With the legalisation of medical cannabis in many countries like Canada, the global medical cannabis industry has boomed quite a bit in recent times. Letâs take a quick look at 20 cannabis companies trading on ASX.

Cann Group Limited (ASX:CAN)

Australiaâs leading medical cannabis company, Cann Group Limited (ASX: CAN) is the first Australian recipient of research and medicinal cannabis cultivation licences and permits from Federal government. The company has cultivation and R&D facilities operating in Victoria, through which, it intends to manufacture a range of medicinal cannabis products for patients in Australia.

Existing Facilities of Cann Group (Source: Company Reports)

In the past six months, CANâs stock has provided a return of 5.47% as on 5th July 2019 and at market close on 8th July 2019, Cann Group Limitedâs stock was trading at $2.090, down 1.415% during the intraday, with a market capitalisation of ~$300.63 million.

Althea Group Holdings Limited (ASX:AGH)

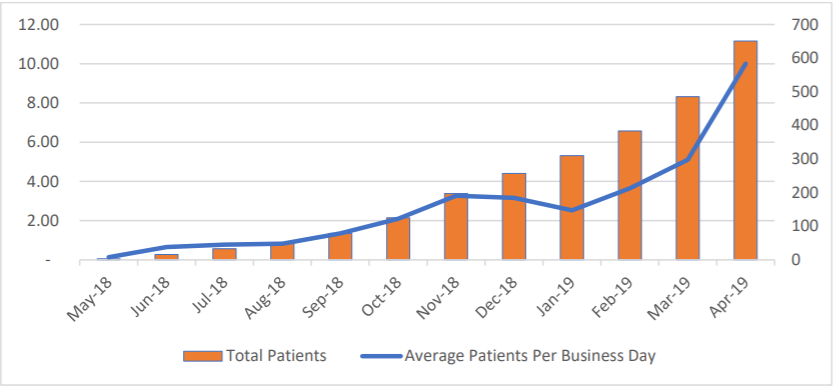

Australian licensed producer, supplier and exporter of pharmaceutical grade medicinal cannabis, Althea Group Holdings Limited (ASX: AGH) recently announced that it is going to supply products for the first UK National Medical Cannabis Pilot program, targeting 20,000 patients before the end of 2021. It is expected that this pilot program will yield valuable data for the company, which can be used to further bolster the case for wider medicinal cannabis use. In April 2019, the company achieved 650-patient milestone, which represents significant patient growth in the last one year, as depicted in the image below.

Patient Growth (Source: Company reports)

In the past six months, Althea Group Holdings Limitedâs stock has provided a return of 251.67% as on 5th July 2019, and at market close on 8 July 2019, the stock was trading at $1.045, down 0.948% during the intraday, with a market capitalisation of ~$214.49 million.

AusCann Group Holdings Ltd (ASX:AC8)

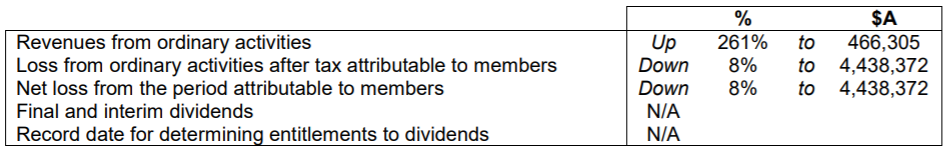

Australian pharmaceutical company, AusCann Group Holdings Ltd (ASX: AC8) recently signed a new supply agreement for the purchase of cannabis resin from Tasmanian Alkaloids, a leading manufacturer of controlled substances. Recently, highly experienced Mr. Ido Kanyon joined the company as a CEO, bringing 15 years of pharmaceutical and medical device business experience to the companyâs Board. For the half year ended 31st December 2018, AusCann Group reported revenues of $466,305, which was 261% higher than the previous corresponding period.

Half year Results (Source: Company Reports)

Half year Results (Source: Company Reports)

In the past six months, AusCann Group Holdings Ltdâs stock has provided a negative return of 45.59% as on 5th July 2019, and at market close on 8th July 2019, AC8âs stock was trading at $0.375, up 1.351% during the intraday, with a market capitalisation of ~$117.29 million.

Zelda Therapeutics Ltd (ASX:ZLD)

Australian-based biopharmaceutical company, Zelda Therapeutics Ltd (ASX:ZLD) was recently granted an approval for opioid reduction trial by the St Vincentâs Hospital Ethics and Governance Committees, which is encouraging news for the company and its shareholders.

