Retailing is the process of making products available to customers and simultaneously earning a profit using multiple channels of distribution. Retailing is one of the fastest growing and challenging industries. Supply chain in the retail sector covers manufacturers, wholesalers, retailers and end users, also known as customers.

There are multiple forms of retail outlets that make available a variety of goods to customers. These include department stores, discount stores, supermarkets, warehouse stores, grocery stores, malls, online shopping platforms, among others.

In this article, we will discuss three popular stocks operating in the retail sector and listed on the Australian Securities Exchange. Let us take a look at these stocksâ recent updates and performance.

Kogan.com Limited

About the Company:

Known for its price leadership via digital efficiency, Kogan.com Limited (ASX: KGN) owns a portfolio of retail and services businesses. Kogan Retail, Kogan Marketplace, Kogan Internet, Kogan Mobile, Kogan Insurance, Kogan Health, Kogan Pet Insurance, Kogan Life Insurance and Kogan Travel are its various businesses. Kogan.com Limited is also the owner and operator of eighteen exclusive private label brands, while offering access to over 2,000 brands across various products through Kogan Retail and Kogan Marketplace.

Business Update:

On 23 July 2019, Kogan.com Limited reported a strong quarter for Kogan Marketplace in Q4 FY2019, which is also the businessâ first full quarter of contribution. The business gained momentum during the entire quarter, owing to the awesome response from both buyers and sellers.

During the period, there was strong growth in the exclusive brands. Significant preparatory work was also done to roll out Kogan Mobile NZ, Kogan Credit Cards and Kogan Super in the first half of FY2020. The company also launched Kogan Cars before the end of June 2019. Moreover, it entered a strong partnership to aid Kogan Energy, which is scheduled to launch before the end of CY2019.

The company made investments in its platform as well as logistics capability. These investments proved useful, as they helped the company to provide its products at a faster rate, at a cheaper price and at multiple locations.

The team of Kogan.com is working continuously in order to build an innovative, well-organised, agile and strong business.

At present, the FY2019 account auditing is under progress, and details related to the trading performance will be made available with the release of FY2019 results due in the month of August 2019.

Business update highlights as per unaudited management accounts:

- The company reported a 15.9% increase in the number of active customers to 1,609,000 for FY19 as compared to the previous corresponding period (pcp).

- Active customer base of Kogan Mobile during the period increased by 24.4% year-on-year. The commission-based revenue for the business in 2H FY2019 went up by 5% as compared to 2H FY2018.

- Kogan Internet reported a year-on-year increase of 273% in active customer base. The robust growth was driven by a strong quarter of promotional activity.

- In the second half of the financial year 2019, the commission-based revenues for Kogan Insurance registered a year-on-year increase of over 100% as compared to 2H FY2018.

- The company also reported an increase of over 30% year-on-year in revenue from exclusive brands during 2H FY2019.

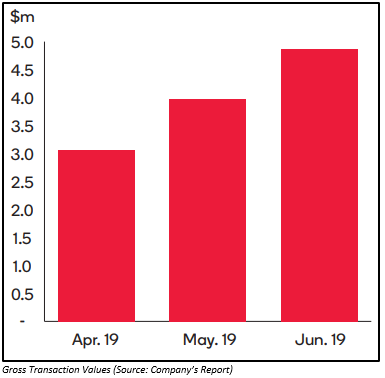

- After the launch of Kogan Marketplace in the third quarter of FY2019, the gross transaction value in its first full quarter stood at:

- The company also created a subsidiary, domiciled in the US, in order to supply wholesale Exclusive Brand products to retailers based in the United States. Moreover, it has received its first orders from large US-based retailers.

Meanwhile, the company compared its unaudited management accounts for 2H FY2019 with 2H FY2018, reflecting a 9% growth in gross transaction value, a 12% increase in gross profit, a reduction in operating cost of over 2% and a more than 25% increase in EBITDA.

By the end of the full year on 30 June 2019, KGN had net available cash of around $ 27.5 million and total inventory worth $ 75.7 million with zero bank debt. However, these figures are based on unaudited management accounts.

Stock Performance:

The shares of KGN have provided a decent return of 26.10% in the last six months. On 25 July 2019, KGN stock opened slightly lower at A$5.140 as compared to its previous closing price of $5.170, down by $ 0.030. At present, the shares of KGN are trading at a price of A$5.010 (AEST: 12:12 PM), down 3.095% from its previous closing price. KGN has a market cap of $484.58 million with ~ 93.73 million outstanding shares, PE ratio of 36.67x and an annual dividend yield of 2.36%.

