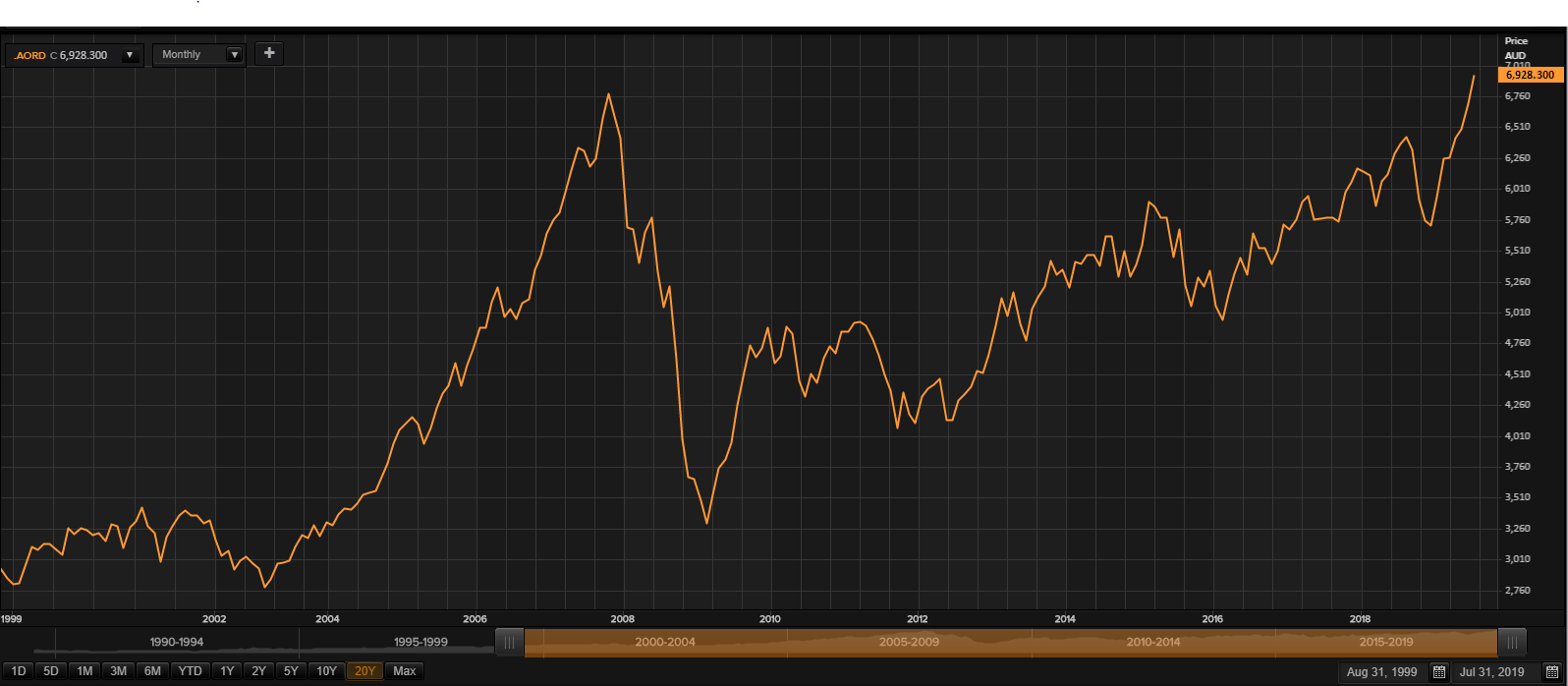

Since the start of the calendar year 2019, the Australian Benchmark index S&P/ASX200, which closed at 5,557.8 on 2 January 2019, has seen an unprecedented rally. On 30 July 2019, the index broke its intraday record at (6851.5) and closing at (6828.7) highs that were previously recorded in November 2007. By 12:21 PM AEST, the index was trading at 6,850.1, up by 24.30 or 0.36%. Since January 2019, the benchmark index has surpassed the rally of 1200 points.