Zelda Therapeutics Ltd recently received cash refund of $769,000 under the Federal Governmentâs Tax Incentive Scheme, which will be used to accelerate Zeldaâs current clinical and pre-clinical programmes. Below is the snapshot of Zeldaâs product pipeline.

In the past six months, Zelda Therapeutics Ltdâs stock has provided a negative return of 14.55% as on 5th July 2019, and at market close on 8th July 2019, the stock was trading at $0.046, down 2.128% during the intraday, with a market capitalisation of ~$35.5 million.

Creso Pharma Limited (ASX:CPH)

Creso Pharma Limited (ASX: CPH) is going to be acquired by a leading global Cannabis company, PharmaCielo Limited. In order to facilitate the acquisition, Creso Pharma recently reduced the balance of its secured loans by $5,150,000. The company recently commenced the cannabis sales from its Nova Scotia-based Mernova Medical, following the receipt of the necessary cultivation licence in mid- February 2019.

The Mernova facility (Source: Company Reports)

In the past six months, Creso Pharma Limitedâs stock has provided a negative return of 15.65% as on 5th July 2019, and at market close on 8 July 2019, the stock was trading at $0.460, down 5.155%, with a market capitalisation of ~$73.21 million.

MMJ Group Holdings Limited (ASX:MMJ)

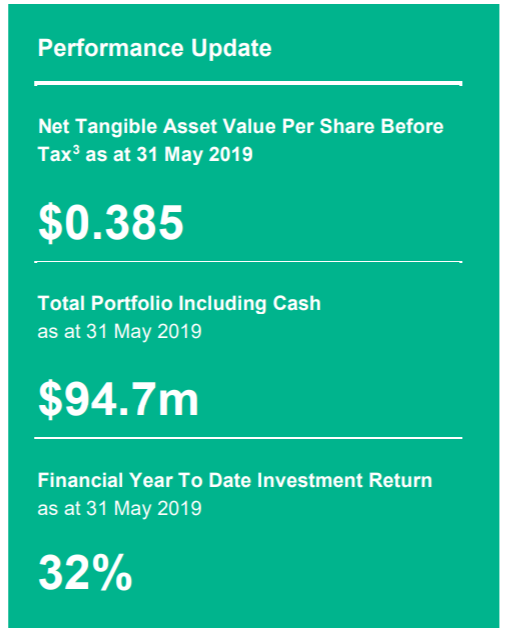

A global cannabis investment company, MMJ Group Holdings Limited (ASX: MMJ) offers investors an opportunity to invest in the unlisted and listed cannabis-related businesses. In an update provided on 14th June 2019, the company announced that as at 31 May 2019, it had Net Tangible Asset Value Per Share Before Tax of $0.385.

Performance Update as at 31 May 2019 (Source: Company Reports)

In the past six months, MMJâs stock has provided a return of 12.77% as on 5th July 2019, and at market close on 8th July 2019, the stock was trading at $0.285, up 7.547%, with a market capitalisation of ~$60.99 million.

Elixinol Global Limited (ASX:EXL)

A global leader in the cannabis industry, Elixinol Global Limited (ASX: EXL) recently announced that its Dutch based wholly-owned subsidiary, Elixinol BV (Elixinol), has signed an exclusive distribution agreement with MedVec International GmbH (Distributor), under which, the distributor will sell Elixinol branded products and white-label products via its existing sales network in the pharmacy and para pharmacy sector. At 2018 Annual general Meeting (AGM), the company informed that it will continue to re-invest its profits to build scale and focus its attention on growth.

In the past six months, Elixinol Global Limitedâs stock has provided a return of 39.29% as on 5th July 2019, and at market close on 8 July 2019, the stock was trading at $3.950, up 1.282%, with a market capitalisation of ~$537.79 million.

Medlab Clinical Ltd (ASX:MDC)

Medlab Clinical Ltd (ASX: MDC) has Australian TGA licenses to possess, research, supply, import and export Cannabis. The company recently announced the receipt of Human Ethics Approval for a second NanaBis⢠trial, which will follow how Australian Doctors use the product NanaBis⢠in a real world setting. Medlabâs research using its patented cannabis-based medicines (NanaBis⢠and NanaBidialâ¢) has continued to progress well and in particular NanaBis⢠continues to yield strong, encouraging results.

