Iron ore prices took a jab in the international market on 24 July 2019, post the Brazilian mammoth- Vale received permission to resume operations. The iron ore miner, which kept the 2019 guidance in the range of 307-332 million metric tonnes, received authorisation to resume activities at its Vargem Grande complex partially. Vale made an announcement on 23 July 2019 in which it mentioned that the resumption of the operations at Vargem Grande would inch up the annual production by five-million metric tonnes.

The announcement by the Brazilian miner depressed the confidence in bulls, and the prices fell in China from the level of RMB 883.50 (dayâs close on 23 July) to the level of RMB 842.00 (Dayâs low on 24 July), a downturn of over 4.69 per cent.

How did the Australian Miners React?

The Australian iron ore behemoths such as Rio Tinto (ASX: RIO), BHP Billiton (ASX: BHP), and Fortescue Metals Group (ASX: FMG) felt the heat of the drop in the iron ore prices, and the Australian miners tumbled on ASX.

Rio Tinto fell from its 23 July closing of A$ 102.760 to the level of 95.720 (Dayâs low on 25 July 2019), the downfall of over 6.85 per cent, while BHP and FMG followed the same trajectory.

However, in the past few trading sessions, except FMG, the above-mentioned Australian miners have shown recovery over the slight improvement in iron ore prices.

Why are Iron Ore Prices Recovering?

Post a substantial decline to the level of RMB 842.00; the iron ore prices recovered amidst a decrease in ports inventory in China. The prices retraced upwards to the level of RMB 892.00 (Dayâs high on 26 July), which in turn, provided cushion to the Australian miners.

The iron ore stockpiles across the 35 significant Chinese ports declined by 800,000 metric tonnes to stand at 106.3 million metric tonnes (as on 26 July), against the previous level of 107.10 million metric tonnes on 19 July 2019.

Whatâs Ahead?

A decline in inventory boosted the longs confidence over the supply lag and supported a speculative buy; however, the steel mills in China are relatively bearish over the prospect of the raw material and are currently deferring the purchase.

Over the deferment, the daily average deliveries across the Chinese ports slipped by 116,000 metric tonnes (as on 26 July), as compared to the previous week to stand at 2.5 million metric tonnes. Apart from that, the tighter regulations in provinces like Tangshan reduced the ports delivery and holds the potential to exert pressure on iron ore prices in future over the long-run.

However, the non-production period in Tangshan is ending on 31 July 2019, which in turn, could provide short-term support to the iron ore prices. The investors should monitor the CISA activities as well to reckon the future direction of the steelmaking raw material prices.

