About Quality Stocks

Quality stocks are the stocks with better consistency and less risk. By quality, it means that the company is able to grow not just in terms of revenue but also in terms of profits. These companies are capable of funding their growth from internal accrual instead of equity or debt. Quality stocks are run by sound management with long-term perspective and good corporate governance practices.

In this article, we would be discussing three quality stocks in Australia, namely Coles Group Limited, Woolworths Group Limited and JB Hi-Fi Limited. All these three companies belong to the retail industry and are popular across Australia.

Coles Group Limited (ASX: COL) is an Australian retailer of products including fresh food, groceries, household items and liquor. The company, which also offers financial services, caters to its clients through stores as well as online medium. Woolworths Group Limited (ASX: WOW) is another major Australian retailer that does not require any introduction. The company provides food, general merchandise and specialty retailing through chain store operations. JB Hi-Fi Limited (ASX: JBH) is an ASX listed retailer that deals in home consumer products. Some of the products offered by the company are consumer electronics, whitegoods and appliances.

COL, WOW and JBH also provide dividends to their shareholders. In this article, we would try to know more about these three companies, as well as take a look at their recently released financial results and stock performance on the Australian Stock Exchange.

Coles Group Limited

The shares of Coles Group Limited have given a decent YTD return of 27.21%. On 11 September 2019 (AEST 01:45 PM), the stock of COL was trading at a price of $ 14.815, up 0.305% from its previous close. COL has a market cap of $ 19.7 billion with approximately 1.33 billion outstanding shares and a PE ratio of 13.73x.

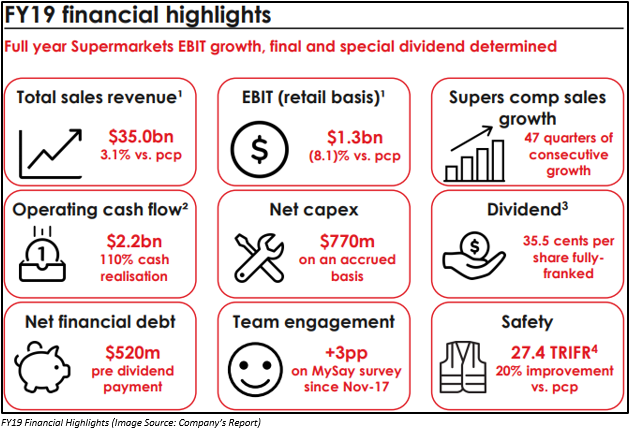

FY2019 Highlights

The company, on 22 August 2019, released its full year results for the period ended 30 June 2019, reporting an increase of 3.1% in the groupâs total sales revenue to $ 35 billion. In the financial highlights, Coles Group reported consecutive 47 quarters of comparable sales growth for Supermarkets. EBIT for Supermarkets also grew by 2.2% year-on-year. However, group EBIT was down by 8.1%, as a result of lower Express fuel volumes as well as corporate costs.

In FY2019, the company noted a 30% growth in online sales to $ 1.1 billion. This was the first profit reported by the online segment of the company in 20-year history. The period also witnessed a strong balance sheet with position of the net debt improved to $ 0.5 billion.

The board of the company has unveiled a fully franked total dividend of 35.5 cents per share including a special dividend of 11.5 cents per share and a final of 24.0 cents per share.

Woolworths Group Limited

The shares of Woolworths Group Limited have given a decent YTD return of 29.26%. On 11 September 2019 (AEST 02:06 PM), the stock of WOW was trading at a price of $ 36.720, down 2.548% from its previous closing price. WOW has a market cap of $ 47.43 billion with approximately 1.26 billion outstanding shares, an annual dividend yield of 2.71% and a PE ratio of 18.27x.

