We are discussing four companies with business activities ranging from engineering solutions to water treatment solutions as we try to dig deeper into the nuances of the businesses. Letâs have a look.

Cimic Group Limited

Cimic Group Ltd (ASX : CIM) is engaged in integrated engineering and primarily focuses on construction and mining, working across the lifecycle of assets, infrastructure and resources projects. Subsidiaries of company are- CPB Contractors including Leighton Asia and Broad, Thiess and Sedgman etc. The company started its operations during 1899 and currently it is spread over 20 countries with a total strength of more than 43,000 employees.

Cimic jointly wins Cross River Rail project.

With a market update on 27 August 2019, CIM informed of receiving Cross River Rail project award from the Queensland Government. The project will be executed jointly with Unity Alliance partners and the group will receive approximately $900 million from the above project. The contract includes Rail, Integration and Systems (RIS) package as part of the project. The above contract comes at the closure of PPP package (Tunnel, Stations and Development) of the government. The PPP package is worth at approximately $2.73 billion.

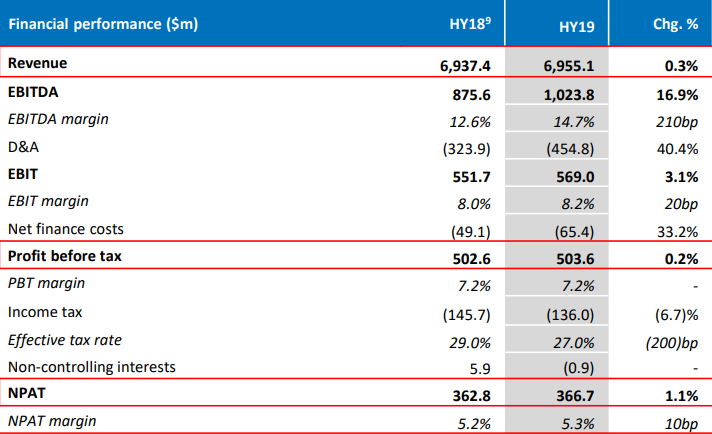

H1FY19 highlights: The company reported ~0.3% growth in H1FY19 revenue at $,6,955.1 million and NPAT at $366.7 million with an EBITDA margin of 14.7%. Net profit margin during the first-half of FY 19 stood at 5.3% as compared to 5.2% in H1FY18. At the end of June 2019, the company reported a cash balance of $2,065.9 million.

(Source: Company filings)

Dividend announcement: The board recommended a fully franked interim dividend of 71 cents against each ordinary share held, payable on 3 October 2019 with record date on 12 September 2019 and ex-date on 11 September 2019. CIM has an annualised dividend yield of 5.03%.

Outlook: As per the management guidance, the estimated FY19 earnings for the group will likely around $790m-$840m, subject to market conditions. The management is positive on mining and construction segments aided by strong infrastructure pipeline and investment from PPPs.

Stock update: On 28 August, stock of CIM closed at $31.010, down 0.641% from its previous close. The 52-week trading range of the stock stands at $30.360 to $51.670, and currently, the stock is trading at the lower band of its 52-week trading range. The stock has delivered negative returns of 32.31% and 37.48% in last three months and six months respectively.

Reliance Worldwide Corporation Limited

Reliance Worldwide Corporation Limited (ASX : RWC) is associated in designing, manufacturing and supply of high quality, reliable and premium branded water flow systems. The company also offers products and solutions for the plumbing and heating industries.

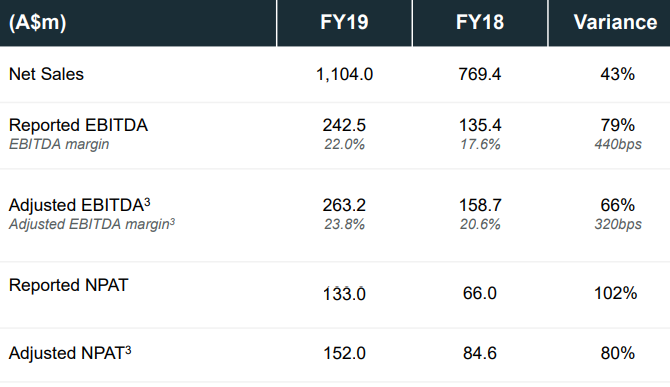

FY19 Result Highlights: The company reported net sales at $1,104 million, up 43.5% over the prior year (+37% on a constant currency basis) followed by reported net profit at $133 million, higher 101.5% y-o-y. Reported EBITDA came at $242.5 million, up 79% y-o-y. The EBITDA margin stood at 21.9% against 17.6% in FY18. The company posted exuberant growth across top-line and bottom-line due to $14.2 million of synergies received from John Guest acquisition in the first full-year of operations.

