We are going through an environmentally vigilant phase, with a rise of attention towards creating a healthy and sustainable surrounding. Businesses undertake CSR works and channelise their activities with an intention to create the least or no possible harm to the environment, edged by the regulatory bodies across the world. Tags like âSay No to Plasticsâ, âSave Waterâ and âGo Greenâ could be witnessed all over the world, with businesses and the general public supporting the causes to safeguard their present and future.

Are collectables worth defending?

Amid these times of constant vigilance, Consumer Staples sector famous group Woolworths Group Limited (ASX:WOW) has recently, triggered a topic of debate. CEO Brad Banducci stated that the collectables programs justified the effort spent on them, from the retailersâ point of view. Although, they are believed to be harmful for the environment and prompted adverse consumer response.

This statement came in after the company made media buzz during the Lion King Ooshies promotion. Collectables took a toll over public places and even on virtual forums. These are available in general stores and are easily accessible to everyone at feasible rates. The news had spread like wildfire in times where the world is stepping ahead to become a plastic-free zone, and bags, straws and likewise products are getting banned at different places. However, the retailers seem to care less, as collectables mint good money, boosting sales at cheaper resources. Retailers usually run collectable programs seasonally or until the stocks last and they restock them again when an interesting and suitable concept crops up.

Defending the concern triggered towards shunning down collectables, it was stated that there were more positives to the subject than the negatives. Collectables create an atmosphere of engagement and foster fun family times, and create excitement for shoppers, among the hoard of available options. Experts of the field believe that collectables connect like-minded people on various platforms, online and offline both, and tends to enhance oneâs social validation, in the contemporary world.

Besides, the company made quite a few announcements in the last few weeks. Let us acquaint ourselves to the same, and understand its business and the stock performance:

Micro-fulfilment centres on the cards

WOW is a food, general merchandise and specialty retailer which functions through chain store operations. The company has been in the news lately, regarding its plans of setting up mini automated and efficient fulfilment centres in supermarkets and liquor stores, to adhere to the increasing customer demands. WOW has partnered up with the US start-up Takeoff Technologies to build the tech-savvy fulfilment centres, with an intention to provide fast and convenient e-commerce solutions to the customers.

Merger of Endeavour Drinks and ALH Group

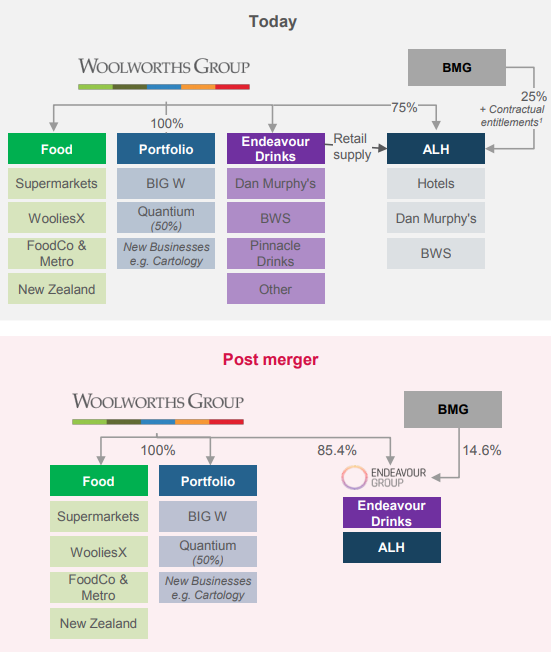

On 3 July 2019, the company pleasingly notified the market on an agreement to unify both the Endeavour Drinks and ALH Group- its drinks and hospitality businesses into a single entity, which is likely to be referred as Endeavour Group Limited. After this amalgamation, the company intends to separate the newly formed business via a demerger or a different value-accretive alternative. The process of separation would occur in CY2020 and would allow the company to benefit from a simplified organisational structure. Also, by this separation, Endeavour Group would have a greater access to capital to pursue investment and growth, while keeping the benefits gained from a solid collaboration with WOW intact.

Endeavour Group

The new entity to be formed, Endeavour Group, is anticipated to be the countryâs s largest integrated drinks and hospitality business that would generate sales of almost $10 billion and EBITDA of a billion dollars. The leading market position would enable the entity to grow and have a strong cash flow to fund investments and maintain a robust earnings profile. The Group would offer store-based and online offerings and would be 85.4% owned by WOW and 14.6% by Bruce Mathieson Group, post the merger. After the demerger occurs, WOW would still retain a minority stake in the entity.

According to the company, it would remain ANZâs leading food and everyday needs business worth of ~$47bn of sales and ~$2.7bn of EBITDA and would continue to focus on further expansion of its retail ecosystem, after the merger.

WOW before and after the proposed merger (Source: WOWâs Report)

WOWâs Partnership with Marley Spoon

On 7 June 2019, the company pleasingly affirmed that it had entered into a strategic partnership with Marley Spoon AG (ASX:MMM) for an initial exclusive term of five years, to work together and grow the Marley Spoon and Dinnerly brands in Australia, while creating operational synergies. The partnership includes a A$30 million investment in MMM by the company through A$23 million worth senior secured convertible note and A$7 million worth issue of MMM shares, resulting in WOW owning 9 per cent of MMM. Both the participants of the deal have entered into a senior secured commercial loan (which has a term of six months) agreement worth A$25.95 million. The agreement bears a fixed rate interest of 7% per annum.

Marley Spoon AG

Marley Spoon is a subscription-based meal kit provider with great a market experience, which would benefit the company through its insights. On the other hand, MMM would have the exposure to the vast customer base of the company and get an opportunity to work with WOWâs sourcing and supply chain teams.

MMMâs CEO Mr Fabian Siegel commented on the deal, stating that the amalgamation would complement the traditional supermarket online offering, in times where grocery spending is undergoing a virtual shift.

New on Board

As announced on 17 May 2019, WOW informed the market that it had appointed Jennifer Carr-Smith as a non-executive director.

Share Price Information and Performance

After the close of trading hours on the Australian Securities Exchange on 9 August 2019, the WOWâs stock was at A$35.4, down by 0.282 per cent relative to its last quoted price. The market capitalisation of the company is A$44.68 billion, with ~1.26 billion outstanding shares. With an annual dividend yield of 2.68 per cent, the WOW stock has generated a YTD return of 21.78 per cent. In the last one, three and six months, the stock has generated returns of 4.66 per cent, 8.73 per cent and 16.93 per cent, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.