JB Hi-Fi Limited (ASX: JBH)

JB Hi-Fi Limited (ASX:JBH) shouts out a record revenue, with JB Hi-Fi Australia, JB Hi-Fi New Zealand and The Good Guys all climbing up the sales and earnings ladder!

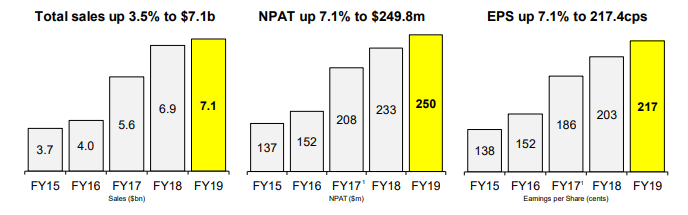

On Monday, JB Hi-Fi Limited, one of the favourite brands of consumers, reported 7.1% growth in Net Profit After Tax (NPAT) to $249.8 million for the year ended 30 June 2019. This comes at the back of 3.5% improvement in the groupâs revenue to $7.1 billion in FY19, compared to the previous yearâs figure of $6.9 billion.

Interestingly, the retailer expects to achieve more revenue in the year ahead. With respect to FY20 Guidance, JB Hi-Fi commented that it expects total group sales to be ~$7.25 billion, that will see:

- JB Hi-Fi Australia recording $4.84 billion revenue, compared to its latest result of $4.73 billion sales in FY19.

- JB Hi-Fi New Zealand sitting at (NZD) $0.24 billion, versus FY19 reported sales of (NZD) $0.236 billion.

- The Good Guysâ revenue at $2.18 billion in FY20, versus FY19 reported sales of $2.15 billion.

Letâs have an in-depth view of the FY19 performance of the group.

The groupâs sales are primarily from its branded retail store networks and online operations. Moreover, JBH also derives revenue from the groupâs commercial and education businesses, JB Hi-Fi Solutions and The Good Guys Commercial.

Total earnings per share (EPS) of the group grew 7.1% to 217.4 cents per share, which allowed the company to maintain a dividend pay-out ratio at robust 65% while also putting aside the sufficient earnings for the reinvestment and the repayments of debt.

Source: Company Announcement

JBH Board declared a final dividend of 51 cents per share, taking the total dividend to 142 cents for FY19, up 7.6% or 10 cps on the prior year. The final dividend is stated to be paid on 6 September 2019, with a record date of 23 August 2019 and an Ex-date of 22 August 2019.

JB Hi-Fi Australia achieved a 4.1% growth in revenue to $4.73 billion, with comparable sales up 2.8%. Online sales grew 23.0% to $258.0 million on engaging online offers. In Solutions business, the company recorded double-digit sales growth while the business was on track to achieve the sales target of ~$500 million per annum, confirmed companyâs report.

JBH CEO Richard Murray stated that JB Hi-Fi Limited had a pleasing finish to Fiscal 2019 with robust revenue in the key tax time promotional period.

On the bottom-line front, JB Hi-Fi Australia achieved 3.9% increase in gross profit to $1.05 billion, resulting in a gross margin of 22.1%. EBIT was up 3.2% on the previous corresponding period to $301.7 million in FY19.

JB Hi-Fi New Zealandâs total sales were up 2.0% to NZD 236.2 million, with comparable sales up 8.2%. EBIT was up NZD 1.0 million or 34.3% on FY18. The segmentâs Online sales surged up 38.3% to NZD 13.3 million or 5.6% of total sales as the business benefited from the improved online platform. However, gross margin was down 37 bps on the previous corresponding period at 17.3%.

The Good Guys reported $2.15 billion revenue, up 2.2% on FY18, with the growth of 0.9% on the basis of comparable sales. The report read that the principal growth categories were Refrigerator, Televisions, Dishwashers, Computers, Laundry and Communications.

Online sales improved 3.7% to $130.9 million or 6.1% of total sales; however, the robust sales on The Good Guys website was partially offset by a decline in third party marketplace sales. EBIT was up 19.8% on FY18 to $72.9 million with EBIT margin up 50 bps to 3.4%. Also, Gross Profit stood at $442.7 million, with gross margin up 33 bps to 20.6%.

