The advancement of science and technology has given birth to a various tech companies that have been utilising modern technology to solve modern issues. The below-mentioned Industrial stocks are using their modern and revolutionary technologies to serve different needs of the clients.

Letâs take a closer look at these stocks and their technologies.

ClearVue Technologies Limited (ASX:CPV)

Smart building material company, ClearVue Technologies Limited (ASX: CPV) is focussed on generating renewable energy by integrating solar technology into building and agricultural industries. The companyâs core technology, ClearVue PV®, is a glass technology which helps in generating electricity and reduce energy consumption. This technology has various applications across the agricultural and greenhouse sectors, as well as the building and construction industries.

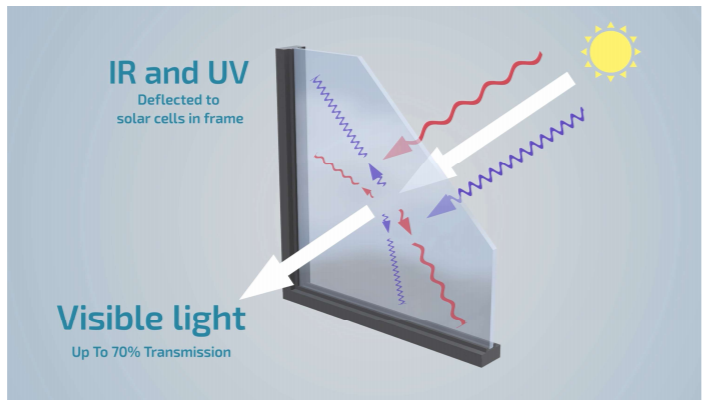

ClearVueâs technology has a glass lamination interlayer doped with inorganic micro and nanoparticles which draws a large number of the infrared and ultraviolet rays from the sun and redirect those rays towards solar cells which are embedded around the glass panels of window frame. These rays are then converted into energy (refer below figure).

Conceptual design using ClearVue glass in residential construction (Source: Companyâs Report)

In weather conditions commonly experienced in Perth, Western Australia, the company can produce electricity up to 30 Watts electric power output by using its glass technology.

The company recently signed a Collaboration Agreement with AquaGen Infrastructure Systems Inc to integrate the ClearVue technology into all of its planned microgrid-based resilient sustainable village developments, and other projects.

The company, recently, also signed an MOU with BeyondPV, a leading developer and designer of photovoltaic technologies, under which BeyondPV will design, manufacture and supply to ClearVue and to ClearVueâs licensed manufacturers solar PV strip modules.

The company has also signed a Consultancy Agreement with Arup Australia Pty Ltd, a world-leading firm of designers, engineers and architects, under which, Arup will work with ClearVue on the development of 4 design typologies of the ClearVue Smart Façade concepts. The 4 prototyped design concepts would be supplied to the selected manufacturers for prototyping and integration into mass production and assembly.

Indicative ClearVue Smart Façade design concepts (Source: Companyâs Report)

In order to grow its profile in the European region, the company has got itself listed on the Frankfurt Stock Exchange.

At the end of the June quarter, the company had cash balance of around $1.4 million. In the second- half period of 2019, the company expects to receive an R&D tax refund. In the June quarter, the company spent around $198k on research and development activities. The net cash outflow for operating activities during the June quarter was around $896k.

In the September quarter, the company expects to incur a cash outflow of $143k for research & development and certification costs, $124k for product manufacturing and operating costs and $183k for staff costs. Including costs of several other activities, the company expects to incur a total cash outflow of $980k for September quarter.

Stock Performance: In the past six months, CPVâs stock provided a negative return of 23.44% as on 15 August 2019. At market close on 16 August 2019, the stock was at a price of A$0.250 with a market capitalisation of circa $23.94 million. The stock has a 52 weeks high price of A$0.830 and 52 weeks low price of A$0.170 with a yearly average volume of ~204,635.

Fluence Corporation Limited (ASX:FLC)

Fluence Corporation Limited (ASX: FLC) with its Smart Products Solutions, including Aspiralâ¢, NIROBOX⢠and SUBRE is rapidly progressing to establish itself as a leader in the decentralized water, wastewater and reuse treatment markets.

In the June quarter, the company earned a revenue of US$11.3 million, bringing the H1 result to US$23.6 million. The revenue from Smart Product Solutions was US$5.6 million in H1 2019, representing 74% growth on pcp.

The companyâs flagship MABR-based products is producing a strong sales pipeline in China with total backlog now standing at US$278 million.

While unveiling the June quarter results, the companyâs Managing Director & CEO Henry Charrabé informed that the financial performance of the business over the June quarter has not been strong. He further assured that there will be strong and growing demand for its decentralised pre-engineered Smart Product Solutions for water and wastewater treatment.

To capitalise on the strong pipeline of opportunities, the company is planning to secure a term loan facility from Generate Capital for up to US$40 million to finance working capital investments, addition to the up to US$50 million project finance facility previously secured from Generate for recurring revenue projects.

In FY19, the Smart Products Solutions revenue is expected to be around US$26 million, significantly lower than the prior guidance of US$44 million, however, it still represent 18% growth on pcp. This reduced expectation is a result of a decrease in NIROBOXTM product forecasts given the shift in sales mix in H1. The company is

The company expects to incur a Sustainable EBITDA by Q4 2019, assuming financial close for Ivory Coast is achieved in Q3 2019.