Besides, the mainstream S&P/ASX200 index, the rally has been depicted in the broader market indices as well. Therefore, it is worth noting that the broader market indices like All Ordinaries and S&P/ASX300 have reached the lifetime highs as well in the recent weeks.

Australian Technology Sector

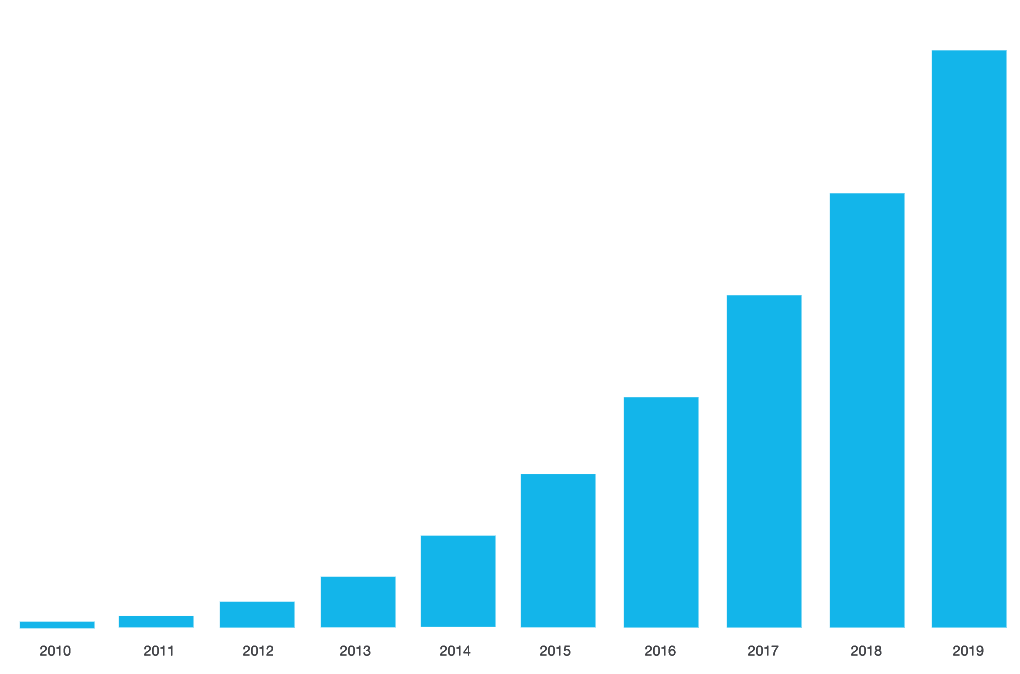

Recently, prominent people from the tech industry have voiced out opinions and declared the sector as underweight in the country. Besides, concerns were also raised over the educational propensity of the country in the sector as well. Nevertheless, the S&P/ASX 200 Information Technology (Sector) has recorded a return of +33.29% over the calendar year, as of 29 July 2019. Currently, the sector is the second best performing one in the benchmark S&P/ASX 200 index.

10 Year Performance S&P/ASX 200 Information Technology (Sector) (Source: S&P Website)

The S&P/ASX 200 Information Technology (Sector) includes Afterpay Touch (ASX: APT), Altium Limited (ASX: ALU), Appen Limited (ASX: APX), Wisetech Global Limited (ASX: WTC), Xero Limited (ASX: XRO), Technology One (ASX: TNE), NEXTDC Limited (ASX: NXT), Link Administration Holdings (ASX: LNK), Iress Limited (ASX: IRE), Computershare Limited (ASX: CPU), Carsales.com Limited (ASX: CAR) and Bravura Solution Limited (ASX: BVS). (It should be noted that this is an indicative list of the stocks.)

WAAAX Stocks

Just like the US has FAANG (Facebook, Apple, Amazon, Netflix & Google), Australia has WAAAX (Wistech, Altium, Afterpay, Appen & Xero). In the US, the S&P 500 index has recently surpassed the 3,000 mark.