JB Hi-Fi is focused on revenue and market share while maintaining the gross margins at stable levels and continuing to evolve the business, said CEO Richard Murray.

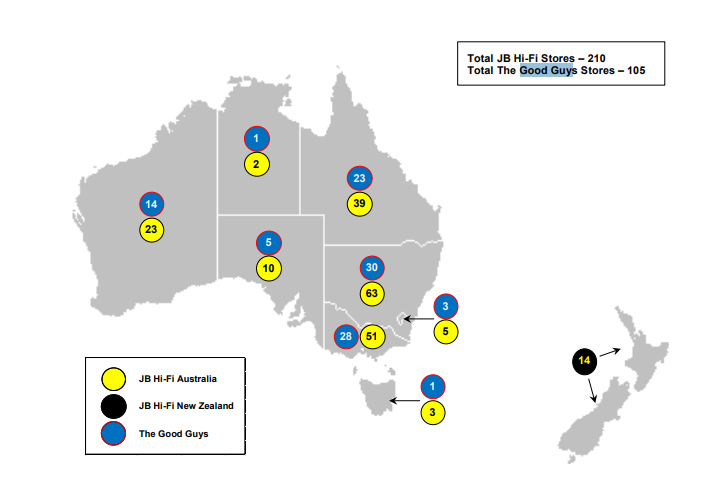

JBH market share in terms of number of stores and location on the map (Source: Company Announcement)

As at 30 June 2019, the group had 196 JB Hi-Fi/ JB Hi-Fi Home stores in Australia, 14 JB Hi-Fi stores in New Zealand and 105 The Good Guys stores in Australia.

Trading Update on Fiscal 2020

- Total sales growth for JB HI-FI Australia was 4.1% (July 2018: 2.9%) with comparable sales growth of 3.2% (July 2018: 0.3%);

- Total sales growth for JB HI-FI New Zealand was -0.4% (July 2018: -2.1%) with comparable sales growth of -0.3% (July 2018: 3.4%); and

- Total sales growth for The Good Guys was -2.1% (July 2018: 2.7%) with comparable sales growth of -3.4% (July 2018: 1.4%).

Stock Performance: JBH stock price surged up 9.979% to last trade at $30.750 on 12 August 2019. The stock closed at a price to earnings multiple of 13.300 x with a market capitalisation of $3.21 billion.

Over the past 12 months, the stock has witnessed a positive price change of 22.74% including an upside of 9.91% recorded in the past three months.

Fonterra Shareholdersâ Fund (ASX: FSF)

On the same day, the stock price of Fonterra Shareholdersâ Fund plunged 5.028% to close at $3.40 after the company unveiled its expectation to report a loss of $590-675 million in FY19.

Consumer staples company, Fonterra Co-operative Group Limited confessed its expectation to report loss this year on evaluating a significant reduction in the carrying value of several assets beside taking other one-off accounting adjustments into consideration. It is expected to result in total ~$820-860 million one-off adjustments.

Chief Executive Officer, Miles Hurrell stated that although the Fonterra Co-operative Groupâs FY19 underlying earnings range is within the existing guidance range of 10-15 cents per share, Fonterra is expected to report a loss of $590-675 million this year, i.e., 37-42 cents loss per share, after taking into account the above-mentioned one-off adjustments.

The management also has decided not to pay any dividend for fiscal 2019!

Fonterra explained that the majority of one-off accounting adjustments are related to non-cash impairment charges on four assets, including DPA Brazil, China Farms, the New Zealand consumer business and its Australian Ingredients business. Also, the divestment of Venezuelan consumer business led to ~$135 million accounting adjustments.

The company reached to this conclusion after completing the review of the business, which had taken place across the full-year, as per the companyâs information.

However, the company assured famers and unit holders on its ability to continue operation, with strong cashflow, reduced debts, and underlying performance of earnings in line with the guidance range.

FSF stock closed at a price to earnings multiple of 11.130x with a market capitalisation of $368.51 million. Over the past 12 months, the stock has declined 20.09% including the negative price change of 11.82% in the past three months.

Also Read: Fonterra Reduced Its Milk Offering Forecast Amid Ongoing Dry Weather In New Zealand

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.