FY2019 Highlights:

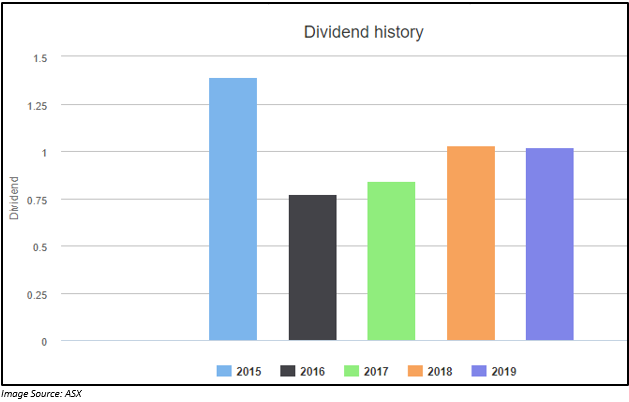

The companyâs sales from continuing operations increased by 3.4% to $ 59,984 million, EBIT grew by 5% to $ 2,724 million, Australian Food EBIT went up by 3.8% to $ 1,857 million and NPAT increased by 7.2% to $ 1,752 million. Dividend or the year stood at 102 cents per share, which represents an increase of 9.7% on pcp. The company has provided its investors with dividend in the last five financial years.

The company reported a strong customer score in Q4 FY2019. Sales and profit in the second half of FY2019 improved, while the company established a strong foundation for all âXâ businesses in place. The momentum in BIG W improved materially. The petrol sale and $ 1.7 billion worth share buyback was also completed during the period.

In the upcoming period, the company would be maintaining its focus and simultaneously progressing its agenda across Woolworths Group. Other than this, the company would also be providing its customers with increased convenience. It would continue to use its technology in the process improvement. The company would be delivering cost efficiencies. It would also be completing the merger of Endeavour Drinks and ALH.

The balance sheet of WOW witnessed a slight decrease in net assets from $ 10,849 million in FY2018 to $ 10,669 million in FY2019. The company reported an increase in cash receipts from customers in FY2019, increasing from $ 66,899 million in FY2018 to $ 68,998 in FY2019. However, there was a slight increase in payments made to suppliers and employees. As a result, net cash generated through operating activities declined from $ 2,994 million in FY2018 to $ 2,948 million in FY2019. Net cash used in investing activities and financing activities was $ 246 million and $ 2,917 million. By the end of the FY2019, WOW had net cash and cash equivalents worth $ 1,066 million.

JB Hi-Fi Limited

The shares of JB Hi-Fi Limited have given a decent YTD return of 55.83%. On 11 September 2019 (AEST 02:20 PM), the stock of JBH was trading at a price of $ 33.670, up 0.03% from its previous close. JBH has a market cap of $ 3.87 billion with approximately 114.88 million outstanding shares, an annual dividend yield of 4.22% and a PE ratio of 15.48x.

FY2019 Highlights

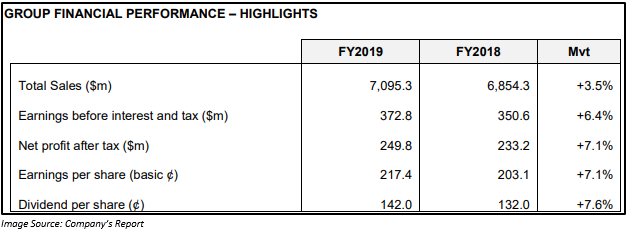

The company in FY2019 reported an increase of 3.52% in revenue from ordinary activities to $ 7,095.3 million. Net profit after tax attributable to members of the company increased by 7.14% to $ 249.8 million. The company unveiled a final dividend of 51 cents per share.

Hardware and services sales during the period increased by 5.4%, with comparable sales growth of 4.1%, driven by communications, audio, fitness, games hardware and connected technology categories. Software sales declined by 7.3% and on a comparable basis, a decline of 8.3% was reported due to a double-digit decline in the Movies and Music categories, which was partly balanced by robust growth in the Games Software category.

Net assets of the company increased from $ 947.6 million in FY2018 to $ 1,044.1 in FY2019 as a result of an increase in total assets, followed by a decrease in total liabilities. The company noted an increase in cash inflow from operating activities from $ 292.1 million in FY2018 to $ 301.6 million in FY2019. Net cash outflow from investing activities and financing activities was $ 59.1 million and $ 195.4 million, respectively. The companyâs net cash and cash equivalents by the end of FY2019 was $ 119.2 million.

The group is confident that it would be able to execute and grow market share. In FY2020, JBH expects its total group sales to be around $ 7.25 billion. The company expects revenue contribution of $ 4.84 billion from JB Hi-Fi Australia, while JB Hi-Fi New Zealand and Good Guys are expected to add $ 0.24 billion and $ 2.18 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.