Introduction

On 10 September 2019, the Australian benchmark index S&P/ASX200, by the end of the trading session, was at 6614.1 basis points, down by 33.9 basis points or 0.5 percent from the previous close.

In the article, we would discuss about the recent updates on the three ASX listed entities - National Australia Bank Limited, classified under financials sector, along with Telstra Corporation Limited and TPG Telecom Limited, both classified under communication services sector.

Letâs go through the stocks under discussion for obtaining a better insight on them.

National Australia Bank Limited

Brokerâs Upgrade & Decent Performance in the third quarter 2019:

As per the market reports, National Australia Bank Limited (ASX: NAB), one of the biggest banks of Australia, is in the conviction buy list of the broker- Goldman Sachs. The broker for FY 19 has projected the companyâs earnings per share to be of $1.94 and the net profit to be of $5,667 million. For FY 20 period, it expects the earnings per share to be of $2.11. The broker is anticipating double digit return in one-year period from the companyâs stock.

On the other hand, on 14 August 2019, NAB released the results for third quarter FY 19, that has delivered 1% increase in the cash earnings to $1.65 billion compared to the first half of FY 19 quarterly average. For 3Q19, the unaudited statutory net profit was reported at $1.70 billion.

The bank during the quarter has posted 1% increase, in the revenue on the back of SME lending growth, which also resulted in slight rise of group margin. At the end of the third quarter ending 30 June 2019, the bankâs Group Common Equity Tier 1 (CET1) ratio stood at 10.4% versus 9.7% in Q3 2018. Also, it recorded Liquidity Coverage Ratio (LCR) at the quarterly average of 128% and Net Stable Funding Ratio (NSFR) of 113%.

Meanwhile, on 23 August 2019, NAB notified that the regulator, Australian Securities and Investments Commission (ASIC) had filed a lawsuit against the bank, and has accused that it has taken the loan applications from unlicensed âintroducersâ between September 2013 and July 2016. This is related to 297 loan applications in the above-mentioned period.

The bank has already disclosed in the inquiry, for the introducer, that some of its employees had taken the over-the-counter cash bribes on fake documents, to increase the number of loan applications of the bank.

CET1 Ratio (%) (Source: Companyâs Report)

On 10 September 2019, NABâs stock, by the end of the trading session was at A$28.48, moving up by 1.605 percent from the prior close. In the last three months period, the stock has generated a return of 2.98 percent.

Telstra Corporation Limited

Revised guidance of FY20 for NBN Coâs Corporate Plan 2020:

Telstra Corporation Limited (ASX: TLS) declared the revised guidance for fiscal year 2020 for NBN Coâs Corporate Plan 2020 on 3 September 2019.

As per this revised forecast, there will be 25% reduction in the number of activations of homes that were planned to be connected in FY20 from 2 million to 1.5 million and the cost reduction target from $660 million to $630 million. The $500k decline in the number of projected premises to be connected reflects that there will 400,000 decline in the Brownfield premises, and 100,000 decline in the Greenfield premises to be connected in FY20.