In the past six months, MDCâs stock has provided a negative return of 9.88% as on 5 July 2019, and at market close on 8th July 2019, the stock was trading at $0.370, up 1.37%, with a market capitalisation of ~$78.61 million.

Roto-Gro International Limited (ASX:RGI)

An emerging cultivator of lawful cannabis and perishable foods, Roto-Gro International Limited (ASX: RGI) is working with new and existing clients to provide design and fit-out solutions for their lawful cannabis and perishable food growing facilities. The company recently announced the appointment of Mr Michael Carli to the post of Non-Executive Chairman and Adam Clode as the new Chief Executive Officer of the company.

In the past six months, Roto-Gro International Limitedâs stock has provided a negative return of 43.94% as on 5th July 2019, and at market close on 8th July 2019, the stock was trading at $0.195, up 5.405%, with a market capitalisation of ~$24.03 million and a daily volume of ~92,768.

THC Global Group Ltd (ASX:THC)

Australiaâs leading medicinal cannabis company, THC Global Group Ltd (ASX: THC) was recently granted a Manufacturing Licence for the production of extracts and tinctures of cannabis and cannabis resin from the Australian Office of Drug Control, which is a significant milestone, representing the completion of the companyâs âFarm to Pharmaâ vertical integration strategy.

Meanwhile, in the last six months, the share price of the company decreased by 11.58% as on 4th July 2019. Currently in a trading halt, THC Global Group Ltdâs stock last traded at $0.420, with a market capitalisation of circa $56.59 million as on 4th July 2019.

CannPal Animal Therapeutics Limited (ASX:CP1)

A global leader in cannabinoid derived therapeutics for companion animals, CannPal Animal Therapeutics Limited (ASX: CP1) is primarily involved in the research and development of medicines to provide veterinarians with clinically validated and standardised therapeutics to treat animals.

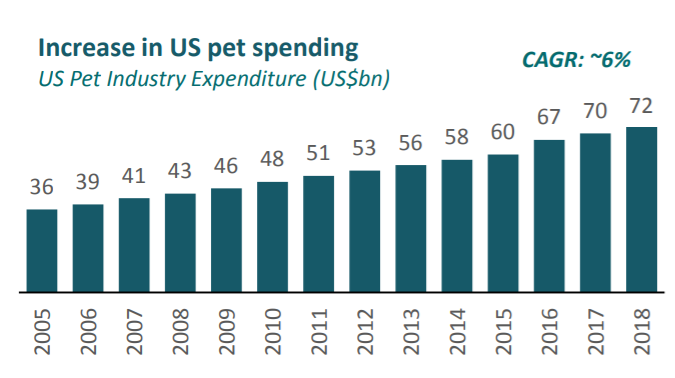

With the increase in the US pet spending as depicted in the figure below, the companion animals market for dogs and cats is estimated to be approximately US$12 billion.

Increase in US pet spending (Source: Company reports)

On the stock performance front, the companyâs stock has provided a return of 46.15% in the past six months as on 5th July 2019. CannPal Animal Therapeutics Limitedâs stock was trading at $0.180, down 5.263%, with a market capitalisation of circa $17.69 million as on 8th July 2019.

IDT Australia Limited (ASX:IDT)

Australian pharmaceutical manufacturing company, IDT Australia Limited (ASX: IDT) was recently granted a Medicinal Cannabis Manufacturing Licence under the Narcotic Drugs Act 1967, complementing IDTâs existing pharmaceutical manufacturing capabilities and facilities.

In the first half of FY19, the company reported a net loss of $2.39 million, which included impairment of intangible assets of $14.14 million.

On the stock performance front, in the past six months, the companyâs stock has provided a return of 10.34% as on 5th July 2019. IDTâs stock was trading at $0.170, up 6.25%, with a market capitalisation of circa $37.82 million as on 8th July 2019.

Impression Healthcare Limited (ASX:IHL)

Impression Healthcare Limited (ASX: IHL) recently entered into an agreement with Myoderm North America for the supply of Dronabinol, the first ever cannabinoid medicine permitted for patient use by the United States FDA.

Recently, the company also raised $1.65 million in an oversubscribed Placement, which was supported by a range of existing âsophisticatedâ investors in Impression, including major shareholders.

On the stock performance front, in the past six months, the companyâs stock has provided a return of 131.58% as on 5th July 2019, and at market close on 8th July 2019, IHLâs stock was trading at $0.041, down 6.818%, with a market capitalisation of circa $25.6 million.

