complete the construction of its new medicinal cannabis production facilities near Mildura which is scheduled to finish in stages (Mildura facility). The Company also provided market update on its bank facility.

Cannâs Revised Stage Approach of Mildura production facilities

Cannâs Mildura Facility was previously intended to complete in a single stage. The estimated cost of the project was $184 million with a total capacity of 70,000 kgs. In late 2020, the commissioning was planned. Also, the works on the facility initiated earlier in 2019. The company has seen a considerable growth to date and has consumed $47 million, which includes acquisition of the Mildura site and existing buildings.

It is expected that the first stage of the project would provide for the annual production of approximately twenty-five thousand kilos of dry flower while targeting commissioning during late 2020. This is subjected to obtaining all the necessary funding and regulatory approvals, licences & permits. However, the details inclusive of the revised project expenses are yet to be finalised and confirmed. The timeline for stage 2 & 3 to be determined later, based on the currently undergoing product demand assessment.

AusCann Group Holdings Limited (ASX: AC8)

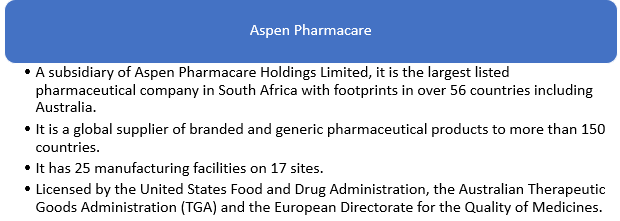

On 25 November 2019, AusCann Group Holdings Limited announced that it has entered into a pharmaceutical packaging agreement with Aspen Pharmacare. AC8 informed that the TGA licensed Aspen Pharmacare Australia Private Limited would offer packaging services for its medicinal cannabis pharmaceutical products.

The selection of Aspen Pharmacare stems from AusCannâs careful management of its supply chain and cost base with an aim to de-risks supply chain via collaborations with leading service providers, ensuring the most cost-effective prudent packaging solution, to ensure quality compliance. AusCann is also eyeing for similar collaborations with different service providers including cultivation & extraction, manufacturing, and regulated distribution service providers.

AusCannâs agreement with Aspen Pharmacare is initially for three years with a possibility for extension. Under this contract, GMP packaging services for AusCannâs patented solid hard-shell capsules are also included, to be manufactured under the contract by AusCannâs manufacturing partner, PCI Pharma. The capsules would be packaged in consumer ready bags by Aspen in its Australian facility.

THC Global Group Limited (ASX: THC)

On 19 November 2019, THC Global Group Limited, provided below the mentioned update to all its shareholders, in accordance with Listing Rule 3.17.1.

Commencement of Medicinal Cannabis Production Supporting +250,000 Australian Patients

- The largest bio-floral extraction facility located in the Southern Hemisphere is now operational.

- At Bundy Facility, the process of harvesting has been initiated to bring cannabis plant material to Southport Facility.

- THC is engaged in cannabis cultivation program for ensuring genetic consistency as well as enabling fast proliferation for rapid build out of plant material supply, by using its patented strains and tissue culturing techniques, the two competitive advantages of THC.

- THC is also planning to commence operations under Eden Farms Cultivation Project underpinning the cultivation of additional 1,000,000 cannabis plants per year at low cost with minimal capex and lead time.

- It is also expected that commercial production of âCanndeoâ branded medicines at Southport Facility to commence from early 2020.

Expanding Sales of CBD Product in New Zealand

- THC distributes CBD oils to patients in New Zealand under its Globalâs exclusive distribution arrangement with Endoca. THCâs supply of CBD oils has increased after the THC Global funded CBDinfo information portal was launched in June 2019, with an entire shipment now being sold out, as a result additional shipment CBD oils is now being ordered by the company.

- For broader patient availability a simplified prescription process has been streamlined in New Zealand.

- The company is anticipating strong sales as soon as its product is exported into New Zealand next year as indicated by strong results with its imported product.

Strong Revenue Growth Performance from THCâs Canadian Operations

- THC Globalâs Canadian hydroponics business has generated over $3 million unaudited trading revenue for 9 months to Q3 2019.

- The company is also expecting to launch new products and a service offering while increasing revenue base to a potential $5 million in trading revenue for 2020.

Botanix Pharmaceuticals Limited (ASX: BOT)

On 25 November 2019, Clinical stage synthetic cannabinoid company Botanix Pharmaceuticals Limited announced de-scheduling of synthetic CBD.

- US Drug Enforcement Administration (DEA) advised that synthetic cannabidiol (CBD) produced by Botanixâs partner Purisys, and used by Botanix, is no longer scheduled as a controlled substance.

- This de-scheduling substantially decreases cost expenses across manufacturing, storing, shipping and conducting clinical and non-clinical studies for Botanix products, which prior to this de-scheduling notice required express approval and licenses from the DEA imposing significant management and cost overheads to the company.

- It is expected that these changes render synthetic CBD the same as other development stage drugs. It is also expected that the speed, risk and cost of developing the Botanix dermatology and antimicrobial pipeline products would significantly be improved after the de-scheduling.

Botanixâs Supply Agreement with Purisys

Botanix entered into a supply agreement with Purisys in October 2019, covering Botanixâs requirements for immediate clinical and future commercial supplies of synthetic CBD. The agreement also commits Botanix and Purisys to work in partnership to set future requirements in terms of volume and to scale up manufacturing as well as optimisation.

| Stock | Share Price (27 November 2019, 12:49 PM AEST) | Market Cap ($) | YTD |

| ASX: CAN | $0.46, down 7.071% | 70.23 m | -77.75% |

| ASX: AC8 | $0.20, down 9.091% | 69.75 m | -65.08% |

| ASX: THC | $0.395, up 1.282% | 53.3 m | -17.02% |

| ASX: BOT | $0.105, trading flat | 101.27 m | 43.84% |

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.