The retail sector is key contributor for developing the economy of Australia. Disruptive forces like changing consumer spending pattern influences the Australian retail sector. However, the current trade war between China and the US can also impact the retail sector. The growth in retail sector is generally driven by demand and supply of specific products.

Letâs have a look at three retailers of Australia along with their recent updates:

Woolworths Group Limited

Woolworths Group Limited (ASX: WOW) is an Australia registered company and is a retailer of food and general merchandise through chain store operations.

On 3rd July 2019, ALE Property Group acknowledged the company announcement of an agreement to merge its Endeavour Drinks division with Australian Leisure and Hospitality Group (ALH) with a future intention to separate the combined entity from the company by demerger or other alternative transaction. ALE owns 86 properties which are let out to ALH via long-term leases.

As per the investor presentation, the merger of Endeavour Drinks and ALH Group will be called Endeavour Group Limited. It added that, the company will be pursuing a separation by demerger or a value-accretive alternative. The separation would allow simplicity and growth in both groups with the benefits of partnership retained via continuing service agreements. Additionally, the merger would establish an integrated drinks and hospitality business with around $10 billion of sales, and $1 billion of EBITDA. However, the company will remain Australia and New Zealandâs leading food and everyday needs business with sales amounting to around $47 billion of and EBITDA of approx. $2.7 billion.

A look at Third Quarter 2019 Sales Results

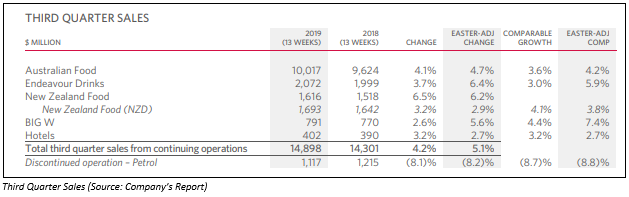

For the 13-week period to 31st March 2019, the company witnessed a rise in the Australian Foodâs sales momentum with Easter-adjusted sales growth of 4.7% benefitting from lower deflation and a more settled weather. The customer scores have remained high but were affected by flood and drought effects on Fruit & Vegetables prices, quality and availability.

During the Q3 FY19, the company opened four new stores out of which one was a Metro, and two stores were closed. At the end of the quarter, the company reported that there were 1,020 Woolworths Supermarkets and Metros, which include 36 Metro branded stores. It was also stated that the Metro stores continued to perform well in the Q3 with double-digit sales increases. Â The following picture gives an overview of sales of third quarter:

The gross margin, EBITDA margin and net margin of the company stood at 29.1%, 6.7% and 3.1% as compared to the industry median of 30.8%, 4.8% and 1.7%, respectively. It delivered return on equity of 8.6% in 1H FY19 against industry median of 5.8%, which represents that Woolworths Group Limited is providing favorable returns to shareholders as compared to the broader industry. The asset to equity ratio stood at 2.29x in 1H FY19 versus 2.78x of industry median.

On 23rd Aug 2019, the stock last traded at A$35.990per share, down 0.056%. At the end of trading session, the market capitalisation of the company stood at A$45.33 billion. Coming to the stockâs past performance, it delivered returns of 4.38%, 6.66% and 25.69% in the time span of one month, there months, and six months, respectively.

JB Hi-Fi Limited

JB Hi-Fi Limited (ASX: JBH) is an Australia-registered company, which is a specialty retailer of home consumer products having its focus on consumer electronics, software etc. JB Hi-Fi Limited got listed on ASX in 2003. Recently, the company through a release announced that Mitsubishi UFJ Financial Group, Inc. has become an initial substantial holder in the company with the voting power of 5.07% for fully paid ordinary shares and 0.02% for options as on 16th Aug 2019. In other update, the company stated that Mr Richard Uechtritz has made a change to his holdings in the company by disposing off 6,700 Ordinary Shares for a consideration of $205,969.37 as on 12th August 2019. The number of securities held by the director post the change stood at 4,816 ordinary shares.

A look at financial performance for FY19

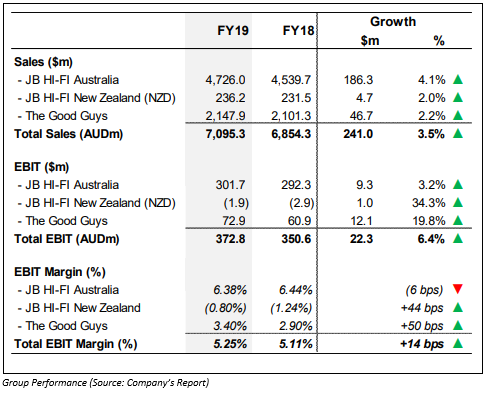

The company recently published a presentation, wherein it communicated about the operational and financial performance of the group as well as segment performance. It started with JB Hi-Fi Australia, where it witnessed a rise of 4.1% to $4.73 billion in sales along with comparable sales increased by 2.8% year over year. It added that there was a rise of 5.4% in the sales of hardware and services with improved comparable sales growing 4.1%, which has been primarily fueled by Audio, Communications, Games Hardware categories. It continues to focus on increasing top line sales as well as gross profit dollars. It was further added that the gross profit improved by 3.9% to $1.05 billion and the gross margin witnessed a fall 4 basis points and stood at 22.1%, which resulted from sales mix, as it manages the fall in higher margin software categories and the growth of low margin brands and categories, which was more significant in the second half.