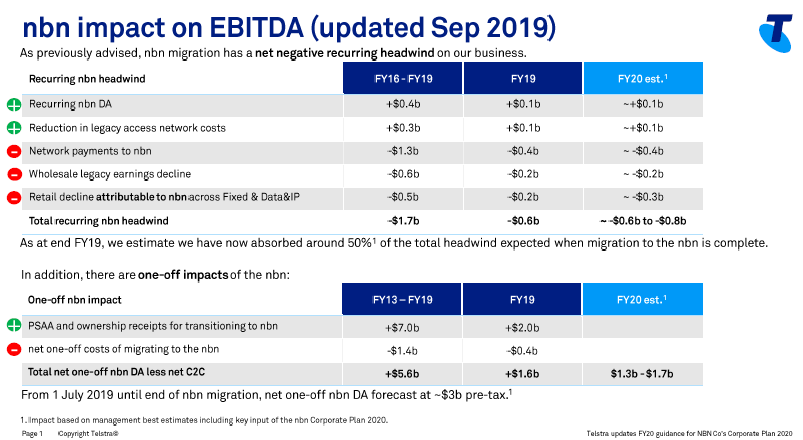

The guidance mentioned above would affect the total income, the underlying EBITDA, and the amount of the included in-year NBN headwind. The reduction will also affect the net one-off DA receipts less the NBN cost to connect, and there would be impact on the free cashflow after operating lease payments. However, the company continues to expect FY 20 underlying EBITDA excluding the in-year NBN headwind to grow by up to $500 million. Further, as per previous estimates, declared on 15 August 2019, the company had projected the NBN in-year headwind to be between $0.8 to $1 billion, which is now expected to be in the range of $0.6 to 0.8 billion. The $200 million movement is expected to be on the back of decline of $100 million in network payments to NBN, and a decline of $100 million in wholesale legacy earnings.

Moreover, for FY 19 results declared on 15 August 2019 closed 30 June 2019, the company had delivered 3.6% fall in the total income to $27.8 billion, 21.7% decrease in EBITDA to $8.0 billion, and 39.6% fall in the NPAT to $2.1 billion. The company has projected that from FY 16 till FY 19, nbn had affected EBITDA adversely by approximately $1.7 billion.

nbnâs impact on EBITDA (Source: Companyâs Report)

On 10 September 2019, TLSâ stock, by the end of the trading session was at A$3.56, moving down by 1.111 percent from the prior close. In the last three months period, the stock has generated a negative return of 3.22 percent.

TPG Telecom Limited

Proceedings in Federal Court of Australia will commence on 10 September:

TPG Telecom Limited (ASX: TPM) court proceedings in Federal Court of Australia took place on 10 September in Melbourne for the determination of the proposed A$15bn TPG-Vodafone merger. The Australian Competition and Consumer Commission has yet again blocked the merger which was to take place among the telecom providers.

Earlier in May 2019, the Australian Competition and Consumer Commission (ACCC) had opposed the proposed merger of TPG and Vodafone Hutchison Australia Pty Limited (VHA) through a Scheme of Arrangement. The case is being led by Justice John Middleton and Michael Hodge, of Hayne Royal Commission fame, fighting on behalf of ACCC.

On the other hand, on 5 September 2019, TPM declared FY 19 results ending 31 July 2019, wherein it mentioned the delivery of Earnings before interest, tax, depreciation and amortisation (EBITDA) before impairment of $809.4m, Net Profit After Tax attributable to shareholders (NPAT) of $173.8m and Earnings per share (EPS) of 18.7 cents per share. Further, on the underlying basis, for FY 19 the company has delivered 13% fall in the NPAT to $376.2 million and also 13% decrease in the EPS to 40.5 cents per share. The sharp fall in the profit was driven by increase in the impairment expense of $236.8m and a substantial rise in amortisation and interest expense relating to the companyâs Australian spectrum licences on the back of cease in the rollout of its Australian mobile network in January 2019.

During FY 19, the company has generated the net operating cashflows before tax of $836.3m, total capex of $717.3m. At the end of the year, TPM had net debt of $1.94 billion which reflects a leverage ratio of about 2.4x underlying FY19 EBITDA. The net debt included the remaining spectrum liabilities, needed to be paid in early 2020).

Additionally, for FY 20, the company anticipates BAU EBITDA to be in the range of $735-$750m. The company projected that by the end of fiscal 2020, it will have less than 15% of its residential broadband customer base remaining on ADSL. In addition, the company will be paying the final dividend of 2 cents per share on 19 November 2019.

FY 19 Financial Performance (Source: Companyâs Report)

On 10 September 2019, TPMâs stock, last traded at A$6.75, falling down by 0.295 percent from the prior close. In the last three months period, the stock has generated a negative return of 4.96 percent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.