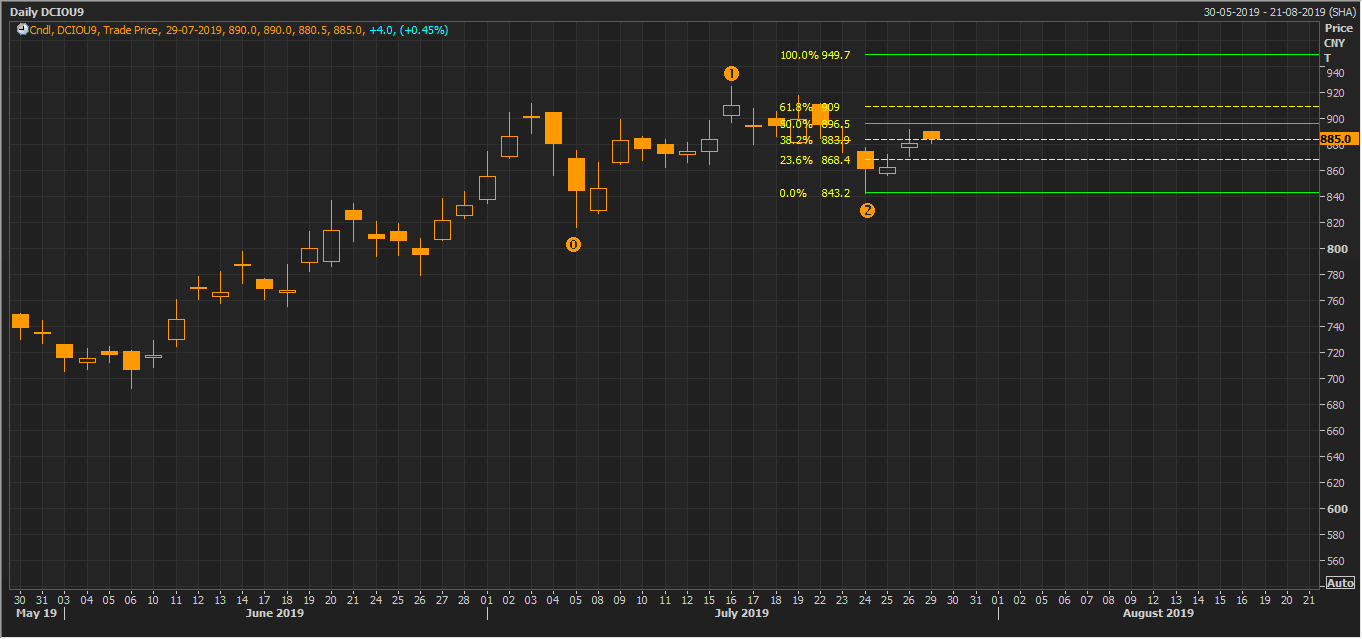

Iron Ore on Charts:

DCIOU9 Daily Chart (Source: Thomson Reuters)

DCIOU9 Daily Chart (Source: Thomson Reuters)

On the daily chart, the iron ore prices retraced back and took the support of upward sloping yellow trendline to take a U-turn up. The prices are trading above the 100 and 50-days exponential moving averages or EMAs, which are currently at RMB 736.4 and RMB 812.2 respectively.

The 14-days Relative Strength Index is presently showing a negative divergence as the prices are going up and the indicator is going downwards, which in turn, could exert pressure on the prices over the short-term, and the indication from the RSI requires further investigation.

While observing the wave movement, the upside wave followed by a correction provides potential coordinates to connect the Fibonacci Series.

DCIOU9 Daily Chart (Source: Thomson Reuters)

DCIOU9 Daily Chart (Source: Thomson Reuters)

Upon extending the Fibonacci series, we can see that the prices are currently moving towards the 60.0 per cent projected level, which is at RMB 896.5. The investors should monitor the level closely as a break above and failure to do so would decide further price actions.

The Supply Recovery:

The Australian and the Brazilian supply sides are picking up strength over time, as in FY2019, BHP produced 270 million tonnes of iron ore, which was unchanged as compared to the previous year production level, despite the impact from the Tropical Cyclone Veronica.

Despite the unchanged yearly production, the June 2019 quarter witnessed a 12 per cent increase in production. In June 2019 quarter, BHP produced 63 million tonnes of iron ore. The Australian giant kept the FY2020 in the range of 273-286 million tonnes, which is higher from the FY2019 production of 270 million tonnes, in terms of both from the lower and upper band of production guidance.

Rio Tinto left the same footprints, and the company witnessed a two per cent increase in quarterly production in June 2019 quarter. Rio kept the production guidance for the FY2019 in the range of 320-330 million tonnes and has achieved the production of 155.7 million tonnes till June 2019 quarter.

Steel Consumption:

The infrastructure and construction push from China are currently supporting the steel consumption, and mills with stockpiled iron ore still prefer to operate despite the lower profit margins due to weak steel prices in the domestic market. However, the mills which are not storing the iron ore supply are currently reluctant over the procurement amid high iron ore prices and bearish future stance.

In a nutshell, the iron ore market is currently brewing over speculations, and the demand of the commodity is presently oblique in the market, which in turn, could exert the pressure on the iron ore prices. The CISA is also adopting measures to curb the prices further, and the production seems to be recovering, which in turn, is dragging the iron ore miners down.

However, the shorter recovery in prices due to inventory decline and over the upcoming end to a non-production period in Tangshan is supporting the prices of iron ore and in a cascade the miners as well, but investors should avoid the spec buy and dig out more on demand-side to fathom the future movement in the iron ore prices.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.