In the June quarter, the company reported a net cash outflow from operating activities of US$7.8 million. Notably, the company received around US$15.05 million as receipts from customers during the quarter which was offset by research and development expenditure (US$752K), product manufacturing and operating costs (US$12,497k), advertising and marketing (US$1,216k), staff costs (US$6,155k) and administration and corporate costs (US$1,981k). The net cash used in investing activities during the quarter was around US$52k and net cash used in financing activities during the quarter was around US$696k.

At the end of the June quarter, the company had cash and cash equivalent of around US$15.6 million. The total estimated cash outflow for the September quarter is US$32.14 million which includes US$500k to be spend on research and development, US$22.03 million on product manufacturing and operating costs and several other expenditures.

Stock Performance: In the past six months, FLCâs stock provided a return of 24.24% as on 15 August 2019. At market close on 16 August 2019, the stock was at a price of A$0.415 with a market capitalisation of circa A$220.35 million. The stock has a 52 weeks high price of A$0.630 and 52 weeks low price of A$0.290 with a yearly average volume of ~661,471.

DroneShield Limited (ASX:DRO)

DroneShield Limited (ASX: DRO), as the name suggests, is worldwide leader in drone security technology, primarily involved in providing pre-eminent drone security solutions to different clients.

The companyâs products are as follows:

DroneGunTM â portable rifle style drone countermeasure;

DroneNodeTM â portable covert drone countermeasure;

RfZeroTM â cost-effective drone detection;

RfPatrolTM â body worn drone detection;

DroneSentinelTM â multi-sensor drone detection;

DroneSentryTM â DroneSentinelTM with defeat capability.

Recently in August 2019, the company released its breakthrough new product, RfZeroTM, an omnidirectional drone detection device with a 1 kilometre range. Designed to be a cost-effective product, RfZeroTM is expected to appeal to a wide range of users.

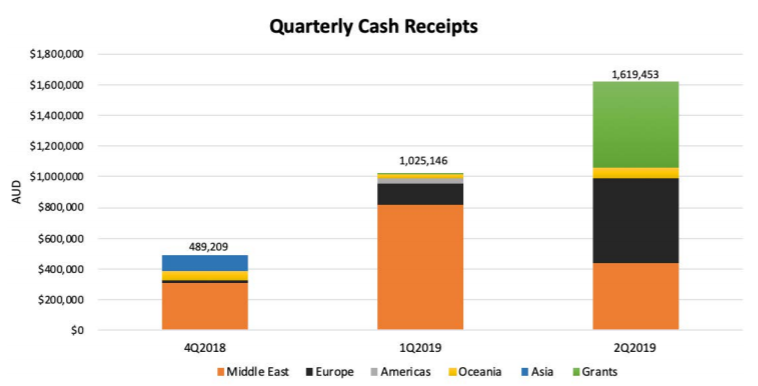

The company currently has around A$2.4 million of existing contracts in delivery, with a material amount of customer receipts expected in September quarter. In the June quarter, the company saw record number of cash receipts i.e., $1,058,518.

Quarterly cash receipts (Source: Companyâs report)

It is to be noted that the cash receipts were flowed from multiple customers, and none of the cash receipts related to the $3.2m Middle Eastern sale announced in June 2018. Net cash âburnâ for the June quarter was negligible at $166,321, with the cash balance stable at $1,561,961

Recently, Regal Funds Management Pty Ltd (RFM) became a substantial holder of the company holding 20 million ordinary shares with 8.29 voting power.

The company recently saw a strong demand for its $9.55 million placement, proceeds of which are to be used for the following reasons:

- bonding requirements for new contracts (where required);

- further development and integration of detection and countermeasure technologies, consistent with end-user requirements;

- an increase in manufacturing capabilities;

- an increase in stock levels (detection and countermeasure products);

- expansion of the companyâs sales and marketing effort globally; and

- general working capital.

Recently, in July 2019, the company partnered with Altitude Angel, the worldâs foremost unmanned traffic management (UTM) provider, to bring âsingle-point situational awarenessâ to manage airspace for users such as airport operators and national governments.

In July, the company also announced a partnership with Bosch, the worldâs foremost provider of security and safety solutions to integrate DroneShieldâs products with Boschâs video surveillance product in order to better serve its customers.

For the June quarter, the company reported a net cash used in operating activities of $312,479k. The June quarter gross cash outflow was $2,108,470. After customer receipts and grant and grant factoring receipts, the net June quarter cash outflow was reduced to $166,321. DroneShield has estimated a gross cash outflow of $1,550,000 for the September quarter, however, this gross cash outflow estimate will not be reflective of the Companyâs net cash flows, which, after receipts from customers and grants/grant factoring, are expected to be substantially more positive than the gross cash outflow.

Stock Performance: In the past six months, DROâs stock provided a return of 114.81% as on 15 August 2019. At market close on 16 August 2019, the stock was at a price of A$0.295, with a market capitalisation of circa A$69.93 million. The stock has a 52 weeks high price of A$0.365 and 52 weeks low price of A$0.090 with a yearly average volume of ~1,720,916.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.