Ecofibre Limited (ASX:EOF)

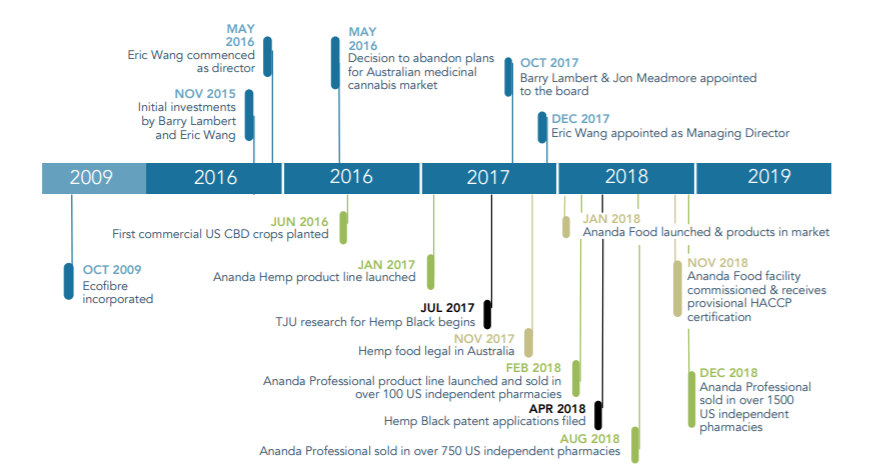

A provider of hemp products, Ecofibre Limited (ASX: EOF) has a long history in hemp capabilities.

Company Timeline (Source: Company Reports)

On the stock performance front, in the past three months, Ecofibre Limitedâs stock has provided a return of 68.13% as on 5th July 2019, and at market close on 8th July 2019, EOFâs stock was trading at a price of $2.990, up 11.152%, with a market capitalisation of circa $832.15 million and a daily volume of ~406,212.

Lifespot Health Limited (ASX:LSH)

A medical diagnostic and monitoring technologies provider, Lifespot Health Limited (ASX: LSH) recently signed an exclusive Heads of Agreement with IONIC Brands Corp. to develop and distribute Lifespotâs software and vaporiser technologies, a significant milestone achieved by the company.

On the stock performance front, in the past six months, Lifespot Health Limitedâs stock has provided a return of 40% as on 5th July 2019. At market close on 8th July 2019, LSHâs stock was trading at a price of $0.085, with a market capitalisation of circa $6.52 million and daily volume of ~15,057.

Bod Australia Limited (ASX:BDA)

A cannabis focused healthcare company, Bod Australia Limited (ASX: BDA) secured a distribution agreement with a leading Australian distributor and supplier of medicinal cannabis products, Burleigh Heads Cannabis (BHC) and partner company, Cannabis Doctors Australia (CDA) for its pharmaceutical grade medicinal cannabis product, MediCabilis⢠5% CBD ECs315 (MediCabilisâ¢).

On the stock performance front, in the past six months, Bod Australia Limitedâs stock has provided a negative return of 24.69% as on 5th July 2019, and at market close on 8th July 2019, BDAâs stock was trading at a price of $0.315, up 3.279%, with a market capitalisation of circa $21.16 million and a daily volume of ~122,809.

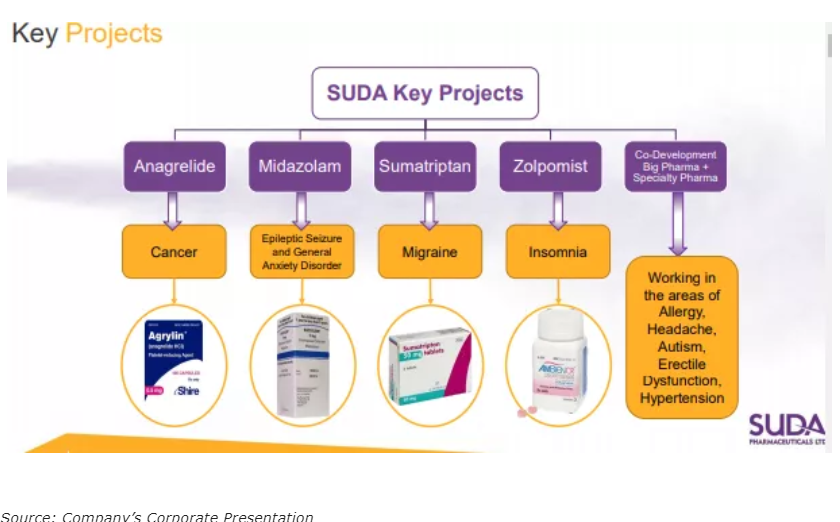

SUDA Pharmaceuticals Ltd (ASX:SUD)

