The importance of August has started showing its stance, with investors and shareholders in anticipation of the earnings report and outlook approaches of the ASX-listed stocks.

Keeping the stock vigilance momentum on, let us don our investor hats, and look at the recent updates and stock performances of WOW, KGN, RHL and MYR:

Woolworths Group Limited (ASX: WOW)

Company Profile and Stock Performance: A consumer staples player, the company provides food, general merchandise and specialty retailing through its chain store operations. In 2012, WOW became the first Australian company to introduce a third-party managed complaints line.

On 7 August 2019, WOWâs stock was trading at A$35.305, up by 1.714% (at AEST 1:14 PM).

WOW might beat Coles in the virtual space race: To pace up the supply to meet increasing customer demands, peers WOW and Coles Group Limited (ASX:COL) are making huge investments in their respective systems. In 2019, COL built a couple of automated fulfilment centres in Sydney and Melbourne post an agreement with Ocado and has taken the lead in the tech-savvy consumer provider space. However, experts believe that WOW, post its partnership with US start-up Takeoff Technologies, might overtake COLâs reign as it builds automated micro fulfilment centres, at lower costs, to enhance fast and convenient e-commerce solutions for the customers. Robotics and automation could be catalysts in building these centres. The market awaits these developments in the online grocery shopping sphere of the country.

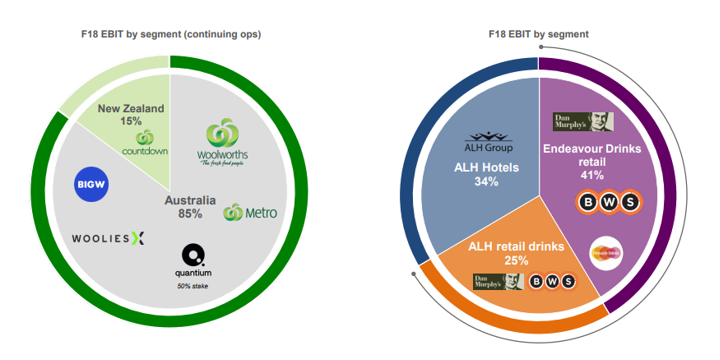

Merger of Endeavour Drinks with ALH: On 3 July 2019, WOW announced that it would merge the Endeavour Drinks division with Australian Leisure and Hospitality Group, expected to be complete in 2H19. The merger would create the countryâs largest unified drinks and hospitality business with sales of ~$10 billion and an EBITDA of ~$1 billion. In the coming days, the combined entity (Endeavour Group Limited) would be separated from WOW by a demerger or an alternative transaction, expected to occur in CY20.

F18 EBIT of WOW and Endeavour Group (Source: WOWâs Report)

Kogan.Com Limited (ASX: KGN)

Company Profile and Stock Performance: An online retail player, KGNâs portfolio includes Kogan Marketplace, Kogan Retail, Kogan Mobile, Kogan Health and Kogan Internet, to name a few. The company has over 8 million active subscribers and is headquartered in Melbourne.

On 7 August 2019, KGNâs stock was trading at A$4.97, up by 2.474% (at AEST 1:29 PM).

FY19 reporting date: On 5 August 2019, KGN notified that it would release its results for the year ended 30 June 2019 on 20 August 2019.

Business Update: On 23 July 2019, KGN released its business update for July 2019, highlighting the below milestones:

- Strong growth in Exclusive Brands with the revenues in 2HFY19 up by over 30% compared to 2HFY18.

- Significant preparatory work to launch key new verticals in 1HFY20 (Kogan Mobile NZ, Kogan Credit Cards and Kogan Super).

- New partnership to launch Kogan Energy in 1HFY20.

- Launch of Kogan Cars.

KGN posted a ~16% Y-O-Y active customer growth. It had cash of $27.5 million as on 30 June 2019 and total inventories of $75.7 million, and no bank debt.

Ruralco Holdings Limited (ASX: RHL)

Company Profile and Stock Performance: A leading Australian agribusiness, RHL caters to the diverse needs of rural and regional Australia with four key operating divisions: Live Export, Water Services, Rural Services and Financial Services.

