In this article, we would discuss five stocks listed on ASX. The Australian benchmark index S&P/ASX200 was at 6848.1, up by 22.3 points (at AEST 1:31 PM).

DroneShield Limited (ASX: DRO)

On 30 July 2019, DROâs stock was trading at A$0.35, up by 4.688% (at AEST 12: 33 PM). Concurrently, the company released an announcement regarding a sole membership with ACI (Airports Council International) Europe. Importantly, DroneShield is the only counterdrone company with membership in ACI Europe now.

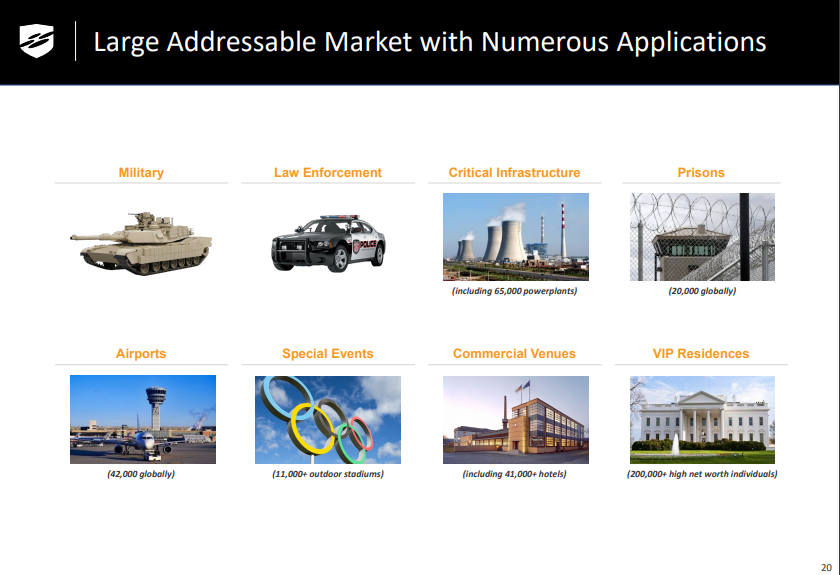

Addressable Market (Source: AGM Presentation, May 2019)

Oleg Vornik, CEO of DroneShield, stated that the company would mitigate the risk of drone threats to the airports, and the companyâs drone detection allows to minimise the risk to the airports such as well publicised Gatwick Airport disruption in December.

The performance of the stock over the past one year has been +26.32%. Also, over the past three months and one month, the return of the stock has been +84.62% and +71.43%, respectively.

Connexion Telematics Ltd (ASX: CXZ)

On 30 July 2019, the company released the change of interests of substantial holder- Lucrene Group Pte Ltd and its Associates effective 29 July 2019. Lucrene Group Pte Ltd now holds 170,033,022 personâs votes with the voting power of 19.99999995%.

On 30 July 2019, CXZâs stock was trading flat at A$0.023 (at AEST 12:38 PM). Also, on 26 July 2019, the company had released the Quarterly Activities Report for the period ended 30 June 2019. Accordingly, it was asserted that the company had witnessed a strong quarter with combined revenue-paying subscriptions at 75,898 for June 2019.

Connexionâs financial condition continued to improve and it produced a positive cashflow and profit. Admittedly, it expects the subscriptions to record the order of $550,000 to $600,000/month along with strong operating margins. Also, the companyâs recorded an increase of $336k in the cash receipts from customers. Besides, the Board of the company has been focusing on optimising costs to improve profitability along with positive cash flow.

Companyâs Overview (Source: AGM Presentation, November 2019)

Connexion has also recorded an unaudited net profit of $448k for the quarter, and it is a debt free company following the payment of borrowed $150k. According to the release, the company intends to improve the OnTRAC B2B services within the GM dealership network. Also, it is expected that the revenue-paying subscription for OnTRAC would be stable at ~70k monthly subscriptions.

The company is actively looking for opportunities within the GM dealership network along with other OEM vehicle dealerships in Australia and the US. Admittedly, the company has been engaged in a strategic review of the business and the business model to optimise the value generated by the companyâs products. Also, it is actively looking for an executive to lead the company into the next phase of development.

The stock over the past one year has given a return of +283.33%. Also, over the past three months and one month, the return of the stock has been +109.09% and +91.67%, respectively.

QuickFee Limited (ASX: QFE)

On 30 July 2019, QFEâs stock was trading at A$0.365, down by 5.195% or 0.020 (at AEST 12:56 PM). On 12 July 2019, the company provided the Business Operations Update. Accordingly, it acknowledged the successful listing of the stock on ASX following the initial public offering of securities (IPO). Also, it intends to use the proceeds from the IPO towards the strong growth, and the company has been engaged with professional service firms to integrate the QuickFee platform.