Interestingly, the index has claimed the 3,000 level from 2,000 in August 2014, on the back of stocks with over 350% return. This group also includes Amazon and Netflix, with returns at 489% and 455%, respectively.

Besides, the other notable names include ABIOMED, NVIDIA, Advanced Micro Devices, MarketAxess Holdings, Take-Two Interactive Software, MSCI, Align Technology & Global Payments.

The below table provide the returns from the WAAAX stocks, and the returns for all the stocks remain on the greener side.

| Name | Ticker | Sector | YTD* | One Month* | 1 Year* | Market Capitalisation (AUD)** |

| Wisetech Global Limited | WTC | Information Technology | 95.24% | 14.66% | 100.79% | 10.58 Billion |

| Altium Limited | ALU | Information Technology | 75.47% | 6.70% | 77.53% | 4.95 Billion |

| Afterpay Touch Group Limited | APT | Information Technology | 126.50% | 11.39% | 87.32% | 6.78 Billion |

| Appen Limited | APX | Information Technology | 145.47% | 7.79% | 182.05% | 3.8 Billion |

| Xero Limited | XRO | Information Technology | 55.59% | 6.62% | 48.58% | 9.22 Billion |

*As of 29 July 2019

** AS of 30 July 2019

Wisetech Global Limited (ASX: WTC)

On 30 July 2019, WTCâs stock last traded at A$32, down by 3.759% from its prior close. Concurrently, the Australia tech giantâs market capitalisation was at ~A$10.58 billion. Recently, the companyâs CEO made remarks and labelled the technology sector in the country as an underweight. He also mentioned the fact that the top twenty companies in Australia are non-tech companies. He also voiced out opinions on the sector and stated that technology should leverage economic growth.

Nevertheless, WiseTech has delivered a return of +95.24% over the calendar year, and that depicts volumes of the investor sentiments.

Altium Limited (ASX: ALU)

By the closure of trading session on 30 July 2019, ALUâs stock last traded at A$37.2, down by 1.899% from the previous close. Over the year-to-date period, the stock has returned +75.47%.

The company is designated under the Information Technology sector within the industry group â Software & Services. The stock of the company is very well-recognised, and it is a constituent of S&P/ASX 200 Information Technology (Sector), S&P/ASX 100, S&P/ASX Mid Cap 50 and more.

It provides products & services including Altium Designer â a 3D printing circuit board, Altium Vault & Tasking, Octopart & Nexus. Mainly, the revenues of the company occur from recurring activities, and Altium Designer contributes to a significant amount of it.

Afterpay Touch Group Limited (ASX: APT)

A technology driven payments entity, APT has a goal towards turning the buying experience amazing for the international consumers. Collectively, it leverages various brands within the group to provide these services. It intends to provide a secure, reliable and globally accepted services while driving customer experience as well.

The stock of the company is a constituent of S&P/ASX All Australian 200, S&P/ASX 100, S&P/ASX Mid Cap 50 and more. Over the past one year, the stock has returned +87.32%. The stock of the company closed at A$26.61, by the end of the trading session, on 30 July 2019.

Appen Limited (ASX: APX)

Appen is a global company, leveraging machine learning & Artificial Intelligence in its services to provide services across industries. Some of the solutions include data analytics, computer vision, fraud detection, search relevance, social media analytics, proofing tool and much more.

The stock of the company has more than doubled in the existing calendar year. The company has confirmed that the earnings would be released on 29 August 2019 for the half year ended 30 June 2019. On 30 July 2019, APX stock last traded at A$30.9, down by 1.655 percent from the prior close.

Xero Limited (ASX: XRO)

Software company, Xero Limited is engaged in the services for small scale businesses. It provides accounting software that could be used on a cloud platform, and it employees over 2500 people. Besides, the company is one of the fastest SaaS company. It operates in Australian, New Zealand & the UK regions.