Nick Scali Limited

About the Company:

Nick Scali Limited (ASX: NCK) is an ASX listed furniture retailing company, serving the Australian market for more than 50 years. It is one of the largest retailers as well as importers of quality furniture in the country. NCK imports more than 5,000 containers of quality leather and fabric lounges along with the room and occasional furniture every year. The company has a reputation of providing its customers with the quality furniture at a lower price.

Products:

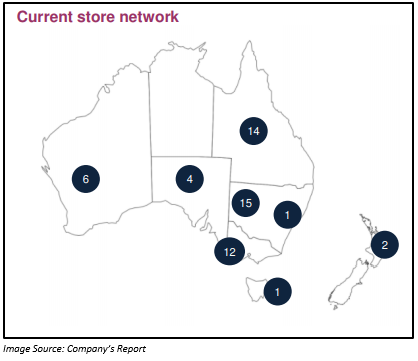

The products of the company include lounges, dining tables, dining chairs, armchairs, buffets/cabinets, TV units, coffee tables, consoles, bedroom furniture, mattress and base, rugs, mirrors, pendants and lamps. The figure below depicts the companyâs current store network.

Recent Update/s:

Change of Interest of Substantial Holder

On 19 June 2019, the company released an announcement related to the change of interest of substantial holder, Perpetual Limited (ASX:PPT) and its related bodies corporate. Earlier, the substantial holder owned 7,731,540 ordinary shares of the company with a 9.55% voting power. However, according to the market, the shareholding has been trimmed down to 6,854,049 ordinary shares of NCK, translating into a voting power of 8.46%.

Appointment of Company Secretary

On 12 June 2019, Nick Scali Limited announced the appointment of Mr Christopher Malley as Company Secretary of NCK. Christopher Malley is also the companyâs Chief Financial Officer.

Stock Performance:

The shares of NCK have provided a decent return of 22.55% in the past six months. NCK stock opened the day on 25 July 2019 at $6.340 as compared to its previous closing price of $ 6.250. At present, the shares of NCK are trading at A$6.250 (AEST: 12:20 PM). NCK has a market cap of $ 506.25 million with ~ 81 million outstanding shares, PE ratio of 11.81x and an annual dividend yield of 7.84%.

Kathmandu Holdings Limited

About the Company:

Kathmandu Holdings Limited (ASX:KMD) is a retailer of clothing as well as equipment that are required for travel and adventure purposes. The company, listed on ASX in November 2009, was founded in New Zealand.

Recent Update/s:

Dividend/Distribution Update

On 12 June 2019, Kathmandu Holdings Limited provided an updated summary of the dividend distribution due to update in the exchange rate to the record date of 7 June 2019. The dividend distribution relates to the period of six months ended 31 January 2019 on the ordinary fully paid shares of the company. The total dividend/distribution payment amount for each ordinary share of the company declared was NZD 0.04, which is equivalent to AUD 0.0379 per share.

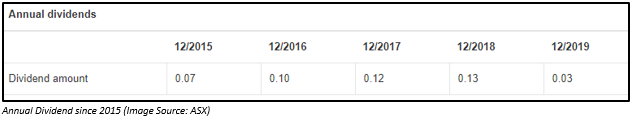

Kathmandu Holdings Limited has been a consistent payer of dividend. Below figure depicts the companyâs dividend history.

1H FY2019 Highlights:

The company reported a 13.3% year-on-year increase in sales to NZD 232 million during 1H FY2019. Its gross profit went up by 9.4% to NZD 141.9 million when compared with the same period a year ago. The companyâs EBIT for the period stood at NZD 20.9 million, while NPAT reached NZD 14.0 million in the first half of the financial year 2019 ended 31 January 2019.

Its Summit Club reported to have a two-million-member base at the end of the six months to 31 January 2019. The Oboz business of the company is the fastest growing brand of hike footwear at REI, the largest outdoor retailer in North America, and the fastest-growing footwear brand in Kathmandu stores. The Oboz business reported strong growth during the period, with pro forma sales growth reported at 38.6% and EBIT growth of 77.1%.

The operating expenses of the company increased during the period by 4.3% at constant exchange rates.

Stock Performance:

The shares of KMD have provided a negative return of 10.18% in the past six months. On 25 July 2019, KMD stock opened at A$2.06 which is slightly above its previous closing price of A$2.03. At present, the shares of KMD is trading at A$2.060 (AEST: 12:27 PM), up by 1.478% from its previous closing price. KMD has a market cap of $ 459.16 million with ~ 226.19 million outstanding shares, PE ratio of 9.11x and an annual dividend yield of 6.67%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.