Currently, the company has a solid pipeline of prospective professional service firm for the integrations in Australia and the USA. It was asserted that the companyâs growth continues as reflected in the latest quarter number.

Customers, Transactions & Lending

Reportedly, the company has 618 professional services firms in Australia and 236 professional services firms in the USA for the year ended 30 June 2019. Also, the unaudited transactions from Australia were recorded at A$28.3 million in FY19, up by 170% from A$10.5 million in FY18. Besides, the unaudited transactions from the USA were recorded at A$136.8 million in FY19, up by 182% from US$48.4 million in FY18. Further, the unaudited lending activity was A$42 million in Australia for FY19, up by 17% from A$36 million in FY18. In addition, the unaudited lending activity was US$8.3 million in the USA for FY19, up by 108% from US$4 million in FY18.

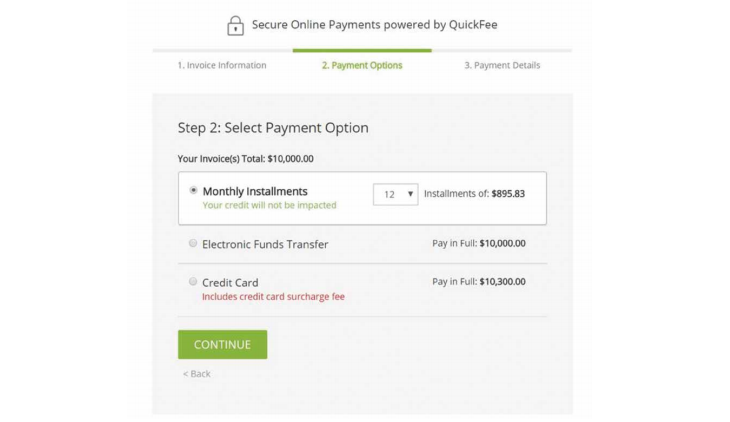

Companyâs Platform (Source: Prospectus, July 2019)

QuickFee has been trying to achieve success in the USA in the similar way it has met in the Australian region. Admittedly, the USA represents the largest chunk of professional services firms globally. Also, the company has welcomed two new sales representatives for the US team on 10 July 2019, who would underpin the company to achieve desired targets. Besides, the company would be updating the shareholders regarding business developments and the full-year results.

In the last five days, the stock of the company has generated a return of 8.45 percent.

Family Zone Cyber Safety Ltd (ASX: FZO)

On 30 July 2019, FZOâs stock was trading at A$0.215, down by 4.444% or 0.010 (at AEST 1:07 PM). On 25 July 2019, the company released an update regarding a fresh strategic partnership. Accordingly, the company had penned an exciting and market leading partnership with Check Point. Also, the partnership would result in an integrated solution for the education sector, and the company would engage with the resellers of Check Point to promote and sell the integrated solution. Initially, the partnership would target ~2,500 private and independent schools in Australia.

The company has not provided any forecast related to the potential revenue from the agreement and the financial materiality of the agreement. However, the company believes the agreement is strategic in nature, which would offer further revenue stream while validating the market opportunity for the companyâs product.

Global Market (Source: Companyâs Investor Presentation, April 2019)

The performance of the stock over the past one year has been -52.13%. Also, over the past three months and one month, the return of the stock has been +50% and +18.42%, respectively.

Hills Limited (ASX:HIL)

HILâs stock had last traded on 29 July 2019 at a price of A$0.2. On 19 June 2019, the company announced that Mr Alan Kinkade AM has resigned from the Hill Board due to increased pressure from commitments, while he would act as a consultant to assist in the development of growth strategies for Hills Health Solutions business.

Business (Source: FY19 Half Year Investor Presentation, February 2019)

On 21 May 2019, the company notified on the number of initiatives, which would improve its financial performance, while providing clarity for the underlying business operations and improve the value for shareholders. Accordingly, the operational review of the distribution business expected the potential savings of over $5 million in the next two financial years, and the company would incur a cost between $300k to 500k in FY19. Besides, the management believes that savings in the range of $3 to $3.5 million would be achieved in FY2020.

Reportedly, the commencement of the strategic review would explore the options to improve the performance of the Hills key business divisions. Also, the company anticipated growth in the Health business backed by major new projects and the GetWell patient care products to the Hills Range.

Importantly, the company managed to record a profit of $8.3 million in FY18, and the strong performance of Health and Communications business was offset by disappointing performance in the Distribution business.

The performance of the stock over the past one year has been -9.52%. Also, over the past three months and one month, the return of the stock has been +22.58% and +8.57%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.