A leader in oro-mucosal drug delivery, SUDA Pharmaceuticals Ltd (ASX: SUD) recently signed a binding term sheet for an exclusive licence with Australian-based, Cann Pharmaceutical Australia Ltd to develop and supply an oral spray of pharmaceutical-grade cannabinoid derivatives. Key projects of the company can be seen in the image below.

On the stock performance front, in the past six months, SUDA Pharmaceuticals Ltdâs stock has provided a negative return of 29.82% as on 5th July 2019, and at market close on 8th July 2019, SUDâs stock was trading at a price of $0.003, down 25% during the intraday, with a market capitalisation of circa $14.23 million and a daily volume of ~3,530,000.

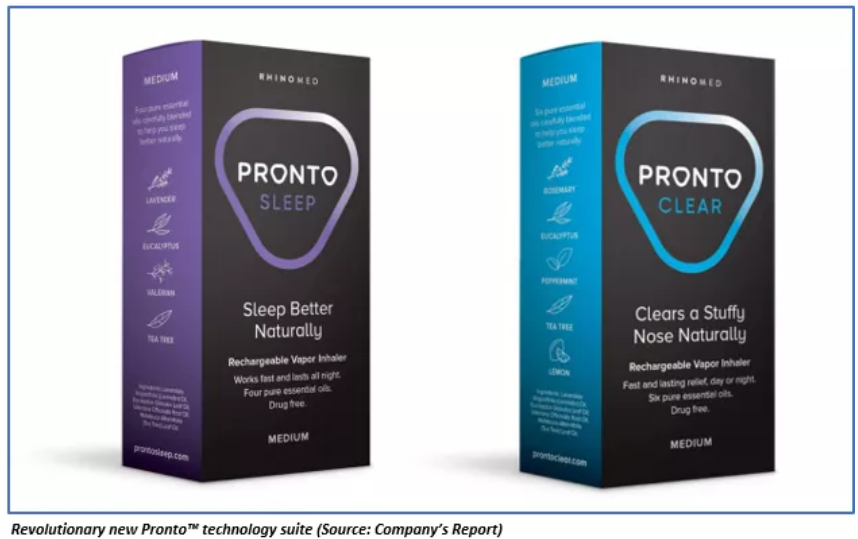

Rhinomed Limited (ASX:RNO)

A global leader in airway technology, Rhinomed Limited (ASX: RNO) recently announced that its revolutionary new Pronto⢠rechargeable dual action vapour release technology has been registered with both the US FDA and the Australian TGA as a class I medical device, which is a significant milestone for the company.

On the stock performance front, in the past six months, Rhinomed Limitedâs stock has provided a return of 26.32% as on 5th July 2019, and at market close on 8th July 2019, RNOâs stock was trading at a price of $0.245, up 2.083%, with a market capitalisation of circa $34.06 million and a daily volume of ~70,590.

Cann Global Limited (ASX:CGB)

Cann Global Limited (ASX: CGB), previously known as Queensland Bauxite Limited, is primarily involved in growing and cultivating of hemp and medicinal cannabis products in Australia.

The company recently released a replacement prospectus, in which, it offered of up to 170,000,000 new shares at an issue price of $0.035 per share to raise up to $5,950,000, with a minimum subscription of $1,995,000, together with one free attaching option for every two shares subscribed for and issued.

The companyâs securities are currently in a suspension state. Cann Global Limitedâs stock last traded at a price of $0.037 as on 27th July 2018.

MGC Pharmaceuticals Ltd (ASX:MXC)

A European-based bio-pharma company, MGC Pharmaceuticals Ltd (ASX: MXC) recently signed a distribution agreement with Mexacare GmbH, which provided the company access to a new marketplace within Europe via Mexacareâs established distribution network.

On the stock performance front, in the past six months, MGC Pharmaceuticals Ltdâs stock has provided a return of 15.91% as on 5th July 2019, and at market close on 8th July 2019, MXCâs stock was trading at a price of $0.051, with a market capitalisation of circa $61.85 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.