Subscriber Growth (Source: Companyâs Website)

Apart from the WAAAX stocks, the rest of the tech stocks in the S&P/ASX200 have mixed sentiments. Please refer to the below table related to the performance of these stocks; the red colour depicts the negative return.

| Name | Ticker | Sector | YTD* | One Month* | 1 Year* | Market Capitalisation (AUD)** |

| Technology One Limited | TNE | Information Technology | 30.91% | 2.10% | 59.56% | 2.52 Billion |

| NEXTDC Limited | NXT | Information Technology | 15.13% | 6.71% | 5.02% | 2.41 Billion |

| Link Administration Holdings Ltd | LNK | Information Technology | 24.18% | 3.42% | 34.20% | 2.71 Billion |

| Iress Limited | IRE | Information Technology | 31.76% | 2.08% | 20.59% | 2.49 Billion |

| Computershare Limited | CPU | Information Technology | 5.41% | 4.23% | 12.13% | 8.73 Billion |

| Bravura Solution Limited | BVS | Information Technology | 30.53% | 3.77% | 52.15% | 1.21 Billion |

*As of 29 July 2019

** AS of 30 July 2019

On 30 July 2019, All Ordinaries, the oldest shares index in the country, was at 6,928.30 up by 16.90 points. Concurrently, S&P/ASX 300 index closed at 6794.3 up by 18.2 points from the previous close.

All Ordinaries (Source: Thomson Reuters)

The macro fundamentals for the country have been getting stronger, and the sentiments in the market appear justified. Globally, the US Fed would start the two-day monetary policy review today. Besides, the easing cycle has already commenced in the country.

Letâs look at the other stocks apart from the tech sector:

ASX 200 â Movers

Magellan Financial Group Limited (ASX: MFG)

At the end of the trading session, on 30 July 2019 MFGâs stock was at A$61.09, down by 0.065% from the previous close. Recently, the company on its FUM update for the month of June has disclosed that the anticipated performance fees for the year could be approximately $83 million, out of which ~$42.7 million has been disclosed in the interim financial report.

The company is an asset management firms with listed and non-listed funds. Besides being in top 200, the stock of the company is recognised by several other indices as well including S&P/ASX 200 Financials (Sector), S&P/ASX 100, S&P/ASX 300, S&P/ASX Dividend Opportunities Index and more.

Over the year-to-date period, the stock has recorded a return of +161.57%.

Saracen Minerals Holdings Limited (ASX: SAR)

On 30 July 2019, by the end of the trading session, SARâs stock was at A$4.13, up by 0.978% from the previous close. The company is engaged in the exploration of gold and owns a few projects. The stock has gained attraction in the current calendar year probably due to the ongoing gold rush.

On 30 July 2019, the company also notified about the strong drilling results like Karari-Dervish and Atbara discovery to name a few, which could be consequential to increase in production and mine life. Admittedly, the company has spent a record $56 million in the exploration activities in FY19. Also, cash & cash equivalents stood at A$154 million as on 30 June 2019.

It appears that the company has been aggressively capitalising on the ongoing gold rush, and that depicts the ability of management to make decisions. Nevertheless, the stock of the company has delivered a return of +40.55% over the past year-to-date period. Besides, it has recorded a return of +114.14% over the past one year.

Fortescue Metal Group Limited (ASX: FMG)

By the closure of the trading session, on 30 July 2019, FMG was at A$8.22, up by 0.859% from the previous close. One of the largest mining companies in the country, Fortescue Metal has been riding high on the back of skyrocketing iron ore prices. Recently, in its released presentation, the company has acknowledged the escalated steel production and better than ever iron ore prices.

Interestingly, the company has attracted a lot of investors lately. Over the period of past one year, the stock of the company has recorded a return of +103.79%. Besides, the stock has returned +114.1% over the year-to-date period. The stock of the company is a constituent of S&P/ASX All Australian 50, S&P/ASX Dividend Opportunities Index, S&P/ASX 300 Metals and Mining (Industry), S&P/ASX 200 Materials (Sector).

By the end of the trading session on ASX on 30 July 2019, the Australian benchmark Index S&P/ASX 200 was at 6845.1, up by 0.28% or 19.30 points from the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.