(Source: Company filings)

The company posted cash balance of $69.3 million as on 30 June 2019. Gross debt stood at $495.9 million against $662.3 million at the end of the previous financial year.

Operating performance: The company reported higher working capital compared to the previous year mainly due to extended support of the growing segments. Revenue from America increased by ~17% y-o-y and there was ~7% increment from Asia Pacific.

Dividend announcement: RWC announced a fully franked dividend of 5 cents against each ordinary share held with a payment date of 11 October 2019. The dividend yield ratio of the company stood at 2.58%.

Outlook: For FY20, the management believes that the company will outpace the industry in terms of revenue growth. The management guided about market positive conditions in America whereas, the Asia Pacific will continue to operate at lower/ declining levels. Europe is expected to remain soft in the short-term owing to Brexit. RWC expects FY2020 NPAT to remain within the range of $150 million to $165 million followed by EBITDA levels of $280 million to $305 million, including the effect of AASB16. From an operational point of view, input costs should remain stable, while average copper costs are expected not to exceed US$6,200 /tonne during FY20. It is expected that there will be no further alteration in tariffs or import duties in the USA and exchange rates are likely to remain stable.

Stock update: The stock of RWC has closed at $3.730, up 6.877% from the previous dayâs close and is trading at a P/E multiple of 20.530x.

Clean TeQ Holdings Limited

Clean TeQ Holdings Limited (ASX : CLQ) is engaged in water purifying services which are extensively used for drinking purposes, agriculture and industrial segments. The company also provides cost-effective extraction techniques for a range of resources, including base metals, precious metals and radioactive elements.

FY19 Financial results: CLQ posted revenues of $4.697 million as compared to $4.209 million in FY18. Loss after tax during the year came at $18.013million against loss of $16.012 million in FY18. Total current assets came at $97.502 million including cash and trade and other receivables at $78.871 million and $3.568 million, respectively. Research and development incentive receivable for the company stood at $14.867 million as on 30 June 2019. Plant property and equipment during FY19 stood at $21.553 million, followed by Exploration and evaluation assets at $121.060 million. Net assets of the company during 30 June 2019 stood at $237.476 million.

(Source: Company filings)

Operating Highlights: During the quarter, the activities of the company are summed as below:

i)Establishment of an integrated project delivery model under which engineering and design is well advanced.

- ii) Completion of a test work program on Sunrise nickel/ cobalt ore at the pilot plant in Perth, which indicated reasonably high metal extraction and recovery rates.

Stock Update: The stock of CLQ closed at $0.340, at par with the previous dayâs closing price. The 52-week trading range of the stock is $0.265 to $0.635, and currently CLQ is trading at the lower band of its 52-week trading range. The stock has generated returns of 25.93% and 4.62% in the last 3-months and 6-months, respectively.

Fluence Corporation Limited

Fluence Corporation Limited (ASX: FLC) is engaged in the decentralised water, wastewater and reuse treatment markets, with integrated solutions its in-house products like including Aspiralâ¢, NIROBOX⢠and SUBRE. Currently, the company has operations across North America, South America, the Middle East, Europe and China. FLC operates across seventy countries worldwide.

Collaboration with Chinese Yiyang High-tech to meet future demand:

With a press release, the company has informed regarding signing a LOI with the Yiyang High-tech Industrial District Management Committee (âYiyang High-techâ) for the formation of a assembly plant for its proprietary membrane aerated biofilm reactor products. To meet the potential demand, the facility will have an yearly capacity of 120 Aspiral ⢠L4 units.

(Source: Company website)

H1FY19 update: Recently, the company has posted H1FY19 updates, which states a booking of US$241 million. Revenue from Smart Product Solutions came US$5.6 million in H1 2019 and grew 74% y-o-y. Florence launched two new products under the NIROBOXâ¢, segment which are the ECOBOX (for industrial wastewater usage) and the NIROFLEX (skid-mounted treatment system). The management believes the above launches will successfully cater to growing demand across pre-engineered Smart Product Solutions segment.

Stock Update: The stock of FLC closed at $0.435, down 1.136% from the previous dayâs closing. The 52-week trading range of the stock is $0.290 to $0.630. The market capitalisation of FLC stood at 236.48 million. The stock has generated mixed returns of -6.38% and 18.92% in last 3-months and 6-months, respectively.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.