JB Hi-Fi New Zealand

The sales of JB Hi-Fi New Zealand segment witnessed a year-over-year rise of 2.0% to NZ$236.2 million. Communications, Fitness, Audio as well as Small Appliances have been key growth categories for the segment. However, when it comes to online sales for the segment, there was a rise of 38.3% to NZ$13.3 million or 5.6% of total sales. Gross margin witnessed a year-over-year decline of 37 basis points to 17.3%.

The Good Guys

Refrigeration, Laundry, Dishwashers, Televisions, Communications, and Computers have been key growth categories for the segmrent, which have driven total sales growth by 2.2% year over year to $2,147.9 million.

Group Performance

The total revenues for the group stood at $ 7,095 million, up 3.5% over the year-ago period. With respect to the balance sheet, the company witnessed a fall in inventory versus previous comparable period on the back of better than anticipated sales in the key tax time promotional period with inventory turnover ratio of 6.3x. The net debt of the company stood at $319.9 million at the end of the period, which is in accordance with the expectations.

On 23rd Aug 2019, the stock last traded at A$31.610 per share, down 0.971%. At the end of trading session, the market capitalisation of the company stood at A$3.67 billion. Coming to the stockâs past performance, it delivered returns of 7.77%, 16.28% and 42.18% in the time span of one month, there months, and six months, respectively.

Harvey Norman Holdings Limited

Harvey Norman Holdings Limited (ASX: HVN) is into integrated retail, franchise, property and digital system. Harvey Norman Holdings Limited got listed on Australian Stock exchange in 1987. As per the release dated 9th August 2019, the company and certain of its controlled entities with certain entities controlled by Gerald Harvey, have entered into sale agreement, wherein the sale of The Byron at Byron Bay Resort will take place at a sale price of $41,764,000, excluding GST. Under the terms of sale, GAG Byron on Byron Property Co Pty Ltd and GAG Byron on Byron Business Company Pty Ltd will be the buyers of The Byron at Byron Bay Resort. The sale is expected to be concluded on the later of 16 September 2019 and the second Monday following grant of liquor license by the appropriate authority.

Change of Directors interest and initial Directors

Recently, the company announced that Graham Charles Paton has made a change to his holdings in the company by acquiring 16,605 fully paid ordinary shares of class B and disposing 16,605 fully paid ordinary shares of class A at the price consideration of $4.15 per share. Going forward, the company added that Maurice John Craven has become an initial director in the company with 7975 fully paid ordinary shares of class A and 7950 fully paid ordinary shares of class B.

Key Highlights from 1H FY19 results:

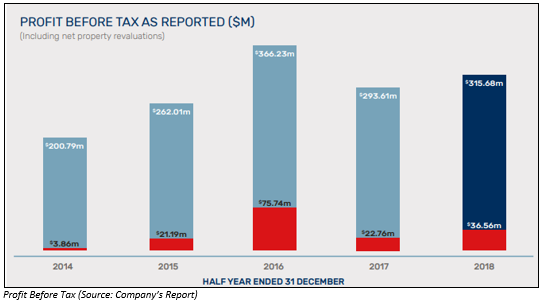

In the 1H FY19, the companyâs net asset has surpassed the milestone of $3 billion and stood at $3.15 billion as at 31 December 2018, with the robust tangible, property portfolio of $2.93 billion reflecting around 93% of the total net asset base. The company delivered offshore retail revenue of more than $1 billion to $1.074 billion in 1H FY19. The net profit before tax of the company stood at $315.68 million. Adding to that the Underlying profit before tax amounted to $297.04 million for the period, which primarily includes franchising operations segment profit amounting to $158.47 million, with a fall of 5.2% from $167.21 million in 1H FY18 and profit from the offshore company-operated retail operations of $77.53 million , reflecting a rise of 25.4% from $61.82 million in 1H FY18.

Outlook

The company is continuing to make investment in the next iteration of the Flagship Strategy and it is on track with investment and expansion plans in Malaysia, along with the anticipation of growing to 25 Harvey Norman® stores in Malaysia within the coming next two years, with potential to rise to more than 50 stores by the end of FY23. It is also looking for potential new retail stores in Singapore.

On 23rd Aug 2019, the stock last traded at A$4.590per share, down 0.864%. At the end of the trading session, the market capitalisation of the company stood at A$5.46 billion. Coming to the stockâs past performance, it delivered returns of 7.18%, 11.84% and 28.97% in the time span of one month, there months, and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.