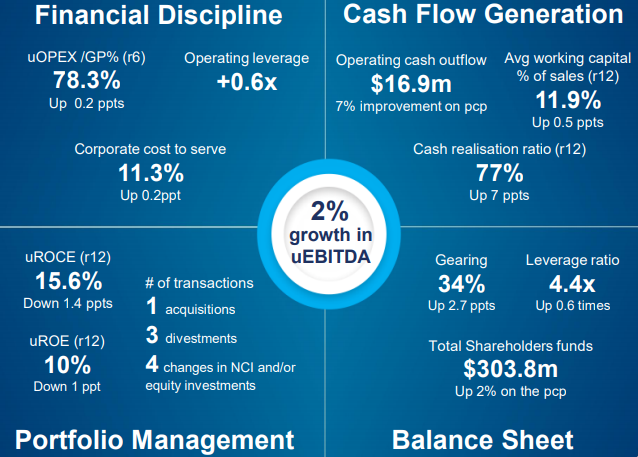

RHLâs Financial Management Highlights for 1H19 (Source: RHLâs Report)

On 7 August 2019, RHLâs stock was trading at A$4.28, down by 0.465% (at AEST 1:29 PM).

The RHL and Nutrien Limited SID: On 27 February 2019, RHL entered into a Scheme Implementation Deed with Nutrien Ltd, in accordance to which the latter would acquire 100% of the issued share capital of RHL for $4.40 per share. RHLâs diluted equity was ~$469 million at an enterprise value of $615 million.

The scheme was subject to ACCC approval, who laid down its concerns on 13 June 2019, stating that the merger would result in the largest retail and wholesale supplier of rural merchandise in Australia, with Elders being the only other large national chain. This might cause the loss of a major national retail competitor, and the ACCC was looking into the scope of sufficient competition to the Ruralco-Landmark retail stores.

The ACCCâs preliminary view was that the proposed deal would not substantially lessen competition in local areas. The final result is due on 15 August 2019, and presently, the company is in discussions with the ACCC to address the issues raised. Due to these glitches, the Scheme meeting was postponed from 17 July 2019 to 6 September 2019.

Most recently, on 29 July 2019, the ACCC stated regarding the competition concerns that Landmark brand of Nutrien would have to divest three rural merchandise stores located in Broome, Alice Springs and Hughenden- the areas of high degree of concentration in case the acquisition moved forward. Besides this, The ACCC would adhere to the opinions of market participants (indicative date for the final decision on the matter being 15 August 2019) on the undertaking and if it would ease competition concerns in the identified local markets.

Myer Holdings Limited (ASX: MYR)

Company Profile and Stock Performance: Operating a portfolio of 66 department stores across Australia, MYR is a consumer discretionary store. It launched its new website in 2018.

On 7 August 2019, MYRâs stock was trading at A$0.492, up by 0.408% (at AEST 1:43 PM).

New on Board: On 21 May 2019, MYR appointed Ms Jacquie Naylor as a Non-Executive Director on its Board, who is also a member of the AICD or Australian Institute of Company Directors and of the IWF or International Womenâs Forum. Chairman, Mr Garry Hounsel welcomed Ms Naylor, stating that MYR was pleased to have one of the most respected retailers in Australia on board.

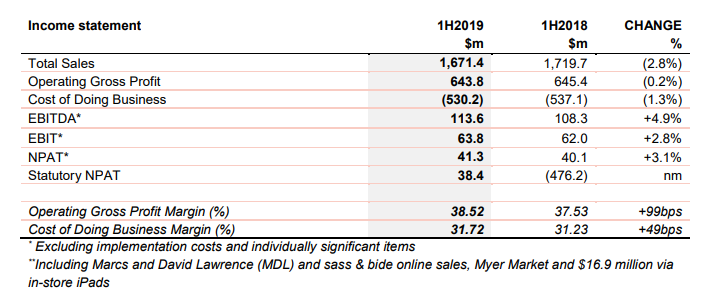

1H19 Results: On 6 March 2019, MYR released its 1H19 Results, posting an Operating gross profit standing at $643.8 million, up by 99 basis points to 38.5% operating gross profit margin and the EBITDA of $113.6 million, up 4.9%. The NPAT was recorded at $41.3 million, due to the offsetting of higher depreciation and interest expense. Total sales were down by 2.8% to $1,671.4 million. However, the online sales grew by 18.6% to $151.2 million. The operating cash flow rose by $8 million during the 1H19 duration. MYRâs net cash stood at $37 million and net debt was recorded $57 million lower than previous year.

MYRâs Income Statement for 1H19 (Source: MYRâs Report)

On outlook front, the business would continue to focus on the execution of the Customer First Plan during 2H2019, focussing on costs, profitability and cash management.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.